Summary:

- Walmart recently attracted attention when an executive pointed out shopping trends in customers using weight loss drugs such as Ozempic.

- Anonymized data on shoppers using these drugs showed evidence of a pullback in their overall baskets.

- As an increasing number of people turn to these medication-based treatments for weight loss, there is a risk of lost sales to grocery-exposed retailers.

- While the risk to WMT is worth consideration, I don’t view it as a significant hurdle for investment.

Joe Raedle

Walmart (NYSE:WMT) attracted attention last week when CEO of U.S. Operations, John Furner, said in an interview that increased usage of drugs taken for weight loss is beginning to have an impact on shopping behavior; specifically, that those using the products are in turn purchasing less caloric foods overall. While this sounds intuitive, perhaps even obvious, it’s a risk to grocery-exposed retailers that may have been overlooked.

With Ozempic and other drugs rapidly gaining traction for weight loss, investors could benefit from considering the potential impact to WMT and other diversified retailers. In my view, I see the risk consideration as warranted but not significant enough to preclude investment altogether.

What Is Ozempic And Why Is It Gaining In Popularity?

Ozempic is an FDA-approved drug made by Novo Nordisk (NVO). Though its primary purpose is to treat people with Type 2 diabetes, an increasing number of people are using the drug for weight loss. The increasing usage also extends to its sister drug, Wegovy, as well as to Eli Lilly’s (LLY) Mounjaro.

Social media has helped propel Ozempic’s use as a weight loss drug. In October 2022, for example, Elon Musk was asked about his secret to fitness. In addition to fasting, he responded with “And Wegovy.” And just the month prior, Andy Cohen referenced Ozempic in a tweet that observed the weight loss results of those in his network.

The increasing uptake of these drugs, which work by suppressing a patient’s appetite, shouldn’t come as a surprise. For one, the drug is proving effective in producing results. Second, there has been a rise in obesity prevalence in the U.S. in recent years, which shows that people are either having a hard time losing weight or are having trouble keeping it off.

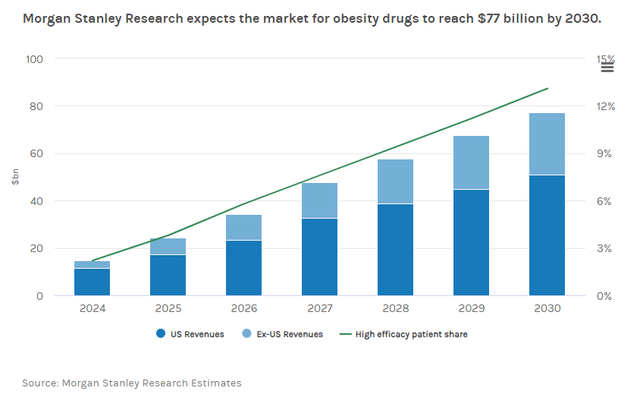

According to data available from the CDC, prevalence has increased to over 40% of the U.S. population from 2017 to March 2020 from less than a third in the early 2000s. And with regards to weight loss drugs, an in-depth survey conducted by Morgan Stanley (MS) projected that about 7% of the U.S. population will be taking such medications in 2035.

Morgan Stanley Research On Market For Obesity Drugs

Market Winners From Ozempic

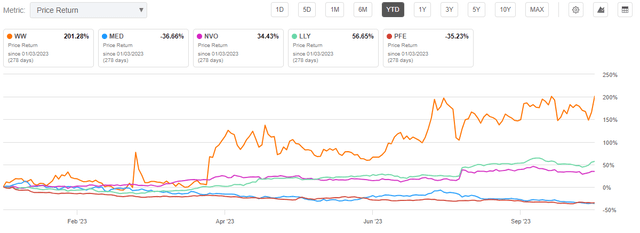

Drug makers with a stake in obesity treatments are the clear winners. LLY and NVO are up over 50% and 30% YTD, respectively. This is in no small part because of the current hype surrounding the weight loss treatments.

In an article published in early June 2023 on Medifast (MED), the company behind the popular weight loss and diet program, OPTAVIA, I noted that the excitement seen in these drugs is reminiscent of the fervor over AI. And I pointed to one of MED’s competitors, WeightWatchers (WW), as a case in point of how investors clearly are awarding a premium to those that embrace a medication-based solution to their business models. Given that the gains are continuing to accrue, I’d re-affirm this past statement.

