Summary:

- PepsiCo, Inc. stock is down 14% from its 52-week high, raising the question of whether it is a buy, sell or hold going into Q3 earnings.

- The article discusses several aspects underlying the recent price decline, besides the rather rich valuation of PepsiCo stock.

- The likelihood of an earnings beat on Tuesday is analyzed and I share what I expect from PepsiCo’s Q3 earnings report next Tuesday.

- Moreover, the attractiveness of PepsiCo stock as a dividend growth investment is questioned.

- As a long-term shareholder who looks to increase his position, I also share how I personally approach the situation – knowing full well that PepsiCo stock is still quite expensive.

Fotoatelie

Introduction

No doubt about it – PepsiCo, Inc. (NASDAQ:PEP) is a wonderful company to own. It meets a variety of criteria that qualify it as an excellent investment. To name a few: The company has great brand strength, a well-diversified portfolio, operates globally, and is shareholder friendly. As I explained in my comparative analysis with The Coca-Cola Company (KO), there is another quality criterion that could be misconstrued by overly textbook investors as acute balance sheet weakness: negative working capital. This is an aspect common to many high-quality blue-chip companies that generate solid excess returns on their invested capital.

However, PepsiCo stock has been quite a weak performer lately. Hence, and considering the company will release its third-quarter earnings on Tuesday, Oct. 10, and hold a conference call at 8:15 a.m. EDT, it’s a good time to reassess. In this update, I discuss the reasons for PEP stock’s decline over the past three months, see what we can expect from the third-quarter earnings report, and finally, consider whether PEP stock is a buy, sell, or hold now that it’s down 14% from its 52-week high of nearly $200.

Why PEP Stock Is Down In The Last Three Months

There are several aspects that I believe are responsible for the fairly poor performance of PEP stock recently, aside from the fact that the stock was definitely quite richly valued with a P/E ratio in the high 20s and a free cash flow yield of just over 2%.

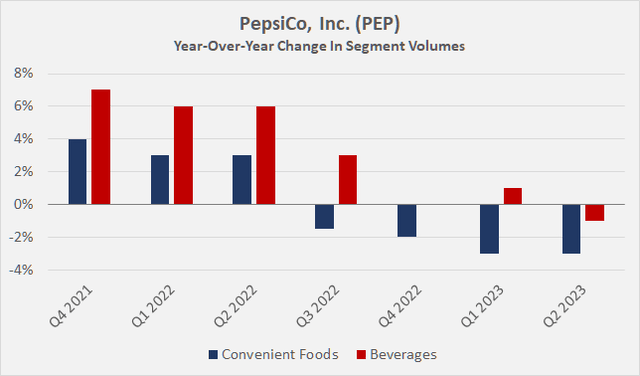

For one, consumers continue to be squeezed by inflation, leading investors to fear that PepsiCo, which owns mostly premium brands, could lose market share to discount or white-label brands. That fear is certainly justified to a certain extent, given that PepsiCo saw a volume decline of 3% in its Convenient Foods segment and 1% in its Beverages segment in the second quarter. For the Convenient Foods segment, this is the fourth quarter that PepsiCo has reported a volume decline (Figure 1).

Figure 1: PepsiCo, Inc. (PEP): Year-over-year change in segment volumes (own work, based on company filings)

However, I don’t think the recent decline in volumes should be over-interpreted. After all, isn’t it the small, everyday treats that can brighten up a bad day? I firmly believe that people living on increasingly tight budgets are more likely to cut back on other things than to forgo the easy-to-obtain and cheap (in absolute dollar amounts) goodies that promise (and deliver) instant gratification. So I view PepsiCo’s recent performance as temporary, also from the perspective that year-over-year comparisons are difficult, as consumers were still much less price-sensitive in late 2021 and early 2022. Nonetheless, it’s certainly a good idea to keep an eye on PepsiCo’s performance in terms of volumes, while its pricing power is undeniable if you look at its performance over the past few quarters.

