Summary:

- UnitedHealth Group will release its Q3 results on Friday, October 13th, before the market opens.

- UnitedHealth’s second-quarter results provided reassurance and turned things around for the entire sector.

- This time around, after significant outperformance over the last few months, expectations are higher, as investors await a positive outlook on every part of UNH’s business, rather than just reassurance.

- Key factors to consider include medical costs, utilization trends, and membership growth in the insurance business, as well as continued growth and margin improvements in Optum.

JHVEPhoto/iStock Editorial via Getty Images

UnitedHealth Q3 Earnings – What Investors Expect:

UnitedHealth Group Incorporated (NYSE:UNH) is set to report its third-quarter results on Friday, October 13th, before the market open.

UnitedHealth’s second-quarter results played a major role in the stock’s surge over the last three months, as UnitedHealth once again proved its resiliency. Unlike the previous quarter, however, the stock is coming into this report with high expectations, trading near all-time highs.

This time, investors aren’t looking for reassurance, they’re looking for a positive outlook on key factors, including medical costs and membership growth in the insurance business, as well as continued strength in the Optum businesses.

UNH Stock – Improving Year-To-Date Performance

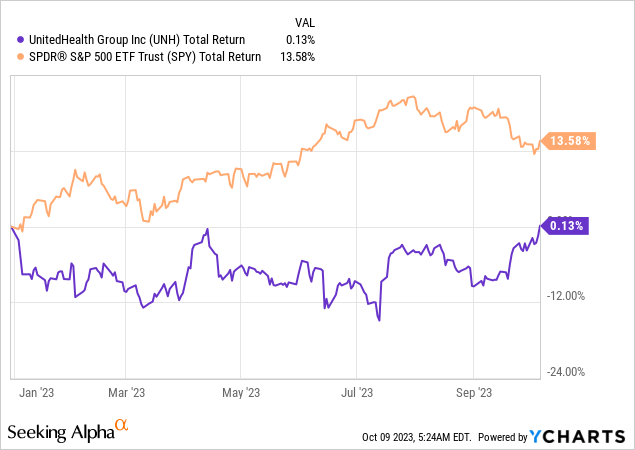

The last time we were here, the gap between UNH and the S&P 500 (SPY) was over 27%. As we can see, the market remained relatively flat since then, while UnitedHealth’s stock has had a nice surge, resulting in an outperformance of nearly 17% since my previous article.

The first half of 2023 was challenging for the healthcare sector, amidst Medicaid redeterminations, PBM scrutiny, higher utilization trends, and shifting market preferences. The sector is still one of the worst-performing YTD, coming in fourth place from the bottom, beating only Utilities, Real Estate, and Consumer Staples.

The bad news that kept piling up during the first half of the year is still relevant, yet there are early signs of improvement, as we’ll discuss in further detail below. Consensus EPS estimates coming into this quarter have only 1 down revision, net, and revenue estimates have seen 14 up revisions, net.

As we can understand, market sentiment is much different this time around, and pressure is high on UnitedHealth to deliver a sufficient quarter in order to sustain its stock incline. So, let’s discuss the key factors to watch for in the report.

Utilization Trends

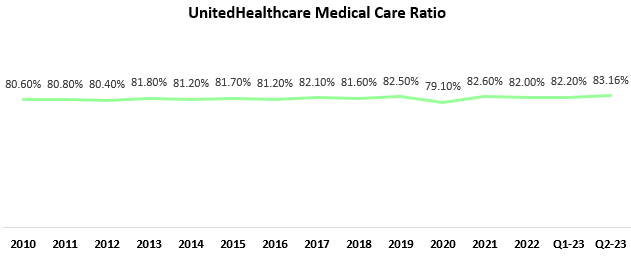

Covid-19 had a positive impact on health insurance providers, and UnitedHealth experienced similar benefits. The pandemic led to people hesitating to go to hospitals and preferring to stay home, resulting in a notable reduction in outpatient care, especially non-urgent services. When individuals are entitled to receive $85 in coverage from their insurance provider but only use $80, as opposed to the typical historical average of $82, the insurer ends up with an extra $2 in retained profits.

This turned upside down on those insurers, though, as the tailwinds of the pent-up demand have now become headwinds, resulting in historically high utilization rates in 2023.

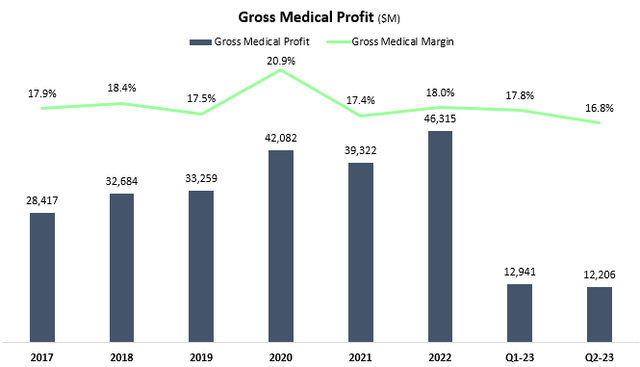

Created and calculated by the author using data from UnitedHealth Group financial reports; Gross Medical Profit is calculated by subtracting medical costs from total premium revenues.

