Summary:

- Cisco Systems is a leader in networking and communication products and services.

- Projections for the long-term CAGR of their industry have inflected upward over the last year and are now above 30%.

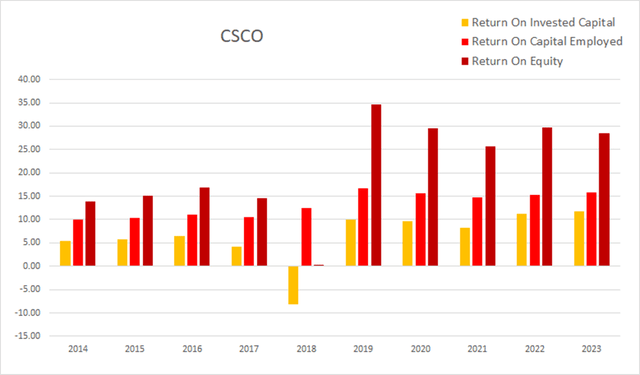

- As of this most recent annual report ROIC was 11.80%, ROCE was 15.73%, and ROE was at 28.44%.

- A discounted cash flow estimate indicates the present share price of $53.07 is only $4.04 (8.2%) above my fair value estimate for its yield.

- I currently rate CSCO stock as a Buy.

jejim

Thesis

I have been a growth investor for many years and am often approached by friends wanting to know my opinion on specific companies. A few days ago, a friend asked me to take a look at Cisco Systems, Inc. (NASDAQ:CSCO). The company lies in a space that is partially outside of my circle of competence, so I have not actually sat down to look at them as a potential investment since before the dot-com crash.

Cisco Systems exists in a highly competitive and constantly adapting industry. In much the same way as Microsoft (MSFT) or Teradyne (TER), this company has stayed relevant by expanding its capabilities through purchases. I consider their recent acquisition of Splunk as an attempt to expand capabilities and grant themselves another business life cycle extension.

Although they have not been growing revenue at a particularly fast rate, I found the company has attractive margins and returns. They have spent the last several years paying down debt and are currently drowning in cash flow. I believe their extremely healthy financial situation, coupled with their culture of adaptation, makes this attractive as a long-term compounder. After looking over their valuation, I believe they are currently trading relatively close to fair value and presently rate Cisco Systems as a Buy.

Company Background

Cisco Systems is a provider of Internet protocol-based networking and other communications products. They have operations in the Americas, Europe, the Middle East, Africa, the Asia Pacific, Japan, and China. They were formed in 1984 and are currently headquartered in San Jose, California.

This is Seeking Alpha’s description of their wide array of products and services:

“The company also offers switching portfolio encompasses campus switching as well as data center switching; enterprise routing portfolio interconnects public and private wireline and mobile networks, delivering highly secure, and reliable connectivity to campus, data center and branch networks; wireless products include wireless access points and controllers; and compute portfolio including the cisco unified computing system, hyperflex, and software management capabilities, which combine computing, networking, and storage infrastructure management and virtualization.

In addition, it provides Internet for the future product consists of routed optical networking, 5G, silicon, and optics solutions; collaboration products, such as meetings, collaboration devices, calling, contact center, and communication platform as a service; end-to-end security product consists of network security, cloud security, security endpoints, unified threat management, and zero trust; and optimized application experiences products including full stack observability and network assurance.

Further, the company offers a range of service and support options for its customers, including technical support and advanced services and advisory services. It serves businesses of various sizes, public institutions, governments, and service providers. The company sells its products and services directly, as well as through systems integrators, service providers, other resellers, and distributors. Cisco Systems, Inc. has strategic alliances with other companies.”

Long-Term Trends

I found multiple estimates for the CAGR of the network as a service market. One projects a CAGR of 35.3% through 2030. Another projects a CAGR of 32.36% through 2028. These projections are elevated from older estimates. Both from 2022, one projected a CAGR of 28.7% through 2027; the other expected a CAGR of 22.4% through 2030.

The fact that more recent estimates for long-term industry growth are higher than older estimates is quite attractive. This could be an early indication of a positive inflection in long-term demand growth.