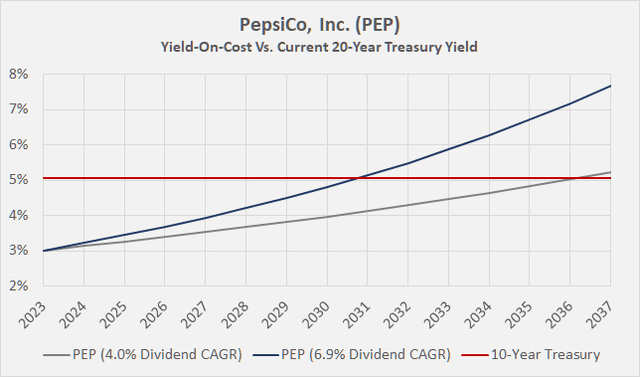

Second, it’s the rotation to higher-growth stocks with exciting stories (AI, weight-loss drugs – to name just two) and the fact that long-term government bonds have finally become an alternative again. While dividend-paying blue-chip stocks have long been referred to as a “bond substitute” (which is itself a fallacy due to the discretionary nature of the dividend), a dividend yield of less than 3% is certainly no longer that enticing. And even if PEP stock is down 14% from its 52-week high and now has a dividend yield of 3.0%, it’s hard to argue away the attractiveness of long-term government bonds. Even if PepsiCo can continue to grow its dividend at 6.9% per annum (the five-year CAGR), it would take eight years to match the 5.06% that the 20-Year Treasury currently offers – or thirteen years if PepsiCo dividend growth declines to 4.0% per year (Figure 2). I can certainly understand why income-oriented investors are increasingly interested in long-term bonds, but since I invest for the very long term, I stick with stocks because they carry no reinvestment risk.

Figure 2: PepsiCo, Inc. (PEP): Yield-on-cost scenarios compared with the current yield on the 20-Year Treasury (own work, based on company filings and data from CNBC)

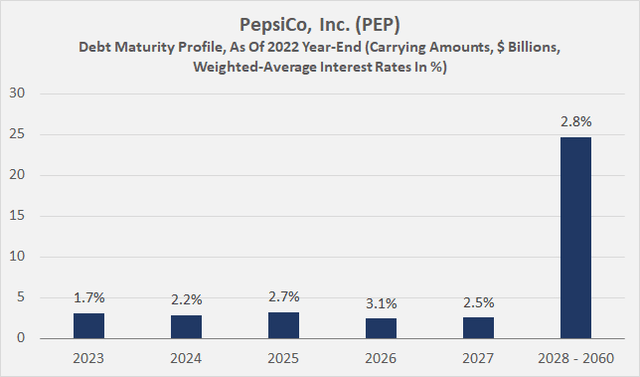

Finally, I think PepsiCo’s balance sheet is one aspect that makes risk-averse investors somewhat cautious against the backdrop of sharply higher interest rates. As of the end of the second quarter of 2023, PepsiCo had $37 billion in net debt – roughly six times its long-term average annual free cash flow. While I concede that a consumer staples company with a reasonably recession-proof business model can manage above-average debt, it is still worth taking note of PepsiCo’s pretty high debt load. However, investors who fear that the snack and beverage giant could suffer significantly in a “higher for longer” scenario should first of all keep in mind that PepsiCo currently pays a weighted-average interest rate of only about 2.7% on its debt.

However, a look at the maturity profile of PepsiCo’s bonds in Figure 3 shows that the short-term maturities (23% of PEP’s debt matures by the end of 2025) have very low average interest rates. Assuming interest rates remain at current levels for several years, and based on current yields on its long-term bonds (e.g., the 2033 notes), PepsiCo would likely need to refinance at a rate of more or less 6%. This would negatively impact the company’s overall weighted average interest rate by about 90 basis points, or worsen its interest coverage ratio from over six times long-term average free cash flow to five times. This is not a major concern, of course, but the somewhat cautious market sentiment makes sense in this context as well.

Figure 3: PepsiCo, Inc. (PEP): Debt maturity profile as of 2022 year-end (own work, based on company filings)

Did PepsiCo Beat Earnings Before And What To Expect From Q3 Earnings?

