Summary:

- PayPal stock has underperformed the broader market this year, likely due to its exposure to mixed e-commerce and consumer discretionary spending trends.

- Stiffening competition represents another factor holding back investor confidence in the stock.

- But several catalysts are on the horizon, including externalizing a portion of BNPL receivables for cash, share buybacks, and new management, which could restore some much-needed credibility to the name.

Justin Sullivan

PayPal’s (NASDAQ:PYPL) stock has taken a beating this year, underperforming broader market gains by a wide margin. The underlying business’ fundamental performance remains primarily linked to e-commerce, as well as consumer discretionary spending trends, which subjects PayPal to significant exposure to ongoing macroeconomic uncertainties. The company also faces idiosyncratic headwinds spanning competition and uncertainties over its longer-term roadmap with the recent change in senior leadership. Investor confidence is also reeling from disappointing 1H23 performance, summarized by declining active users and tepid growth.

But after the stock’s 81%+ decline from its pandemic-fuelled all-time high and absence of gains from much of the market’s rally this year, it is hard to not wonder if the rout has already priced in the looming downside risks. This is met with impending compensatory factors, including management’s reaffirmed commitment to achieving $5 billion full year free cash flow. Much of this will be supported by the sale of PayPal’s European Buy Now Pay Later receivables later this year to KKR under a multiyear agreement. The installation of new CEO Alex Chriss effective September 27 also turns a new page for PayPal, potentially alleviating some of the uncertainties that came with a longer-than-expected term filled by a largely temporary management team.

While PayPal’s moat is admittedly facing the rising threat of emerging competition, the company continues to lead the online payments processing market by a wide margin. Taken together with some of the impending tailwinds heading into the second half of the year, PayPal’s prospects for a sustained trajectory of profitable growth remains largely intact, making the stock’s valuation at current levels an attractive risk-reward set-up.

Competition and Consumer Spending Weakness Remain Too Close For Comfort

Admittedly, PayPal’s performance has been under the rising threat of competition in recent quarters. Instead of payment processing and online checkout pureplays, many of PayPal’s most prominent rivals are typically latched to a bigger ecosystem favoured by everyday merchants and consumers. They include Shopify’s Shop Pay (SHOP), Google Pay (GOOG / GOOGL), and most notably, Apple Pay (AAPL).

Specifically, Apple Pay has emerged as the leading global digital wallet in recent years, with almost 90% share of “in-store digital wallet payments in the U.S.” Although Apple Pay’s performance in the online payments market remains inferior to its share of in-store taps, the pervasive use of the digital wallet underscores its prospects of further corroding PayPal’s current leadership over the longer-term. By leveraging their respective consumer reach and selling the convenience card, the emerging platforms are becoming real threats capable of displacing PayPal’s market share in branded checkout – a key driver of the company’s profitability. The challenge is also corroborated by the company’s declining count of active users in recent quarters, and tepid growth in TPV despite coming off of a slower PY compare.

In addition to competition, PayPal also remains highly exposed to evolving macroeconomic uncertainties – particularly, weakness in the consumer spending backdrop. Unlike payment processing networks like Visa (V) or Mastercard (MA), PayPal only benefits from a limited basket of online consumer spending categories, most of which are discretionary and exposed to risks of immediate pullback as spending power weakens. While PayPal’s TPV has shown modest reacceleration this year, with management observing better-than-expected stabilization in e-commerce growth, the trend’s sustainability remains in question.

Although the economy has stayed resilient amid one of the most aggressive monetary policy tightening campaigns, we see increasing signs of weakness. While inflationary pressures have started to ease in recent months – though still far from the Fed’s 2% target – a slowdown might finally be coming for the labour market. The final straw that’s been viewed as fundamental to the economy’s strength against the past 18 months of aggressive monetary policy tightening now risks bearing the “full force of the Fed’s [525 bps] of rate hikes” implemented since March 2022. Specifically, with rate hikes typically levying a lagging effect on different corners of the economy, they are starting to bite the labour market – historically, the labour market has started to feel the brunt of tightening pains about 18 to 24 months after the first hike, which means the countdown starts about now.

