Summary:

- WTI and Brent crude oil prices have risen, but Chevron’s stock has remained flat recently and is down 4.3% year to date.

- California has filed a lawsuit against Chevron and other major oil and gas companies for allegedly lying about climate change and causing damages.

- The lawsuit highlights the potential economic and environmental consequences of climate change, including water supply loss and agricultural production decline in California.

- This could lead to a great deal of pain for the space, but any resolution will take time and would probably look similar to what transpired in the tobacco industry.

Mario Tama/Getty Images News

Over the past month, WTI crude prices have risen about 8.6%, while Brent crude has jumped 9.7%. Meanwhile, natural gas prices, as measured by Henry Hub, jumped 5.8%. You would think that this would bode well for really all of the companies that benefit from higher oil and gas prices. But this has not been the case across the board. One of the majors in the space, Chevron (NYSE:CVX), has seen its share price be virtually flat over the past month and, year to date, the stock is down 4.3%. To be very clear, companies like Chevron are large and complex. They have many working parts and there are many different factors that influence price movements. But one thing that has certainly proven to be a negative has been legal action taken by various state and local governments against not only Chevron, but also against some of its massive competitors.

The latest salvo in this assault has come from the state of California. Because of the damage caused by climate change in the state, combined with future damage expected, the state is seeking compensation for what it describes as decades of lying by the companies, with those lies leading to tremendous socialized losses and the loss of countless lives, while the companies in question allegedly benefited to the tune of 10s of billions of dollars each. It’s unclear the impact this litigation might have on the players in this space. The good news is that any sort of damages that might be awarded will likely be paid over many years. But the bad news is that the case against the firms looks damning.

Some major allegations

On September 15th of this year, Rob Bonta, the Attorney General for California, filed a lawsuit with the Superior Court of the state of California in San Francisco against some of the largest oil and gas companies on the planet. The list consisted of Chevron, Exxon Mobil (XOM), BP (BP), ConocoPhillips (COP), and Shell (SHEL), as well as against the American Petroleum Institute (or API). Truthfully, this article could be written about anyone of these companies. But I’ve decided to emphasize Chevron because of its exposure to the state. The company’s operations there date back to no later than 1876 when oil was first struck within the state. The company wasn’t called Chevron back then. But through multiple transactions spread across many decades, the company has grown to what it is today.

According to the lawsuit filed against these five companies, scientists working on behalf of the firms in question understood the potentially catastrophic effects that could be caused by carbon emissions. From that time through 1997, the companies and the American Petroleum Institute publicly claimed that either there was no relevant evidence of climate change or that there was, but that evidence of anthropogenic climate change was either nonexistent or severely lacking. This changed in 1998. The companies continued to claim that either addressing anthropogenic climate change would be costly and/or that the degree to which warming would occur because of human activity was highly speculative.

The 135-page lawsuit gives them multiple examples of how the companies and the American Petroleum Institute worked hard in what California claims were attempts to ‘deceive’ the public. Examples included lobbying, issuing faulty scientific conclusions, advertising, and more, all for the sake of preventing any sort of legislation that might help reduce the effects of greenhouse gas emissions since any sort of action would almost certainly harm the profits of these companies. One of the most damning conclusions came from a 1980 presentation made by Dr. J. A. Laurman, an expert in climate change at the time, to the American Petroleum Institute of which Chevron was a member. That presentation estimated that by the year 2038, if nothing changed, there would be, ‘major economic consequences’ caused by climate change and that by 2067 we would see, ‘globally catastrophic effects’.

Of course, these problems would not just bubble up overnight. According to California, they are already proving to be a problem. Over the past three years, California has already allocated $8 billion for the purpose of modernizing water infrastructure and management, as part of a plan to address a potential loss of 10% of its water supplies by the year 2040 caused by climate change. While a 10% drop may not sound like much, it could have devastating consequences for the state. This is because California is responsible for over 60% of all US vegetable production and for approximately two-thirds of US fruit and nut crops. In fact, it’s even responsible for the production of 80% of all almonds produced across the globe. 40% of all water usage in the state is allocated toward the agricultural industry and it’s expected that climate change could cause production declines of 40% for avocados and 20% for almonds, table grapes, oranges, and walnuts, by 2050.