Guidance

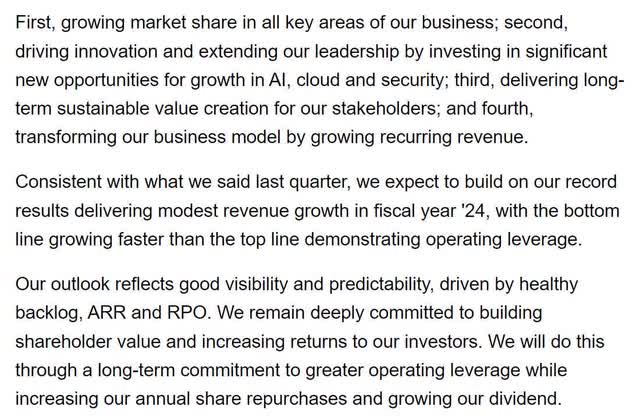

Their most recent earnings call transcript revealed that strong demand allowed them to achieve over 30% total sequential product order growth. Also, total subscription revenue increased by 10% during 2023. Overall, their present situation appears to be quite positive.

CSCO Guidance 1 (Earnings Call Transcript, Q4 2023)

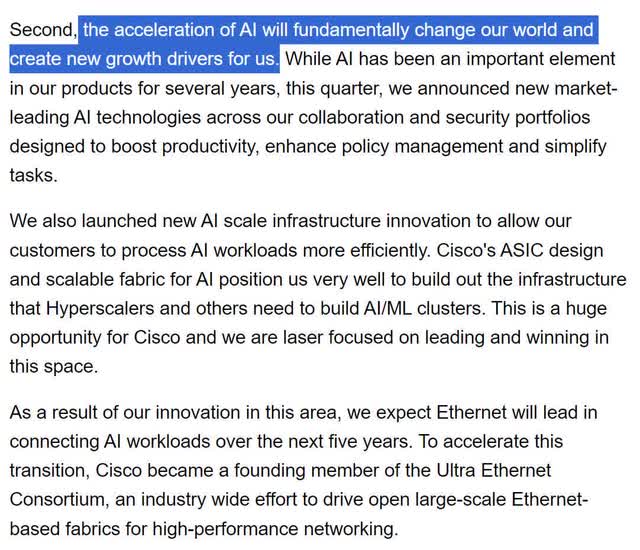

Cisco believes it will find ample opportunity in the emerging AI industry. With AI infrastructure expected to have a CAGR of 43.5% until 2029, and the AI-based cybersecurity market projected to experience a CAGR of 23.6% through 2032, being able to provide services for AI should provide them with additional revenue growth. I view this as a synergistic expansion into a new market. It is too early to tell if Cisco will also be able to establish a moat in this emerging sector.

CSCO Guidance 2 (Earnings Call Transcript, Q4 2023)

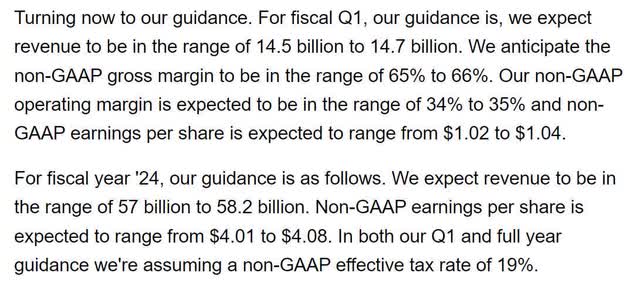

Their guidance is projecting both revenue growth and a gross margin expansion.

CSCO Guidance 3 (Earnings Call Transcript, Q4 2023)

Annual Financials

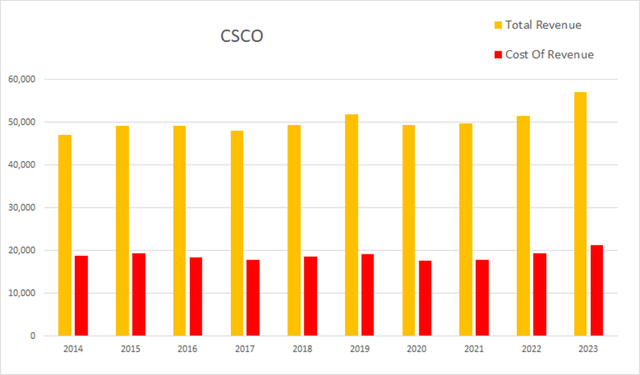

The company has been experiencing slow but fairly stable growth. In 2014 they had an annual revenue of $47,142M. By 2023 that had risen to $56,998M. This represents a total increase of 20.91% at an average annual rate of 2.32%.

