Summary:

- Netflix’s membership growth has slowed to single digits, indicating saturation in their main markets.

- The introduction of a lower-priced ad-supported plan and a crackdown on password-sharing could attract additional subscribers and boost revenue.

- Maintaining a consistent content budget could lead to significant profits for Netflix and enhance its operating margin and free cash flow generation.

Giuliano Benzin

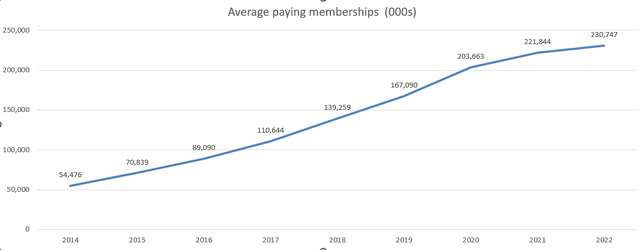

Netflix (NASDAQ:NFLX) has gone through an explosive growth period since its initial launch until FY20, with paid memberships increasing by more than 20% year over year. However, starting from FY21, their membership growth has begun to moderate to single digits. It seems that Netflix is reaching saturation in its main markets, including North America and Europe. Their future growth may depend on how they monetize existing subscribers.

On the other hand, Netflix has moved past the heavy investments in streaming content and has reached a point of reflection where they can maintain their content spending flat to ensure the satisfaction of existing subscribers. According to my model, their stock price is slightly overvalued, leading me to assign a ‘Hold’ rating for Netflix.

Post-Explosive Growth Landscape

Netflix’s paid memberships increased by 20% in FY19 and 21.9% in FY20, but started to moderate, reaching 8.9% in FY21 and 4% in FY22. Meanwhile, the average monthly revenue per paying membership only grew by 0.8% in FY22, compared to the 9.5% growth in FY17 and 9.3% in FY18.

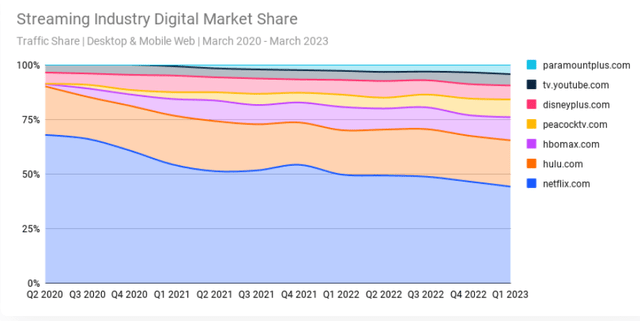

I believe Netflix’s explosive growth period has come to an end, making it challenging for the company to continue gaining market share in the future. Initially, when Netflix launched its streaming services, it pioneered and disrupted the pay TV market. However, in recent years, numerous streaming services have emerged, including Hulu, Disney+, YouTube TV, HBO Max, Peacock TV, and Paramount Plus. With all these providers competing against each other, it has become increasingly difficult for Netflix to expand its market share.

Secondly, during the pandemic, a significant number of people started working from home, leading to a surge in Netflix subscribers. I think Netflix likely reached its peak number of potential customers during this period, and as more people return to the office in the post-pandemic era, it will be challenging for Netflix to significantly increase its memberships.

According to Similarweb Insights, Netflix has been losing market share in the US, dropping to 44.21% in Q1 2023. In contrast, HBO Max and Peacock TV have been gaining market share during the same period.

Lower-Priced Ad-Tier and Password-Sharing Crackdown

In late 2022, Netflix introduced its Basic with Ads – a lower-priced, ad-supported plan aimed at reaching more customer segments. This Ad-Tier plan costs only $6.99 a month in the US market. I believe Netflix’s Ad-Tier could attract additional subscribers, and the combined revenue model of membership plus ads might yield similar profit margins as their regular streaming services. From a cost perspective, the Basic with Ads version could be more suitable for low-income families and individuals who don’t watch movies or TV shows frequently.

Moreover, Netflix possesses advanced data analytics capabilities, allowing it to strategically integrate ads into its streaming services and maintain a similar margin profile as its regular offerings.

Additionally, Netflix has initiated efforts to crack down on password-sharing. According to data from the Leichtman Research Group, 33% of Netflix accounts are shared across multiple households. Netflix’s management has indicated that they are gradually implementing measures to address password-sharing in most countries where they operate. They also point out that while some users might eventually subscribe to Netflix for their own accounts, others may not immediately do so. This transition could take anywhere from 3 to 6 months or longer.

I firmly believe that the password-sharing crackdown is a strategic move to maximize Netflix’s profits. Although some shared account users might choose to subscribe individually, others may not. Nonetheless, the crackdown is expected to boost Netflix’s revenue growth and increase its membership numbers, making it a positive step for the company’s future.