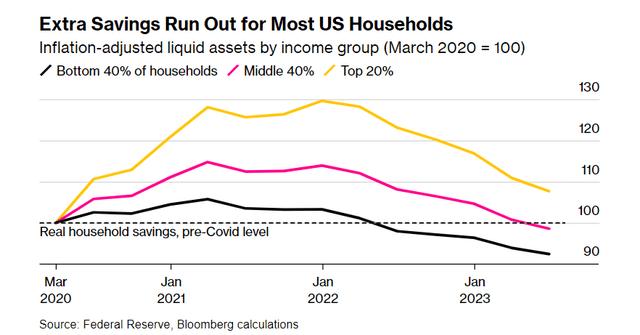

The risk is inadequately coupled with diminishing household savings and rising debt loads. The majority of American households have seen their savings fall below pre-pandemic levels, indicating that the benefits of pandemic-era stimulus have more than exhausted. Meanwhile, credit card debt and delinquency rates are also on the rise. All of this spending crunch is exacerbated by the resumption of student loan repayments this month, which threatens to displace about $100 billion in annual discretionary spending – a direct headwind to PayPal. With TPV – a function of consumer discretionary spending – at risk of further cyclical weakness in the near-term, and weakening transaction take rates at PayPal, management’s optimism for impending signs of e-commerce recovery seems premature.

But PayPal’s Market Share Remains Strong

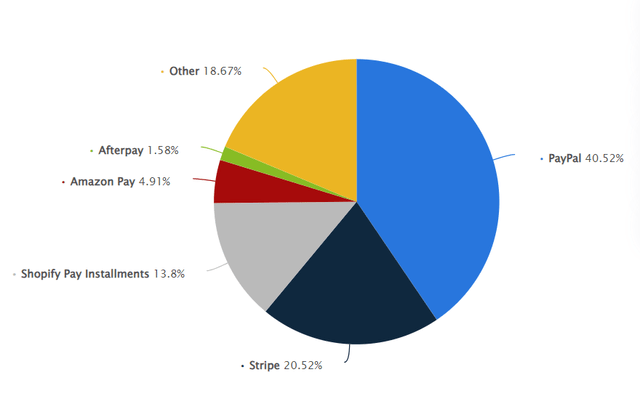

Despite the increasing threat of competition, PayPal continues to lead the online payment processing market by a wide margin. The company facilitates almost 60% of U.S. digital wallet payments through PayPal Checkout, while second runner-up Apple Pay only accounts for about 13%.

The lead is likely to help PayPal sustain its earnings growth trajectory going forward, and also give it time to better reinforce its moat in digital payment processing. The company’s appeal and reach to both online consumers and merchants are likely driving its lead to Apple Pay in facilitating online payments, despite the latter’s expansive installed base. Merchants have been aversive to installing Apple Pay checkout in their online storefronts due to reasons such as exposure limitations, given format’s availability on OS devices only; some have also cited difficulty in accessing information about customers’ purchasing habits in the past as a reason for their aversion to Apple Pay. But PayPal’s reach extends beyond this limitation to all devices and online platforms. And to address the impending competition, the company has also recently included Apple Pay support in its Advanced Checkout payment offering to merchants. This effectively allows PayPal to better manage the threat of Apple Pay by taking a share of payments facilitated through the rival’s digital wallet, while also collecting relevant data on consumer purchasing habits.

On the consumer front, PayPal has also been actively addressing demands for convenience which competing checkout and digital wallet offerings provide. This includes the recent rollout of passkey support to facilitate password-less sign-ins, increasing latency in the checkout process without compromising on security. With 70% of transactions facilitated through PayPal now being password-free, the continued rollout of passkey support across different operating systems and geographies are likely to help it better address evolving consumer needs and prevent market share loss.