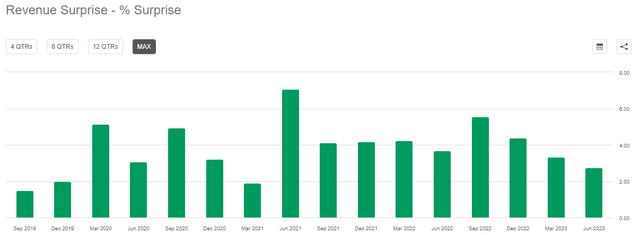

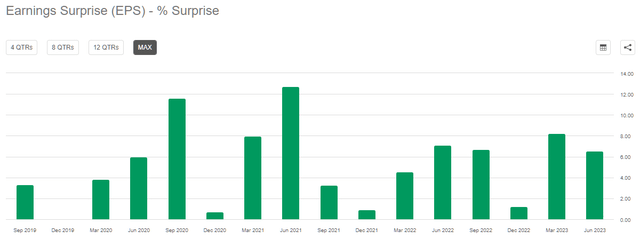

PepsiCo has a history of delivering positive earnings and revenue surprises. For at least the last sixteen quarters, PepsiCo exceeded consensus revenue estimates by 2% to 7% (Figure 4) and earnings per share (EPS) estimates by up to nearly 13% (Figure 5).

Figure 4: PepsiCo, Inc. (PEP): Revenue surprises on a quarterly basis (Seeking Alpha) Figure 5: PepsiCo, Inc. (PEP): Earnings per share surprises on a quarterly basis (Seeking Alpha)

With that in mind, an earnings beat next Tuesday seems very likely, but at the same time, I think the company’s impeccable track record is very well understood and therefore shouldn’t cause PepsiCo’s stock price to jump. Of course, I can imagine a positive market reaction if PEP reports a return to volume growth, especially since smaller rival General Mills, Inc. (GIS) recently reported rather poor volume numbers for its first quarter of fiscal 2024 (ending August 27, 2023).

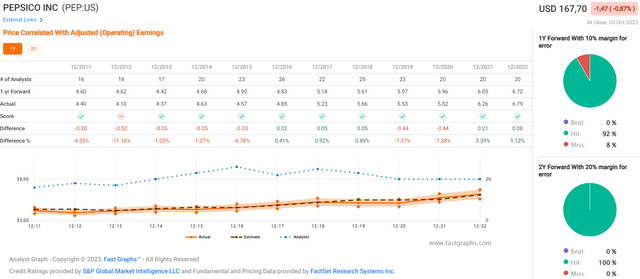

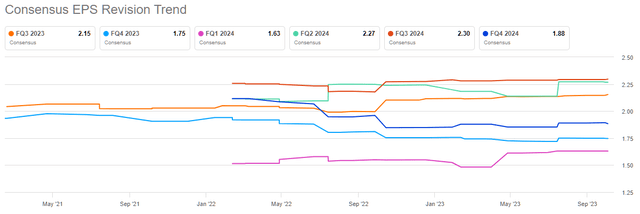

Another aspect to consider when assessing the likelihood of an earnings beat is earnings revisions. Short-term upward revisions by analysts can be an indication of an imminent earnings beat. However, due to the apparent ease of predictability and low volatility of PepsiCo’s earnings (as evidenced by FAST Graphs’ pristine analyst scorecard in Figure 6), revisions have remained fairly insignificant in recent months (Figure 7). That said, the long-term outlook for PEP’s revenues and earnings has improved over the past six months.

Figure 6: PepsiCo, Inc. (PEP): Analyst scorecard on a one-year forward basis (FAST Graphs) Figure 7: PepsiCo, Inc. (PEP): Earnings per share revision trend on a quarterly basis (Seeking Alpha)

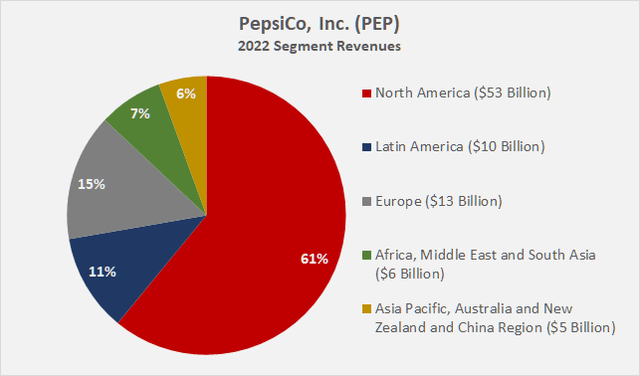

However, aside from the high probability of an earnings beat due to the impeccable track record (and the positive guidance revision after Q2), I think it makes sense to take note of the recently appreciated U.S. dollar. PepsiCo reports its revenues and earnings in U.S. dollars but generates more than 40% of its sales outside North America, including Canada (Figure 8). Still, I don’t think PepsiCo’s significant exposure to foreign economies will have a major impact on its upcoming sales and earnings numbers. For example, recall the rapid appreciation of the U.S. dollar in the third quarter of 2022 – PepsiCo delivered an EPS surprise of nearly 7% and a revenue surprise of 5.5% in this arguably challenging environment.

