Summary:

- Home Depot is facing a tough year in FY23 due to high interest rates, which are affecting home sales and slowing down remodeling and DIY projects.

- Inflation is easing up, and it’s anticipated that the Fed will cut rates by at least 1% in 2024, boosting existing home sales.

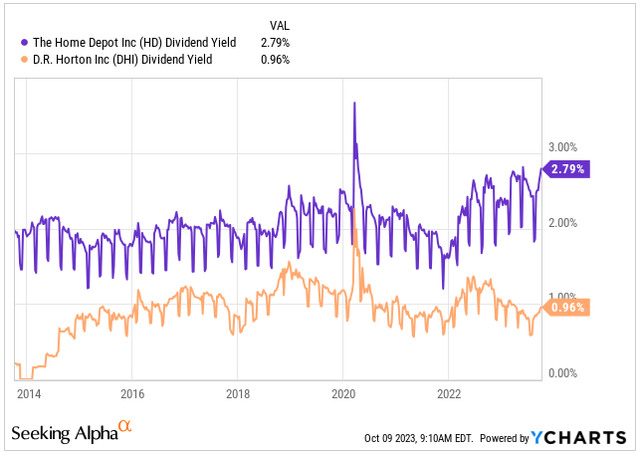

- HD raised its dividend by 435% in the past decade, yielding 2.79% now, with a safe payout ratio, and no signs of stopping the growth despite the challenges.

- HD is currently trading at a discount compared to its historical averages, making it an attractive choice.

- With the expected EPS growth, I anticipate an average annual return of about 10% in the next 6 years.

Justin Sullivan

Investment Thesis

If you were to ask me what my favorite dividend growth stocks were, I guarantee you Home Depot (NYSE:HD) would be among the top 5.

To put it simply, HD is a popular store where people can buy tools, materials, and appliances for home improvement projects. And home improvement projects have been very popular during the COVID-19 lockdowns and that is one of the reasons why the stock has done exceptionally well in recent years.

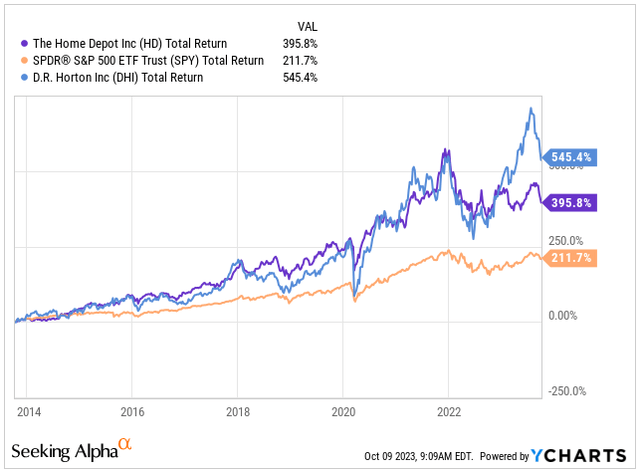

HD has impressively delivered a total return of 396% over the past decade, more than doubling the return of the S&P 500 Index (SPY), despite its fundamentally simple business model.

Now, the challenge arose when the pandemic ended, and the Fed had to shift gears by tightening its policies, raising interest rates due to soaring inflation. This led to a drop in consumer confidence and sluggish economic growth.

The increased rates significantly impacted people’s disposable income and their appetite for mortgage rates. Many who had secured low-interest rates during the pandemic were reluctant to move and lose their favorable rates.

This situation created pressure not only for Home Depot, the home improvement giant but also for home builders like D.R. Horton (DHI).

So, let’s assess the current macroeconomic sentiment and see if Home Depot is currently a good bargain amidst these challenges.

Macroeconomic Development Keeps Home Depot Under Pressure

Looking at the performance chart above, it’s clear that home builders are holding their ground better than HD.

The key factor here is that new homes are still selling, but older ones, where people secured lower interest rates, are moving sluggishly.

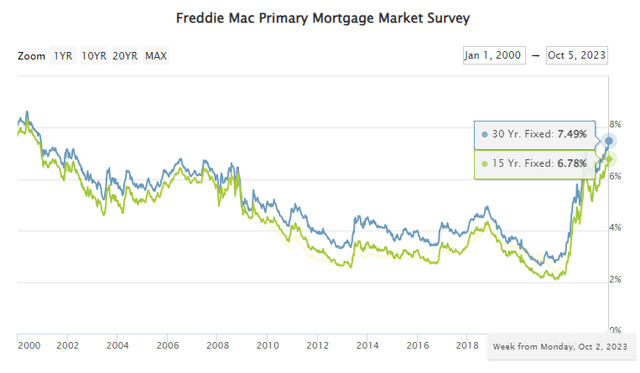

Just take a look at the graph below – the 30-year fixed rate soared to 7.49% in October.