The company is also working on increasing the pre-approved amount for BNPL transactions in the second half of 2023 to better capitalize on the payment format’s conversion trends. Since the roll-out of BNPL in the U.S., the company has seen a 30% increase in relevant users, with pre-approved amounts likely incentivizing incremental purchases through the format. Other features aimed at improving consumer retention and acquisition includes PayPal’s cashback Mastercard rewards program on its branded Mastercard. The company has also recently announced the gradual rollout of Apple Pay support for its branded cards. The consumer-focused features recently introduced are not only expected to reinforce PayPal’s exposure to TPV, but also drive increased conversion and improve the system’s appeal to merchants.

Share Buybacks Could Unlock Incremental Upside

Share buybacks have been a key component to management’s roadmap in driving value for shareholders. The company has decreased its diluted share count by 6% since 2021, and has committed to buying back $5 billion worth of shares in the current year. Considering management’s guidance for $5 billion free cash flow by the end of the year, they are essentially redistributing the bulk of it back to shareholders. This is consistent with the capital allocation strategy it has implemented in recent years.

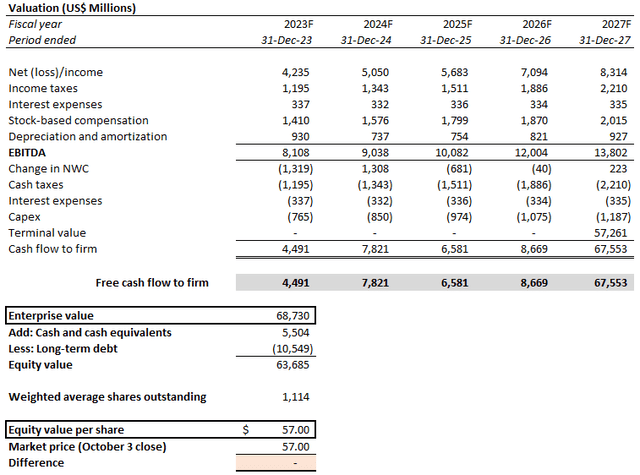

Our base case projections estimate about $20 billion in aggregate free cash flow to be generated through mid-decade. This represents about a third of PayPal’s current market cap. And a share buyback program of this extent would not only imply favourable downside protection for investors, but also unlock incremental per share upside potential from current levels.

New Management Improves Visibility on PayPal’s Long-Term Roadmap

Since Dan Schulman’s retirement announcement earlier this year, the news has left a void filled with uncertainties over the direction of the company amidst an ongoing turnaround strategy to shore up growth and profitability. With Schulman having been at the helm of the company for eight years, the longer-than-expected transition period has likely contributed to PayPal’s expansive roster of temporarily filled roles in senior management.

This includes current acting CFO Gabrielle Rabinovitch, who has been largely serving the role since previous CFO John Rainey’s departure in May 2022. Rabinovitch remained acting CFO for the company following an almost non-existent stint by Blake Jorgensen who was hired to replace Rainey in August 2022 before taking a leave of absence the following month due to health reasons and fully stepping down in March 2023. Rabinovitch, who originally led Investors Relations, is also acting Treasurer for the company in the time being. Meanwhile, Chief Strategy Officer Jonathan Auerbach has also recently announced his upcoming departure from the company on June 1, 2024.

The slew of senior management turnover comes at a pivotal time for PayPal as it looks to revamp the structure of its business to unlock incremental engagement growth and profitability. The company has largely been operating on the direction of temporary leadership during this pivotal time, which likely contributed to an incremental risk premium on the stock.

But new CEO Alex Chriss’ arrival in late September is likely to lift this major overhanging risk on the stock. The development effectively lessens concerns over the company’s upcoming growth roadmap and strategic priorities in our opinion.

