Summary:

- Microsoft has been one of the world’s largest companies for over two decades although its Big Five peers have showcased higher growth rates.

- The company is of high quality as its business model is sticky, and its products and services are mission-critical and are a small part of its customers’ operating expenses.

- The article argues that, despite the quality label, Microsoft is a hold due to having a full valuation. The point is supported by two valuation frameworks.

Koichi Kamoshida/Getty Images News

Introduction

In this article, I’m going to analyze Microsoft (NASDAQ:MSFT), which has been one of the world’s largest companies for over two decades. I analyze Microsoft’s history, and business lines in addition to incorporating a valuation analysis based on the dividend discount model, discounted cash flow model and valuation multiples derived from a peer group.

Investment Thesis

Microsoft is undoubtedly a high-quality company that deserves a premium valuation. The company took its place among the largest companies on the planet when it launched Windows, the PC operating system. By becoming the operating system of choice, Microsoft was able to cross-sell new products to their customers such as Word, Excel and PowerPoint which would later on become known as Office (and today it’s known as Microsoft 365). The company has a strong position within the business IT tools market as it has become very embedded within organizations’ IT infrastructure. In Buffett terminology, the company has a very strong moat as the hurdle for a customer to switch to another provider is extremely high. As long as everything works, there’s no need to switch unless prices increase significantly. Microsoft is obviously aware of this, and most likely won’t increase prices above a certain point that would make customers consider alternatives. I have listed a few bullet points that support the qualitative statements I have made here regarding Microsoft being a high-quality company (all figures refer to the last 10 years if not otherwise noted):

- Diversified revenue streams due to their broad product/service portfolio

- Part of the revenue model is recurring which is more stable than transaction-based revenues

- The company’s economic characteristics are superb, generating about 22% returns on invested capital (ROIC). Adjusting for excess cash it jumps to 82% (assuming the company’s operating cash is 10% of sales for working capital requirements)

- Robust top line growth of about 10% p.a.

- EBIT margins north of 30%

- Growing dividend of about 10% p.a. in addition to share buybacks at an annual pace of around 0.4-1.0% of outstanding shares

- Strong balance sheet with net debt including lease liabilities of -$51 billion (the Activision Blizzard deal will weaken it temporarily)

If you nodded along while you read the above, you most likely agree with me that the company is of high quality. As some investors have said, however, a great company doesn’t make it a great investment. It’s the valuation that bugs me, and we’ll get to that at the end of this article.

History

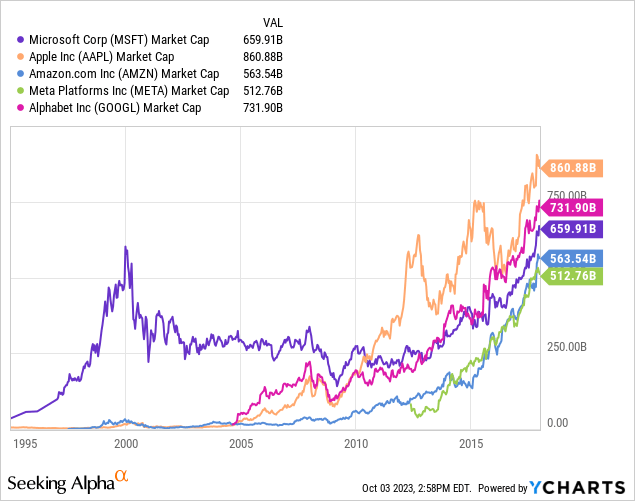

Founded in 1975, Microsoft’s mission was “a computer on every desk in every home“. Microsoft did indeed achieve its mission. The company has been one of the world’s most valuable companies for longer than any other Big Five Tech company: Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN) and Meta (META). A brief history lesson: Microsoft was firing on all cylinders already in the 90s when Zuckerberg was almost a teenager and Google founders Larry Page and Sergey Brin worked out of a garage. Amazon became formidable in the late 90s while Apple’s Macintosh sales were declining due to Microsoft’s popular new operating system Windows which almost managed to monopolize the market. Interestingly, it took Microsoft about 16 years to surpass its peak market cap in the year 2000 (the company paid cumulative dividends of $10.59 per share during this period however).

Although it took Microsoft quite a while to rebound from the internet bubble peak, the company grew topline around 9% p.a. during this period (topline quadrupled) while EBIT only grew 4% p.a. (doubled). I’m comparing the year 2017 to the year 2000.

