Summary:

- NextEra Energy provides a contrarian opportunity for (dividend) investors after last week’s sell-off which was related to a subsidiary’s reduced growth outlook.

- NextEra Energy is a new-energy company with considerable investments in new energy segments.

- The drop in NextEra Energy’s share price is a buying opportunity as NEE has good dividend coverage and maintained its long term EPS forecast.

- NEE is also oversold after it lost 25% of its value in the last few weeks.

peshkov

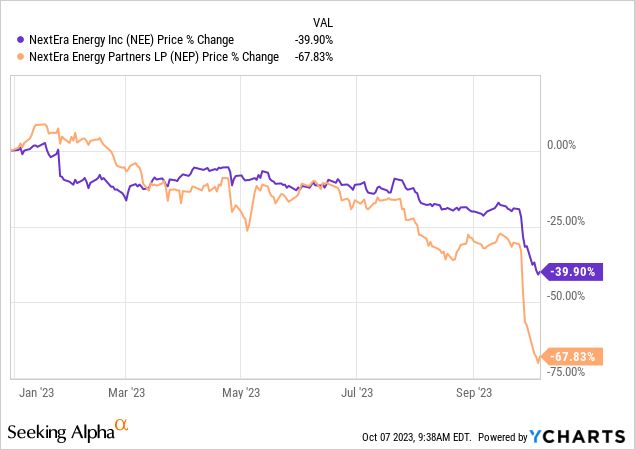

I started a small position in another beaten-down company last week: NextEra Energy (NYSE:NEE), which in my opinion, provides dividend investors with a contrarian opportunity to invest after one of the company’s subsidiaries, NextEra Energy Partners (NEP) — which is also listed on the stock exchange — curtailed its growth and dividend outlook, resulting in a sharp sell-off of NextEra Energy’s shares. I recently also bought 3 REITs that pay yields of up to 12%, taking advantage of the carnage in the REIT sector.

While an investment in NextEra Energy certainly has risk, I believe the market is overreacting to the announcement. With shares of NextEra Energy plunging 25% lately, I believe NextEra Energy has not only an attractive risk profile, but also material rebound potential!

NextEra Energy is a new-energy company with attractive long term EPS growth prospects

NextEra Energy is a utility company with considerable investments in wind, sun and battery storage projects. The company had 68 GW in operations in the second-quarter plus another 20 GW in backlog as the company invests in new energy segments and drives growth in its renewables segment. NextEra Energy owns Florida Light & Power through, which it provides utility services in Florida, and NextEra Energy Solutions, which consolidates the company’s new energy assets: 75% of NextEra Energy’s business relates to FPL and 25% to other energy interests.

NextEra Energy is also the parent company of NextEra Energy Partners which was formed in 2014 to acquire, manage and own contracted clean energy projects. These projects are expected to generate stable cash flows which will be used to pay a growing distribution to the company’s unitholders.

NextEra Energy: why are shares dropping?

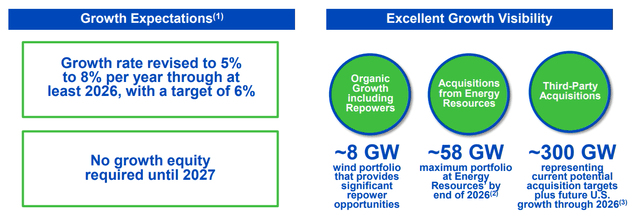

The drop in NextEra Energy’s share price is due to NextEra Energy Partners recently announcing that it will reduce its dividend growth from a range of 12-15% annually to a more sustainable range of 5-8% per year. Since NextEra Energy’s financial prospects are tied to NextEra Energy Partners, the utility’s share price has taken a serious hit. NextEra Energy Partners also said that will reduce its dividend growth rate due to higher financing costs which are linked to higher interest rates. As borrowing becomes more expensive, management had to make a decision about curtailed dividend growth.

