Summary:

- Tesla, Inc.’s deliveries increased by 40% in 2022 and remain on track for another 37% increase this year.

- Tesla has new market-leading products coming soon, including the Cybertruck and Tesla Semi.

- Tesla’s energy generation and storage business is growing, and should continue expanding as we advance.

- Traditional automakers are struggling to compete with Tesla in the EV space and face challenges in transitioning from ICE cars.

- Tesla should surpass future consensus figures, delivering substantially higher revenues and better profitability than many estimates suggest.

Scott Olson/Getty Images News

Despite a softer-than-anticipated deliveries report, Tesla, Inc. (NASDAQ:TSLA) remains the most promising company in the auto industry. Tesla’s deliveries increased by 40% in 2022, and the company is on track to increase deliveries by another 37% this year. Moreover, Tesla has incredible, new, market-leading products coming online soon, including the long-awaited Cybertruck and the Tesla Semi. Also, Tesla’s energy generation and storage (“EG&S”) business is taking off, and sales should continue soaring as its EG&S segment continues expanding.

Additionally, Tesla is pioneering the artificial intelligence (“AI”) space, incorporating AI with its electric vehicles (“EVs”), increasing its lead over the competition, and cementing its place as the preeminent leader in the auto industry. Despite Tesla’s valuation, its stock should continue garnering robust demand as Tesla’s growth should continue eclipsing other automakers. Moreover, Tesla’s profitability should continue improving and could increase considerably as the economy exits the transitory slowdown phase, moving into the new AI-propelled era. Tesla’s stock should go much higher in the coming years, and it is the only “auto stock” I need in my portfolio.

Why Tesla Is The Only “Auto Stock” That I Need

There are many car stocks out there. We have traditional automakers like General Motors (GM), Ford (F), Toyota (TM), and many others. Also, we have the new age EV makers like Lucid (LCID), Rivian (RIVN), NIO (NIO), and more. Nonetheless, there is only one Tesla, and it is head and shoulders are above the rest.

The problem with traditional/legacy automakers is that their main products are internal combustion engine (“ICE”) cars. ICE is a dying technology, as many countries plan to phase out ICE vehicles in the coming decades. Norway is leading this trend and only allows zero-emissions vehicles to be sold from 2025. Britain, Israel, and Singapore plan to ban new ICE vehicle sales in 2030. China, the most significant car market globally, plans for 20% plus EV/non-ICE car sales by 2025 and the majority by 2035. Even the gas-guzzling U.S. says half of all cars sold in 2030 should be zero-emission vehicles. The EU plans to ban the sale of new fossil fuel vehicles in 2035.

Therefore, when considering Tesla’s “high valuation,” please consider Tesla’s enormous long-term opportunity to dominate the global market with its vehicles.

While legacy automakers have EV programs, they are many miles behind Tesla. Turning a traditional automaker into an efficient EV manufacturer is challenging and expensive. Think of all the multibillion-dollar production facilities geared toward manufacturing ICE engines, transmissions, and other costly auto parts that could soon be obsolete. Companies can’t simply push a button to retool their manufacturing facilities and production lines to produce high-quality EVs.

While traditional automakers have EV programs, many are relatively weak and cannot effectively compete with Tesla. For instance, at the end of Q2 2023, GM sold 33,659 EVs compared to Tesla’s 935,000 vehicles. Moreover, GM has much work ahead if it is serious about making its EV program profitable. Now, this is not a story unique to GM, as Ford, Toyota, and other mainstream automakers struggle to make EVs competitive on a mass scale, producing EVs primarily as a side project that is not profitable. Thus, while many traditional automakers struggle with their EV programs, Tesla continues innovating, increasing its lead over its competition.

Moving over to Tesla’s true EV competitors, Lucid and Rivian have yet to demonstrate the ability to mass produce vehicles effectively, never mind competing with Tesla on a mass scale. NIO, the Chinese premium EV maker closest to a Tesla competitor, burns cash exceptionally quickly, continuously raising capital/diluting its stock, posting a 1% gross margin in its last quarter.