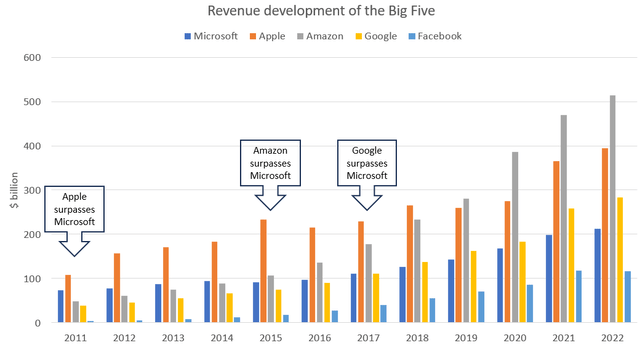

From the market cap graph above, we can also see the advent of the new technology behemoths from 2005 and onwards. All of these, except Meta, have now surpassed Microsoft in revenues as can be seen in the graph below (note that Microsoft’s fiscal year (FY) ends in June i.e. the year 2022 on the graph refers to Microsoft’s FY2023).

Revenue development of the Big Five (company financial statements)

Microsoft’s growth slowed down simply because its markets were becoming saturated. The company tried to find new growth segments through acquisition during this time such as the acquisitions of:

- Nokia’s phone segment in 2013 (didn’t work out and scaled-down investments in 2016)

- LinkedIn in 2017 which has proven to be a successful acquisition

- GitHub in 2018. The general feeling is that GitHub is a successful acquisition although I haven’t seen any numbers as it’s consolidated within the Intelligent Cloud segment

In 2017 the company found its next organic growth pocket: cloud computing through its Azure service (I’ll give a more thorough rundown of the cloud computing numbers in the business segment part of the article). From FY2017 to FY2023, Microsoft’s topline has doubled while EBIT has quadrupled i.e. the company managed to quadruple EBIT in 6 years while it took it 17 years to double EBIT previously. Most of this is attributable to Azure. It’s also noteworthy that although Microsoft has lagged behind its peers in revenue growth, the company is more profitable.

The Business

So what does Microsoft do? As with all of the big tech companies, Microsoft is involved in several different markets. The company has separated its operations into three segments. These segments have several sub-segments of which there are ten in total. The segments are classified as:

- Productivity and Business Processes

- Intelligent Cloud

- More Personal Computing

To be fair, the names didn’t say much to me when I first saw them. To get a better understanding of what Microsoft actually does you (or at least I) need to look at the sub-segments.

The sub-segments that are a part of Productivity and Business Processes are:

- Office products and cloud services: Applications such as Office, Teams and Copilot are provided to businesses and consumers. These are wrapped together in Microsoft 365 which was previously known as Office 365

- LinkedIn: Digital recruiting, marketing services and subscriptions

- Dynamics: Software and tools for businesses such as financial management, enterprise resource management (ERP), customer relationship management (CRM) and supply chain management

The sub-segments part of Intelligent Cloud are:

- Server products and cloud services: cloud servers (Azure cloud services), databases (SQL Server), operating systems for servers (Windows Server), coding environments (Visual Studio), data center management (System Center) and licenses to access the above. This sub-segment also includes healthcare and enterprise AI services (Nuance) and a code hosting platform (GitHub)

- Enterprise services: Consulting services, training and certifications for Microsoft products

The sub-segments of More Personal Computing are:

- Windows: Operating system (Windows) and cybersecurity (Microsoft Defender)

- Devices: Consumer electronics such as laptops and tablets (Surface), virtual reality headsets (HoloLens) and other PC electronics

- Xbox: gaming such as consoles and subscriptions (Xbox)

- Search and news advertisement: advertisement through search (Bing) and a browser (Microsoft Edge)

Now we (or at least I) have a much better understanding of what Microsoft actually does. We can also conclude that Microsoft is mostly Business-to-Business (B2B) focused which is usually characterized as being less cyclical than Business-to-Consumer focused companies.

