Summary:

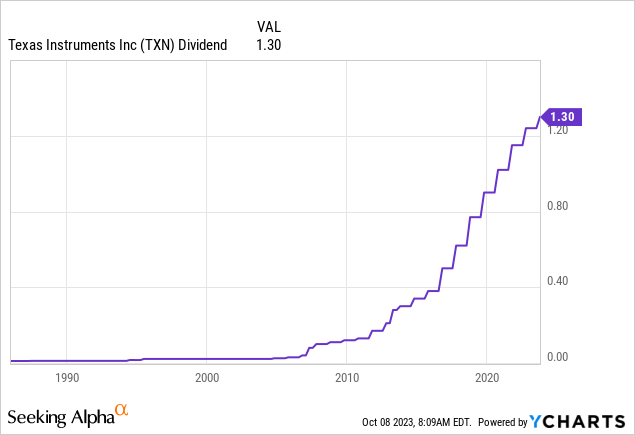

- Texas Instruments is a dividend growth stock with a >3% dividend yield and a 15% 5-year dividend CAGR.

- TXN has a strong business model with robust competitive advantages and a focus on analog and embedded processing products.

- The company is confident in the industrial and automotive markets, with long-term growth potential and opportunities for market share expansion.

Matteo Colombo

Introduction

The other day, I wrote an article titled Retiring (Early) With Dividend Growth: Why DGRW Is A Terrific ETF. In that article, I did three things.

- I explained the necessity to invest for the long term.

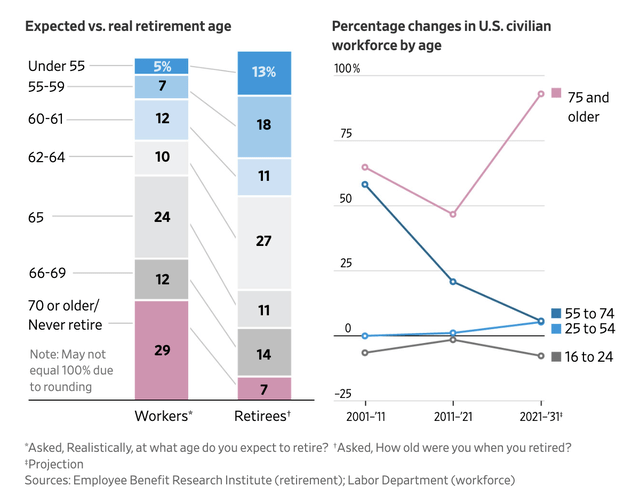

Almost 30% of workers expect to retire after turning 70 or not at all. Just 5% expect to retire before turning 55. That’s much less than the actual number of current retirees who retired early.

According to a Bloomberg article I highlighted back then (emphasis added):

Nearly one in five people aged 59 and older said they didn’t have a retirement account and 27% of respondents said they haven’t set anything aside for their later years. That compared to a quarter of Gen X respondents.

For those aging Americans who do have retirement accounts, persistent inflation has thwarted their plans, worsening the $7 trillion retirement-savings shortfall. Among baby boomers who are employed and saving for retirement, 17% said they’ve decreased their contributions to their retirement accounts as a result of inflation. Another 5% of respondents aged 59 and older said they can’t afford to contribute to their retirement account at all.

- I also explained that one way to prepare for future retirement is to invest in dividend growth investments.

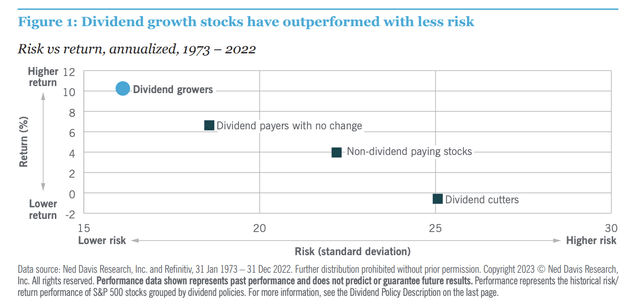

Historically speaking, dividend growth stocks present the best mix between risk and return.

Since 1930, 41% of the market’s total return came from dividends. Also, dividend growth stocks have a great balance between outperformance and subdued volatility, as shown in the chart below. This disproves the higher risk, higher reward notion.

- The third thing I did was give people a dividend growth ETF.

However, this article isn’t about an ETF. It’s about Texas Instruments (NASDAQ:TXN), a stock I previously discussed in May when I wrote that the stock would be very attractive, close to $150.