Therefore, startup EV manufacturers are extremely clumsy in their ramp-up process, and it needs to be clarified whether they can produce EVs profitably or may fail due to high capital requirements and a challenging economic environment. Meanwhile, due to its competitive advantages, economies of scale, and high level of profitability, Tesla can temporarily drop prices on its vehicles to capture market share from the struggling EV manufacturers.

I’ve owned Tesla’s stock for ten years, and it’s been one of my most successful investments. I continue owning Tesla’s stock as the company remains dominant and market-leading and should continue expanding its share in the years ahead.

Tesla Delivers Another Excellent Quarter

Tesla recently announced its Q3 production and deliveries. It produced 430,488 vehicles in the quarter, delivering 435,059 in this time. While this illustrates a minor decline from last quarter’s deliveries of 466,140 vehicles, Tesla reiterated its target of delivering approximately 1.8 million cars for the full year. The sequential decrease in production and deliveries was due to planned downtime in Tesla factories. Tesla has delivered more than 1.37 million in the first three quarters of 2023 and should eclipse the 1.8 million delivery mark as it will likely deliver more than 430,000 vehicles in Q4 to end the year. The increase to 1.8 million deliveries in 2023 will be about a 37% increase over last year’s delivery numbers.

In Dollar Terms

Tesla delivered 15,985 Model S/X vehicles and 419,074 Model Y/3s. If we subtract the 8% for leasing vehicles in the Model S/X segment, we have about 14,706 Model S/Xs sold. Also, if we remove the 4% for lease accounting in the Model Y/3 segment, we have around 402,311 Model 3/Ys sold in Q3. Applying an ASP of about $44,000 in the Model 3/Y segment and around $110,000 in the Model S/X space provides a vehicle sales estimate of $1.62 billion (Model S/X space) and $17.7 billion (Model 3/Y segment). Combined automotive sales could be around $19.3 billion in Q3.

Tesla – Q3 Sales Estimates

- Automotive sales: $19.3 billion

- Regulatory credit revenue: $500 million

- Automotive leasing: $600 million

- EG&S: $1.8 billion

- Services and other: $2.2 billion

- Total revenues: $24.4 billion

While my revenue estimate is around the consensus sales figure, profitability may be better than anticipated in Q3. Tesla has approximately 3.171 billion outstanding shares. Consensus estimates suggest an EPS of around 76 cents in the third quarter. This dynamic implies a net income of about $2.41 billion or a net income margin of approximately 9.9%.

Last quarter, Tesla delivered 91 cents per share, beating the consensus estimate by 10 cents, approximately a 12.35% beat rate. Also, last quarter’s net income margin was about 10.8%. If Tesla achieves a 10.8% income margin in the third quarter, its net income will be about $2.64 billion, amounting to about 83 cents per share, a beat rate of about 9%. Therefore, Tesla could surpass the beaten-down consensus estimate EPS figures, a positive dynamic for its stock.

Significant Longer-Term Profitability Potential

In 2022, Tesla reported an EPS of $4.07. However, this year’s consensus estimates are for $3.40, a 17% YoY decline. The lower EPS is due to transitory factors like a slow macroeconomic environment, higher costs due to inflation, price cuts, and other temporary phenomena. Therefore, Tesla’s profitability should improve as the economy exits the downturn and economic conditions improve.