CSCO Annual Revenue (By Author)

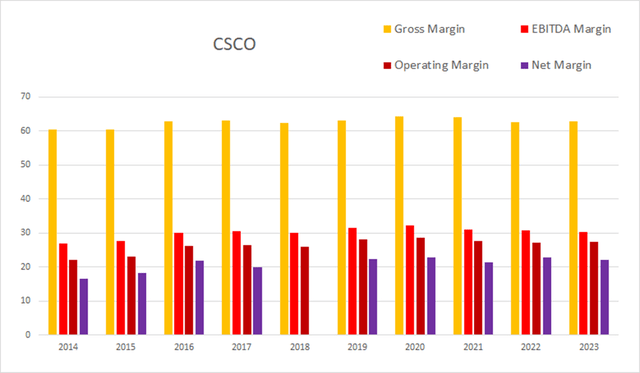

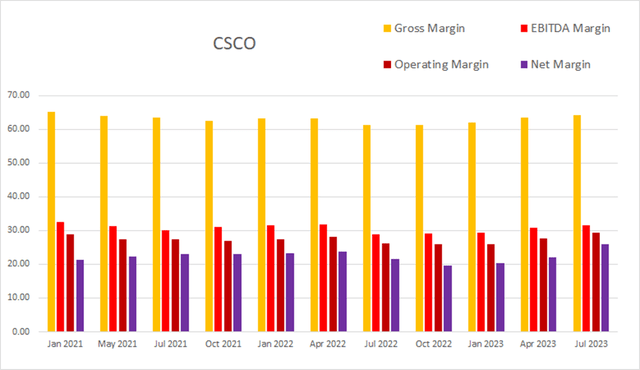

Their margins have been slowly expanding over the last decade. As of the most recent annual report, gross margins were 62.73%, EBITDA margins were 30.21%, operating margins were 27.35%, and net margins were 22.13%.

CSCO Annual Margins (By Author)

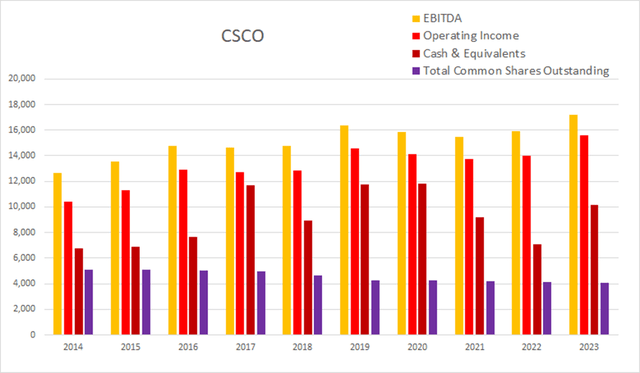

They have been buying back shares while growing income; this is extremely attractive. Total common shares outstanding were at 5,107M in 2014; by the end of 2023 that fell to 4,066M. This represents a 20.38% decline in share count, which comes out to an average annual rate of -2.26%. Over that same time period, operating income rose from $10,425M to $15,588M, a 49.53% total rise, at an average rate of 5.50%.