Figure 8: PepsiCo, Inc. (PEP): 2022 segment revenues (own work, based on company filings)

As mentioned above, management’s announcement of a return to volume growth in both segments could boost investor confidence. Given the easier comps in the recently ended quarter (see Figure 1) and due to higher advertising spending in the first half of the year, I think a return to volume growth is actually possible – despite the lackluster numbers from General Mills. Finally, while news of a return to volume growth could spark a (modest) post-earnings rally, I think PepsiCo shares, which are still quite expensive, continue to trade more on external factors such as labor market data, bond yields and, of course, Federal Reserve Chairman Powell’s remarks than on operating fundamentals.

Conclusion – Is PEP A Good Stock To Buy Now Before Earnings?

PepsiCo stock has been blowing off some steam after flirting with an – arguably lofty – $200 price tag. PEP stock is down 14% from its 52-week high, but that doesn’t necessarily mean it’s a buy. The company continues to perform very well in this difficult environment, but it’s certainly not without weaknesses.

Its balance sheet is fairly highly leveraged, and if we are indeed in for a “higher for longer” scenario, refinancing of the currently low-cost (in terms of interest rates) short-term maturities will reduce PepsiCo’s debt-servicing capacity. But even if the company refinances all its bonds maturing by the end of 2025 at a coupon of 6%, the weighted-average interest rate will still be well below 4%.

Somewhat slow long-term free cash flow and a high payout ratio of 60% to 100% of free cash flow (depending on whether acquisitions and divestitures are included in the calculation) suggest that management could return to somewhat more conservative dividend growth rates in the future. This makes PEP stock somewhat unattractive when compared to the de facto 5% risk-free Treasury yield that can currently be locked in for 10 to 20 years. Depending on PEP’s future dividend growth rate, it could take well over a decade for investors to match long-term Treasuries in terms of generated income (of course, different taxation should also be kept in mind). However, investing in shares of blue-chip companies has the advantage of avoiding reinvestment risk – what if interest rates are back at 0% when the long-term government bonds purchased today mature?

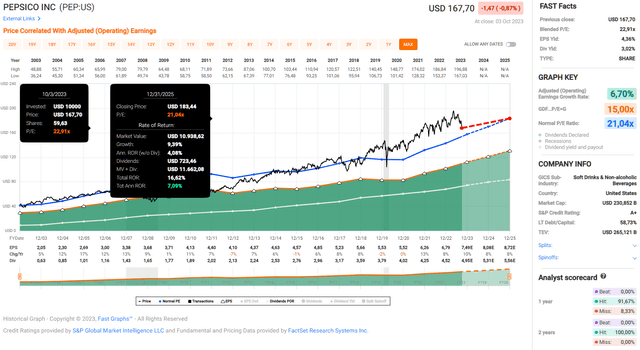

I have a hard time calling the stock a great investment at its current price – even though I expect the company to beat earnings estimates next Tuesday when it reports its third-quarter results and long-term prospects are very solid. The stock could jump on positive news of a return to modest volume growth, largely due to relatively easy comps and increased ad spending. However, with a blended P/E ratio of 23, PEP stock isn’t exactly cheap. That said, if analysts’ estimates are accurate, PEP stock price outlook and return prospects over the next few years are pretty acceptable for a blue chip (annualized return of 7.1%, Figure 9). Consider also that this expected return includes even a modest multiple contraction to a P/E ratio of 21.

Figure 9: PepsiCo, Inc. (PEP): FAST Graphs chart, based on adjusted operating earnings per share (FAST Graphs)

All in all, I remain ambivalent about PEP stock valuation. However, it is difficult to argue against the quality of the company, and that is why I am sticking to my New Year’s resolution. I have not added to my PEP position this year, but will:

add at least 5% [of the current position size] to my position in the fourth quarter of 2023 if an opportunity ($140, P/E of 20, FCF yield of 3%+) does not present itself sooner.

Your New Year’s Resolution For 2023: Invest $10,000 In These 10 Stocks, Dec. 30, 2022

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PEP, GIS, KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Additional Disclosure: I might initiate a beneficial Long position through a purchase of the stock in OGN over the next 72 hours. The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.