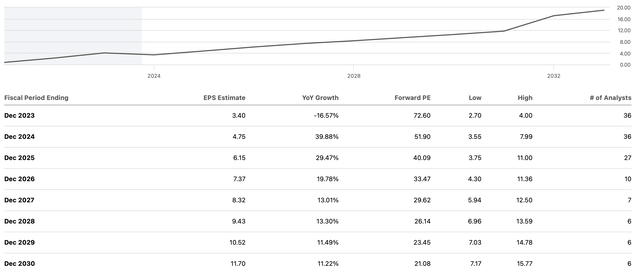

Consensus EPS Estimates

EPS estimates (SeekingAlpha.com )

Next year’s consensus EPS estimate is $4.75, but Tesla can achieve EPS much higher than this. Tesla’s profitability is significantly better in “good times.” For instance, Tesla reported a net income margin of about 15.5% in H1 2022. Due to price cuts and other transitory factors, Tesla’s net income margin declined to 10.8% in H1 2023. Suppose Tesla returns to a similar level of profitability next year (as in H1 2022). In that case, its net income on an estimated $130 billion in revenues should be about $20.15 billion, translating to an EPS of about $6.35, substantially higher than the suggested $4.75 figure.

Also, I must point out that the higher-end EPS estimates go up to $7.50-8. Thus, my estimate of $6.35 is realistic and modest compared to more aggressive figures. Furthermore, examining the consensus $4.75 figure implies a net income of about $15 billion. This figure suggests a net income margin of approximately 11.5%, implying very little profitability from the lows we see this year. Tesla’s profitability should rebound more than the implied 11.5%. Thus, its EPS could be substantially higher than the proposed consensus estimated figure.

Why Revenues Could Increase More Than Expected

– Don’t Doubt the Cybertruck Potential

We’ve waited a long time for the Cybertruck, and it should be available for customers in early 2024. The Cybertruck could account for approximately $8 billion in annual revenues (lower-end estimate). Thus, we could see 2024/2025 revenues increase more than the consensus estimates suggest.

– The Tesla Semi Should Provide Excellent Results

The Tesla Semi is in production, and deliveries are on their way. However, mass production revenues should filter down to the bottom line in 2024 and further years. The Tesla Semi offers remarkable performance and could contribute around $12.5 billion in annual revenues in the next few years.

– Tesla’s Energy Business – Taking Off

Have you looked at Tesla’s EG&S business lately? Last quarter. EG&S contributed$1.51 billion in revenues, approximately an 83% YoY revenue surge. EG&S 2023 H1 revenues surged by 105% over H1 2022. Tesla’s Megapack massive energy storage is in high demand, and sales should continue to increase.

– Tesla’s Leading AI Solutions

I don’t know any other car companies leading the global AI revolution, but Tesla is. Tesla has been perfecting its AI program for years. Tesla is developing robotics, full self-driving (“FSD”) chips, Dojo chips, neural networks, and more. Moreover, Tesla should benefit immensely from the future robotaxi concept. This segment is expected to grow from essentially nothing to a $45 billion industry in several years. Tesla is pioneering the AI revolution and should benefit immensely in the coming years.

Where Tesla’s Stock Could Be in Future Years

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $140 | $186 | $242 | $310 | $387 | $472 | $566 |

| Revenue growth | 40% | 33% | 30% | 28% | 25% | 22% | 20% |

| EPS | $6.35 | $9.80 | $13.33 | $17.73 | $23 | $29 | $36 |

| EPS growth | 70% | 54% | 36% | 33% | 30% | 28% | 25% |

| Forward P/E | 35 | 34 | 33 | 32 | 31 | 30 | 28 |

| Stock price | $343 | $453 | $585 | $736 | $899 | $1080 | $1200 |

Source: The Financial Prophet.

Risks to Tesla

Despite my bullish outlook and optimistic projections, risks exist. Tesla faces increased competition from traditional and new-age automakers determined to take market share. Additionally, Tesla’s profitability may recover slower than anticipated and not reach a similar level as in prior high profitability times. Further, Tesla’s revenue and earnings growth may be slower than expected, leading to multiple contraction and a lower stock price. The challenging macroeconomic environment could continue weighing on Tesla’s business, negatively affecting its stock price. Also, Tesla’s future projects may not achieve similar success as its wildly popular Model 3 and Y vehicles. Investors should examine these and other risks before committing to a Tesla investment.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!