CSCO Annual Share Count vs. Cash vs. Income (By Author)

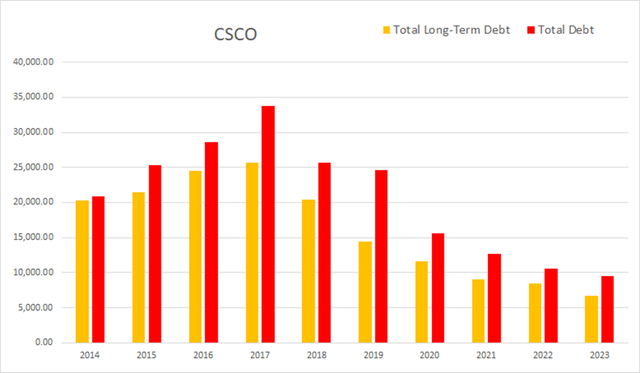

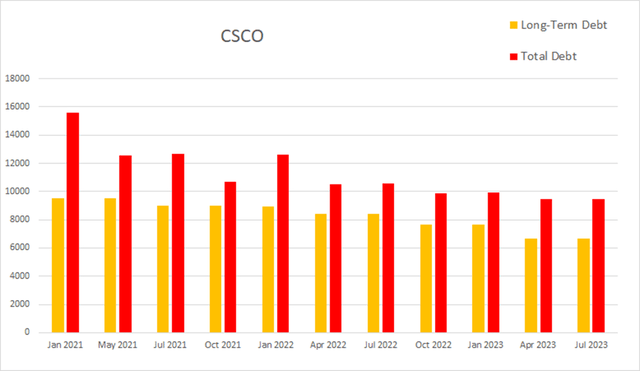

Their debt reached a peak in 2017 but has been shrinking since then. As of the 2023 annual report, they only had $535M in net interest expense, total debt was $9,452M, and long-term debt was $6,682M.

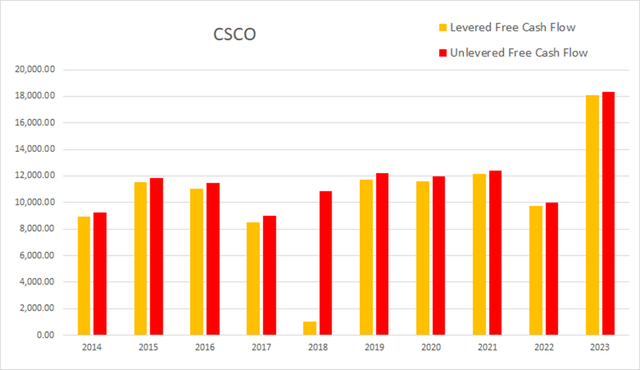

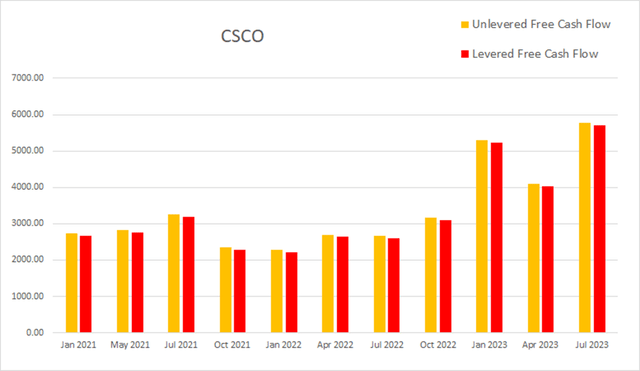

Their annual cash flow situation is extremely healthy. As of this most recent annual report, cash and equivalents were $10,123M, operating income was $15,588M, EBITDA was $17,219M, net income was $12,613M, unlevered free cash flow was $18,340.5M, and levered free cash flow was $18,073.6M.

CSCO Annual Cash Flow (By Author)

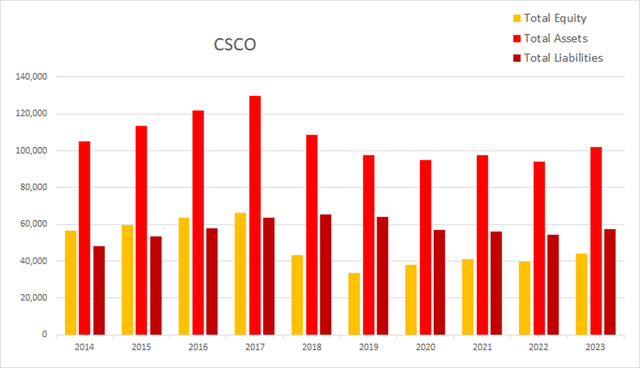

Their total equity fell with their assets from 2017 to 2019. It has been slowly rising since then.