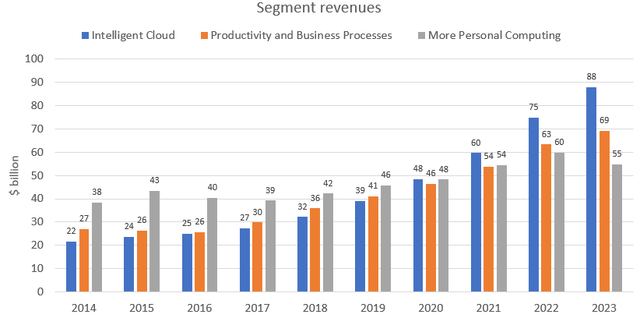

So how large are the different segments? In the graph below I have separated the three segments by revenue over the last decade. Intelligent Cloud has grown the most (15% p.a.) driven by the sub-segment Server products and cloud services. Productivity and Business Services grew 10% p.a. while More Personal Computing only grew 4% p.a. Also note that More Personal Computing was the largest segment up until 2020.

Segment revenues (company financial statements)

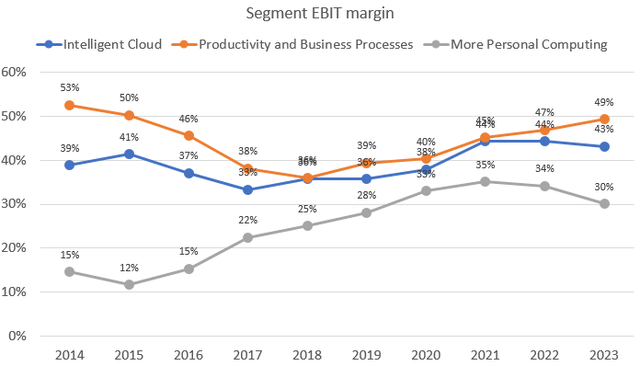

The profitability of all of these segments is very high as can be seen in the graph below. Intelligent Cloud and Productivity and Business Processes have kept their margins fairly steady indicating EBIT growth in these two segments has come from topline growth. In More Personal Computing, the EBIT margin has doubled from 15% to 30%. It’s a superb achievement, indicating however that for the segment to generate higher EBIT, it needs to produce topline growth going forward as the relative profitability most likely won’t double during the next decade.

Segment EBIT margin (company financial statement)

With the segment number out of the way, let’s dig a bit deeper to see what has actually driven the growth of these segments.

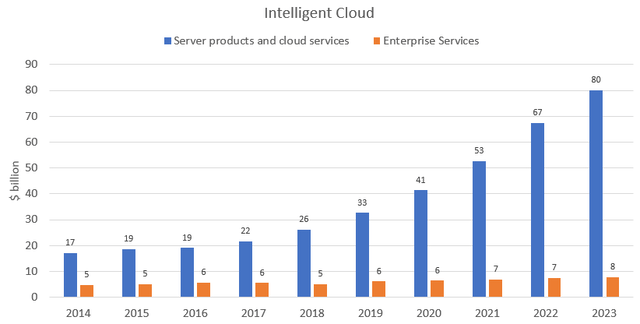

Intelligent Cloud

Sub-segments: Intelligent Cloud (company financial statements)

Server products and cloud services has grown 16% p.a. during the last decade. The shift from on-premise to the cloud started in earnest in 2017, growing 24% p.a. from FY2017 up to FY2023.

Enterprise services doesn’t really move the needle and has grown 5% p.a. during the last decade. I suspect the current trajectory will continue going forward as consulting is very competitive. Also, companies have budgets on how much they’re willing to spend on training and certificates and it’s probably not going to increase fundamentally in the future.

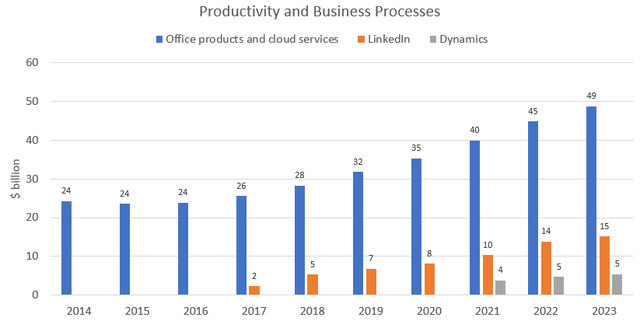

Productivity and Business Processes

Sub-segments: Productivity and Business Processes (company financial statements)

Office products and cloud services have grown 7% p.a. during the last decade. Nothing to write home about although it is from a large base. I view this segment as sticky, mission-critical and a relatively small expense for customers. So even though growth could slow down, I have a hard time seeing negative growth in this segment. Innovations such as Copilot could reignite growth but it remains to be seen how many customers are willing to pay for it.