As we can see, UnitedHealth’s gross medical profit reached a low point in the second quarter, and according to its management, they expect the increased utilization among seniors to continue:

In the second quarter, outpatient care activity among seniors was a few 100 basis points above our expectations. As we’ve highlighted, specific orthopedic and cardiac procedures had increased its far above that level of variation. And as we developed and filed our 2024 Medicare Advantage offerings, we assume that these levels of heightened care activity will persist throughout next year.

— John Rex, UnitedHealth Group CFO, Q2 2023 Earnings Call (emphasis added).

I highlighted the last sentence above to make sure readers understand that higher utilization should no longer be a margin headwind for 2024. It could, however, be a top-line headwind, as higher-priced programs could repel some customers.

Created by the author using data from UnitedHealth Group financial reports.

In the Q3 report, investors should obviously focus on the near-term numbers, but just as important is the commentary about the impact of higher prices. The best-case scenario for shareholders would be resilient demand and decreasing utilization, as it could lead to margin expansion. However, my base case assumption is that demand remains resilient while utilization remains high, leading to normalization and a return to 2019-level margins.

Membership

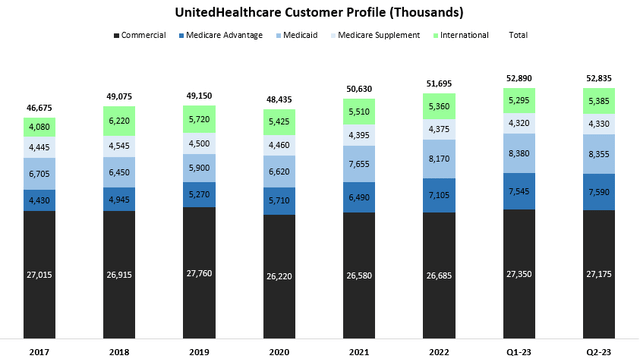

In our last article, we discussed the impact of post-Covid coverage losses for millions of Americans. As a reminder, an estimated 15 million Americans are expected to lose Medicaid coverage due to redeterminations taking place within the 12-month period starting last March.

Created by the author using data from UnitedHealth Group financial reports.

As we can see, some of these effects are showing up in UnitedHealth’s numbers, which have seen a small Q/Q decrease in total members in the second quarter. Specifically in Medicaid, UNH lost a small amount of 25,000 members, reflecting less than 0.3% of Medicaid members as of the end of Q1.

Investors should closely monitor the ongoing post-COVID effect, as well as look for further clarity regarding UnitedHealth’s ability to continue to grow in a tougher economic environment.

Optum

So far, we discussed UnitedHealth Group’s legacy business in health insurance. Optum is where the strength of the group truly shines. UnitedHealth Group’s unique positioning within the health value chain positions it to weather many of the insurance headwinds, as many of them transform into tailwinds for the Optum businesses. As demand for health-related activities rises, Optum stands to gain and capitalize on the increased demand for its non-insurance health services.

Optum Rx

Who would imagine that a pharmacy services business could generate so much buzz? Apparently, when the regulator sets its mind to it, it can rattle any industry. Optum Rx aggregates the group’s Pharmacy Benefit Management (PBM) activity, which is 50% of the segment’s business, as well as other ancillary services, including pharmacy-related medical and behavioral care.

The segment displayed an impressive growth acceleration in the second quarter of over 15.5% in sales, all the while maintaining margins steady at 4.2%. Investors should closely monitor the segment’s profitability, which has the potential to improve even further with the entry of multiple biosimilars into the market.

Over the last few quarters, we’ve seen many headlines demonstrating increased scrutiny over PBMs, with the latest being a new Senate bill aimed at increasing transparency, accountability, and competition among pharmacy benefit managers.

Although they can’t be considered objective, both CVS Health (CVS) and UNH, which I follow closely and are two of the largest PBMs in America, are repeatedly saying there isn’t too much fat to trim here. Meaning, that whatever noise those headlines make, it’s hard to imagine any significant effect of regulation on their PBM businesses, even if any of those headlines were to actually materialize.

That being said, investors closely monitor comments made by the companies, who oftentimes make things sound worse than they are to soften the regulator. As we saw during the early parts of the year, managed care stocks do trade up and down based on such comments, and as such, it will be a key focus point.

Optum Health

Optum Health continued to display remarkable growth in the second quarter, increasing sales by over 36.0% Y/Y. However, margins continued to decline, coming in at 6.4%, compared to 7.9% in the prior year period.