CSCO Annual Total Equity (By Author)

They were already producing fairly attractive returns before 2017. From 2019 onward their returns have maintained an elevated range. As of the most recent annual report, ROIC was 11.80%, ROCE was 15.73%, and ROE was at 28.44%.

CSCO Annual Total Returns (By Author)

Quarterly Financials

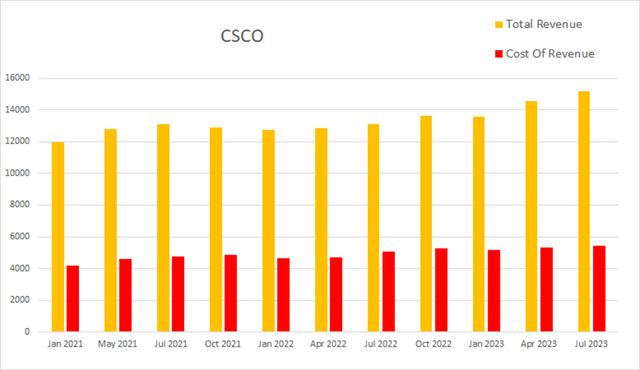

Their quarterly financials are also showing slow revenue growth. Eight quarters ago Cisco Systems had a quarterly revenue of $13,126M. Four quarters ago, it was $13,102M. By this most recent quarter that had risen to $15,203M. This represents a total two-year increase of 15.82% at an average quarterly rate of 1.98%.

CSCO Quarterly Revenue (By Author)

This most recent quarter gross margins were 64.12%, EBITDA margins were 31.59%, operating margins were 29.44%, and net margins were at 26.03%.

CSCO Quarterly Margins (By Author)

The sum of their last four quarters of buybacks comes to 1.07%.

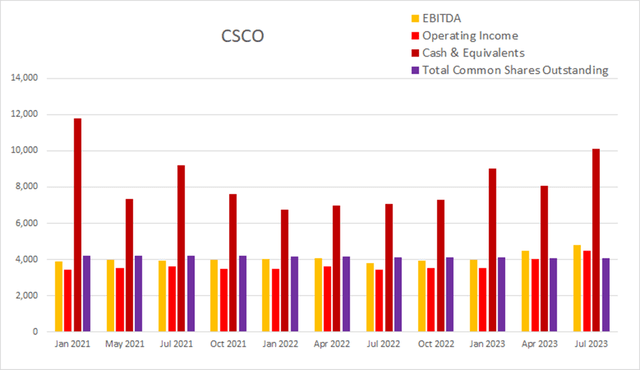

CSCO Quarterly Share Count vs. Cash vs. Income (By Author)

Their debt situation continues to improve. This most recent quarter, Cisco Systems had $201M in net interest expense, total debt was at $9452M, and long-term debt was at $6682M.

CSCO Quarterly Debt (By Author)

As of the most recent earnings report, cash and equivalents were $10,123M, short-term investments were at $16,211M, quarterly operating income was $4,476M, EBITDA was $4,803M, net income was $3,958M, unlevered free cash flow was $5,769.5M, and levered free cash flow was $5,700.1M.

CSCO Quarterly Cash Flow (By Author)

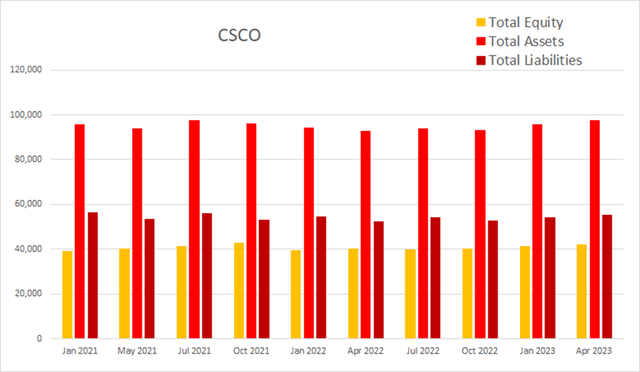

When viewing total equity on a quarterly basis, it has been fairly stable since the beginning of 2021.