Since then, the stock has fallen roughly 11%, trading very close to my target price.

What makes TXN so special is its >3% dividend yield combined with a 15% 5-year dividend CAGR and its business model that comes with both secular demand growth and strong pricing power.

While TXN is currently suffering from lower global economic growth, it’s poised to continue what it has done in the past: deliver outperforming total returns, including a more-than-decent dividend.

So, let’s dive into the details!

The Dividend (Growth) Powerhouse

Even old companies can still be innovative dividend growth stocks!

Since its inception in 1930, TXN has played a pioneering role in advancing semiconductor technology, transitioning from vacuum tubes to integrated circuits.

Currently, the company operates in over 30 countries, with revenue reaching $20 billion in 2022.

The company focuses on two primary segments: Analog and Embedded Processing. The remaining sales are put in the other category.

| USD in Million | 2021 | Weight | 2022 | Weight |

|---|---|---|---|---|

|

Analog |

14,050 | 76.6 % | 15,359 | 76.7 % |

|

Embedded Processing |

3,049 | 16.6 % | 3,261 | 16.3 % |

|

Other |

1,245 | 6.8 % | 1,408 | 7.0 % |

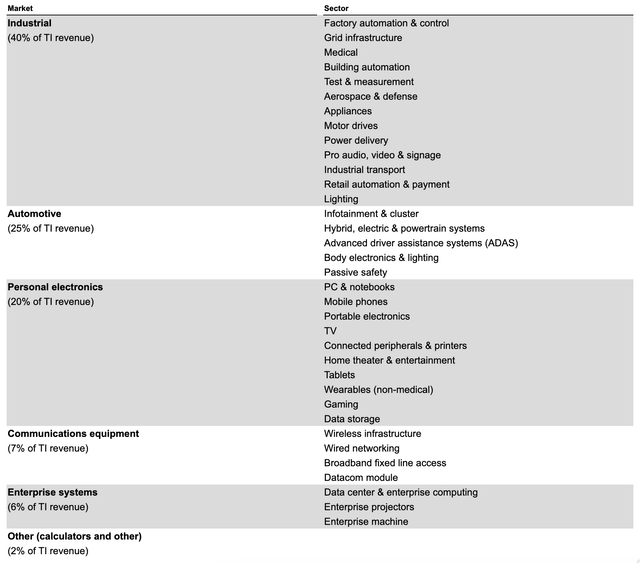

Below is an overview of the markets the company serves with its chips and services. The higher the rank, the bigger the revenue share.

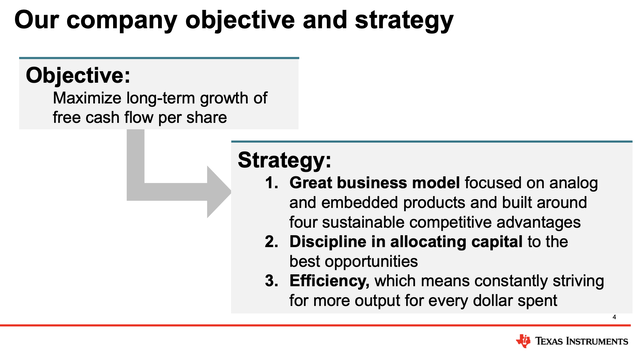

The strategy to drive long-term growth revolves around three core elements: emphasizing analog and embedded processing products, disciplined capital allocation, and operational efficiency.

Its robust competitive advantages include a strong manufacturing and technology foundation, a diverse product portfolio, extensive market channels, and product diversity and longevity.

Texas Instruments intends to fortify these advantages through strategic investments and prudent capital allocation.

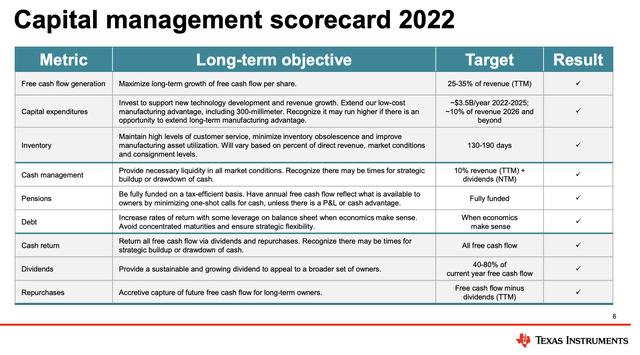

This is what its 2022 capital management scorecard looked like (it achieved all targets):

The company’s capital management strategy is centered around its dividends and buybacks. Its goal is to distribute 40% to 80% of its free cash flow to shareholders while using the rest for buybacks. This means that the company gives priority to paying out dividends rather than focusing on buybacks.

