Summary:

- Rivian’s shares slumped by around 20% due to investor concerns about a convertible debt offering.

- The company plans to raise at least $1.5 billion through green convertible bonds, potentially raising a total of $1.725 billion.

- Rivian’s need to raise funds is driven by its massive cash burn rate and failure to access new funds could lead to a cash shortage in the near future.

Compassionate Eye Foundation/David Oxberry/OJO Images Ltd

Article Thesis

Rivian Automotive (NASDAQ:RIVN) has seen its shares slump on Thursday due to investors being worried about a convertible debt offering. This indicates that funding worries are to be taken seriously, as Rivian has to raise additional capital in order to pay for its massive cash burn. In the meantime, production growth continues, which is a positive sign.

What Happened?

Rivian announced a plan to raise new funds on Wednesday. The company seeks to issue at least $1.5 billion worth of green convertible bonds. Convertible bonds naturally can result in shareholder dilution down the road, which is why investors didn’t like this move at all: On Thursday, Rivian’s shares crashed by around 20%, deleting around $4.5 billion of the company’s market capitalization. To me, this suggests that the share price hit could be a near-term overreaction – a $1.5 billion convertible bond raise resulting in a market cap decline of around 2x -3x that magnitude seems like a very drastic reaction by the market.

What Do We Know About These Convertible Bonds?

Not all facts are known yet, but we know a couple of things about the convertible bonds Rivian Automotive plans to issue.

First, these are green bonds: Green bonds raise money that’s solely invested in green or environmentally-friendly projects. Since Rivian Automotive is an electric vehicle pure-play, many or most of its investments and projects will be green, thus the company should not be very restricted when it comes to deploying the proceeds. A legacy automobile company that’s not an electric vehicle pure-play would likely be more restricted in deploying the proceeds from a green bond offering, as ICE vehicle investments hardly will be “green enough.”

Second, Rivian will issue at least $1.5 billion worth of convertible bonds. Initial purchasers will have the option to buy an additional $225 million of these bonds if they want to, meaning Rivian could raise a total of $1.725 billion via this convertible bond sale – at least before expenses.

Third, these bonds will have a maturity date in 2030. That gives Rivian quite some time to work with the proceeds, and if things go right, Rivian could be quite profitable in 2030 – in that case, paying back the bonds (if they aren’t converted to equity) might be possible from the cash flows RIVN’s operations generate. Of course, profitability in 2030 is not guaranteed, but if Rivian has not managed to turn profitable seven years from now, the company arguably faces existential troubles either way, with or without these bonds maturing.

The interest rate on these bonds and the conversion rate are not known yet, these will be determined when the offering is prized. It seems likely, however, that the interest rate will be quite meaningful: After all, interest rates have soared over the last couple of weeks, and even ultra-safe treasuries are yielding around 5% right now. Since RIVN is an unprofitable company with a massive cash burn rate and significant uncertainties when it comes to future margins, profits and so on, investors will likely demand a huge risk premium compared to the yield on treasuries. An 8% interest rate, for example, would mean interest expenses of around $120 million to $140 million (if initial purchasers utilize the option to buy another $225 million) per year for Rivian Automotive. Of course, it’s possible that the interest rate is lower than that, but that would likely only happen if conversion rates are very favorable for the buyers of these convertible green bonds.

RIVN’s Need To Raise Funds

The market’s reaction to this news announcement could be overblown, but it’s pretty clear that Rivian will face some headwinds from this bond offering going forward. First, interest expenses will add to the company’s already massive net losses and cash burn, all else equal.

Second, the convertible nature of these bonds means that the risk of future dilution rises, all else equal – if everything goes great and RIVN turns out to be a very profitable company eventually, current shareholders will not get as large a portion of these future profits following the conversion of these bonds. One could thus argue that issuing convertible bonds limits the potential upside in a very bullish scenario for RIVN’s shares, compared to a scenario where no convertible bonds are issued.

There is, however, a good reason for Rivian to issue these bonds despite these headwinds: If the company doesn’t access new funds, it will simply run out of money.