While uncertainties remain over Chriss’ vision for PayPal going forward, it is likely that his arrival will drive more impactful progress in expanding the company’s market share and profit margins over the longer-term, given previous management’s potential reluctance in implementing changes due to the anticipated leadership turnover. This includes potential for a clearer AI implementation roadmap at PayPal, which previous management had hinted on in recent earnings calls. We also expect increased visibility on the company’s forward strategy for better monetizing SMB opportunities. With more than 80% of commerce remaining offline today, and “trillions of offline retail dollars moving online over the much longer-term”, there is still significant headroom for growth at PayPal. And Chriss’ previous background in leading Intuit’s (INTU) Small Business and Self-Employed Group is likely to bring the skills and language needed at PayPal to better penetrate SMB opportunities stemming from the continued adoption of hybrid online-offline storefronts.

Fundamental and Valuation Considerations

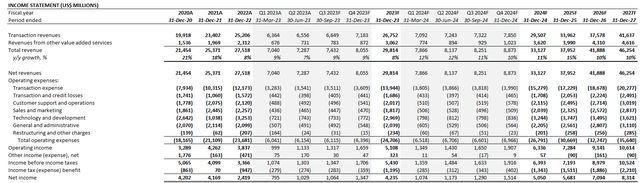

Updating our forecast for PayPal’s latest earnings results and management guidance, we expect gross profitability expansion to remain tepid in the low- to mid-single digits this year. This is in line with expectations for conservative revenue growth driven by the combination of tepid TPV expansion and ongoing FX headwinds on transaction take rates. We are also remaining conservative about the potential impact of ongoing macroeconomic uncertainties on PayPal’s branded checkout and payment processing volumes in the near-term, which are significant contributors to its bottom line.

PayPal_-_Forecasted_Financial_Information.pdf

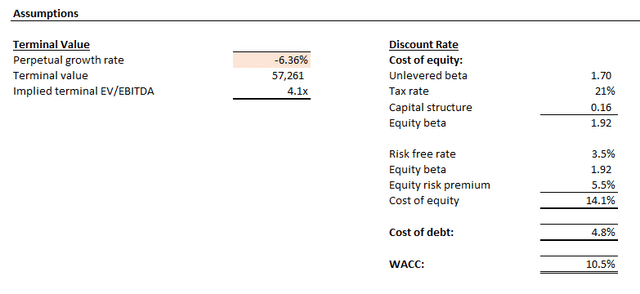

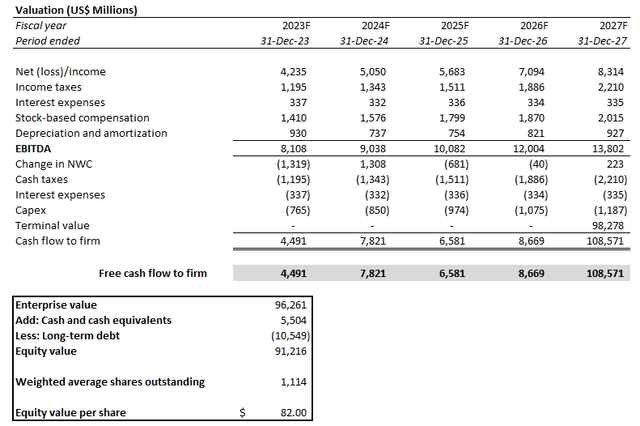

However, we believe the stock’s performance at current levels underprices the durability to PayPal’s sustained trajectory of profitable growth, despite near-term company-specific and macroeconomic challenges. Taking PayPal’s projected cash flows in conjunction with our base case fundamental forecast, and discounting them by a 10.5% WACC in line with the company’s capital structure and risk profile, the stock’s current price of about $57 implies negative perpetual growth – similar to Meta Platforms’ (META) case last year before its steep run-up supported by a low bar of expectations from investors and a positive shift in fundamental performance.