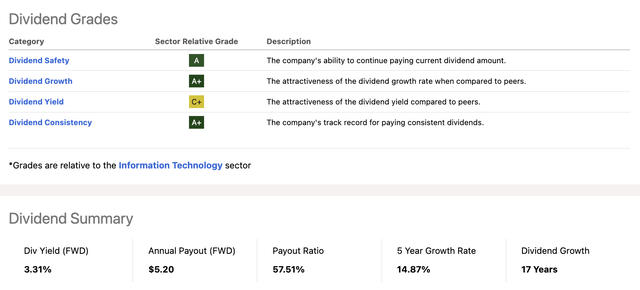

Currently, TXN yields 3.3%. This dividend is protected by a 57% payout ratio. It also comes with 17 consecutive years of annual dividend growth and a five-year dividend CAGR of 15%!

In general, the company has one of the best dividend scorecards I’ve seen in a very long time. I would even argue that the C+ grade should be at least A-, as the median sector yield is just 1.8%. This would give the company only grades in the A range.

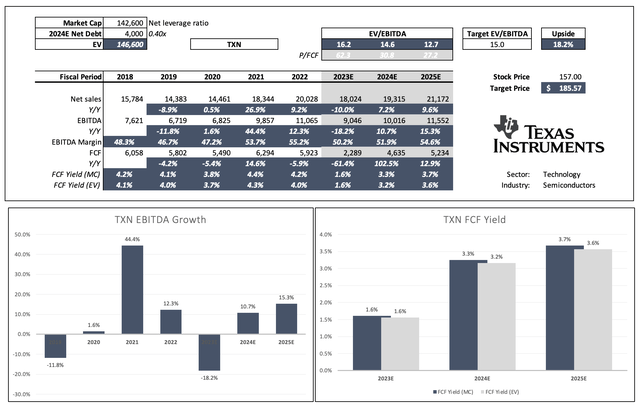

Also, note that the dividend is protected by a healthy balance sheet with a 0.4x 2024E net leverage ratio (as seen in the valuation model in the valuation part of this article) and an A+ credit rating.

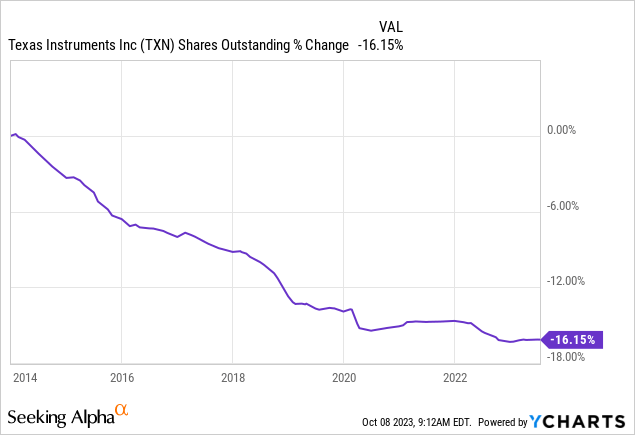

Over the past ten years, TXN has bought back 16% of its shares.

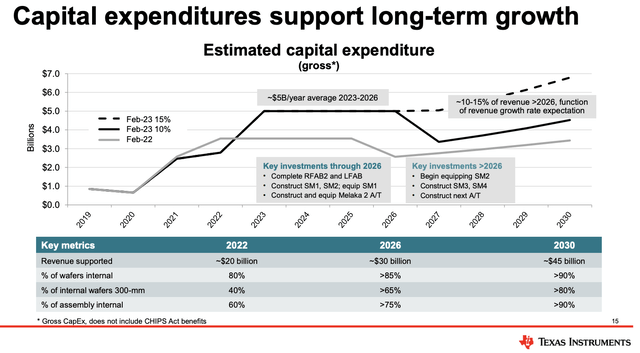

Having said that, and going back to its strong business, TXN places strategic importance on in-house manufacturing to gain cost advantages and supply chain control. It has made substantial investments in advanced 300-mm capacity, aiming to create a competitive manufacturing structural cost advantage.