I mean, wouldn’t you rather stick with your cozy old home with a 3% rate, rather than jump into a new one with such a high interest burden?

It’s worth noting that we haven’t seen interest rates like this since the early 2000s. It’s a challenging situation for anyone looking to buy or sell a home.

Mortgage Market Survey (Freddie Mac)

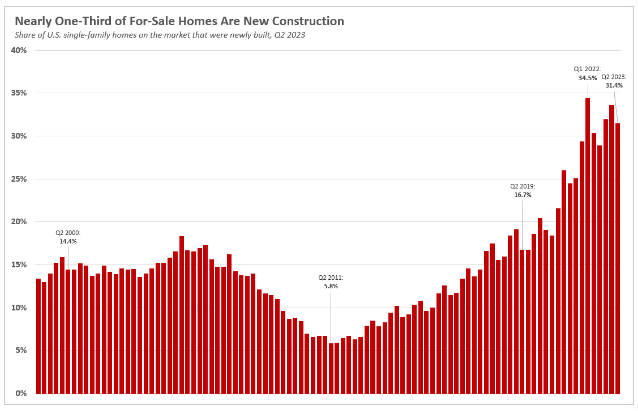

Here’s the situation: more than a third of the homes sold in the U.S. are brand new, a peak not seen in the last 20 years. This trend is great news for construction companies but not so great for consumer-focused businesses like HD, which thrive on renovations and DIY projects in older homes.

In practical terms, unless interest rates decrease, motivating people to sell their older homes and invest in renovations, HD could experience significant pressure in both earnings and stock performance.

New Construction vs. Existing Homes Sales (DSNews)

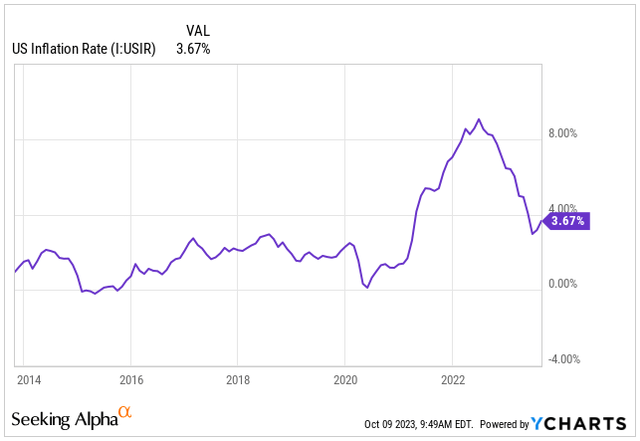

The Fed is currently emphasizing the idea of “higher for longer.” While I’m confident they’ll exert every effort to combat inflation and reach the 2% target, there’s already a noticeable cooling off in inflation.

On one hand, this rhetoric is a strategic move. Creating a sense of fear among the public and consumers is a way to intentionally slow down the demand for goods and services, consequently leading to lower inflation.

US Inflation Rate (Seeking Alpha)

In my view, though it’s speculative, a lot of economists anticipate a cut in rates by around 1% in 2024, bringing the Fed Funds rate to the mid-4% range.

If this happens, it could spur the economy by lowering mortgage rates, reigniting the real estate market, especially for older properties. Companies like HD could seize this chance and capitalize on the opportunity.

So the question is, what implications does all of this hold for HD’s earnings?

According to Home Depot’s guidance shared during their Q2 FY23 earnings call, they anticipate a sales decline of 2% to 5% compared to FY22, reaching around $152 billion.

The operating margin is also expected to decrease from the current 14.9% to somewhere between 14% to 14.3%.

This is likely to result in a decrease in EPS of around 7% to 13%, leading to an FY23 EPS of about $14.

This latest outlook is actually worse than what the company had initially expected at the beginning of the year, indicating significant pressure.

However, in my view, considering the anticipated rate cuts in 2024, HD seems well positioned to endure these challenges and deliver better results beyond FY23.

The King of Dividend Growth

Considering the 7.8% year-to-date decline in HD’s stock, the company is currently offering a dividend yield of 2.79%. This rate is significantly higher than its four-year average of 2.28% and surpasses that of D.R. Horton.

Dividend Yield (Seeking Alpha)

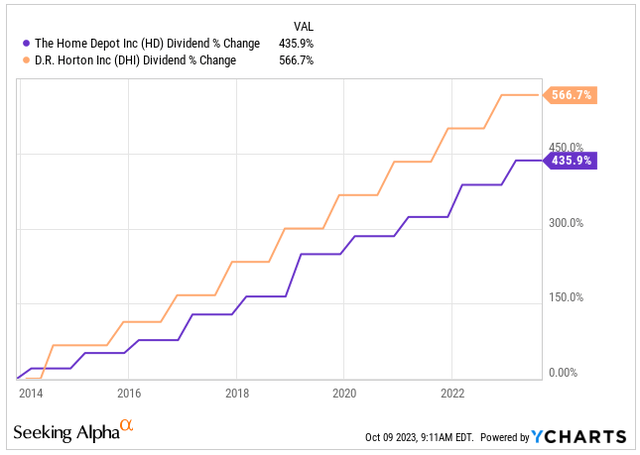

What’s even more impressive is Home Depot’s track record in dividend growth. They’ve increased their dividend by a staggering 435% over the past decade, averaging an annual growth rate of 43.5%.

