Summary:

- We are upgrading Tesla, Inc. to a hold in spite of our cautious view of the auto industry in 2H23.

- Q3 2023 deliveries declined 7% QoQ to 435,059 and fell below Wall Street estimates at 461,640, primarily due to factory shutdowns for upgrades.

- We think the automotive market will experience headwinds from the high interest rate environment, but expect Tesla to fare better than the market in Q4 2023 and 1H24 with recent upgrades.

- We fully expect Tesla to remain aggressive with its pricing strategy but expect the company to hold its margins through 2024 due to the planned cost reductions.

- We now see a more balanced risk-reward profile for Tesla.

Milan Markovic/E+ via Getty Images

We’re upgrading Tesla, Inc. (NASDAQ:TSLA) to a hold from a sell. We continue to be cautious about the auto industry in 2H23 but expect Tesla will fare better than the peer group in Q4 2023 and 1H24 with its model 3 and Y upgrades. Our previous concerns about the company’s price cut strategy in the higher interest environment and weaker demand have been factored in for the most part. We’re more optimistic about Tesla holding margins in 2024 due to its planned cost reductions next year.

We think Q3 2023 earnings results, scheduled for October 18th, will reflect the factory shutdowns and price cut impact, but see a more balanced risk-reward profile for the stock in Q4 2023 and 1H24. Management warned of the slower production this quarter on the Q2 2023 earnings call, noting, “We expect that Q3 production will be a little bit down because we’ve got summer shutdowns to — for a lot of factory upgrades.” We think the company remains on track for its 1.8M vehicle deliveries target for the year in spite of this week’s lower delivery and production numbers. Tesla reported deliveries of 435,059 for the quarter, down 7% QoQ, falling below Wall Street estimates of 461,640. In comparison, last quarter, the company reported deliveries of 466,140, comfortably beating estimates of 445,000 units.

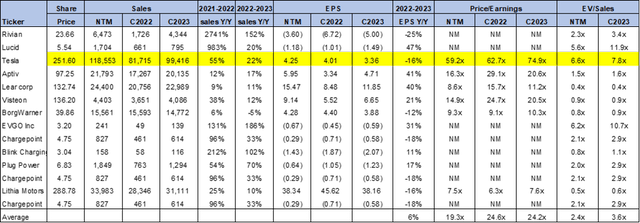

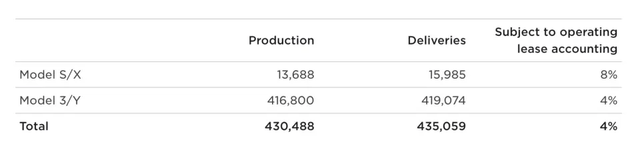

The following chart outlines Tesla’s deliveries and production for the quarter ending September 30th.

TSLA 3Q23 deliveries & production

We continue to expect Musk to push the aggressive pricing strategy in the second half of the year. Still, we’re less concerned about margins now as Tesla’s cost reductions make progress toward 2024. Additionally, we expect the upgrades on Models 3 and Y that curbed production this quarter will boost deliveries in the last quarter of FY23. We think the upgrades will position Tesla to better compete with offerings from Ford (F) and BYD, among others, in the electric vehicle (“EV”) space.

While we think the automotive market will experience headwinds from the high-interest rate environment and a slower-than-expected recovery in China, we think Tesla will likely fare better than the automotive market in Q4 2023 and 1H24 with its recent vehicle updates.

Valuation

The stock remains expensive, and while we see a more balanced risk-reward profile in 2024, we don’t see attractive entry points at current levels. On a P/E basis, the stock is trading at 74.9x C2023 EPS $3.36 compared to the peer group average of 24.2x. The stock is trading at 7.8x EV/C2023 Sales versus the peer group average of 3.6x. We recommend investors stay on the sidelines in the near-term.

Word on Wall Street

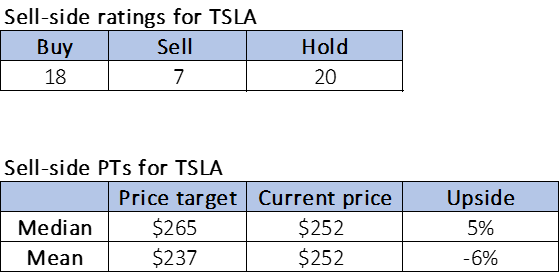

Wall Street is bearish on the stock. Of the 45 analysts covering the stock, 18 are buy-rated, 20 are hold-rated, and the remaining are sell-rated. The stock is currently priced at $252 per share. The median sell-side price target is $265, while the mean is $237 for a potential -6% to 5% upside.

The following charts outline Tesla’s sell-side ratings and price targets.

TSP

What to do with the stock

We’re upgrading Tesla to a hold. We remain less optimistic about the auto industry in 2H23 as we see a correction underway, but we believe Tesla will fare better than the industry in Q4 2023 and 1H24. We think CEO Elon Musk will continue with the price cut strategy but think concerns over margin contraction will be offset by the cost reduction plans in 2024. We still don’t see attractive entry points to jump into the stock in the near term but see a more favorable risk-reward profile toward 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.