Summary:

- AT&T, a former dividend aristocrat, cut its dividend in 2022 after announcing a spin-off.

- The dividend cut was necessary for the company to continue its path to growth and free up capital.

- AT&T has been taking steps to improve its position and is worth considering for investment.

- Due to expected slower growth in 1H of ’24 and the restart of student loan repayments, AT&T could see a decline in phone net adds over the next few quarters.

- I believe investors with a long-term outlook get almost 70% upside to its high price target.

Spencer Platt/Getty Images News

Introduction

I’m assuming anyone reading this article is most likely a dividend investor like myself. Before AT&T (NYSE:T) cut the dividend last year, the stock was a dividend aristocrat with a long history of raises under its belt. No investor ever wants to deal with a cut as this is hurtful to their income stream. Some use these to supplement their income in retirement, or reinvest their dividends to buy more shares. I was debating investing in the company well before the cut but never pulled the trigger. I followed the stock closely and then came the spin-off announcement, which ultimately led to the dividend cut.

I was happy telling myself “Glad I dodged that bullet” when I read the news. Although a dividend cut is almost never met with positivity, sometimes it’s needed for a company to continue its path to growth. One way to do this is by cutting the dividend to free up capital. We all know telecom companies have large debt loads and this is always a concern for investors. Stocks like AT&T and Verizon (VZ) pay out billions in dividends each year and this money could be used to continue growing their businesses. Since the cut, T has seemingly been doing all the right things in my view. This has caused them to jump back on my radar, so let’s dive into what I think of T and see if they deserve a spot in your portfolio or not.

What Has AT&T Been Doing Since The Cut?

Before the dividend cut, T paid out roughly $15 billion a year in dividends. In the 12 months since then the company has paid out $9.3 billion in dividends and had $15.2 billion in free cash flow. Since the cut, they have not raised the dividend unlike its peer VZ who recently raised theirs by 1.9% last month. Although a raise is always welcomed, I think this is a smart move by T to hold steady.

Whenever a company cuts their dividend, it’s a big blow to a shareholder’s confidence. You’re constantly worried what’s the next step for the company and how they will look going forward. With telecom companies it always seems to be one thing or another. T cut the dividend to free up cash and then the lead cables issue came about. While it remains to be seen what comes of this, management seems confident it will not be a huge issue going forward. Recently, the U.S. EPA said there were no immediate health threats from telecom cables. The EPA established a national working group to consider next steps to ensure this does not pose a threat.

Strong Start To 2023

Excluding the lead sheath cables issue, AT&T has had a strong start to the year. During Q1 they reported EPS of $0.60 and revenue of $30.14 billion. Revenue was up 1.4% from a year prior while EPS was down from $0.63. Cash from operations was also down by nearly $1 billion. This was due to timing of working capital, including lower securitizations. Additionally, T added 424k postpaid phone net adds for the 11th straight quarter with more than 400k net add with continued low postpaid phone churn.

They also added 272k fiber net adds for the 13th straight quarter. And during Q2 continued this with an increase in EPS by 5%. Cash from operations increased almost 48% quarter-over-quarter from $6.7 billion to $9.9 billion. FCF also increased from $1 billion to $4.2 billion, and management expects this to be $16 billion or better by the end of this year. This is in comparison to peer VZ who had 263k retail postpaid phone net adds in Q1 and 136k in Q2. So, as you can see T has been on the right track.

T also has been outperforming VZ when it comes to 5G coverage as well. Although both fall behind T-Mobile (TMUS) by a large margin, T has been making up ground with 30% 5G coverage compared to VZ’s 13%. This increased from 18%. Furthermore, T is the only carrier with 5G connectivity of some type in all 50 states. So, while investors have been skeptical about the company since the cut, T has been moving in a positive direction to right the ship.

How’s The Debt?

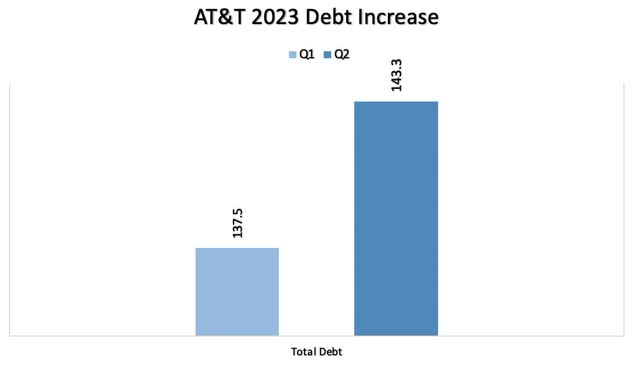

The elephant in the room about any telecom company is always their debt load. And T has been focusing on this as well. It’s one of the reasons I think it was a smart move to hold the dividend instead of increasing it like VZ did. T has held it steady since the cut, and one reason is that they can focus on the debt. Management has been making a concerted effort to pay this down over the last three years. They’ve managed to reduce it by $20 billion since then but investors may still be weary by the rise in 2023. In March of 2022, debt decreased from $211.3 billion to $140 billion at the end of the year but has since risen to almost $144 billion currently.

