Summary:

- Google’s AI potential is underestimated by the market, making the stock a buy.

- Google’s Bard chatbot is growing rapidly, while OpenAI’s ChatGPT growth has flattened.

- I further anticipate Google’s new Gemini to be a milestone in AI applications, enabling multi-modal and differentiating capabilities.

Ole_CNX

Google AI: From Bard to Gemini

The thesis of this article is straightforward. In the remainder of this article, I will argue that the AI potential of Alphabet/Google (NASDAQ:GOOG) (NASDAQ:GOOGL) is still underestimated by the market. As such, I rate the stock as a buy.

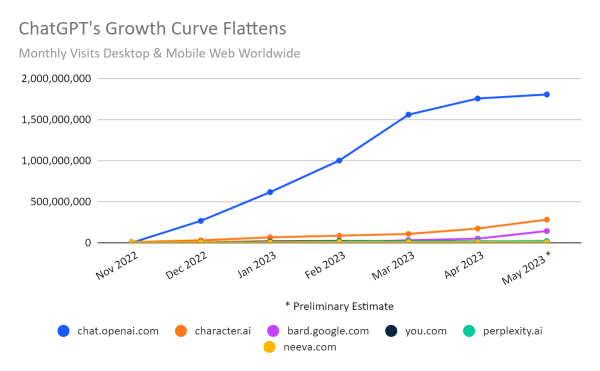

Admittedly, OpenAI (and its partner Microsoft) is still leading generative AI applications. But this is precisely the reason that creates the mispricing in GOOG stock the way I see it. As you will see in the next section, ChatGPT (Chat Generative Pre-trained Transformer) growth has begun to flatten in recent months, while Google Bard kept growing at a rapid pace. I anticipate the trend to continue due to the fundamental difference (i.e., advantages) of GOOG’s AI products in combination with its search business.

As we all know, in response to OpenAI’s of ChatGPT, Google introduced Bard, a conversational AI chatbot that is based on Large Language Models (“LLMs”). The few key traits distinguish Bard from ChatGPT in my view. First, Bard continuously pulls information from the internet and is able to use information that is more recent than what ChatGPT uses. A recent study showed that Bard could provide up-to-date information while ChatGPT struggled. The combination of generative AI and Google’s tremendous data capacity can also provide large potential to drive revenue growth. I view the digital advertising space as an immediate example. Bard could be used to analyze customer data and identify patterns and trends that would be difficult or impossible to spot manually. This information can then be used to create more targeted and effective advertising campaigns.

Then, in addition to Bard, Google’s DeepMind is already testing the next generation of its AI product, Gemini. According to this Reuters report, Google provided a test version of Gemini to a small group of companies last month. I have not used Gemini myself. But from the comments provided by Demis Hassabis (DeepMind’s CEO), I do not think it is an exaggeration to call it a milestone in AI applications. Existing AI products (including ChatGPT, Bard, and all other AI products I’ve tried) are mostly limited to text processing.

Gemini, in contrast, is expected to have multi-modal capabilities. That means it can process information far beyond texts. For example, Gemini is expected to generate texts, images, and also more complicated codes. To be detailed in the next section, these abilities will be the next growth areas in the AI space.

Bard vs. ChatGPT

As just mentioned, ChatGPT is still dominating the generative AI space, but its growth has begun to flatten in recent months as shown in the chart below. To wit, this chart shows that:

Traffic to OpenAI (the vast majority of which is to the ChatGPT subdomain) only increased 2.2% month-over-month in May. But Google Bard’s visits increased by more than 187% from April. That helps build Google’s credibility in the generative AI space as it works to incorporate those capabilities into its core search engine and other products.

similarweb.com

I anticipate the above trend to continue due to the fundamental difference mentioned above and also the introduction of Gemini. Besides the more up-to-date information provided by Google’s AI products, Bard and Gemini would also be able to leverage Google’s extensive access to a vast array of training data. These AI products can be trained using the enormous amount of data from various Google services, including Google Search, YouTube, and Google Scholar. For example, the image capabilities of its Gemini can benefit from videos and their transcripts on YouTube. These are differentiation advantages that other competitors do not have.

Is Google stock a buy, sell, or hold?