LinkedIn, on the other hand, has shown tremendous growth since its acquisition in 2017. The growth has slowed from 34.3% in FY2022 to 9.6% in FY2023. The latest quarterly year-over-year growth rate was only 5.3%. The hot job market during 2021-2022 clearly drove LinkedIn’s good performance. Further weakness is likely at least in the near term as the job market has cooled and unemployment jumped from 3.5% to 3.8% in August.

Dynamics has been included in the Other sub-segment before 2021 so we don’t have a long history to reflect upon here. It has however shown strong growth during FY2021-2023. It’s a fairly small part of the whole, and there’s a bunch of competitive software to choose from (think of all the financial planning and ERP software that’s out there) so time will tell how this segment performs.

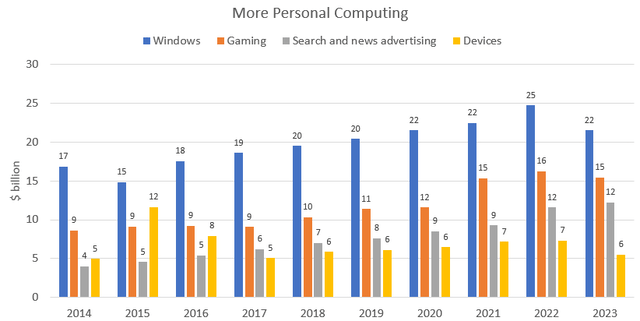

More Personal Computing

Sub segments: More Personal Computing (company financial statements)

Windows has only grown 2% p.a. during the last decade. Once it was the product that defined Microsoft but has become less relevant over time (although still the third largest sub-segment). Revenues are driven by licenses purchased by PC manufacturers (OEMs) which are installed on the PCs they sell. The PC market has become saturated as most people who want to own a PC own a PC. Companies that want to provide a PC to their employees have also done so. There’s of course a renewal cycle for PCs which drives Windows revenue but I don’t expect Windows’s growth trajectory to pick up.

Gaming has grown 7% p.a. during the last decade and revenue decreased slightly in FY2023. The gaming market is estimated to be worth over $200 billion, making it a huge opportunity for Microsoft. If the Activision Blizzard deal ever gets completed, gaming will overtake Windows as the third-largest sub-segment. It remains to be seen whether Microsoft is able to improve the segment’s growth trajectory with the deal. As always with large acquisitions, much can go wrong. Synergy forecasts may prove too optimistic and there may be a culture clash. Time will tell whether it’s a successful one. To Microsoft’s credit, they have integrated large acquisitions successfully before so I’ll give them the benefit of the doubt here.

Search and news advertisement has grown 12% p.a. during the last decade. The growth has obviously lagged behind the closest competitor Google Search. Now with OpenAI’s ChatGPT integrated into Bing, Microsoft could potentially increase the growth trajectory of its search business. As I’ve stated here, it’s still too early to say how this will play out.

Devices is a minor part of the whole and has been down/flat since the acquisition of Nokia’s mobile business in 2013. Microsoft scaled down its investments in phones in 2016. Virtual reality headsets (HoloLens) could be the next growth pocket for Microsoft in this sub-segment. SeekingAlpha shared some interesting news recently regarding a contract with the U.S. Army that could be worth $22 billion over 10 years. Nothing is signed yet and may happen in FY2025 so still quite uncertain.

Business segment conclusions

Having looked at all the different segments and sub-segments, we have a better picture of Microsoft’s business and where the potential growth can come from. The sub-segment Server products and cloud services probably has the best growth trajectory ahead of it as businesses are still in the middle of their shift to the cloud journey. Search and news advertising also benefit from robust expected growth in digital marketing spend in the coming years. Office products and cloud services could reignite its growth with new innovations such as Copilot. With this said, we probably can’t expect Microsoft to grow topline organically in the mid-teens as it has done during 2017-2023. At least not until the company finds the next pocket of growth. The next meaningful growth pocket could be linked to AI but it’s still a fairly imprecise exercise when evaluating how much revenue can be generated from it (although many analysts try). Acquisitions such as Nokia, LinkedIn, GitHub and Activision Blizzard will most likely also be conducted in the future for further growth.

