Summary:

- Microsoft has integrated AI into its business productivity software, aiming to increase productivity in the white-collar workforce.

- The company’s approach to integrating AI capabilities across its tech stack and network is expected to generate significant revenue.

- Positive reviews suggest that businesses may increase spending on Microsoft’s AI software during economic contractions due to its productivity gains.

- MSFT’s lead in AI will be significantly augmented if this product becomes prized and widely used, as current indications suggest.

Jean-Luc Ichard

We believe Copilot will fundamentally transform our relationship with personal computing

– Satya Nadella, Microsoft CEO

This article is dedicated to those who, like myself, have battled for countless hours in the trenches of white-collar tedium. Only you can truly understand the productive potential of Microsoft’s (NASDAQ:MSFT) new CoPilot product!

Have you ever stared at an Excel spreadsheet for far too many minutes, or even hours (surely not days?!), hoping the thing would fill itself in? Perhaps you were paralyzed in an uncontrollable and fundamental human rebellion at the degrading and repetitive nature of the task ahead of you and covered in a dripping wet blanket of utter despondence.

Yes, friends. I’ve been there. Great products have a straightforward value proposition that can be easily understood. In my mind, Microsoft’s new copilot product ends white-collar procrastination. Is everything perfect? No. Do you HAVE TO fact-check its output? Yes. Nonetheless, if you’ve wasted away in painful productivity meetings with middle managers, you know this is essentially an interminable gold mine. This product provides a seasoned white-collar worker with ample ways to save bundles of time when properly used.

How many hours have you lost trying to find e-mails you swear you can remember? What about writing and research? Do you get tangled in summarizing complicated material and lose hours doing tangential research to ensure you sound competent? Well, friends, the white-collar savior is here. Your days in the symbolic and emotional barb wire of thankless, menial business tasks could finally be at an end.

Microsoft’s new CoPilot product is where the rubber meets the road on the AI trend. Imagine the collective effects of all those hours in agony being erased in future quarters. Imagine what businesses would pay to unlock huge labor efficiencies.

Microsoft has become known as the market’s AI-maven. While other firms like Nvidia (NVDA) are experiencing prodigious, almost unprecedented revenue and earnings gains from selling its vital AI chips, the Sultan of Software is taking a much more direct approach. Despite its crowned status in AI, the firm’s price performance has languished over the past month. The recent Microsoft 360 Copilot product release is an underappreciated catalyst, though. Microsoft will shatter all expectations on how this critical extension of AI functionality to masses of commercial enterprises affects the firm’s earnings.