Additionally, in February 2023, despite looming challenges, Home Depot announced a 10% increase, indicating their unwavering commitment to returning value to shareholders.

Dividend Growth (Seeking Alpha)

It’s worth noting that despite the impressive dividend growth rate, Home Depot typically maintains its payout ratio within the range of 40% to 55%. Even with the current challenges, the ratio stands at 50%, which, in my opinion, still qualifies as a very secure dividend payout ratio.

Additionally, over the last decade, the company has bought back 29% of its outstanding shares, underscoring its shareholder oriented policy.

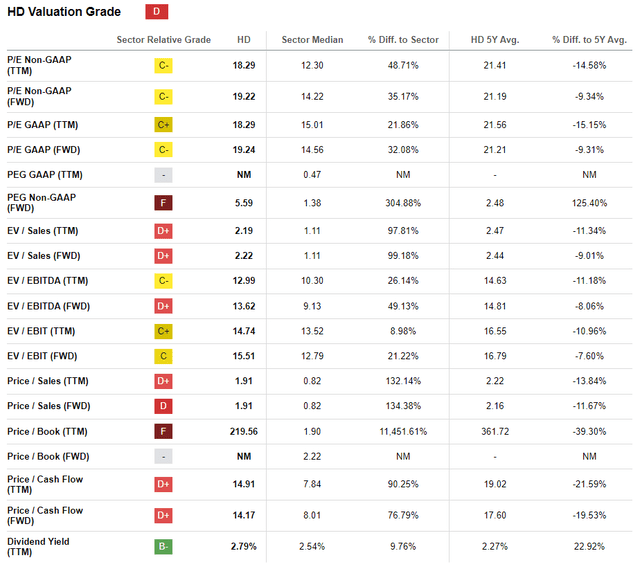

Slightly Undervalued with Promising Future

In terms of its valuation, HD is currently being traded at a lower valuation compared to its historical averages.

The PE Ratio for FY23 earnings is 18.29x, which is 15% lower than its 5-year average of 21.41x.

Looking at FY24 earnings, the Forward PE Ratio is 19.24x, indicating a 9.3% undervaluation compared to the 5-year average of 21.21x.

Both EV/Sales and EV/EBITDA also show an undervaluation of around 11% when compared to historical averages.

This means that the company is presently trading at an average discount of about 11.6% when compared to its historical norms.

Is this a fantastic bargain?

Not necessarily, especially if you’re specifically looking for value investments. However, it could be considered a good investment given the quality of the business and the expectation that it will recover and grow in the future.

Allow me to explain this further below.

Valuation Grade (Seeking Alpha)

Based on what analysts are predicting, the company is expected to increase its EPS by 7.5% annually between 2024 to 2030. Personally, I find this projection quite realistic, and given the promising opportunities for HD, it might even be a bit conservative.

This estimation suggests that the EPS could reach around $23 by the end of 2030. Considering this growth, along with the potential for stock appreciation and factoring in dividends, we could see total annual returns of nearly 10% annually.

| Fiscal Year | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| EPS | 14.00 | 15.24 | 16.21 | 17.30 | 18.79 | 20.05 | 21.27 | 23.00 |

| EPS Growth | -9.9% | 8.9% | 6.4% | 6.7% | 8.6% | 6.7% | 6.1% | 8.1% |

| Forward PE | 21.2 | 21.0 | 21.0 | 20.5 | 20.5 | 20.0 | 20.0 | 20.0 |

| Stock Price | $ 297 | $ 320 | $ 340 | $ 355 | $ 385 | $ 401 | $ 425 | $ 460 |

Conclusion

In the article I’ve presented, the current economic climate isn’t favorable for HD. We’re seeing the highest interest rates in two decades and a sharp decline in existing home sales, putting pressure on home remodeling and DIY projects – key areas for HD’s business.

Because of these challenges, HD’s stock performance has taken a hit in the last year, coupled with expected decreases in both EPS and sales YoY.

Despite these obstacles, my outlook is positive. I believe things could improve, especially if the Fed cuts rates in 2024, potentially giving a boost to existing home sales.

Considering these factors, I’m optimistic about HD’s ability to increase its EPS beyond FY23, possibly at a rate of around 7.5% annually. This growth could translate into overall annual returns of approximately 10%.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.