Summary:

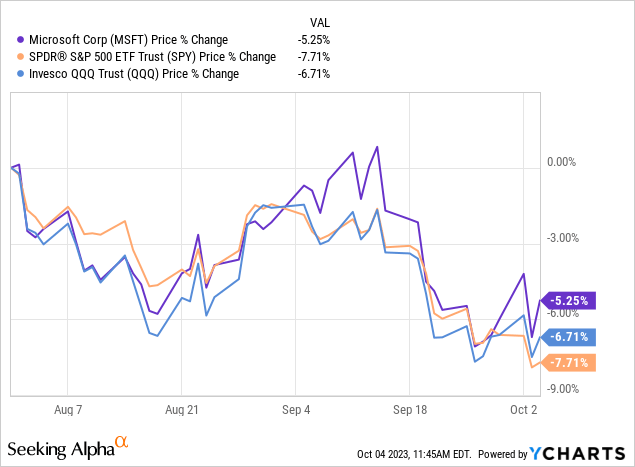

- Amidst a sharp ascent in long-duration treasury yields, Microsoft stock has dropped by 5% since late July, whilst showing relative strength versus broader market indices.

- In my view, artificial intelligence and strong business fundamentals are supporting a flight to safety trade into MSFT stock (along with other big tech stocks).

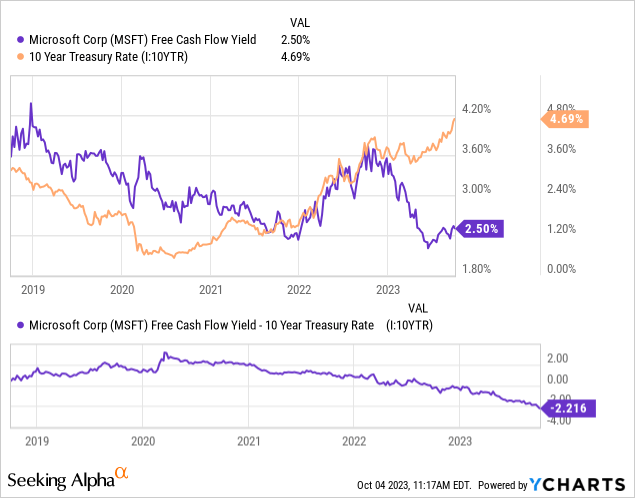

- While exciting developments around Microsoft’s Copilot AI assistant are raising hope of imminent monetization of Gen AI, MSFT’s equity risk premium has fallen deeper into the negative territory.

- The long-term risk/reward for Microsoft remains unattractive. Hence, I continue to rate MSFT stock as “Sell” at current levels.

Ahmad Bilal/iStock via Getty Images

Introduction

Amid a wild run-up in long-duration treasury yields, Microsoft (NASDAQ:MSFT) has seen its stock drop by ~5% since I reiterated my bearish stance on MSFT stock in late July, citing a valuation problem:

Microsoft is a robust business (as evidenced by its Q4 FY23 report); however, after a spectacular year-to-date rally the stock is priced for perfection, and despite a post-ER sell-off, MSFT’s risk/reward remains highly unfavorable for investors.

Microsoft is well-positioned to benefit from the secular trend of artificial intelligence; however, a negative risk premium violates the immutable laws of money. In my view, Microsoft is incredibly expensive (at ~35x P/E) in relation to its growth profile [even in a zero-interest rate environment]. And while bulls may disagree, we no longer operate in such an environment, with risk-free US Treasury bonds yielding nearly 4-5%.

With Microsoft’s equity risk premium firmly in the negative territory, the stock offers no margin of safety. Since the turn of the century, we have only seen such negative equity risk premiums for Microsoft during the 2007-08 (Great Financial Crisis) and 2000-2002 (Dot-com Bubble) periods, and we all know what happened with the stock market and Microsoft during and immediately after these periods.

And as we saw in this note, MSFT is grossly overvalued on an absolute basis. Considering Microsoft’s absolute valuation, elevated trading multiples, and negative equity risk premium, I continue to believe that the stock will undergo a painful correction in the near to medium term.