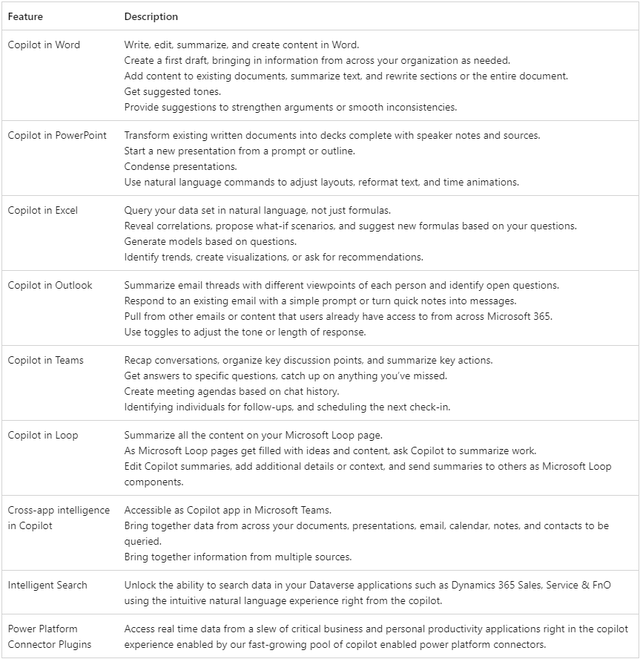

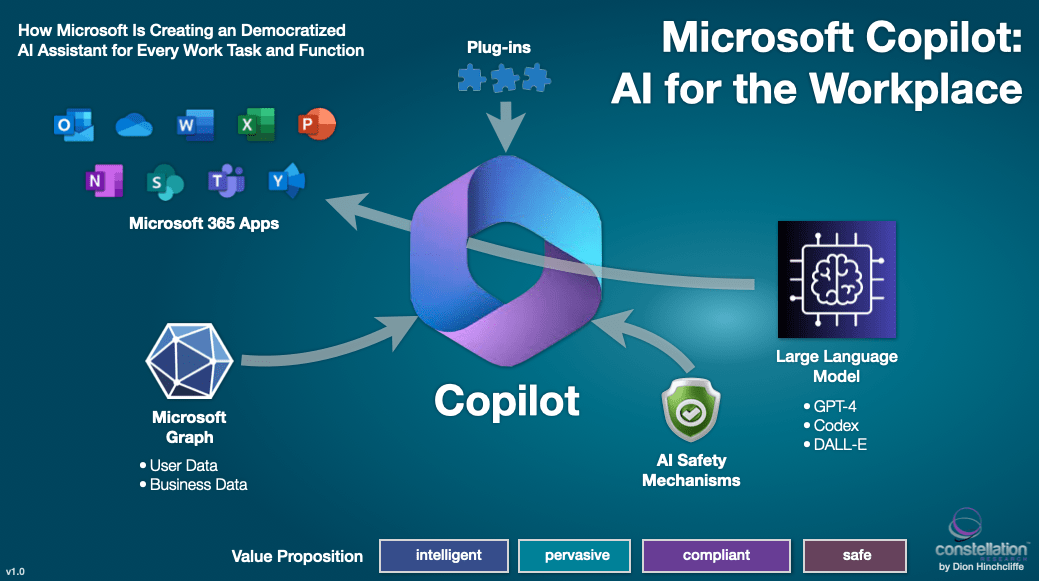

The recently released Microsoft co-pilot product integrates AI into Microsoft’s ubiquitous business productivity software. Of course, the firm had an excellent and prolific start to the year after the show-stopping ChatGPT product introduction. As impressive as that software is, the way Microsoft integrates new AI capabilities across its entire tech stack and world-class network is where the real money will be made.

I wrote about Microsoft in June and insisted it is the starting point for a thematic portfolio concentrated on artificial intelligence. Rather than being deterred by the price weakness since then, I view it as an enormous opportunity on the heels of a release of what I think will be the most profound product, in terms of commercial and macroeconomic impact, utilizing AI-powered solutions so far. Needless to say, this will likely be incredibly accretive to Microsoft earnings in the coming quarters and years.

Microsoft Investor Relations

Many investors rightly point out that they see evidence of froth and irrational exuberance about how markets respond to artificial intelligence. Part of this is how AI has been portrayed in cinema for multiple generations. From 2001: A Space Odyssey to HBO’s hit series Westworld, the technology has been portrayed in both a malevolent and nearly omnipotent light. The reality is closer to spreadsheets on steroids rather than Skynet, though. The truth around the commercial potential for artificial intelligence is infinitely more boring than the idea of the AI that exists in the collective consciousness.

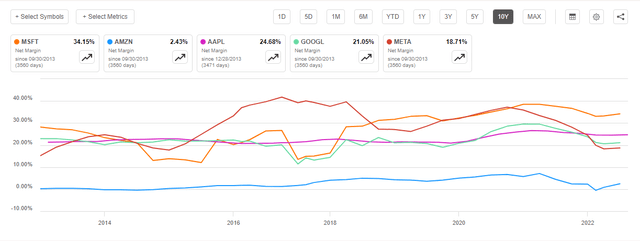

Microsoft had an exciting start to the year and saw very healthy price gains on the heels of its AI triumph, partially bolstered by Google falling flat on its face. ChatGPT has impressive functionality, and it has forever changed the way humans understand AI. Still, compared to the commercial potential of Microsoft’s CoPilot product, ChatGPT will seem like a cheap parlor trick. The new product is coming on the heels of outperformance over key big tech rivals over the past decade.

A lot of companies overuse the phrase “democratize” when they are describing a technological solution. However, I think Microsoft has the chops and history to put its money where its mouth is on the claim that its Copilot add-on will be the first product to truly democratize AI in an area where it is most valuable: the workflow of low and mid-level white-collar workers. Yes, while there are a lot of bold claims about AI, I think Microsoft’s product has the potential to empower white-collar workers in terms of productivity in the way the AK-47 was a game-changer in favor of African revolutionaries.

Reviews have suggested the software is a game changer, and how it can dramatically increase the white-collar workforce’s productivity may also produce some unanticipated countercyclical earnings attributes. In other words, rather than paring back spending on Microsoft’s exciting new product during an economic contraction, businesses may increase their spending because of productivity gains. Of course, there will also be a drive to adopt what competitors are adopting. But the new software is a significant thread in the bull case for Microsoft on AI, and so far, the prospects look good:

- A survey of IT managers by JPM found that respondents expected 56% of their generative AI spending to go to Microsoft compared to 13% and 12% for Amazon (AMZN) and Google (GOOGL).