CSCO Quarterly Total Equity (By Author)

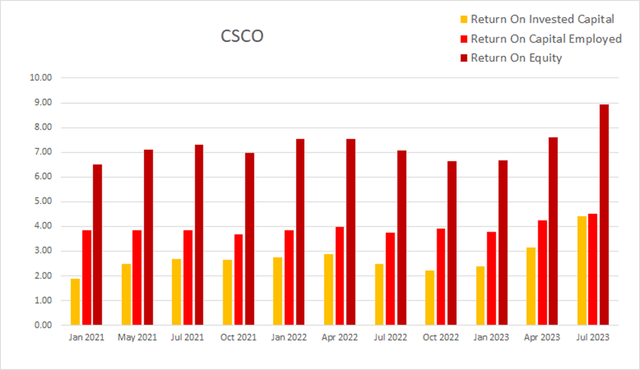

Their returns have been quite attractive. Both return on invested capital and return on equity inflected upward over the last couple of quarters. As of the most recent earnings report, ROIC was 4.41%, ROCE was 4.52%, and ROE was 8.92%.

CSCO Quarterly Returns (By Author)

Valuation

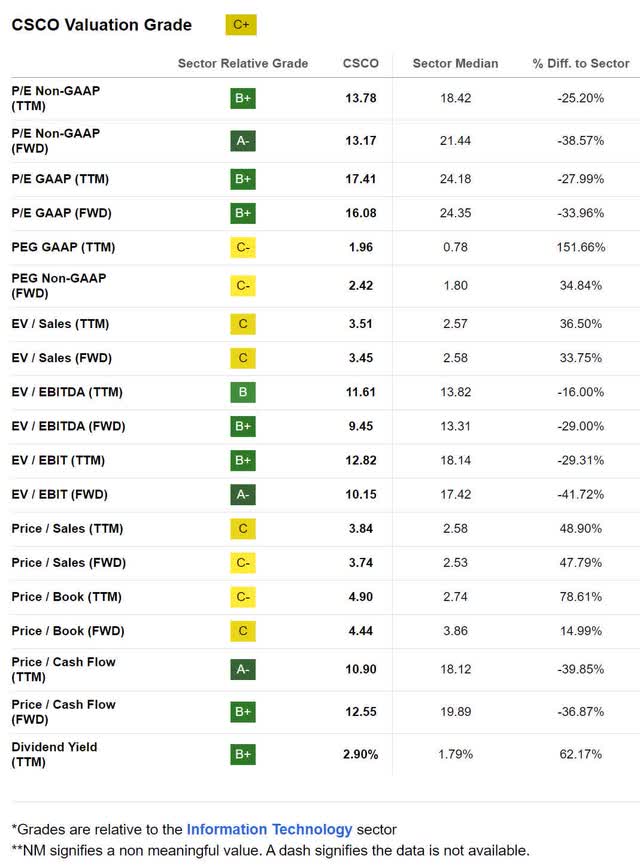

As of October 5th, 2023, Cisco Systems had a market capitalization of $216.73B and traded for $53.07 per share. Using their forward P/E of 16.08x, their EPS Long-Term CAGR of 5.43%, and their forward Yield of 2.92%, I calculated a PEGY of -1.925x and an Inverted PEGY of -0.5193x. As the PEGY value is above 1, this implies the company is presently overvalued.

They currently have an enterprise value of $199.85B. This gives them an EV/EBITDA of 9.45x and a Price/Cash Flow of 12.55x.

CSCO Valuation (Seeking Alpha)

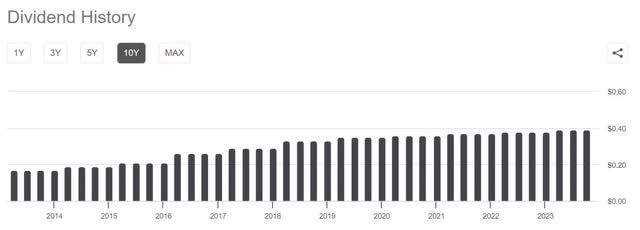

Using their forward annual payout of $1.56, their 10-year dividend growth rate CAGR of 9.08%, a discount rate of 9%, and assuming the growth rate is only maintained for 5 years, a discounted cash flow calculation produces an estimated value of $25.21 per share.