Source: Microsoft: Another Solid Quarter, But MSFT Stock Is Still A Sell

The ongoing price correction has led to a slight improvement in Microsoft’s free cash flow yield (up from 2.4% to 2.5%); however, the rapid run-up in treasury yields is driving Microsoft’s equity risk premium further into the negative territory. As I shared in my last update, Microsoft has never had a negative equity risk premium outside of the Great Financial Crisis (2007-09) and the Dotcom bubble (2000-02). A negative equity risk premium violates the immutable laws of money, i.e., Microsoft’s current valuation is simply unsustainable, and a significant correction is still overdue.

Given the obvious overvaluation, Microsoft’s stock should logically be an underperformer during a broad stock market correction. However, MSFT stock has shown relative strength in recent weeks by outperforming broader indices such as the S&P 500 (SPX) (SPY) and the Nasdaq 100 (NDX) (QQQ).

So, what’s driving the resilience in Microsoft stock?

Well, my bet is on artificial intelligence and sound business fundamentals.

In today’s note, we will first discuss some of Microsoft’s latest announcements around its Copilot AI assistant. Then, we will look at select business fundamentals that could support a premium valuation. Lastly, we will re-evaluate MSFT’s fair value & expected returns to make an informed decision on the tech giant’s stock.

Microsoft Copilot AI Looks All Set For General Availability In The Enterprise World After Windows Integration

Since expanding its partnership with OpenAI at the back end of last year, Microsoft has been introducing generative AI features across its ecosystem, building AI-powered copilots into several of its products – Microsoft 365 (boosting productivity at work), Bing & Edge (redefining search), GitHub (making coding more efficient), MS Office apps, and on PC with Windows.

On 21st September 2023, Microsoft announced the unification of these capabilities into a single experience – Microsoft Copilot, an everyday AI companion. In essence, Copilot is very much like the AI chatbot you chat with via Bing search, with a few Windows-specific features, i.e., the ability to launch apps, find and play music, etc. According to Microsoft’s announcement,

Copilot will uniquely incorporate the context and intelligence of the web, your work data and what you are doing in the moment on your PC to provide better assistance – with your privacy and new Microsoft security tools to protect families and businesses at the forefront. It will be a simple and seamless experience, available in Windows 11, Microsoft 365, and in our web browser with Edge and Bing. It will work as an app or reveal itself when you need it with a right click. We will continue to add capabilities and connections to Copilot across to our most-used applications over time in service of our vision to have one experience that works across your whole life.

While the unification of Copilot across the Microsoft ecosystem may not seem like a big deal at this time, I think that having a unified Copilot can drastically improve customer experiences through personalization.

To learn more about Microsoft’s Copilot AI assistant and to visualize its functioning, visit Microsoft Blog.

Copilot was rolled out (in preview) as part of a free update to Windows 11 on 26th September, along with 150+ new features that bring AI-powered experiences to apps like Paint, Photos, Clipchamp, etc. And soon (within fall), Copilot will be made available across Bing, Edge, and Microsoft 365.

So far in 2023, there’s been a wild rush to build generative AI solutions; however, the monetization piece of the generative AI story remains a significant challenge for most companies. Microsoft Copilot for Windows is going to be free for commercial customers, hence, the Windows integration is not a significant deal for Microsoft.

However, Microsoft 365 Copilot moving out of the early-access program [EAP] and into general availability on 1st November 2023 is the biggest update to come out of Microsoft in recent months.

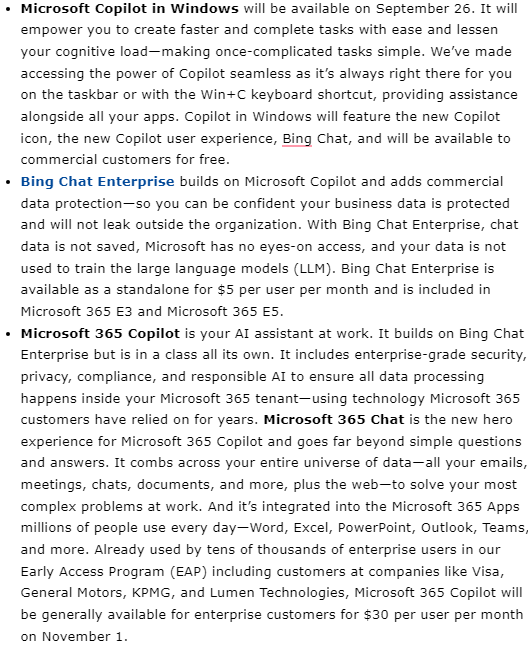

Here’s what Microsoft shared on its product line-up for commercial customers:

Microsoft Blog Microsoft Blog

As you may know, Microsoft has ~300M users across its ecosystem. At $30 per user per month, Microsoft 365 Copilot could potentially generate $9B in monthly revenue (at full adoption). While bullish investors are optimistic about Copilot AI adoption being explosive, Microsoft’s management has called for a gradual rise in adoption and revenue growth from AI, and at this $30 price point, I think it could be a year or more before we see any meaningful numbers from Microsoft 365 Copilot.

