Summary:

- JPMorgan Chase’s financial performance remains strong, with a 40% increase in net profit compared to last year.

- The yield on JPMorgan’s Series M preferred shares has increased to approximately 6% due to rising interest rates.

- The potential for a capital gain on JPMorgan’s preferred shares exists if interest rates decrease in the future.

Michael M. Santiago

Introduction

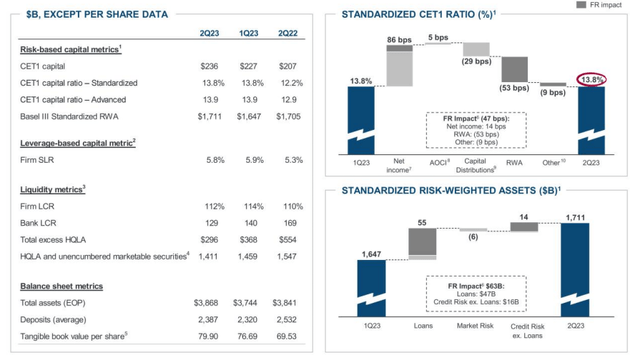

JPMorgan Chase (NYSE:JPM) is a household name in the financial sector. With a market capitalization of approximately $415B and a worldwide brand recognition, the bank is seen as a leader in its sector. Its financial performance is strong, and although there’s a push from US regulators forcing the banks to shore up their capital ratios, JPMorgan shouldn’t have any difficulties to reduce the total amount of risk-weighted assets by securitizing a portion of its loan portfolio. That way, the amount of RWA decreases and the CET1 capital ratio increases even if no additional capital is generated.

In this article, I will be following up on the Series M preferred shares. I discussed that series almost two years ago but as the interest rates have gone up, the preferred share price has come down and the effective yield has increased.

The bank still is a profit machine

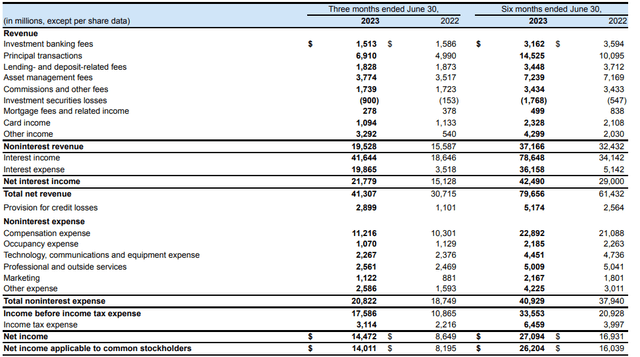

Before digging deeper into the preferred equity offerings by JPMorgan, I obviously wanted to make sure the financial performance of the bank is still strong. The bank will report on its second quarter next week, so I had to look back at its Q2 performance.

As you can see below, JPMorgan reported a net interest income of $21.8B. That’s an increase of approximately 40% compared to the second quarter of last year and it’s slightly higher than the net interest income in the first quarter of this year. That’s encouraging as the net interest income is an important driver of the net profit.

That being said, JPMorgan also has a very substantial investment banking and asset management division, so its earnings profile is very different from a “normal” commercial bank which mainly has to count on the net interest income and sometimes the gain on the sale of loans and credit card income. The income statement below shows JPMorgan generated about $19.5B in non-interest income while it spent $20.8B on non-interest expenses. This means the bank is almost breaking even on just the non-interest income and that’s a very comfortable position to be in.

In fact, the pre-tax income increased to $17.6B thanks to the lower net non-interest expenses and the higher net interest income. As you can see above, the $17.6B already includes the impact of a $2.9B loan loss provision despite that provision being about 20% higher than in the first quarter of this year. After taking the relevant taxes into account as well as deducting the net income attributable to the minority shareholders, JPMorgan reported a net profit of $14B. This represented an EPS of $4.76 and pushed the H1 EPS to $8.86. I can’t say this was a surprise as in my previous article I had already argued the bank’s common stock may offer a better total return perspective than the preferred shares as JPM completed the purchase of the First Republic Bank assets.

The preferred share yields are stabilizing

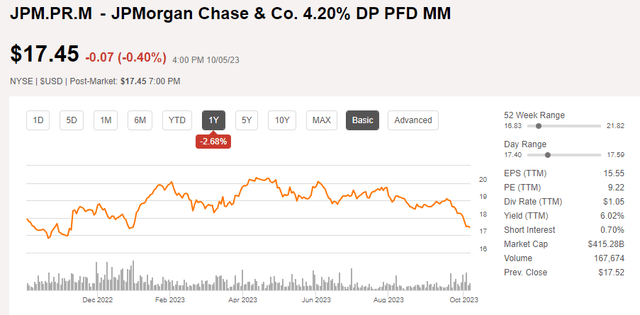

I have been keeping an eye on several of JPMorgan’s preferred share issues but about two years ago I zoomed in on the Series M preferred shares (NYSE:JPM.PR.M).

In the third quarter of 2021, JPMorgan issued 80 million units of its Series M preferred shares. The M-series are a non-cumulative preferred share with an annual preferred dividend of 4.20% per year which results in $1.05 per share, paid in quarterly installments. The 80 million units have a total value of $2B, so this was a relatively sizable issue by JPMorgan as the bank was obviously taking advantage of the low interest rates on the financial markets.

While the yield of 4.20% was indeed low and I ultimately passed on initiating a long position, the situation has changed pretty dramatically over the past 18 months. As the interest rates on the financial markets started to increase, the market prices of fixed income securities started to decrease and the Series M preferred shares were no exception.

The Series M preferred share is currently trading at $17.45 for a yield of approximately 6%. That’s still not high, but this security is – just like so many other fixed income securities – an interesting call option on the normalization of interest rates. Just as an example, if the market only requires a preferred dividend yield of, say, 5.25% from JPMorgan by the end of next year, this preferred share will be trading at $1.05 / 0.0525 = $20 for a 14.6% capital gain. Of course, there are no guarantees in life but this type of fixed rate preferred shares offer an interesting possibility to speculate on lower interest rates going forward.

Investment thesis

I have held off on buying non-cumulative preferred shares issued by financial institutions for several years but I recently started buying the Wells Fargo (WFC) busted preferred share Series L (WFC.PR.L). Not because the yield is extraordinarily high, but because I anticipate the interest rates on the financial markets to level off in the next few years and that would pave the way for a capital gain on the fixed rate preferred shares.

That also is the case for JPMorgan’s preferred shares. A 6% preferred dividend yield isn’t exciting, that’s true. But if you expect a 100 bp decrease in the cost of capital (decreasing from 6% to 5% on the preferred equity), there’s a potential for a 20% capital gain down the road. And even if that only materializes in three years from now, the total annualized return would still be a high single digit number.

I currently have no position in JPMorgan’s preferred shares but I’m keeping a close eye on the share price performance.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I have no position in any JPMorgan securities, but I do have a long position in WFC.PR.L, which was mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!