During last month’s Goldman Sachs Communacopia & Technology Conference, the company elaborated on ongoing trends, challenges, and opportunities.

The company started by expressing its confidence in both the industrial and automotive markets, emphasizing their long-term growth potential.

In particular, it highlighted the industrial sector’s breadth, mentioning areas like automation, grid infrastructure, medical, and robotics. These industries are experiencing accelerated adoption of automation and more sophisticated solutions, leading to content growth.

TXN believes this growth will extend over decades, making the industrial market a key driver for its company.

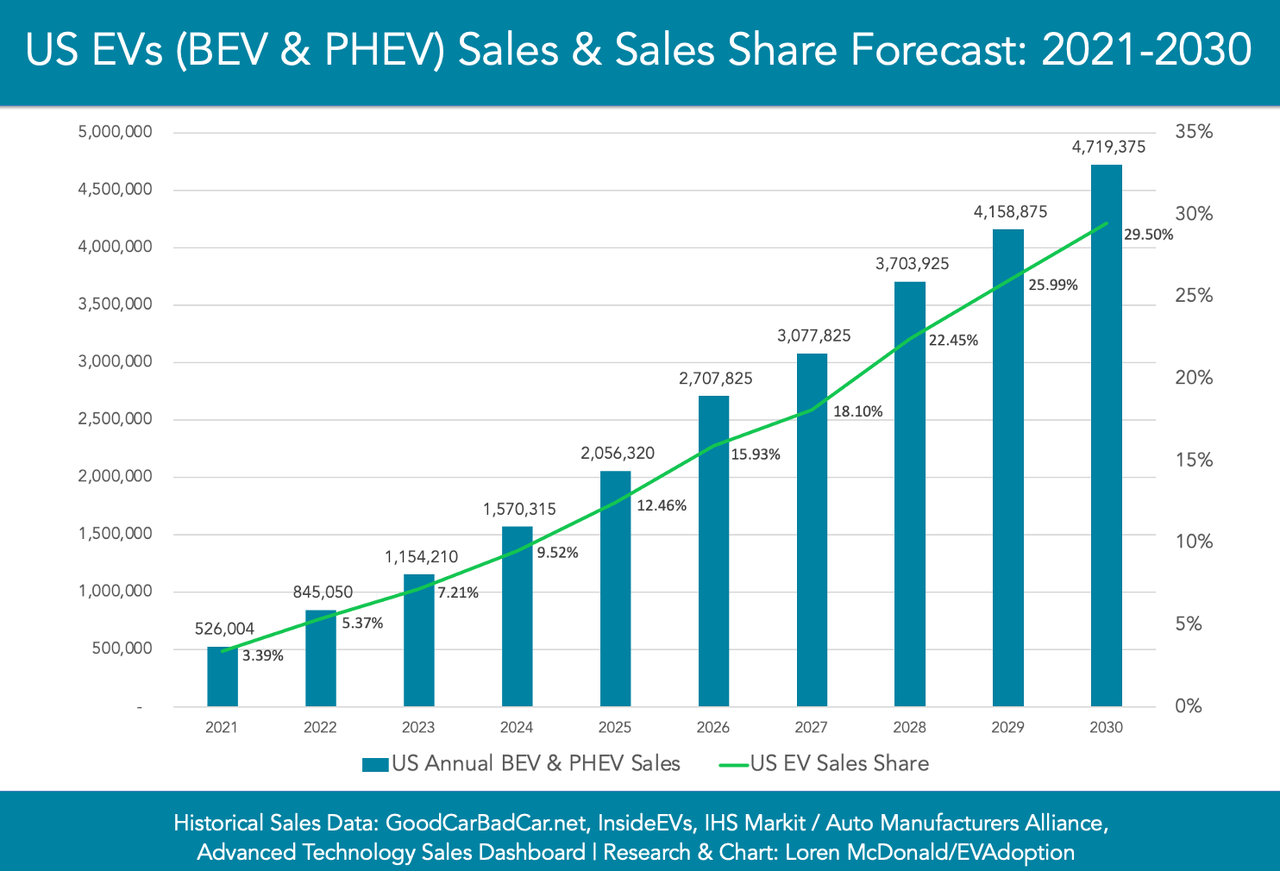

The company also mentioned that EVs still account for just a small percentage of total vehicle sales. EVs use roughly twice as many chips as conventional cars. Long-term EV penetration is expected to see significant growth, supporting TXN’s long-term outlook.