Given these exciting product developments and Microsoft’s strong track record, I think MSFT does warrant an AI premium. That said, numbers are still a missing piece in this AI story, and until that changes, one can safely say that AI hype is keeping Microsoft’s stock propped up.

Another reason for the market pricing MSFT at >30x P/E is its status as a safe haven stock. With long-duration treasury yields surging higher, a flight to safety trade is helping the “Magnificent 7” big tech stocks hold up better than others! But, is Microsoft really safe? I don’t think so, let’s see why.

Mr. Market Views Microsoft As A Safe Haven Due To Its $64B Net Cash Balance, Robust FCF Generation, and Sound Dividend Growth Story

In addition to its AI promise, I think that Microsoft’s premium valuation stems from widespread investor appreciation for its rapidly growing cloud infrastructure and [monopolistic] enterprise & consumer software businesses that render MSFT a reliable free cash flow printing machine!

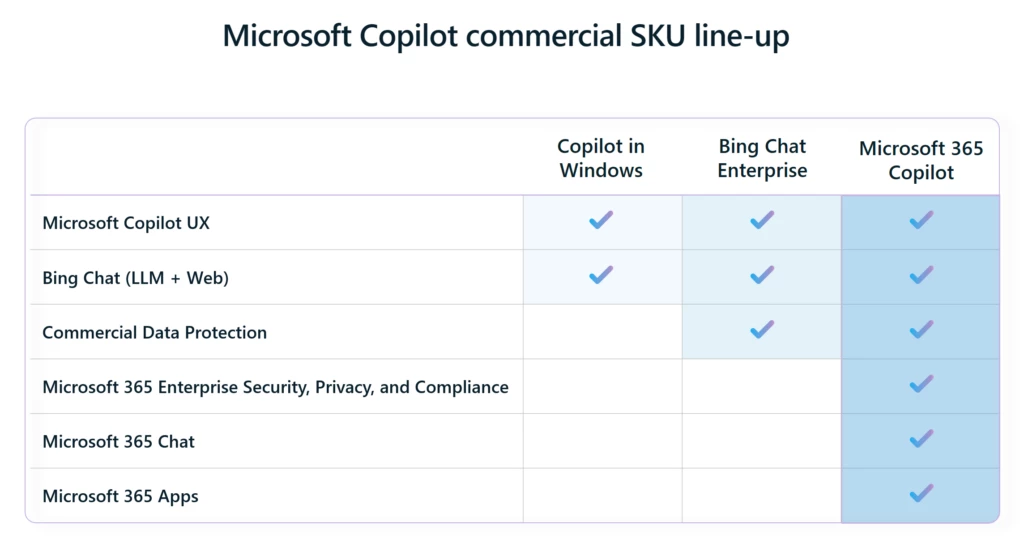

Over the last twelve months, Microsoft has generated ~$59.5B in free cash flow and returned nearly $40B back to shareholders in the form of stock buybacks and dividends.