- Venture Capital giant Sequoia found that 90% of the startups it has invested in use OpenAI as a critical tool.

- Keith Weiss of Morgan Stanley presents a compelling argument that a novel supporting business ecosystem is developing around Microsoft’s OpenAI-enabled tools, which are distinct and much more advanced than competitors.

- Microsoft is making massive investments to solidify and augment its lead in AI. It is near a record level of CAPEX, has acquired over a dozen AI companies, and its extensive ecosystem enables an AI assistant with far greater practical use and breadth of capabilities compared to the competition.

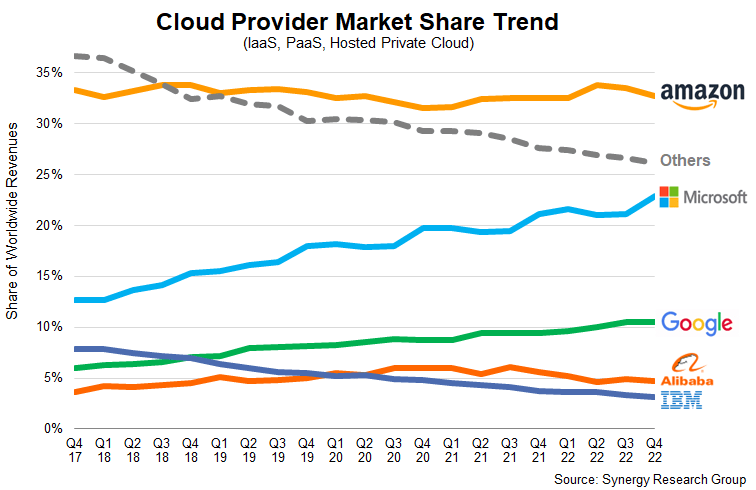

- Microsoft’s broad integration of AI, including over to the highly lucrative Azure segment, could create a self-sharpening effect. A significant competitive advantage in Azure that leads to a significant market-share gain could cause the firm to outperform all current expectations.

There are few companies I feel more confident recommending to long-term shareholders than Microsoft. The convergence of a vast network, a global reach, and a significant headstart on investment in a critical transformational trend make me confident in owning this company for the long haul. I still think the firm should be the foundation of a thematic portfolio in AI, and its Copilot product release has only confirmed my conviction in the stock.