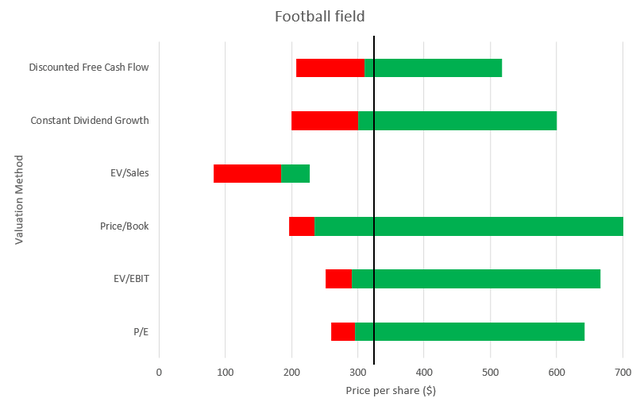

Valuation

I have valued Microsoft using two different frameworks. I have used two cash flow models which are the dividend discount model (DDM) and the discounted cash flow model (DCF). I have also used valuation multiples based on a comparable peer group. The multiples are EV/Sales, EV/EBIT, P/E and P/B. Microsoft doesn’t really have any perfect peers as it’s active in so many different segments. Here I have used the other four companies of the Big Five as Microsoft’s peer group. They’re similar in terms of size and some of them have similar business lines such as Alphabet and Amazon in cloud computing, Meta in social networking and Alphabet in search. The multiples for the Big Five companies can be seen below. The max/min is the range around the median in percentage terms.

| Name | Market-cap ($ million) | Enterprise value ($ million) | P/E (FWD) | P/B (FWD) | EV/Sales (FWD) | EV/EBIT (FWD) |

| Apple | 2,770,000 | 2,720,000 | 29.2x | 47.2x | 7.1x | 24.0x |

| Alphabet | 1,740,000 | 1,660,000 | 24.6x | 6.0x | 5.4x | 19.4x |

| Amazon | 1,320,000 | 1,430,000 | 58.4x | 6.8x | 2.5x | 50.1x |

| Meta | 811,000 | 795,000 | 23.6x | 5.4x | 6.0x | 18.7x |

| Median | 26.9x | 6.4x | 5.7x | 21.7x | ||

| Max | 117% | 636% | 24% | 131% | ||

| Min | -12% | -16% | -56% | -14% |

In the “football field” graph below you can see the output from the different valuation methods. When applying the median, max and min multiples to Microsoft’s FY2024 financials we get a range of possible stock values. In the DDM I have used 9% as the base case growth rate for Microsoft’s dividend and 8.5% and 9.5% for the bear and bull cases respectively. The return on equity I have used is 10% as I have assumed that that’s the best alternative return one could earn by investing for example in an S&P 500 index fund. In the DCF model I have assumed 10% growth during FY2024-2028 and 7% growth as the terminal growth rate. I have assumed that the return on equity equals the company’s weighted average cost of capital (WACC) i.e. 10% as Microsoft has more cash than debt. EBIT margin is expected to remain at 40% throughout the forecast period while capex, depreciation and NWC are modeled as 12%, 6% and -10% of sales respectively. In the bear/bull case I have adjusted the growth rates and margins by +/-2% during the forecast period and the terminal growth rate by +/-1%. The black line represents Microsoft’s current share price of about $327. I also limited the x-axis to show a maximum of $700 per share to make the graph more reader-friendly as Apple’s P/B of 47.2x results in a Microsoft share price of $1,490.

Valuation analysis (companies’ financial statements, SeekingAlpha)

The base case and median share prices I get for the different methods are:

- DCF: ~$310

- DDM: $300

- EV/Sales: $184

- EV/EBIT: $291

- P/E: $296

- P/B: $234

They are all below the current price of $327 which would indicate Microsoft is slightly overvalued. However, there is always uncertainty surrounding the assumptions and the overvaluation is not significant enough to warrant a sell rating which is why I rate Microsoft as a hold. I also give more weight to the DCF and DDM than to the comparable multiples due to the peer group’s different business lines. Although Microsoft is a high-quality business, I believe its shares are fully priced. The expected return is 8.7% which is below what you could earn on the best alternative investment (10.0% from the S&P 500).

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.