On top of benefiting from secular growth, the company is committed to gaining market share by leveraging its competitive advantages.

During the Goldman Sachs conference, the company emphasized that it aims to continuously increase its market share over the long term. These competitive advantages include manufacturing control, a broad portfolio of technologies, and channel support. The company’s goal is not just to ride the market growth but to actively capture a larger share by offering superior solutions.

This also includes investing in new capacities during downturns, even though this may temporarily hurt margins.

The company is currently investing in new production capacities, leading to elevated capital expenditures, allowing the company to boost internal assembly and become less dependent on suppliers. This supports margins in the longer term.

Even during the past few years, the company had fewer supply shortages thanks to internal capabilities.

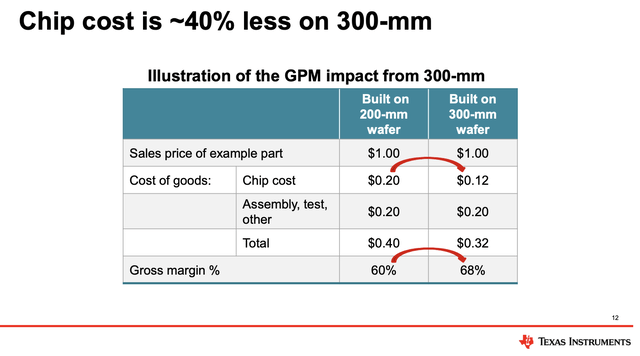

Furthermore, the conference was used to put an emphasis on the adoption of the aforementioned 300-millimeter wafer technology, which is expected to come with significant margin and supply benefits.

So if you think about the plan we’ve showed in the beginning of the year, higher percentage internally, higher percentages, 300-millimeter wafers. We are going to leave the decade with more than 90% internal, both on the front end and the back end, meaning fabs and assembly and test, more than 80% on 300-millimeter wafers. – TXN at Goldman Sachs Conference

The company also addressed the perception of Texas Instruments being aggressive on pricing while maintaining high margins, as it explained that the company competes for profitable business and doesn’t shy away from challenging markets. The cost advantages of 300-millimeter wafer technology enable competitive pricing while maintaining profitability.

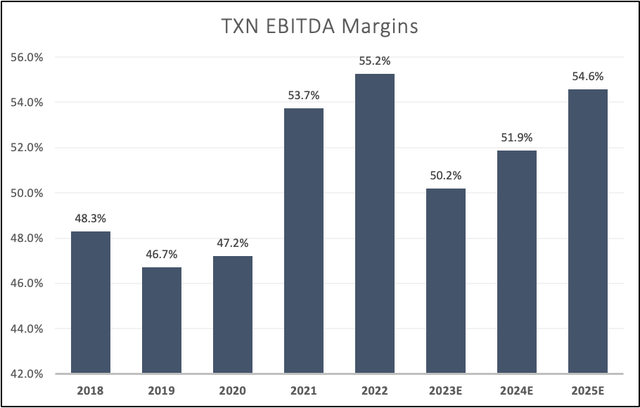

Analysts expect the company to grow its margins consistently over the next few years.

Leo Nelissen (Based on analyst estimates)

This brings me to the valuation.

Valuation

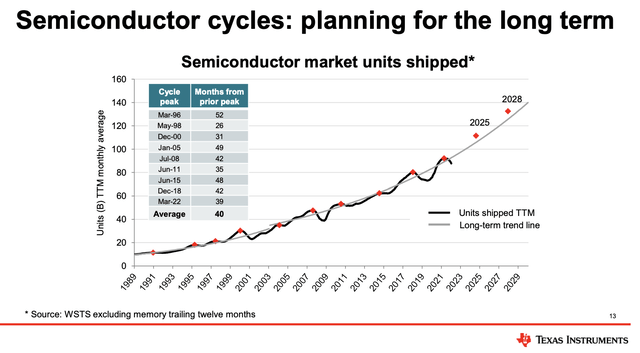

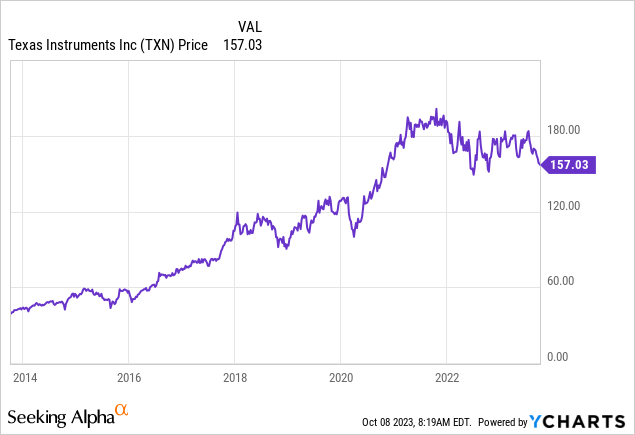

Despite all of the good news, TXN shares have gone sideways since the post-pandemic rally.

