Summary:

- Intel beats earnings expectations and returned to profitability after two quarters of GAAP losses.

- Intel plans to spin off its Programmable Solutions Group business to raise cash and focus on its core CPU business.

- Intel CEO Pat Gelsinger’s track record of success is mixed, but the spinoff could be a positive catalyst for the company.

- Intel’s AI plans hold promise.

- For those who aren’t risk averse and invest for the long term, Intel is worth a good look.

Justin Sullivan

A bit about Intel

Intel (NASDAQ:INTC) is a leading semiconductor company that develops and manufactures microprocessors, graphics processing units (GPUs), network accelerators, and memory chips. It is one of the world’s largest semiconductor chip manufacturers by revenue, and its products are used in a wide range of applications, including personal computers (PCs), servers, data centers, smartphones, and Internet of Things devices.

The company also owns Personal Solutions Group (PSG) which it acquired in 2015 for $16.7 billion. PSG, formerly Altera, was a leading provider of field-programmable gate arrays (FPGAs). FPGAs are chips that can be programmed after they are manufactured, making them versatile for a wide range of applications, including data centers, telecommunications, and aerospace.

Intel is known for its innovation in the semiconductor industry, and its products have played a major role in the development of the computer industry. The company is also investing heavily in new technologies, such as artificial intelligence and machine learning.

Intel’s Financial Performance

When Intel reported earnings in July, the company beat expectations and returned to profitability after two straight quarters of losses.

Intel’s earnings per share of 13 cents, adjusted, came in ahead of Refinitiv’s consensus estimate for a loss of 3 cents. Revenue of $12.9 billion was also above Refinitiv’s estimate of $12.13 billion.

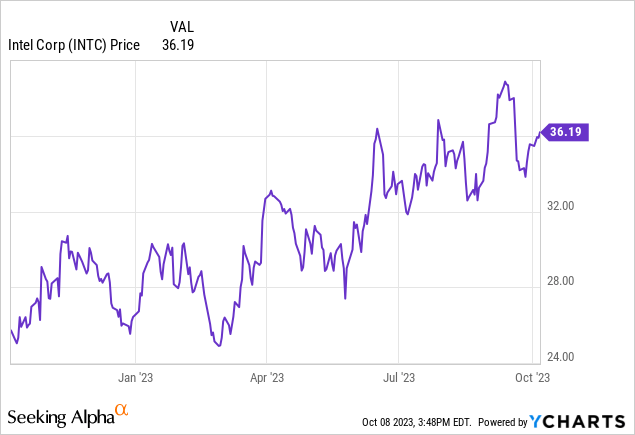

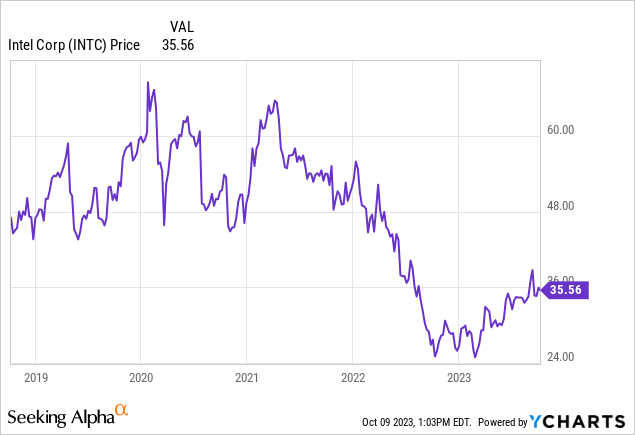

The company’s shares are on a rising trend, having reached what is a probable low.

This is true for both 2023 and the longer term 5-year time period.

For the third quarter, Intel expects earnings of 20 cents per share, adjusted, on revenue of $13.4 billion at the midpoint. This is ahead of analysts’ expectations for earnings of 16 cents per share on revenue of $13.23 billion.

Intel’s CEO, Pat Gelsinger, said on a call with analysts that Intel is making progress on its cost-cutting initiatives and that the company is well-positioned for long-term growth.

Please note that when I invest, I tend to look at companies’ strategies, their actions, the industries they’re in, their leadership and the feasibility of their plans. I have written about and worked in technology for more than two decades, and investing in my knowledge, individual company strategies and their leaders rather than financial and actuarial analysis has served me well.

Intel to Spin Off PSG Business, Raising Cash and Sharpening Focus

On October 4, 2023, Intel announced that it will spin off its Programmable Solutions Group (PSG) business as a standalone company. The spinoff is expected to be completed in two to three years and will raise cash for Intel and allow it to sharpen its focus on its core CPU business.