Risks and Where I Could Be Wrong

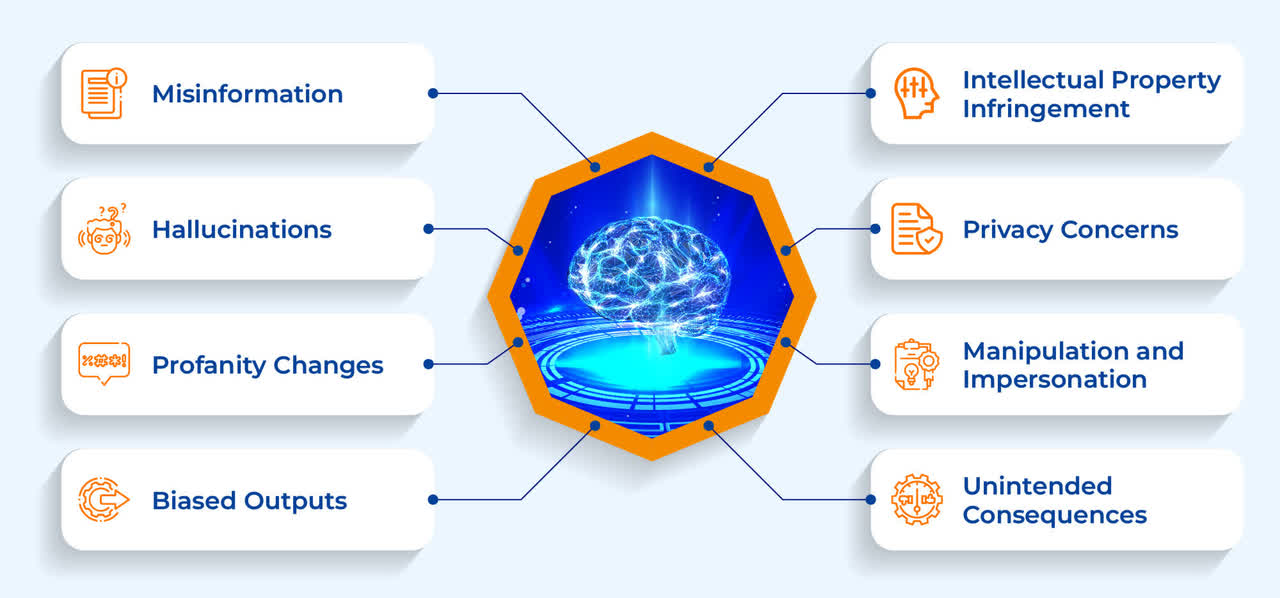

This new tool Microsoft has introduced is pretty impressive, but it is also very early. It is also being released into massive expectations, and given the prodigiousness of those expectations, it could be hard to live up to. Furthermore, the technology is sophisticated and able. Nonetheless, it is new, and many kinks must be worked out. A recent lawsuit from content creators illustrated one potential roadblock.

Still, it can also be misused in ways that could be to the detriment of the product’s accuracy and the confidence it conveys in users’ minds. For example, the “hallucinations” and inaccuracies that generative AI is prevalent to at times can cause embarrassment and errors in the hands of a careless user. Also, multiple risks have been observed. However, in my estimation, the risks in this area are somewhat offset by the recent strength of the cloud segment. Any reversal of cloud gains would be a significant risk for the stock.

Synergy Research Group

In other words, this technology is pretty new and being deployed on a massive scale. There are always risks to that. Instead of being the resilient and easy-to-use AK-47 in a metaphorical sense, it could end up being more akin to the American M-16, which was troubled by fragility to in-theater conditions and other problems that made it initially ill-suited as a weapon for the common soldier. If Microsoft has jumped the gun and rushed this product, it could cause it to be underwhelming from a shareholder perspective. Or, like early rifles and their mass use in the American Civil War, it could have fantastic abilities that are out of reach except to the users with the highest proficiency.

There are growing signs that the limits to commercial usefulness and the constraints of generative AI will become more prevalent and apparent. There could be something to this take, but Microsoft, given its vast resources and technological headstart, is likely better suited than most competitors to meet these challenges. Still, if generative AI recedes in importance, these advantages may be less valuable. I think Microsoft is better prepared than most companies, given its incredible financial position and colossal cash hoard.

Conclusion

It is rare that, as a stock analyst, I have a lot of experience with the underlying product. I can’t often validate a product how Warren Buffet can validate a Coke. However, I am a seasoned veteran of white-collar tedium and the tools you can use, or not, to extricate yourself from it and find efficiency. I am convinced that this new product is probably the most important product for mass use in the artificial intelligence revolution. There are a lot of co-pilots for specific industries or tasks, but now there is one co-pilot for the most vital white-collar toolset of the information age.

And unlike many startups with promising AI assistants, you’re not betting on an unproven team here. You’re betting on a company that has shown it can transform itself in CAPEX-heavy ways. It broke into the cloud and had several other growth engines and perhaps Earth’s most valuable commercial network. We are in the early days of Satya Nadella’s AI-driven Microsoft for AI, but we are about to witness the first crucial product of that effort.

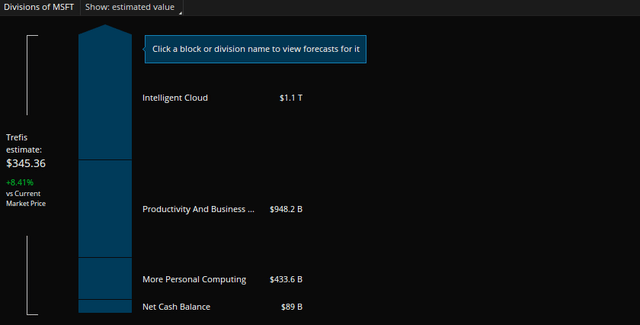

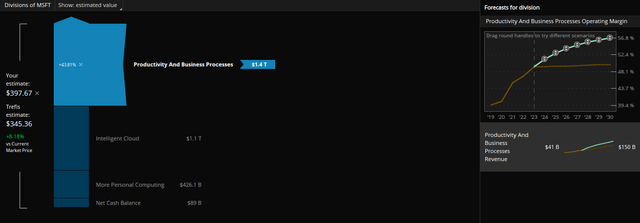

I am a firm believer that effort will exceed current investor expectations. As you can see above, better-than-expected outcomes concerning Microsoft’s sprawling Productivity and Business Processes segment significantly improve the implied intrinsic value of the stock. I hope to present many graphs and AI-enabled content in my next piece about Microsoft using its exciting Copilot product!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.