So why the increase? This was due to $4 billion T had in one-time and discrete items the company had to pay off. This included the WarnerMedia post-closing adjustment payment, the final NFL Sunday ticket payment, and the company redeeming in full the $8 billion preferred interest in their mobility subsidiary. The company expects to make a final clearing payment of about $2 billion tied to their 2021 spectrum acquisitions. But the company stated they’re still on track to reduce debt by $4 billion by the end of this year and expects a target range net debt to EBITDA of 2.5x by the 1H of ’25. One thing to note is that 95% of T’s debt is fixed-rate with an average 4.15% interest rate, so they will have to refinance some of their debt at a higher rate if we remain in the higher for longer environment as expected.

Future Outlook

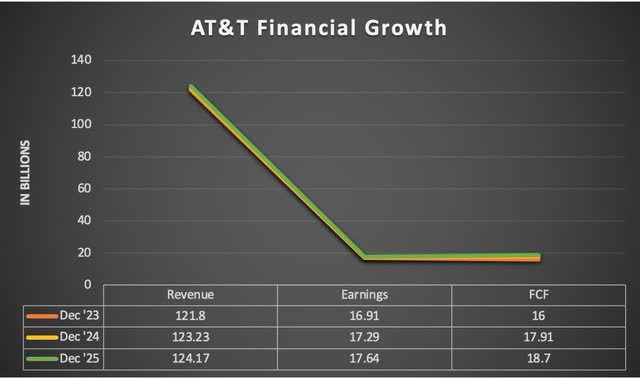

Investors know telecom companies grow like snails. But all we can ask for is some type of growth. T is expected to grow revenue more than $2 billion over the next two years while earnings are expected to grow at a slower pace from almost $17 billion to $17.64 billion. The largest increase expected is the growth in free cash flow from $16 billion to $18.7 billion by 2025. This is most likely due to the cost savings plan put forth by management.

By the end of 2023 this is expected to be $6 billion+ and management sees an opportunity to increase this by another $2 billion over the next three years. So to be fair the company has been executing its strategy to optimize growth in the coming years. This means continued growth in the 5G mid-band spectrum and postpaid phone net adds over the coming quarters. 3rd quarter FCF is also expected to come in slightly higher than Q2 with a range of $4.5-$5 billion range.

Valuation

Those who believe in T’s long-term outlook are getting a great bargain in my opinion. At the time of writing the stock offers almost 70% upside to its high price target of $25 and currently trading at a lower P/E than both peers VZ and TMUS, and below its 5-year average of 8.6. The stock is cheap in my eyes right now so investors looking to start a position should layer in over the next few months. The company is also expected to report earnings later this month and if they report good news as expected, I think the share price could spike. Below you can see analysts have a moderate buy rating for the company, which tells me they’re optimistic about the future in the near-term like myself.

Risks

A well-known risk the company faces is refinancing their debt at a higher rate. Another risk investors should be aware of is the restart of the student loan repayments. Beginning this month, students will need to start repaying their student loans after a 3-year pause due to the pandemic. This coupled with inflation could cause consumers to look for cheaper alternatives as they cut costs to repay their debt. Consumer spending is also expected to contract in the first 2 quarters of 2024 before picking back up later in the year. Furthermore, if we do enter into a recession in the near-term, we will most likely see a rise in job losses as well causing further pressure on telecom companies as consumer spending becomes tighter.

Investor Takeaway

T has been making concerted efforts to turn the company around since the dividend cut last year. One smart move I think the company made was electing to keep the current dividend so they can focus on debt repayments going forward. Investor sentiment is already low so keeping the dividend here should not further hurt the stock. If the company can continue growing its cash flows through cost-saving efforts and postpaid phone net adds while decreasing debt, I believe this will increase overall market sentiment which will in turn cause the share price to rise. Additionally, they offer great upside to those who believe in the long-term outlook and in my opinion T has been on the right track. T has had a strong start this year and unless the lead sheath cables become a bigger issue going forward, I expect them to continue this into 2024.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.