Scaling up an automobile company is very expensive and requires massive investments. Inventory needs to be financed, new employees have to be trained, the company needs to buy equipment and build production facilities, new showrooms have to be paid for, and so on. Other EV startups, such as Lucid Group (LCID) or NIO (NIO) have experienced the same, thus Rivian is not in a unique position.

Over the last year, the company generated operating cash flows of -$5.70 billion, according to Seeking Alpha’s data. That means Rivian has been burning through almost $500 million per month over the last year. That does not yet account for the company’s investments or capital expenditures. Those totaled another $1.13 billion over the same time frame, for an annual free cash burn of $6.83 billion, or $570 million per month.

While the company ended the second quarter with a cash position of $10.2 billion (including short-term investments), that will most likely not be enough to pay for Rivian’s cash needs until the company is able to self-fund. If the current cash burn rate continues, Rivian would burn through its $10.2 billion cash pile in 1.5 years or 18 months. If the company wants to keep a cash position of $3 billion at all times, the limit would be reached in just 13 months. It’s thus pretty clear that there’s a major need for Rivian to access new funds, as the company would otherwise run out of cash in the not-too-distant future. Issuing bonds now in order to add to its cash reserves is not a bad move.

That being said, it’s far from guaranteed that Rivian will not issue new debt or equity in the coming quarters. After all, the proceeds of $1.5 billion to $1.725 billion from this convertible bond sale will barely be sufficient to pay for the cash needs of a single quarter, at least when we look at the trailing twelve months cash burn rate of $1.71 billion per quarter. Further capital raises during 2024 are thus not unlikely, I believe, although this does also depend on other factors, such as Rivian’s progress in scaling its operations and improving its margins. If RIVN is successful in these areas, the company could be able to reduce its cash burn rate next year, which would allow the company to operate for a longer period of time with the cash reserves it currently holds.

Is RIVN A Buy?

During the cheap money times during the pandemic, many EV companies were hyped up. Rivian was trading at around 10x the current price for a very short period of time following its IPO. The hype is gone, and investors have come to the conclusion that the EV space is competitive, that margins aren’t high, and that the automobile business is very capital intensive.

Rivian is doing a solid job when it comes to scaling up its production – the performance is much better than that of Lucid, for example. RIVN has produced a little more than 16,000 vehicles in Q3, or more than 60,000 annualized. That indicates solid ongoing growth, although it is, by far, not enough to operate profitably.

While RIVN is doing a solid job of building out its operations, the cash burn is hefty, and there are major uncertainties when it comes to the question of when RIVN will be profitable, and what margins will eventually look like – for the company and the industry as a whole.

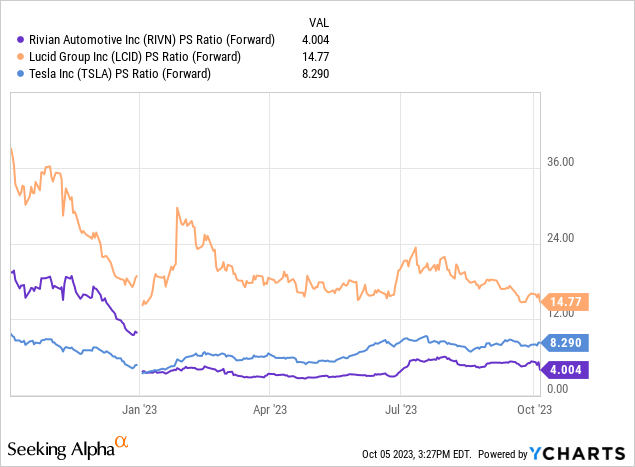

At 4x forward sales, Rivian is a lot cheaper than both Tesla (TSLA) and Lucid, but that does not mean that Rivian is a great deal here. Due to the uncertainties and potential macro troubles – a recession could be harsh for the automobile industry – I’m not buying into RIVN.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NIO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Is This an Income Stream Which Induces Fear?

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!

The primary goal of the Cash Flow Kingdom Income Portfolio is to produce an overall yield in the 7% – 10% range. We accomplish this by combining several different income streams to form an attractive, steady portfolio payout. The portfolio’s price can fluctuate, but the income stream remains consistent. Start your free two-week trial today!