Summary:

- The Coca-Cola Company stock has underperformed the market and reached 52-week lows, making it cheaper and more attractive for investors.

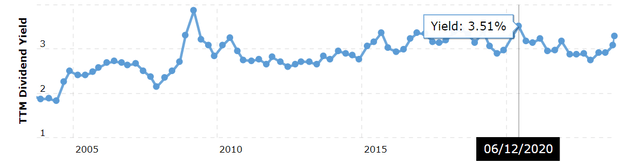

- The stock is yielding above 3.50%, a rarity that hasn’t happened since the height of the COVID panic.

- Coca-Cola’s stock has rarely had two consecutive down years, and historically has had positive returns following a down year.

Justin Sullivan

It is fair to say 2023 was already a little rough for The Coca-Cola Company (NYSE:KO) stock, as it had underperformed the general market by a wide margin (-12% vs 11%) going into trading October 5th, 2023. Things then turned from bad to worse, as the stock lost another 5% to finish at $52.38% while making 52-week lows.

Given the company’s and stock’s pedigrees, one might have expected a double or even triple-whammy, like bad earnings report, some sort of Government mandate and general market selloff all happening on the same day. Instead, the only plausible reasons I could find were weaknesses going into earnings season and rumors about the increasing popularity of weight loss drugs, which apparently have some effect on food consumption.

Fads come and go. Today’s popular weight loss drug could be tomorrow’s biggest healthcare nightmare. It is hard to predict what may happen with these wonder-drugs in the future. However, at the basic human instinct level, hunger, thirst, and the need to breathe are never going away. Ever. So, rather than debating the effect the drug may have on food companies and their stocks, I’d like to focus on how investors can take advantage of this madness that has resulted in Coca-Cola stock looking cheaper and more attractive in more ways than one.

Quick reminder that my most recent coverage of Coca-Cola stock was in August, when I had rated the stock a “Buy.” Since then, the stock has lost 14% compared to the market’s 3% loss. However, with the recent selloff, I am now upgrading the stock to “Strong Buy” and present a few reasons for the same below. Let us get into the details.

Has Rarely Been Cheaper

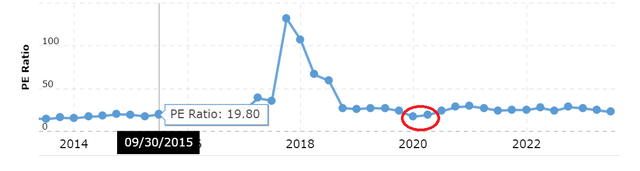

Quality rarely comes cheap, but when it does, don’t let the opportunity go. At the current market price of $52.38, Coca-Cola stock is trading at a forward multiple of 19.84 based on an EPS estimate of $2.64. We need to go back to the COVID lows (red circle below) to find the last time the stock had a multiple (although, trailing) in the late teens. And before that, all the way back to 2015.

In short, you don’t often see this stock trading at such depressed valuations. The window may not last long should the market regain its senses and stop hating on income stocks in general and realizes that going against nature to curb hunger and thirst is worse than consuming what many believe to be unhealthy.

Has Rarely Yielded Higher

As a direct consequence of this selloff and the company continuing to reward investors with annual dividend increases, Coca-Cola stock is now yielding above 3.50%, which doesn’t happen all too often. The last time the stock yielded higher was, you guessed it right, at the height of the COVID panic. Back then, the world as we knew it was literally changing in front of our eyes, and some predicted it was forever. Basically, a doomsday valuation back then. It is now being repeated for, wait for it, a wonder-drug and a recession-to-be that everyone has predicted and are waiting for? In short, more reasons to buy if you can see through this panic.

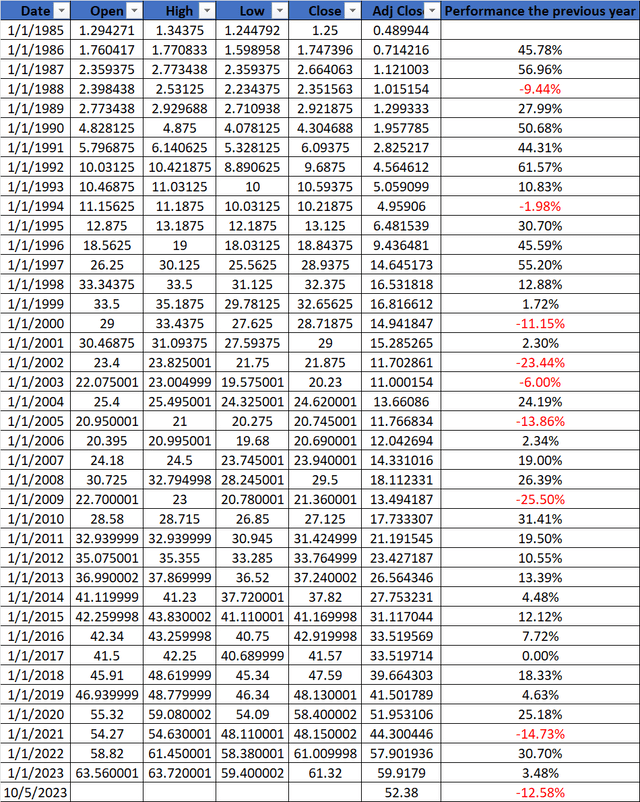

Has Rarely Had Two Consecutive Down Years

Thanks to Yahoo Finance, I was able to pull up Coca-Cola stock’s annual performance dating back to 1985. I was astounded to see that in nearly 40 years, the stock has had two consecutive down years just once, and that was during post-dotcom-crash recovery days. Including 2023, there have only been 9 years (1/4th) where the stock had negative adjusted returns (adjusted for dividends and stock-splits). More importantly, in the year immediately following a down year, Coca-Cola stock returned an average of 7.68% overall (excluding dividends) and 9.63% if we ignore the rare blip when it had two consecutive down years.