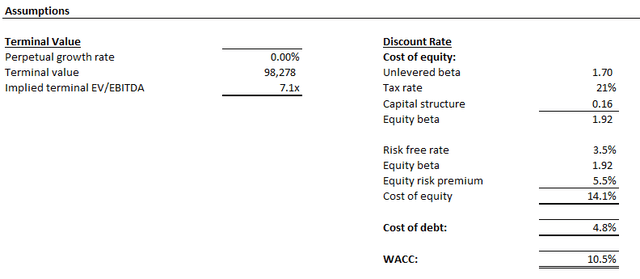

Admittedly, stiffening competition and lingering macroeconomic pressures remain immediate challenges to PayPal’s near-term prospects. But management has shown consistent commitment to shoring up profitable growth at PayPal in recent quarters, and incoming leadership is likely to reinforce visibility over the company’s forward strategy and reduce execution risks currently priced into the stock. Even at a conservative 0% implied perpetual growth rate, our DCF model shows the stock should trade at $82.

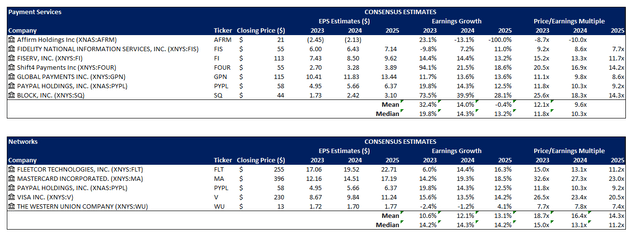

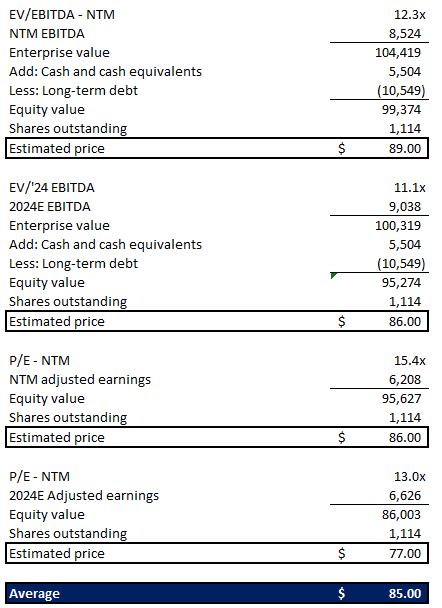

This is in line with PayPal’s implied valuation on a relative basis to its payment processing and networks technology peers.

Considering PayPal’s market leadership in facilitating online checkout and payments, alongside ongoing efforts in retaining and acquiring engagement, which supports continued cash flow growth, we believe the stock warrants a valuation multiple closer to the peer group average.

Author

By equally weighing the outcomes with results from our DCF analysis under a conservative 0% estimated perpetual growth rate, the stock shows prospects for valuation of as high as $84.

Author

Achieving this would likely require a valuation re-rate for the stock. This would depend on consistent progress in underlying fundamentals supportive of continued market share gains to protect PayPal’s leadership in online payments processing, as well as a supportive strategic roadmap by new management. We view the company’s upcoming earnings calls over the next six months as a critical time for the new CEO to shift the narrative on PayPal for the better and restore credibility to the stock.

The Bottom Line

Admittedly, PayPal has significant exposure to some of market’s biggest risk factors right now, spanning macroeconomic weakness to industry-specific competition. Unlike its rivals, PayPal does not have an external moat – such as Google Pay’s leverage of advertising, Apple Pay’s leverage of its broader ecosystem of device installed base and other service sales, and Shop Pay’s leverage of Shopify’s ecosystem of merchant solution sales – to latch onto, other than online payment processing. However, the company remains fundamentally sound with durable support for sustained cash flow growth. The business is also unlikely to face substantial displacement of longer-term growth opportunities, which makes the stock’s underperformance at current levels a compelling risk-reward set-up.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly in chat, more research content and tools designed for growth investing, and joining a community of like-minded investors, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to our portfolio of research coverage and complementary editing-enabled financial models

- A compilation of growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!