Summary:

- AT&T is expected to report Q3 earnings with a decline in EPS and minimal revenue growth.

- The company has a history of beating EPS estimates but mixed results with revenue.

- Key things to monitor include FCF, debt reduction, and updates on the lead cable situation.

Brandon Bell

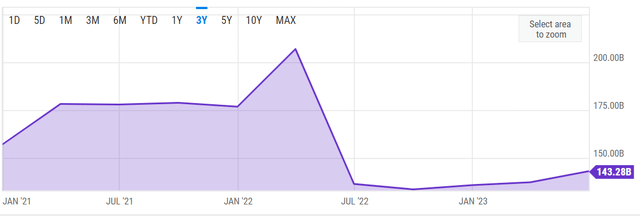

AT&T Inc. (NYSE:T) is expected to report its Q3 earnings pre-market on Thursday, October 19th, 2023. Analysts expect the company to report 62 cents/share on the back of $30.25 billion revenue. Should AT&T meet these expectations, it’d represent an EPS decline of 8.80% and a revenue growth of less than 1%. If that doesn’t impress you, you are not alone but there are more important things to keep our eyes on as AT&T strives to prove it is a new company these days.

ATT Earnings Preview (Seekingalpha.com)

My most recent coverage on AT&T was a Buy from a few weeks ago when I called the company’s recent moves on reducing expenses, keeping debt steady, and focusing on FCF as early signs of its resurgence. Since then, (including dividend) the stock has slightly outperformed the market as it is down -2.93% compared to the market’s -3.07%. I retain my “Buy” rating on the stock based on dividend safety (explained below in “Things To Monitor”) and stock valuation (also covered below.)

Let us now preview AT&T’s Q3 with an eye on recent EPS revision trend, the company’s recent earnings history, key metrics to track in Q3, valuation and technical strengths as we head into the report.

Declining Expectations

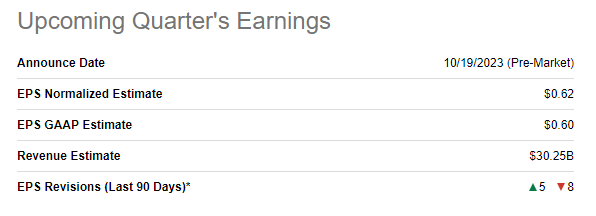

It is safe to say AT&T is going into earnings with muted expectations from the analyst community. 8/13 EPS revisions and 9/13 revenue revisions have been to the downside. However, the company’s CFO recently expressed supreme confidence in the company’s ability to meet its Free Cash Flow [FCF] commitment of $16 billion for the FY. This is covered in detail below.

ATT Q3 Revisions (Seekingalpha.com)

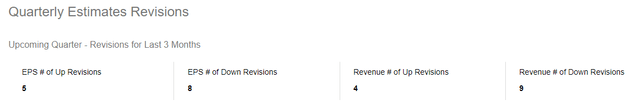

Overall, since the beginning of the year, FY 2023 Q3’s EPS expectation has trended down from 68 cents/share to 62 cents/share or about 9%. It may not be a bad thing for a company like AT&T with its doubters (most of them, rightly so) to head into the earnings report with lowered expectations.

ATT Q3 Trend (Seekingalpha.com)

Beat or Miss? I Say Slight Beat On Both

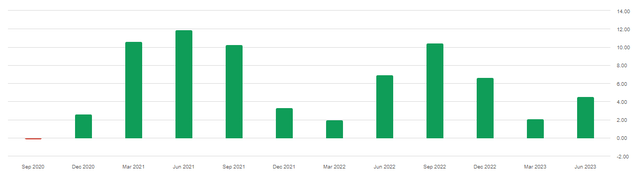

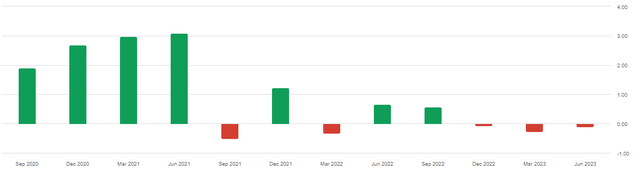

AT&T has beaten EPS estimates in the last 11 consecutive quarters with the beats ranging from 2% to 12%. One of the largest beats, by 10.42%, came in Q3 2022 and it remains to be seen if Q3 2023 (the one this preview is for) shows whether AT&T has seasonal tailwinds this time of the year. Revenue has been more of a mixed bag with just 3 quarters beating out of the last 8. But the margin of the 5 misses have been so tiny that the 3 beats have helped push the average surprise over these last 8 quarters to the positive territory at .14%.

Given the company’s recent focus on cutting costs, I expect an EPS beat with revenue meeting or slightly beating expectations.

ATT EPS History (Seekingalpha.com) ATT Revenue History (Seekingalpha.com)

Things To Monitor

- The biggest thing I will be monitoring is the company’s FCF in Q3. Given the fact that AT&T reported about $5 billion in FCF in H1 and still stands by its FY target of $16 billion, Q3 and Q4 on average should bring in $5 billion each in FCF to meet this target. In the past, I’d have bet that AT&T was unlikely to meet this aggressive target for H2, but given the company’s recent focus on FCF and reducing expenses, I am willing to bet AT&T will report > $5 billion in FCF in Q3. The CFO appeared quite confident at the recent BofA investor conference:

“a little bit more” from DirecTV, “you put all that together, it should put you in the $4.5B to $5B range of free cash flow for Q3.“

Should AT&T meet $16 billion in FCF for FY 2023, then its payout ratio based on FCF will be slightly less than 50%. I arrived at this based on the fact that the company has 7.149 billion shares outstanding and pays $1.11/share in annual dividend. That means, AT&T needs just $7.93 billion in annual FCF to cover its dividend.