If I instead assume the 9.08% dividend growth is maintained for 20 years, it produces an estimate of $49.03. By this estimate, the present share price of $53.07 is only $4.04 (8.2%) above fair value. Because I believe the company is likely to be able to continue producing attractive returns, this is the valuation estimate I am putting the most confidence in.

CSCO Dividend History (Seeking Alpha)

The Splunk Deal

Before I talk about risks and catalysts, I should address the recent acquisition of Splunk. Typically, M&A activity does not automatically translate to improving operational efficiency. The new addition has to be a good fit for the already existing business model, and I believe this one is.

I have come across claims that Cisco overpaid for Splunk. However, I believe it is too early to tell if the purchase will ultimately turn out to have been wise. I keep thinking about when Warren Buffett and Charlie Munger decided to buy See’s Candy purely for its cash flow and were planning on backing out if the seller had demanded an extra $100K. Years later, they speak of what a horrible mistake it would have been to walk away instead of just agreeing to pay a little more, but they didn’t know it at the time.

Whether or not Cisco overpaid for Splunk won’t be able to be determined until years from now. Cisco is currently expanding its AI and cloud-based capabilities and the addition of Splunk’s cybersecurity capabilities is a part of that. The key takeaway I get is that Cisco believed they needed to purchase Splunk to be able to achieve their long-term operational goals. This may take years to come to fruition. We will have to wait to see how this addition affects their growth and financials.

Risks

As I mentioned earlier, Cisco Systems exists in a highly competitive industry. I found an article from July of 2023 detailing their many competitors and steady decline in market share. With Cisco existing in a constantly changing industry, they face perpetual threat from competition.

Specifically, Cisco faces competition from Arista Networks, Inc. (ANET). Although still much smaller, they have managed to achieve staggering revenue growth. It appears they may pose a long-term threat and are probably also worth researching as a potential investment.

The Fed’s recent announcement of higher for longer is unlikely to negatively affect the networking and communications industry by as much as most others. With the yield curve already strongly inverted, I already believed we were facing a recession before the announcement. I now believe a recession is imminent and have become more selective with which industries I am still willing to hand out buy ratings in. While Cisco was heavily affected by the dot-com crash, it experienced a relatively quick recovery during the 2008 crash, dropping from around $24 per share to around $15; it managed to find itself back at $24 again by the end of 2009. The crash in February of 2020 took it from around $46.50 to around $34.50; it recovered by early June. The conclusion I come to is that because Cisco is blessed with relatively inelastic demand, significant dips in valuation have a history of being bought back up.

CSCO Long-Term (TradingView via Seeking Alpha)

Catalysts

The company is currently expanding its AI capabilities. As our artificial intelligence and machine learning capabilities improve, demand for related services should experience significant growth.

Cisco has a history of buybacks and dividend growth. Their buyback rate has dropped noticeably over the last year, and it’s reasonable to speculate that is because they knew they were planning on making a large purchase. I do not know if the purchase of Splunk will be joined by additional acquisitions. However, when they are done with their current wave of capability expansion, they are likely to elevate their buyback rate.

Conclusions

Cisco Systems appears to be an attractive long-term compounder. They maintain strong margins and attractive returns. Innovation is often extremely expensive and comes with a low success rate. I believe their strategy of staying relevant through technological change by purchasing new capabilities as they emerge is a wise one.

My primary hesitancy around handing out a buy rating revolves around the lack of a margin of safety. My estimates for fair value place the current market price slightly above intrinsic value. However, with attractive long-term compounders, we can expect to have to pay more for quality. With this company being large enough that it’s impossible for it to fly under the radar, being able to buy close to its intrinsic value might be the best opportunity we are presented with.

I am reviewing Cisco at the request of a friend who is already a shareholder. I believe the risk of buying too high outweighs the risk of missing out if Cisco were to experience a sudden rally. Because of the lack of a margin of safety in today’s share price, if I were determined to enter a position in CSCO, I believe it’s best to slowly dollar cost average into weight instead of buying heavily at today’s price

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.