Superior Court of the State of California

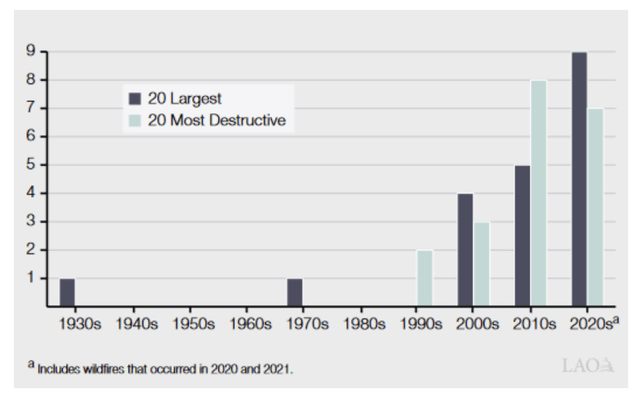

In 2016 alone, the state claimed that the agriculture industry lost over $600 million directly and around 4,700 jobs because of climate change. And one fire alone, known as the Camp Fire, that occurred in 2018, resulted in 4.3 million acres of land, or 4% of all land in California, burning. This caused $16 billion worth of damages because of the destruction of 19,000 structures and 85 civilian deaths. In fact, as you can see in the image above, fires have gotten larger and more destructive in the state in the past few years.

Some of the greatest damage will come from the coast. Over the past century, sea level rise for the state has been about 8 inches. And current forecasts see this picture worsening, with additional sea level rise of between 3.5 feet and 6.6 feet occurring by the end of the century. That puts at risk around 600,000 people and $150 billion in property and infrastructure. To address these matters, California has initiated a number of different programs, with one calling for $52.2 billion to addressing climate change between 2021 and 2027.

I only included some of the details from that lawsuit into this article. After all, I could write an article many times larger than this if I included every detail. But if you want that information, I would encourage you to read more about it here. When I think of this particular scenario, I think of one where, if the allegations made by the state do turn out to be correct, that these companies will ultimately end up paying a great deal for it. And I do think that the kind of end result we will see might not be terribly different from what the tobacco industry experienced a couple of decades ago.

The first health warnings to be put on tobacco products came out in 1966. It wasn’t until 1998 that 52 states and territories ratified the Master Settlement Agreement with the four largest tobacco companies. That particular settlement called for the major tobacco companies to pay out around $206 billion over the first 25 years of the life of the settlement. It’s important to note that while smoking rates have plummeted, those companies are still alive today and still generating significant cash flows. Earlier this year, I even wrote about one of them, Altria Group (MO), which you can read about here.

There are, of course, noticeable differences between the tobacco industry and the oil and gas industry. Unlike tobacco, there are severe differences in competition that could cause problems if American oil companies have yet another expense to cover while competing in a global market against firms that already produce for less than they do. Keep in mind that the US oil and gas industry is one of the most expensive markets from a production perspective already, so any additional costs that these companies might have to deal with could create pain for the industry as a whole.

There are other differences as well. For instance, while both industries initially claimed that there was no real evidence of a problem, the tobacco industry remained adamant about this, while the oil and natural gas industry has come around and acknowledged that climate change is real and is a man-made issue. In its latest annual report, for instance, Chevron even went so far as to say that it, ‘supports the Paris Agreement’s global approach to governments addressing climate change and continues to take actions to help lower the carbon intensity of its operations while continuing to meet the demand for energy’. They even stated in the following paragraph that, ‘Chevron believes that the future of energy is lower carbon’.