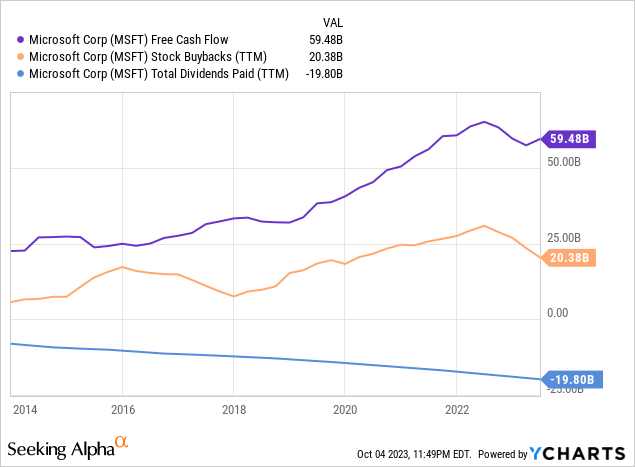

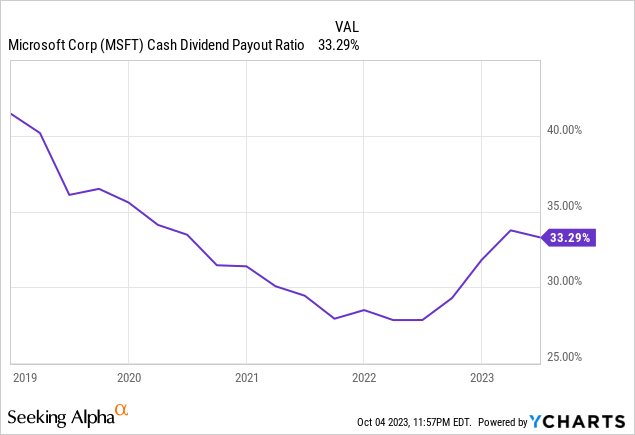

While Microsoft’s dividend yield of 0.85% is nothing to write home about in the current interest rate environment, MSFT is a solid dividend growth story as you observe on the chart below. With a cash dividend payout ratio of just ~33%, Microsoft has ample room to grow its dividend considerably over the coming years.

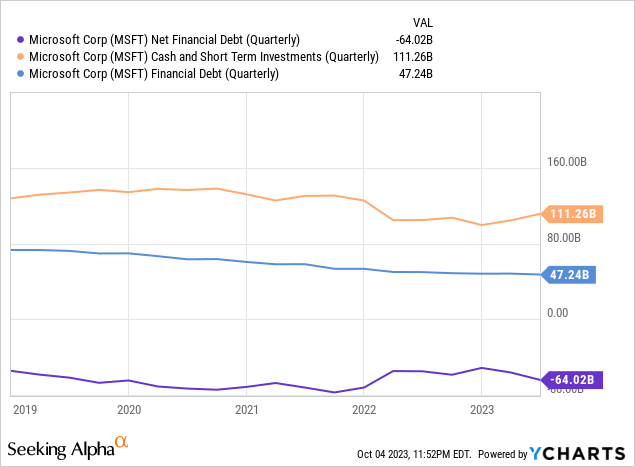

With treasury yields spiking up, investors are looking for safety in the bosom of cash-rich and cash-producing companies like Microsoft, which as of Q2 2023, held $111B in cash and short-term investment ($64B in net cash) on its balance sheet.

While Microsoft has a massive net cash cushion right now, the $69B Activision Blizzard (ATVI) deal is about to close, and that would considerably alter MSFT’s balance sheet. Given where interest rates have moved, Microsoft will likely use a mix of debt and cash to complete the ATVI acquisition (instead of all debt), but we will re-assess the balance sheet when the deal closes.

For now, Microsoft boasts a fortress-like balance sheet, and we know that MSFT’s free cash flow generation is rock-solid! The business is still growing at a healthy double-digit rate and is expected to do so for years to come. On paper, Microsoft looks like a safe haven.

However, when we add Microsoft’s negative equity risk premium into the mix, the story changes drastically. As I see it, Microsoft’s business is a safe haven, but MSFT stock (at current valuation: forward P/E of ~28-30x) is far from being a safe haven.

Concluding Thoughts: Is MSFT Stock A Buy, Sell, Or Hold?

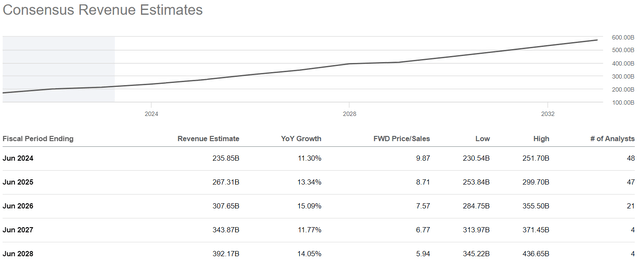

While Microsoft’s AI story has real substance, it remains a mature (fundamentally sound) business that is unlikely to experience explosive growth like what we have seen with the likes of Nvidia (NVDA) and Super Micro Computer (SMCI). According to consensus analyst estimates, Microsoft is set to grow at low-double-digit rates over the next five years, and even the unified Copilot AI Assistant is unlikely to move the needle here in the near term.

