Summary:

- NKE continues to execute brilliantly at a time of uncertain macroeconomic outlook, boasting bottom line beats thanks to the higher interest rate environment.

- While its inventory levels remain elevated, we are not overly concerned, since its gross margins are still healthy, comparable to the pre-pandemic averages.

- However, we believe the correction observed in the NKE stock may not be over yet, with the North American region likely to be further impacted over the next quarters.

- This is because of the potentially tightened discretionary spending, as the US federal student loan repayment starts from October 2023 onwards.

- With lower highs and lower lows, it remains to be seen when we may see bullish support materializes, putting an end to this decline.

leolintang/iStock via Getty Images

The Nike Investment Thesis Is Much Improved Here, But Do Not Jump In Yet

We previously covered NIKE, Inc. (NYSE:NKE) in December 2022, discussing the Chinese reopening cadence. Mr. Market appeared to have been very optimistic about China’s potential revenge spending then, with it supposedly contributing to the company’s top and bottom lines while solving its elevated inventory levels.

However, due to the overly lofty valuations, we had rated the stock as a Hold then, while iterating an entry point of below $100s for an improved margin of safety.

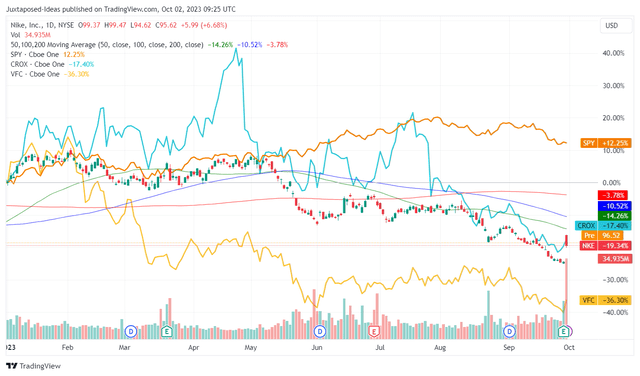

NKE’s Stock YTD Performance

True enough, most consumer discretionary stocks, including NKE, have been beaten down over the past few quarters. This is a direct contrast to the outperformance observed with the wider market YTD.

Perhaps part of the pessimism is attributed to the underwhelming performance posted in NKE’s North American region, which is an important metric since the segment comprises 43.8% of its overall top-line in the latest quarter.

With the region’s top-line already decelerating over the past few quarters, thanks to the tightened discretionary spending and elevated interest rate environment, market analysts may remain bearish about consumer discretionary stocks for a little longer.

Even then, we are not certain if there may be a floor to this decline, attributed to the potential impact of the US federal student loan repayment from October 2023 onwards, potentially triggering further headwinds to the company’s performance over the next few quarters.

For now, NKE’s inventory levels remain elevated at $8.69B (+2.8% QoQ/ -10% YoY), compared to the pre-pandemic averages of $5.31B. The elevated unsold items also mean that its long-term debts of $8.92B (inline QoQ/ YoY) have yet to normalize to FY2019 levels of $3.46B (inline YoY).

Then again, while an elevated debt on balance sheet usually triggers profitability headwinds, attributed to elevated interest expenses, the Fed’s sustained rate hike have also offered great returns thus far.

For example, NKE recorded a net interest income of $34M in FQ1’24, much improved compared to FQ4’23 net interest income of $16M (based on FY2023 overall net interest income of $6M and the first three quarters of 2023 net interest expense of $22M), FQ1’23 net interest expense of $13M, and FY2019 net interest expense of $49M.

The increase in its net interest income in the latest quarter is impressive indeed, despite the nearly tripled debt levels from FY2019 levels.

This is thanks to the management’s prudent decision of using part of its robust balance sheet of $8.79B (-17.6% QoQ/ -25.9% YoY) on short-term investments, yielding higher returns against its debt interest expenses.

In addition, despite the near record high inventory levels, the retailer has yet to embark on aggressive pricing actions, naturally preserving its gross margins at 44.2% (+0.6 points QoQ/ -0.1 YoY), not too far from its FY2019 gross margins of 44.7% (+0.9 YoY).

As a result of these developments, it is unsurprising that NKE has reported a profitability beat in FQ1’24 despite the top-line miss, with revenues of $12.93B (+1% QoQ/ +2% YoY) and GAAP EPS of $0.94 (+42.4% QoQ/ +1.1% YoY).

The robust GAAP EPS profitability at an annualized sum of $3.76 also suggests the management’s ability to continue paying its annualized dividends of $1.36 at an estimated payout ratio of 36.1%, improved compared to its 5Y payout ratio of 41.29%.

