Summary:

- Lucid Motors is facing challenges with production ramp and slower-than-expected growth in deliveries, leading to sales estimate resets.

- The company’s disappointing delivery numbers and increased losses have raised concerns about its profitability.

- Market forecasts show a significant decline in sales compared to six months ago, indicating a potential decline in the company’s valuation.

Justin Sullivan/Getty Images News

Lucid Group, Inc. (NASDAQ:LCID) is facing the very real prospects of dipping into penny stock territory in the near term as the electric vehicle company deals with an uncertain production ramp, much slower-than-expected growth in deliveries, and substantial sales estimate resets compared to six months ago.

After aggressively acquiring stock in the EV company in 2022, I occasionally doubled down on Lucid Motors as I believed in the company’s potential in the electric vehicle market. With that being said, Lucid Motors has delivered a number of disappointments lately, particularly as they relate to deliveries.

Though the company shored up its balance sheet and just started its Lucid Air assembly in Saudi Arabia, I think the stock (unfortunately) is set for a longer period of underperformance.

Disappointing Delivery Runway, Guidance Risk, Jeddah Production Start

Obviously, it is never a good sign when a company widely expected to deliver stellar production growth disappoints the investor base with its sales and delivery numbers, but this is what happened to Lucid Motors in 2023.

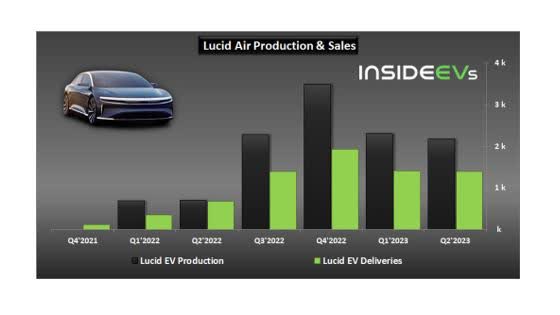

Lucid Motors oversaw a steep drop in both production and delivery figures this year, and the electric vehicle company produced just 2,173 vehicles during the second quarter but only delivered 1,404 of them.

Lucid EV Production And Deliveries (Lucid Motors)

On a 2Q-23 run rate basis, Lucid Motors is on track to deliver 5,616 electric vehicles in 2023, but the company presented a slightly more ambitious delivery goal of at least 10K deliveries in 2023 (a downgrade compared to the prior forecast). If demand cools and Lucid Motors fails to pull off a substantial delivery rebound in the second half of the year, the EV company might have to pull its guidance yet again.

The exceptionally weak performance in deliveries is the reason why I have come to change my view of Lucid Motors, even after the company managed to raise $3 billion in new capital in the second quarter, bolstering up its balance sheet.

Lucid Motor also said at the end of September that it finally started the assembly of the Lucid Air in Jeddah, Saudi Arabia. It is the first manufacturing facility outside of the United States and highlights the company’s ambitions to be an international player in the electric vehicle industry.

Initially, Jeddah is expected to churn out 5K electric vehicles annually before gradually stepping up the production volume to a long-term annual output of 155K electric vehicles. Unfortunately, even the start of production in Saudi Arabia has not had a positive impact on Lucid Motors’ stock price.

Profitability In Question

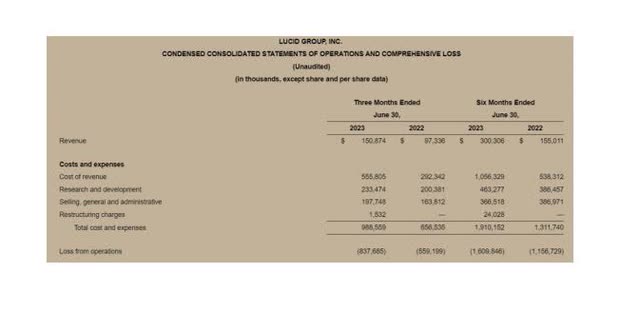

While Lucid Motors’ deliveries have tanked, the company’s losses have expanded. The electric vehicle company accumulated $1,610 million in operating losses in the first half of the year, reflecting a 39% YoY increase.

Lucid Motors did raise another $3 billion from investors in the second quarter to account for the cash burn, but investors are likely going to see the EV company continue to rack up considerable losses in 2023 and 2024. Together with slowing delivery and sales growth, this could be a major challenge for the EV company, and particularly its valuation.

Loss From Operations (Lucid Motors)

The Market Now Models A 40% Decline In Sales Compared To Six Months Ago

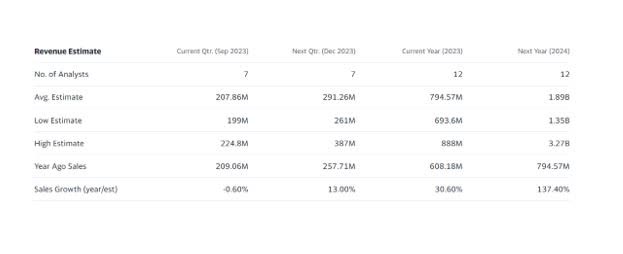

The market has already begun to account for a much slower sales ramp than last year, as a result of Lucid Motors cutting its production guidance for 2022 and 2023.

The market presently forecasts less than $800 million in sales for 2023, which is down from $1.34 billion in March, reflecting a whopping 40% decline in the average estimate.

The same is true for Lucid Motors’ expected sales potential in 2024: The market now models $1.89 billion in sales compared to an earlier forecast of $3.24 billion (reflecting a decline of 42%).

Revenue Estimate (Yahoo Finance)

While Lucid Motors is still growing its sales and is clearly capable of boosting its liquidity, its commercial trajectory does not look good. If there is more evidence that Lucid Motors’ production and delivery growth slows in the third quarter, investors must be ready to deal with new sales estimate resets as well as Lucid Motors’ stock falling into penny stock territory.

Lucid Motors’ equity still has a market value of $12.7 billion, implying a leading P/S ratio of 6.8x. That’s a rich multiple to pay for a company that has seen a 40% estimate reset to the downside in the last six months.

Why Lucid Motors Might See A Lower Or Higher Valuation

I think Lucid Motors has a strong value proposition with the Lucid Air sedan, and the kick-off of assembly in Jeddah is a step in the right direction, but I also acknowledge that the electric vehicle startup faces growing risks associated with its sales and production ramp.

If the company does not see a significant increase in deliveries in the third quarter, Lucid Motors is at a very real risk of having to raise capital again within the next year. The risk/reward situation has greatly deteriorated in the first half of 2023, and I count my investment in Lucid Motors as the largest investment error I have made so far.

Upside Risk

Lucid Motors’ stock has been prone to sudden spikes in volatility. Lucid Motors is heavily shorted, and I pointed out the risk of a potential short squeeze in February, which was the last time LCID was seeing sudden and drastic upside price momentum.

I detailed my views about Lucid Motors’ short squeeze potential in my article entitled Lucid: A Short Squeeze May Be Ahead. Presently, Lucid Motors has 24% of its float shorted, so any good news on the part of the EV company could result in a short squeeze move.

Short Interest History (MarketBeat)

My Conclusion

I am pained by my substantial investment I made in Lucid Motors in 2022 because the company is on an unsatisfying trajectory even though it reported some good news lately as well, including the start of assembly in Jeddah, Saudi Arabia, as well as the company’s ability to shore up its balance sheet with another $3 billion from investors.

With that said, however, the change in guidance and particularly the huge drop in sales estimates can’t and shouldn’t be overlooked.

With dialed-down production guidance for 2023, ongoing sales revisions, and widening losses, I think the stock may very well enter penny stock territory. Hold.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LCID either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.