NextEra Energy’s dividend coverage

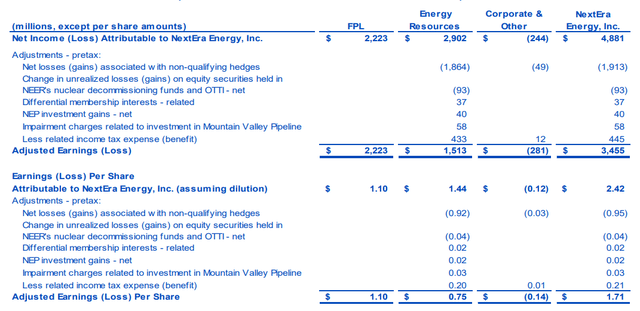

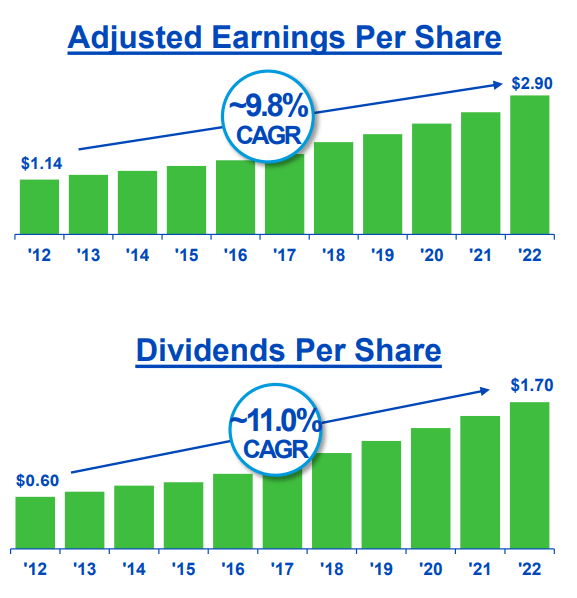

NextEra Energy presented dividend investors with near double-digit adjusted EPS growth in the last decade (~10%) and translated this earnings momentum into an annual average growth rate of 11%. The current dividend payout is $0.47 per share quarterly which calculates to a dividend yield of 3.7%.

Source: NextEra Energy

In the first six months of FY 2023, NextEra Energy achieved adjusted earnings of $3.5B which calculated to adjusted EPS of $1.71. This means that the parent company had a dividend coverage ratio of 183% YTD. Given the very good dividend coverage of the parent, I believe the dividend of NextEra Energy should not be affected by the lowered growth prospects of NextEra Energy Partners. NextEra Energy also still expects to grow its adjusted earnings to a range of $3.63-$4.00 by FY 2026, from $2.90 per-share in FY 2022.

Valuation of NextEra Energy

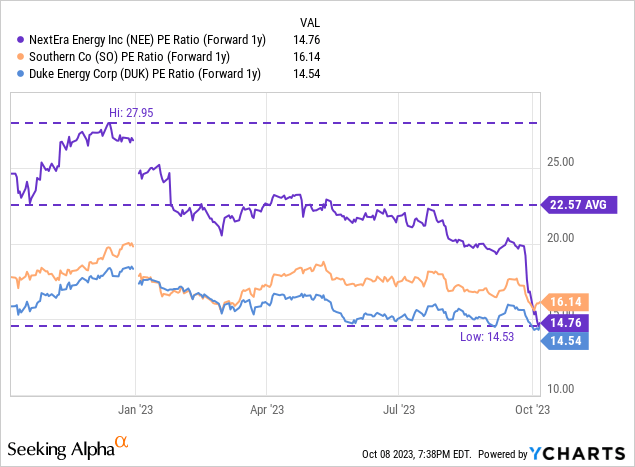

NextEra Energy is a trading 25% lower after NextEra Energy Partners recently changed its growth outlook. I doubt, however, that a 25% cut to the company’s valuation multiplier is an appropriate response given that NextEra Energy has good dividend coverage and sticks to its own growth forecast. NextEra Energy is currently trading at 14.8X FY 2024 earnings which is significantly below the shares’ 1-year average P/E ratio of 22.6X. The valuation is more in line with those of its rivals now, however, I believe investors can continue to expect above-average dividend growth that would be worthy of a premium.

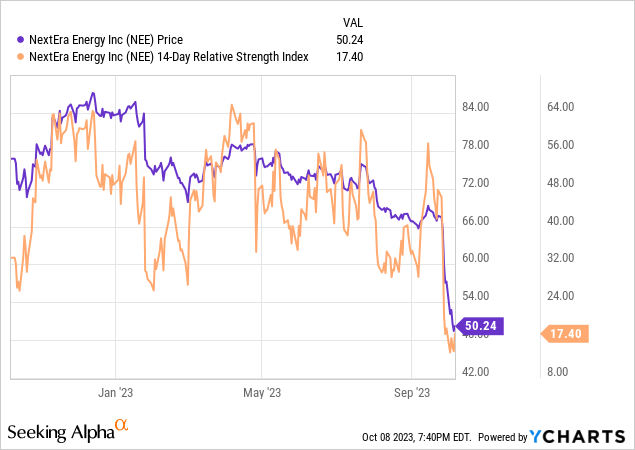

In my opinion, dividend investors have overreacted to last week’s growth outlook and investors could see recovery gains in the medium term. Shares of NextEra Energy are now way oversold, based off of the Relative Strength Index, which is a contrarian signal that investors have turned too bearish on the utility company.

Risks with NextEra Energy

There is always a certain amount of risk when buying a company whose share price has dropped significantly in a very short period of time… after all, it can always go lower. However, investors also have a tendency to overreact to corporate announcements in the short term which is why I have bought a small amount of shares in NextEra Energy, largely because I believe the dividend of the parent company will not be affected. I did not buy for the dividend, but rather for the recovery potential that I see in shares of NEE.

Final thoughts

I believe there is a unique opportunity for (dividend) investors to lean into the fear and purchase shares of NextEra Energy at a significantly reduced price and valuation multiplier. NEP has said it will reduce its dividend per unit to a more sustainable range of 5-8% which has led to a major sell-off for NextEra Energy’s shares, but the change in distribution policy has not really changed the earnings outlook for the parent company in my view. I believe investors are now driven by fear which is always something I look for when I buy discounted shares!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NEE, MPW, O, WPC either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.