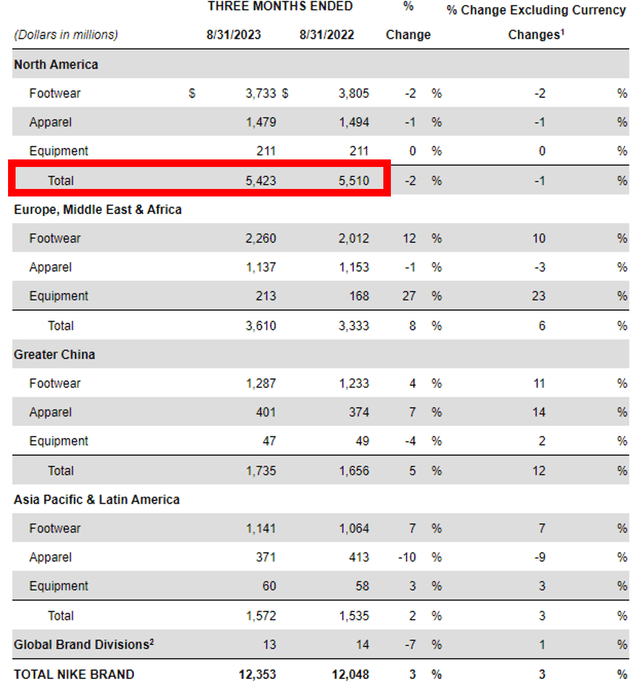

NKE’s Revenue Segments In FQ1’24

We believe much of the profitability tailwind may be attributed to NKE’s excellent growth in the EMEA at $3.61B (+6% YoY), Greater China at $1.73B (+12% YoY), and APAC at $1.57B (+3% YoY) well-balancing the North American segment’s decelerating demand at $5.42B (-1% YoY) in the latest quarter.

While China’s reopening cadence appears to have missed market analysts’ expectations, we are not overly concerned since much of the headwind is attributed to the temporal foreign exchange instead of consumer demand.

For example, the NKE management has already guided market share growth in China for FQ1’24, significantly aided by the robust consumer demand for its “most premium and elevated retail” offerings, sustaining its “strong double-digit growth in Q1 and Q2.”

The optimistic cadence is further sustained by the management’s promising guidance for FQ2’24:

We expect second quarter reported revenue growth to be up slightly versus the prior year, as we faced our most challenging comparisons from fiscal ’23. We expect second quarter gross margins to expand approximately 100 basis points versus the prior year… (Seeking Alpha)

These commentary suggests NKE’s more than decent performance ahead, likely to sustain its promising execution since the start of the pandemic.

So, Is NKE Stock A Buy, Sell, Or Hold?

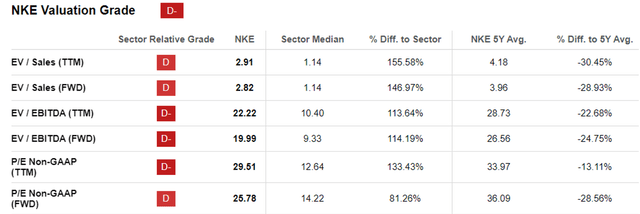

NKE Valuations

Thanks to its excellent execution thus far, the NKE stock continues to record premium valuations compared to the sector medians, sustaining the same trend over the past five years. However, we must also highlight that its FWD valuations have been discounted compared to its 1Y and 5Y means, demonstrating the same pessimism embedded in most consumer discretionary stocks.

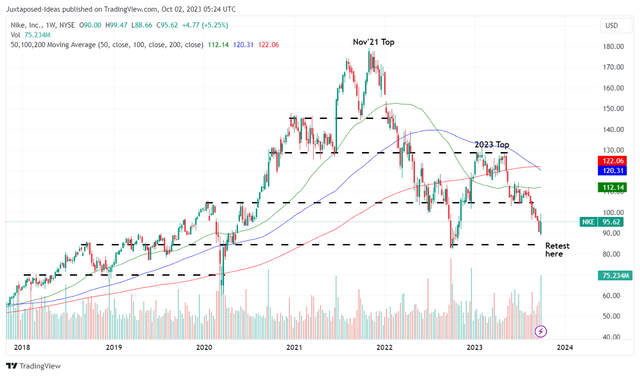

NKE 5Y Stock Price

NKE has also dramatically returned much of its hyper-pandemic gains. Despite so, we believe the correction may not be over yet, based on the lower highs and lower lows since May 2023. The stock is likely to retest its next critical levels of $85 in the near term, implying a potential downside of -11.1% from current levels.

As a result of the potential volatility, we prefer to continue rating the NKE stock as a Hold here. Interested investors may want to wait for a little longer, until bullish support materializes and a bottom to this decline is observed.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.