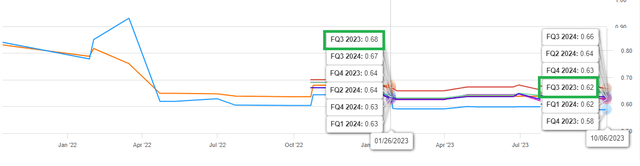

- AT&T’s long-term debt continues hovering around the $140 billion mark, which is below the $150 billion line in the sand I’ve written about in my past articles. But even the current debt level is $40 billion more than the company’s market cap, a clear and present danger sign. Had this been any other company, I’d have given serious thoughts about my position but since I’ve got a snowballing effect with my reinvested dividends, I am staying with AT&T waiting for a reasonable turnaround in its fortunes. Nonetheless, I’d be watching the debt level to see signs of reduction.

- Although I don’t expect too many details, it will be interesting to see if the company reports any updates on its lead cable situation. At the recent BofA conference, the company acknowledged it was working with authorities in providing all necessary details. While there may not been any recent news about this, I believe this is still a cloud hanging over the stock price.

Valuation

The biggest thing the stock has going in its favor, on paper, is its valuation. Assuming an investor knows nothing about AT&T but is told there is a stock trading at 6 times forward earnings but has a relatively safe, nearly 8% yield, their eyes would light up. Once you factor in the debt and the company’s history of making things harder for itself and its investors, the valuation begins to make sense.

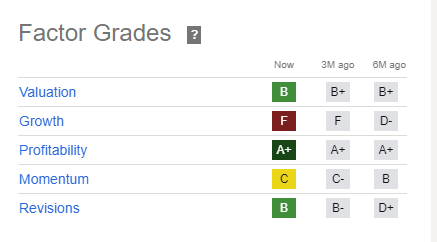

And then there is this pesky question of growth, or lack of it. Earnings are expected to grow (I am using that word very loosely) at 0.31%/yr for the next five years. Overall, I agree with Seeking Alpha’s quant ratings here, especially on valuation and growth.

Arriving at a fair value for AT&T based on history can be a little tricky due to the wild fluctuations in earnings and hence its historical PE in the past. However, I am presenting three options for readers to choose from:

- In such situations where the valuation has been all over the place, median is a better metric than mean and AT&T’s median PE over the last 5 years stands at 10.54. If AT&T trades at a multiple of 10.54 based on forward EPS of $2.43, I’d be doing splits on my street. Since I could never do a split, we can rule that possibility out. However, a forward multiple of 8 isn’t too much to ask for, given that the company is finally focused on reducing debt and enhancing FCF. Applying a forward multiple of 8, we arrive at a price target of $19.44, a hefty 33% increase from here. And not to mention, the 8% yield on top of that.

- Verizon Communications Inc. (VZ), the closest peer possible, is trading at a slight premium at 6.6 times forward earnings. Applying the same to AT&T’s current FY 2023 EPS estimate, we arrive at a conservative target of $16.

- AT&T’s average EPS beat over the last 4 quarters has been by about 6% and should that apply to Q3, an EPS of 65 to 66 cents will be the result. This should nudge 2023’s EPS close to $2.50. Applying a low multiple of 6 and a high multiple of 10, we arrive at a wide range of $15 to $25. But once you realize the stock is below $15 right now and still pays a near 8% yield, the case to buy is easily made as long as the company does not let old bad habits creep in (read debt and bad acquisitions).

ATT Rating (Seekingalpha.com)

Technical Indicators

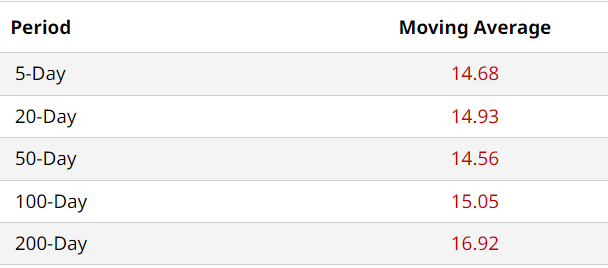

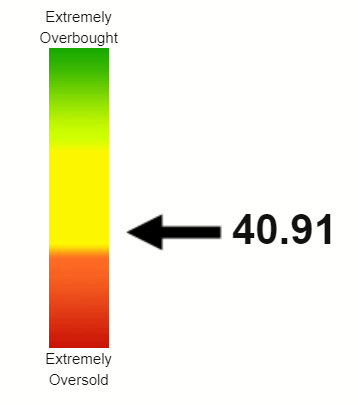

AT&T’s stock has been on a shaky ground technically for a while. It had one of the lowest Relative Strength Index [RSI] I’ve seen with a large cap but has since recovered a little on that metric with the current RSI being 40.91. However, the stock has clearly not found a technical base/bottom yet as it is below all the important moving averages. The 200-Day moving average is more than 17% away from the current market price, suggesting a lower base is being formed.

Should the company disappoint with its Q3 numbers and the market in general continues punishing income stocks, a breach below $14 won’t surprise me.

ATT Moving Avg (barchart.com) T RSI (stockrsi.com)

Conclusion

I am quite confident that AT&T will report impressive FCF in Q3 with EPS and revenue coming in close to or slightly above expectations. But I don’t expect that to move the stock upwards unless the beats are by wider than recent margins. At this point, the market expects the company to be working on reducing its debt and merely acknowledging the problem is not enough anymore. It is time to show the proof in the pudding. I retain my cautious “Buy” rating on the stock primarily based on the safe dividend but with eyes on FCF and debt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.