Instead of recognizing climate change as an existential threat, it and companies like it are now working hard to adapt for the future. I have written about this before when it comes to rival Exxon Mobil. For Chevron specifically, it’s worth noting that management, in 2021, pledged to allocate $10 billion of its capital expenditures between 2021 and 2028 toward lower carbon investments. And in both 2021 and 2022 combined, they made $4.8 billion in investments in this space if you include the company’s purchase of REG. By 2050, the company even hopes to reach net zero emissions for its Upstream operations.

This is great because it opens up a door for it and others like it to transition to a cleaner future. But this does nothing to atone for the past sins that it and rivals committed. The good news is that Chevron has a solid track record of generating cash that it can use to cover these costs. Of course, this assumes that energy prices don’t tank at some point. Oil and gas markets are some of the most volatile in the world and covering what might ultimately be very specific cash outflows on a year-to-year basis with cash inflows that could be all over the map could be problematic. But if we use the last three years as an example, we see that the firm has done very well for itself and its shareholders.

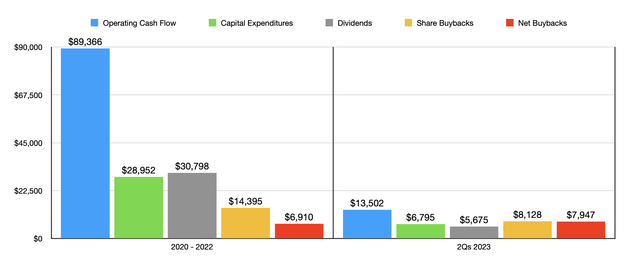

Over the past three years, Chevron has generated $89.4 billion in operating cash flow. That excludes the $13.5 billion that it has generated in the first half of 2023. By comparison, capital expenditures totaled only about $29 billion. However, the company did spend $30.8 billion on dividends and $6.9 billion on net share buybacks. The actual value of share buybacks was about $14.4 billion. But the difference was used for employee compensation. At present, the company has net debt of only $11.9 billion compared to $158.3 billion for its book value of equity. And even that would be higher to the tune of $56.2 billion had it not been for treasury stock purchases. The bottom line is that, so long as energy prices don’t plummet for the long run, firms like Chevron do have plenty of capital to work with. Of course, this is not something that investors should wish to see. But I would argue that some sort of negative outcome for the company and the industry is likely based on the evidence that California has offered up.

Unfortunately, the timing for the company probably could not be worse. When the firm filed its annual report for 2022, it disclosed that it was already codefendants in 23 separate lawsuits brought about by 17 US cities and counties, three states, the District of Columbia, a group of municipalities in Puerto Rico, and a trade group, regarding climate change issues. And in April of this year, the US Supreme Court issued a ruling in which it denied Chevron and four other major oil companies the opportunity to move these cases from the state and local level to the federal level where the chance of dismissal would be higher. The five cases involved in this rolling included cities and municipalities in Colorado, Maryland, California, Hawaii, and Rhode Island. So while the big news right now involves California, these other states and other areas in general are also on the hunt.

Takeaway

Based on the data provided, I would argue that, in the near term, the risk for shareholders in Chevron is fairly limited. By the time you deal with the case in question, as well as any subsequent appeals, not to mention factoring in long term payments, you could be talking years. Over those few years, it and its competitors will likely continue to generate strong cash flows. But if you are looking at this from the longer-term picture, I would be less optimistic. For now, I still believe that the company makes for a decent ‘buy’ prospect. But this is definitely an issue their investors should monitor closely as time goes on.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is a service geared toward investors who are interested in keeping track of oil and gas E&P firms. It offers its subscribers cash flow deep dive analyses into a portfolio of 36 different E&P companies of all sizes, as well as periodic sensitivity analyses. The world of E&P companies is incredibly volatile and understanding how healthy these firms are and how well they can stand up in different environments can result in attractive returns, especially in an environment where oil and/or gas prices are elevated.