This is caused by cyclical weakness in a secular uptrend. During the second quarter, the gross profit margin decreased by 540 basis points, primarily due to lower revenue and increased capital expenditures.

The revenue for the quarter stood at $4.5 billion, a 3% increase sequentially but a 13% decrease year-over-year. The revenue breakdown showed an 18% decline in Analog revenue, a 9% growth in Embedded Processing, and a 10% decline in the other segments compared to the same quarter the previous year.

The end markets experienced varying performance, with Automotive being a standout performer, while other sectors faced challenges. Automotive production is still benefitting from pent-up demand, as manufacturers were not able to turn all of their demand into finished vehicles during the first two years after the pandemic.

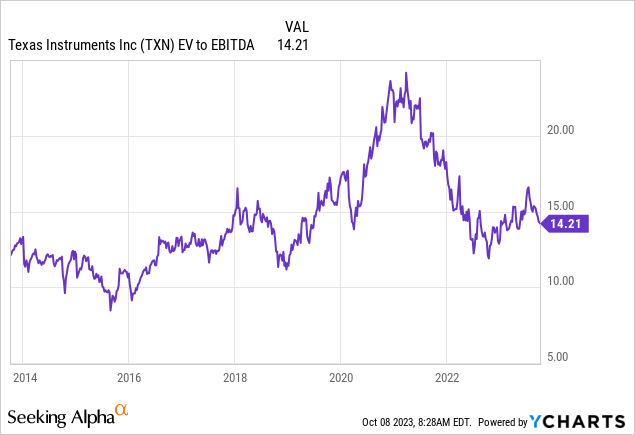

After dropping roughly 20% from its all-time high, the company is now trading at 14.2x EBITDA, which is close to its longer-term median.

In the next two years, EBITDA growth is expected to accelerate to 15% in 2025. The same goes for free cash flow, which is expected to double next year.

I believe that a 15x EBITDA valuation is warranted, which would give the stock a fair price target of $186, which is 18% above the current price.

Leo Nelissen (Based on analyst estimates)

The current consensus price target is $187, which is a dollar higher than my estimate.

While I will give TXN a bullish rating, investors need to be aware that we’re far from a perfect situation. Global growth is extremely weak, inflation is sticky, and central banks aren’t likely to lower rates anytime soon (because of inflation.

So, if you decide that TXN is right for you, I would suggest that gradual buying is the way to go. Buy a small position now. Add gradually over time. If the stock keeps falling, investors can average down. If the stock takes off, investors have a foot in the door.

I currently apply this strategy to every single investment.

Also, I currently do not own TXN. I’m looking at how to incorporate the stock into my portfolio – especially in light of other stocks on my watchlist.

As I’m a dividend growth investor focused on wide-moat companies with stellar capital spending, I believe that TXN would be a great fit for my portfolio.

Takeaway

TXN, a pioneer in semiconductor technology since 1930, is more than just an old company.

With a robust dividend yield of over 3%, a remarkable 15% 5-year dividend CAGR, and a strong balance sheet, it’s a dividend powerhouse.

The company’s commitment to market leadership, technological innovation, and long-term growth positions it as a solid investment choice.

While global economic challenges persist, TXN’s strategic focus on industrial, automotive, and EV markets offers promising opportunities.

The company’s competitive advantages, such as in-house manufacturing, product diversity, and prudent capital management, make it a standout in the sector.

In a world of uncertainty, TXN’s potential for both dividend growth and capital appreciation makes it a compelling addition to any investor’s portfolio.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Test Drive iREIT© on Alpha For FREE (for 2 Weeks)

Join iREIT on Alpha today to get the most in-depth research that includes REITs, mREITs, Preferreds, BDCs, MLPs, ETFs, and other income alternatives. 438 testimonials and most are 5 stars. Nothing to lose with our FREE 2-week trial.

And this offer includes a 2-Week FREE TRIAL plus Brad Thomas’ FREE book.