As I wrote in my previous article and management reiterated, Optum Heath is primarily focused on capturing the immense growth opportunity, by providing high-quality and conveniently available care to over 103 million patients.

Investors will closely monitor the relationship between growth and margin here, and as long as sales are increasing in the 35%-40% range, I don’t think we’ll hear any complaints over an immaterial margin contraction. However, both numbers will be key, as well as the total number of consumers served. Furthermore, investors should eye any change in the company’s long-term target for margin here, which stands at 9%, quite far from where we are currently.

Optum Insight

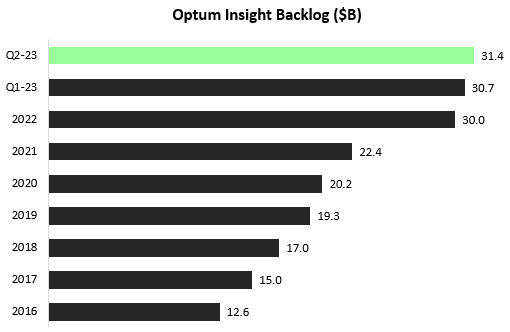

UnitedHealth Group’s crown jewel, Optum Insight, continues to shine with its impressive performance. The segment achieved margins exceeding 20.7% and revenue growth of over 42.4% in the second quarter. And with Optum Insight, the leading indicator is its backlog.

Created by the author using data from UnitedHealth Group financial reports.

Despite challenging times for healthcare providers, there has been remarkable demand for Optum Insight’s products. As overall healthcare activity continues to rise, we anticipate a further surge in demand for Optum Insight’s offerings.

Alongside tracking the backlog, investors will be closely watching the profit margins of the Optum Insight segment. During the first half of the year, these margins dipped into the low twenties. It’s noteworthy that the management has set a long-term target of 20.0%, underscoring their commitment to expanding market share over prioritizing immediate profitability.

It’s crucial to emphasize that Optum Insight continues to be the most lucrative segment within the group. Despite accounting for less than 4% of total revenues, it contributes nearly 12% to the overall operating profit.

UNH Stock Valuation

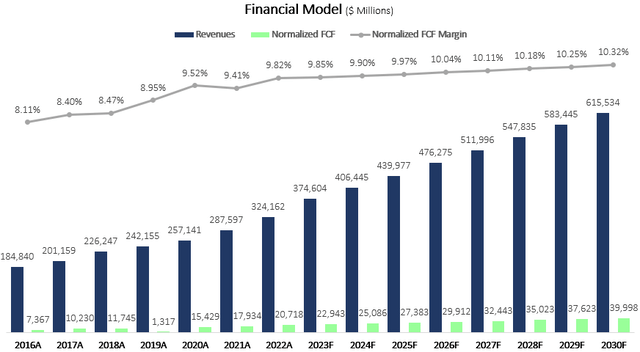

I used a discounted cash flow methodology to evaluate UnitedHealth Group’s fair value. I project the company will grow revenues at a 7.4% CAGR between 2023-2030, which is higher than the consensus of approximately 5%-6%, but below the company’s past 7-year CAGR of 9.8%. I estimate revenues will grow at this pace due to backlog fulfillment at Optum Insight, and the company’s ability to maintain or grow market share in all the other segments.

I project normalized free cash flow (“FCF”) margins will increase gradually to 10.3%, as the higher-margin Optum businesses become a larger portion of the company, medical costs normalize, and Optum Health margins expand closer to the management’s long-term target.

Created and calculated by the author using data from UNH’s financial reports and the author’s projections; Normalized FCF calculated as Net Income + Depreciation & Amortization – Capex.

Taking a WACC of 8.9%, I estimate UnitedHealth’s fair value at $571 per share, which represents a 9% upside compared to the market price at the time of writing. Clearly, the upside is much lower compared to where it was just a few months ago.

Despite the above, I believe the long-term growth model, which I detailed in my previous article, remains intact. As long as UnitedHealth continues to grow EPS at a mid-teens pace, and I estimate it will, I expect it will continue to provide market-beating returns. As such, I would initiate a position even at current prices but would wait patiently for an attractive entry point to build a major stake.

Conclusion

UnitedHealth Group is scheduled to announce its third-quarter results on Friday before the market opens. Unlike the previous quarter, expectations are high, as the stock trades near all-time highs.

Investors await a positive outlook regarding utilization trends, medical costs, and membership growth in the insurance business, as well as continued strength in Optum. This time around, expectations are signaling a beat and raise, rather than a need for reassurance.

After its outperformance over the last three months, UnitedHealth Group is trading at a less attractive valuation, which in my opinion still grants a Buy rating, but it’s no longer a Strong Buy unless we see a major surprise to the upside.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of UNH either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.