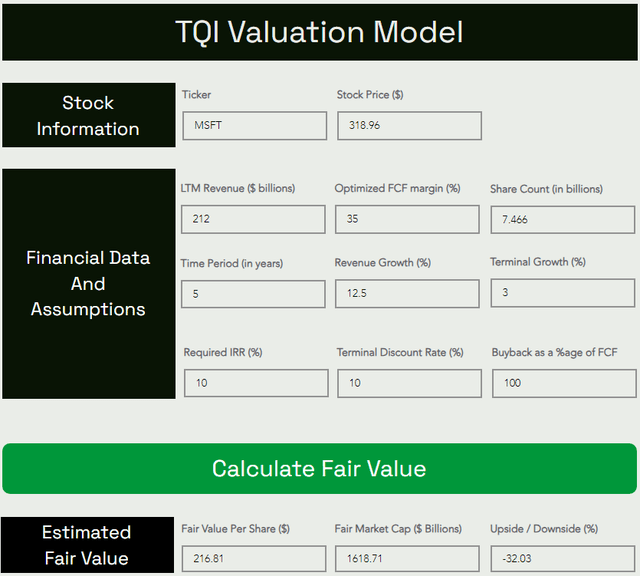

Given the increasing likelihood of a FED-induced economic downturn, MSFT’s consensus estimates could prove to be unattainable in due time. However, for the purpose of modeling Microsoft, we shall utilize a generous 12.5% CAGR rate for the next five years.

Despite using aggressive assumptions for growth and margins, Microsoft continues to look significantly overvalued:

TQI Valuation Model (TQIG.org)

According to TQI’s Valuation Model, Microsoft’s fair value is ~$217 per share (or $1.62T). With the stock trading at ~$319 per share, I see a downside of -30% to fair value in MSFT stock.

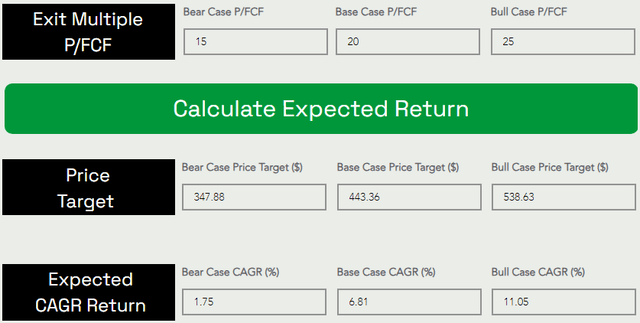

Predicting where a stock would trade in the short term is impossible; however, over the long run, a stock would track its business fundamentals and obey the immutable laws of money. If the interest rates were to stay depressed, higher equity multiples would be justifiable. However, I work with the assumption that interest rates will eventually track the long-term average of ~5%. Inverting this number, we get a trading multiple of ~20x [P/FCF].

TQI Valuation Model (TQIG.org)

Applying this figure as an exit multiple, Microsoft stock can rise from ~$319 to ~$444 per share in the next five years at a CAGR of 6.81%. While this expected return is slightly higher than what one can get from treasuries [4.5-5.5%], MSFT’s expected return falls well short of my investment hurdle rate of 15% and the S&P 500’s long-term average return of ~10%.

In the event of a hard landing, I could see Microsoft retracing to its fair value (and who knows, it could probably overshoot to the downside like in previous economic downturns). Despite a ~5% correction since my last update, I still see further downside risk of 30-40%+ in MSFT stock. Now, I will never short a high-quality business like Microsoft, but if I owned MSFT, I would sell here and look for a better entry point through price/time correction. At this point, [risk-free] treasuries present a better risk/reward than Microsoft’s stock, and that’s where I would park my cash until the risk/reward dynamic changes.

Key Takeaway: I continue to rate Microsoft a “Sell” at $319 per share.

Thank you for reading, and happy investing! If you have any questions, thoughts, and/or concerns, please feel free to share them in the comments section below.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Prepared For A Crash?

To navigate this highly uncertain macroeconomic environment, we Qvestors [TQI community members] are pursuing bold, active investing with proactive risk management. Join our investing community and take control of your financial future today.

Your investing journey is unique, and so are your investment goals and risk tolerance levels. This is precisely why we designed our investing group – “The Quantamental Investor” – to help you build a robust investing operation that can fulfill (and exceed) your long-term financial goals.