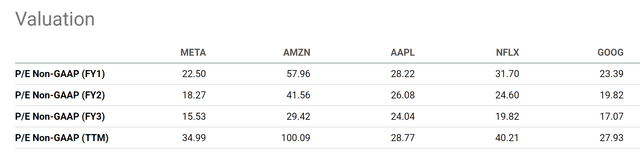

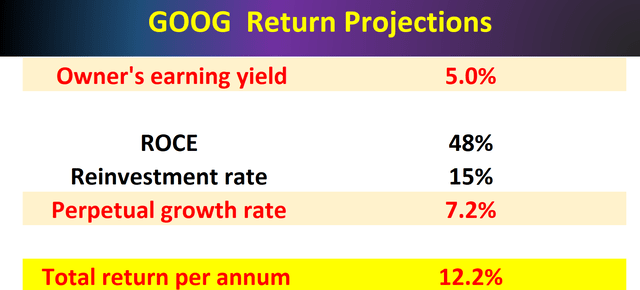

Despite the above-differentiating advantages, Google stock is now trading on the market at the cheapest valuation among major tech firms. As seen in the chart below, its current TTM P/E is about 28x, the lowest among the FAANG stocks. Its FY1 P/E is even lower, about 23x, also among the lowest. Furthermore, as detailed in my earlier article, GOOG’s accounting EPS systematically underestimates its true economic earnings power by 10% to 15%. Thus, in terms of owners’ earnings, its P/E is even lower.

I anticipate such a price-value gap to provide an asymmetric upside potential. All told, my projected return is more than 12% per annum for the next 3~5 years as seen below. The return projection includes about 5% from the owner earning yield. As just mentioned, this is based on an owner’s earnings P/E of ~20x, 15% lower than its FY1 accounting P/E of 23x. The return projection also includes a 7.2% contribution from EPS growth. My growth rate is estimated from its ROCE (return on capital employed, averaging 48% in recent years) and reinvestment rate of around 15%.

Other risks and final thoughts

There are a few other risks in both the upside and downside worth mentioning.

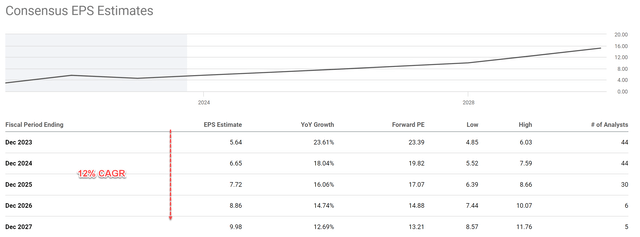

First, the upside risks. My estimate could be on the conservative side for at least three reasons. First, my growth rate quoted estimate excluded the possibility of the explosive success of its AI projects. Second, my growth rate quoted above is the real growth rate excluding the role of inflation. All told, consensus estimates are projecting a much higher growth rate of around 12% in the next few years as you can see in the chart below. Third, my estimate above also ignores the possibility of a valuation expansion, which is totally possible in my view. As mentioned, it is currently the cheapest stock among the FANNG group, and its FW P/E would quickly decrease to only 13x~14x in a few years based on consensus projection under the current conditions.

Also, recently, CFO Ruth Porat will serve as President and Chief Investment Officer (“CIO”) of Alphabet and Google. In this new position, Ms. Porat will focus on Alphabet’s investments in its Other Bets portfolio, which I view as another positive catalyst for high-risk and high-return opportunities at GOOG.

Now, the downside risks. First, GOOG has to navigate the evolving landscape of policies and regulations. This is a risk that is common to all other big tech firms. However, GOOG might be more exposed due to the concentration of information and the nature of its products. For example, it is currently involved in an antitrust trial against the U.S. Department of Justice (“DOJ”). The case is considered the largest antitrust trial in the information technology world since Microsoft’s trial (~30 years ago). And one of Ms. Porat’s key roles as the new CIO is to engage with policymakers and regulators. As aforementioned, a strength of GOOG’s AI system is that it provides more up-to-date information. However, this is a double-edged sword because providing up-to-date information is tremendously valuable and also prone to misinformation at the same time. Google has to find the right balance to address this difficult challenge.

All told, my view is that Google’s positives easily outweigh the negatives under the current conditions. To reiterate, I see three key points to support my bull thesis here. First, its existing Bard is rapidly growing. Second, I anticipate its new Gemini to be a milestone in AI applications, with multi-modal and differentiating capabilities. And finally, I see its current valuation as an underestimate of its growth potential.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

As you can tell, our core style is to provide actionable and unambiguous ideas from our independent research. If your share this investment style, check out Envision Early Retirement. It provides at least 1x in-depth articles per week on such ideas.

We have helped our members not only to beat S&P 500 but also avoid heavy drawdowns despite the extreme volatilities in BOTH the equity AND bond market.

Join for a 100% Risk-Free trial and see if our proven method can help you too.