History need not repeat itself, but 4 decades of data is nothing to scoff at.

Coke Since 1985 (Returns compiled by author with yahoo finance data)

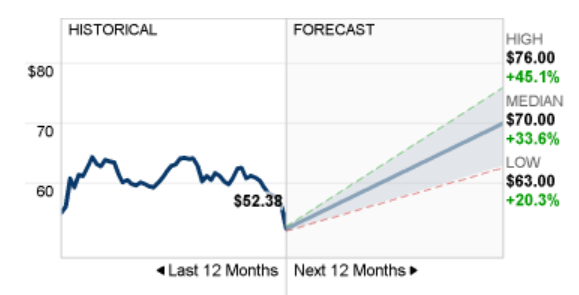

Has Rarely Been This Far From Price Targets

I don’t have historical data to back up this section like I did with the three above. But the 20 analysts covering Coca-Cola stock have a median price target of $70, presenting a 33.63% upside from here, not including dividends. Of course, these targets are not foolproof, but what is interesting is that even the lowest 12-month price target of $63 is a handy 20% away from here.

KO Target (Money.cnn.com)

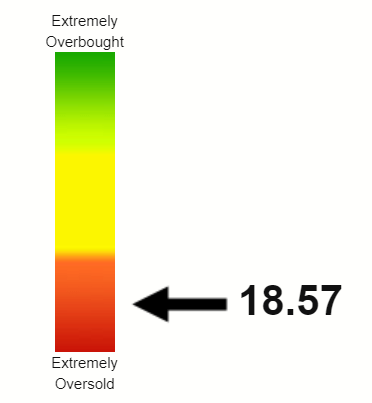

Technically, Way Below Oversold

Coca-Cola’s stock is starting to look funny technically as well. I have rarely seen large cap stocks trading with a Relative Strength Index [RSI] of 18.57. I raised concerns about the stock’s valuation at $65 after its April earnings report. At that point, Coca-Cola stock’s RSI was at 82, and since then, the stock has lost nearly 20%, some of which may be justified. “Some” but not all. The market tends to overshoot in both directions, and this time, I believe it has overshot to the downside. The stock is due for a bounce back, especially if the earnings report on October 24th does not disappoint.

KO RSI (stockrsi.com)

Business As Usual And Conclusion

Through all this stock market noise, I expect the Coca-Cola company to have operated in its usual efficient manner when it reports its earnings in a few weeks. I will be paying special attention to the Free Cash Flow, which as I highlighted in this article was a little concerning in H1 (at $4 billion) but has been guided by the company to be $9.5 billion for the entire FY. This suggests Q3 and Q4 together are expected to bring in nearly 40% higher FCF than Q1 and Q2 did.

Coca-Cola has now paid the same quarterly dividend of 46 cents/share for the last 3 quarters. This means, going by history, just one more quarter before investors likely get a 62nd consecutive annual dividend increase. If the company sticks to the same 4.5% increase it handed out in 2023, the new annual dividend for 2024 is likely to be around $1.92/share, which works to a 3.70% yield for someone buying here at $52.38. Once again, a rarity.

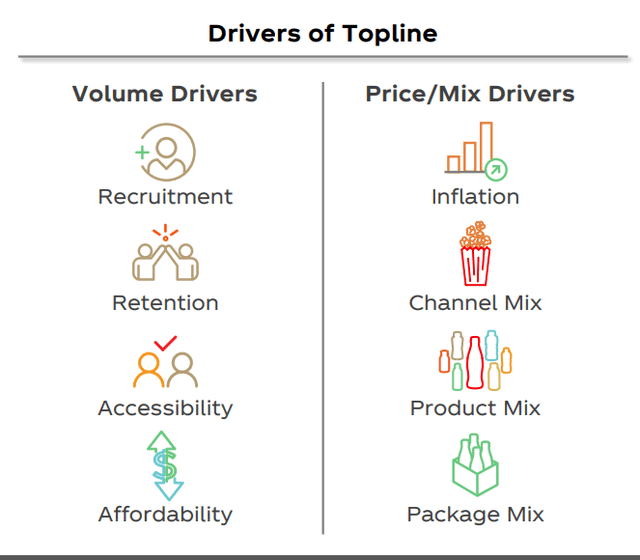

As I covered in the August article linked earlier, the company continues to focus on its volume (top line) as it knows the operational efficiencies in place will take care of the bottom-line. The chart below conveys most of the things that investors need to know about Coca-Cola company. The company understands that its people (recruitment and retention) help drive its volume, while ensuring its products reach consumers as wide and broad as possible (accessibility and affordability). The third part of the puzzle are the products, which have pricing power, brand name, and variety.

Coca-Cola Volume and Price Drivers (investors.coca-colacompany.com)

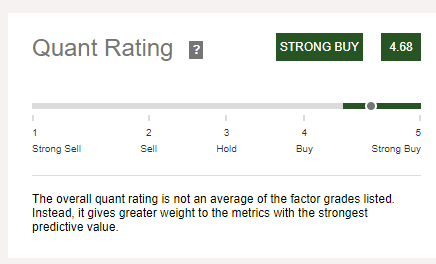

To conclude, I am upgrading the stock to “Strong Buy” and I am glad that Seeking Alpha’s quant rating agrees with me.

KO Quant (Seekingalpha.com)

Analyst’s Disclosure: I/we have a beneficial long position in the shares of KO either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.