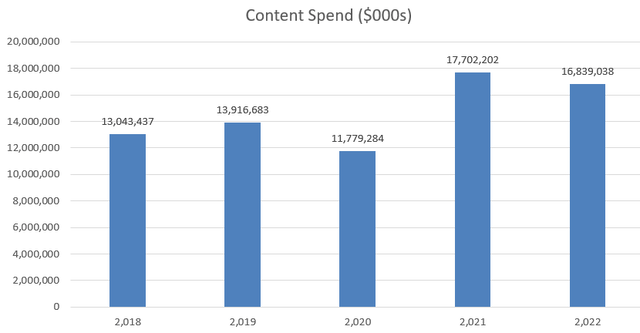

Peak Content Spend Behind Them

Netflix spent approximately $17 billion annually on content in the past two years, and they expect their content expenditure in FY24 to remain at a similar level as FY22. This substantial investment represents around 56% of their total revenue. Therefore, maintaining a consistent content budget could lead to significant profits for Netflix, provided they continue to grow their overall revenue.

I agree with Netflix’s management plan to control its content budget. After years of continuous investments in digital content, Netflix has reached a point where it can maintain customer satisfaction while keeping its content investment at the same level. I recognize that for streaming services, content is paramount, as poor content quality can lead to increased membership churn rates. Netflix has successfully struck a balance between content spend and customer satisfaction.

Financially, maintaining a flat content budget could enhance their operating margin and increase free cash flow generation. The potential for growing free cash flow is particularly attractive for investors.

Recent Result and Outlook

In Q2 FY23, Netflix experienced a 2.7% year-over-year revenue growth, with a simultaneous 8% increase in global streaming paid memberships. Both revenue and operating profits were generally in line with their expectations. For the FY23 guidance, they are maintaining their expectations of an 18-20% operating margin and forecasting a 7.5% revenue growth in Q3 FY23.

I am particularly impressed with their free cash flow generation. They generated $1.34 billion in free cash flow in Q2 FY23, marking a significant improvement compared to Q2 FY22. This increase in free cash flow is attributed to their content spend as well as delays caused by strikes. During the earnings call, their management indicated they still anticipate substantial improvement in free cash flow in FY24, despite the possibility of some irregularities between the years. As discussed earlier, I believe they have passed their peak period of content spending, suggesting their free cash flow is likely to improve in the coming years.

On the balance sheet, they closed Q2 with $14.5 billion in debts and $8.6 billion in cash. With a gross debt leverage below 1x, their balance sheet appears very strong. Additionally, they still have $3.4 billion of capacity remaining under their $5 billion share buyback authorization.

Key Risks

My primary concern regarding Netflix lies in the increasingly competitive streaming landscape. Unless Netflix maintains a distinct advantage in content offerings, it may find itself in a pricing battle against other streaming services. Given the ease with which families can switch from one service to another, there is little loyalty among customers. Consequently, Netflix must focus on consistently providing high-quality content, excellent customer service, and competitive pricing to retain its subscriber base.

Furthermore, a nearly five-month Hollywood writers’ strike: WGA reaches ‘tentative’ deal to end 146-day strike by Hollywood writers has caused significant delays in content creation. These delays could impact Netflix’s content spending and cash flow growth, potentially leading to irregularities in the coming quarters. The positive aspect is that Netflix’s management has acknowledged the potential for these irregularities in its guidance.

Valuation

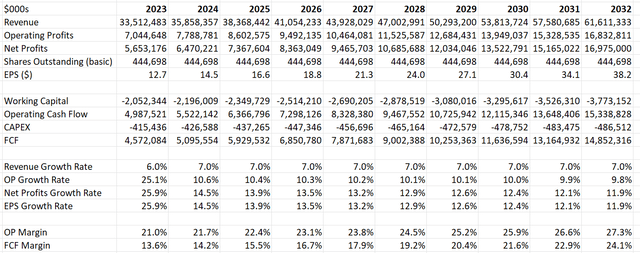

I believe Netflix’s explosive growth period is now in the past. The introduction of their Ads-tier and the crackdown on password sharing could contribute to some revenue growth. I forecast their membership growth will slow down in the near term, as discussed before, and thus I assume a 5.8% increase in paid membership, a similar level to FY22, and a 1.2% increase in average revenue per membership driven by their additional Ads revenue. To sum it up, I expect their revenue to grow at 7% in the coming years.

Additionally, as their content spending enters a maintenance phase, Netflix’s operating margin and free cash flow margin should benefit from operating leverage; in other words, their revenue growth would outpace their expense growth. According to my calculations, a top line growth of 7% combined with a 3-4% increase in expenses could drive around 70 basis points of annual margin expansion. Therefore, my model forecasts improvements in their operating margin and free cash flow margin, reaching approximately 27.3% and 24.1% by FY32, respectively.

Netflix DCF Model – Author’s Calculation

The model utilizes a 10% discount rate, a 4% terminal growth rate, and a 15% tax rate. Based on these parameters, the fair value of their stock price is calculated to be $370 per share, as per my estimates. This value is derived after discounting all the free cash flow from the firm.

Conclusions

While Netflix may not sustain double-digit revenue and membership growth in the upcoming years, its consistent content spending approach could lead to margin expansion and increased free cash flow generation. The Ads-tier plan and password crackdown are expected to create growth opportunities for Netflix, in my view. Considering that the stock price is slightly overvalued, I have assigned a ‘Hold’ rating to Netflix.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.