The spinoff could give Intel more focus. Intel is currently facing a number of challenges, including competition from Taiwan Semiconductor Manufacturing Company (TSM) and Advanced Micro Devices (AMD). By spinning off PSG, Intel can focus its resources on its core businesses of manufacturing and designing CPUs.

Intel CEO Pat Gelsinger says the spinoff could unlock the value of PSG. PSG is a growing and profitable business, but it is currently part of Intel, which is a much larger and more complex company. By spinning off PSG as a standalone business, Intel can give PSG the opportunity to grow and innovate more quickly.

Although the spinoff of PSG could benefit Intel, it is too early to say whether the move will be worth it.

Gains Likely to Come From Windows 12 (or whatever it will be called)

At the Citi 2023 Global Technology Conference, Intel CFO, David Zinsner, let it leak that a Windows refresh (Windows 12?) is on the way. “We actually think 2024 is going to be a pretty good year for the client, in particular because of the Windows refresh,” he said. This per PC Gamer.

Intel is developing its Meteor Lake desktop processors, which include AI for the Windows refresh.

Intel’s Artificial Intelligence Projects

Artificial intelligence is one of the key growth drivers that Intel sees, propelling the global semiconductor industry to annual revenue of $1 trillion by 2030. With the AI chip market expected to grow by 30% annually through 2032, reaching $227 billion in annual revenue by the end of the forecast period, it is clear that the proliferation of AI will be vitally important for Intel and other chipmakers.

The good news is that Intel’s Gaudi deep learning processor is starting to gain traction with customers. Intel says it already has a revenue pipeline of more than $1 billion for its AI accelerators through 2024. Of course, that’s a small figure compared to Intel’s trailing-twelve-month revenue of $56 billion, but the company expects its AI accelerators to gain further momentum. Intel also says that a quarter of its latest fourth-generation server processors are being deployed for AI workloads.

Additionally, the company plans to add a dedicated AI engine to its upcoming Meteor Lake server processors. These moves could help Intel establish itself in the market for general computing AI chips, which the company believes will account for 60% of the overall AI chip market in the long term. The remaining 40% of the AI chip market will be comprised of accelerated computing chips, such as graphics cards for training large models, a space that Nvidia (NVDA) currently dominates.

Intel’s Current Valuation, Challenges and Opportunities

Intel’s current valuation is approximately $151.56 billion as of October 8, 2023.

Its valuation has fluctuated in recent years, but it has been on a steady rise since the beginning of 2023. This is likely due to a number of factors, including its earnings growth, return to profitability and its investments in new technologies such as artificial intelligence.

CEO Pat Gelsinger’s Track Record of Success

Gelsinger has a mixed track record of success from a shareholder’s perspective. He was appointed CEO of VMware in 1999, and the company’s stock price increased by over 1000% during his tenure as CEO. However, it is important to note that VMware was a high-growth company at the time, and the semiconductor industry has changed significantly since then.

Gelsinger was also CEO of EMC from 2005 to 2012, during which time the company’s stock price increased by about 50%. However, EMC’s growth slowed during Gelsinger’s tenure, and the company was eventually acquired by Dell in 2016.

Gelsinger was appointed CEO of Intel in 2021. Intel’s stock price has declined by about 25% since Gelsinger became CEO, but it’s important to note that Intel was struggling when he took the job.

The Downside and the Risk

For those who don’t invest for the long term and are mostly risk-averse, Intel may not be a good bet at this time because while Intel is trying to catch up and keep up with its competitor NVIDIA, NVIDIA is not sitting still.

With global unrest being what it is, Microsoft may not release its next operating as soon as Intel believes, and I am basing at least part of my thesis on this.

Intel is investing heavily in new manufacturing capacity. This investment is necessary for Intel to remain competitive, but it will also weigh on the company’s profitability in the near term.

With global unrest being what it is, anyone’s plans could be disturbed at any time. Long term this may not be as big a problem in my view as Intel will eventually bring more of its manufacturing home.

Buy, Hold or Sell

Overall, Intel is a risky investment. However, the spinoff of PSG, AI, and an upcoming Windows release hold promise. And CEO Pat Gelsinger’s track record of success prior to joining Intel has been impressive. Ditto for his cost-cutting track record. Investors should carefully consider their own investment goals and risk tolerance before deciding whether to buy, sell, or hold Intel stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.