Seeking Alpha – Chart To Highlight YTD Outperformance Of Those With Exposure To GLP-1-Based Drugs

Other winners could include select industrial operators of cold-storage warehouses, such as Americold Realty Trust (COLD). The stock hasn’t seen outsized gains this year. But they could be one to watch due to the complicated logistics surrounding the shipping of the medications.

Pharmaceutical distributors, for example, such as Cencora (COR), Cardinal Health (CAH), and McKesson (MCK), are three companies that recently reported soaring revenues from weight loss medications, yet the results didn’t translate into their bottom lines due in part to the higher operating expenses associated with the cold-chain nature of the products and the logistics of moving the product to market.

Market Losers From Ozempic

In addition to the winners, there are also potential losers. The first that comes to mind are food stocks. Because the drugs work by suppressing appetite, it’s reasonable to assume that those using the products are likely to buy less food, particularly products on the bottom end of the nutritional spectrum.

I’ve written previously about current Pepsi (PEP) CEO, Ramon Laguarta’s, decision to double-down on PEP’s core business of snacks and beverages. This decision could be more closely scrutinized in an era where consumers are cutting back on food consumption.

The leadership teams at Campbell Soup (CPB) and Conagra (CAG) have also noted that they’ve begun answering more questions about the drug’s impact on sales. One reason for investor curiosity is likely due to findings in the aforementioned Morgan Stanley research report, which found that people could cut their daily caloric consumption by as much as 30% by using the drugs. That could amount to about 600 calories a day.

And for those that find themselves cutting back on food expenditures, they may not only save on caloric consumption but also dollar consumption. With prices staying higher for longer, a cut to the grocery bill could come as a welcome surprise to many who have become increasingly stretched.

Aside from the grocery store names, such as Kroger (KR) and Albertsons (ACI), more diversified retailers who derive a portion of their sales from consumables could also be negatively impacted. These names include Target (TGT), Costco (COST), and Walmart.

What Is WMT Leadership Saying About Ozempic?

Of most attention is WMT, especially given recent comments from WMT’s CEO of U.S. Operations, John Furner, in an interview with Bloomberg. In the interview, Furner noted that customers taking Ozempic are buying less food. He backed up this assertion by pointing to patterns noted from anonymized data on shoppers.

While notable, he did somewhat forewarn against rushing to conclusions, as usage is still in the early days. Additionally, he mentioned that though customers using the products buy less food, they still tend to spend more with the company on an overall basis. Part of this offset is likely due to that fact that WMT themselves sell these drugs through their pharmacies.

Market Reaction To WMT’s Comments About Ozempic

Investors have sent shares of WMT lower over the past five days. The stock is down about 2.5% compared to a 1% gain in the broader S&P (SPY) over the same period.

Seeking Alpha – WMT Stock Performance Over Last Five Days

While Furner’s comments may have factored into the decline, I’d attribute the weakness more to the news surrounding CEO, Douglas McMillon’s, recent stock sale.

WMT Key Stock Metrics

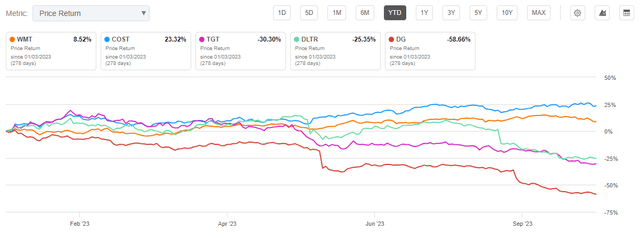

Despite the recent weakness, with shares down 5% on the month, WMT is still up in the upper-single-digit percentage range on a YTD basis. While the stock is trailing COST, its performance is well ahead of other retailers, such as TGT, as well as the dollar stores, Dollar Tree (DLTR) and Dollar General (DG).

Seeking Alpha – WMT YTD Stock Performance In Relation To Related Peers

And in their last earnings release, WMT’s reported comparable sales were over 200 basis points above consensus estimates, with strength reported in their groceries and health/wellness products on additional market share gains.

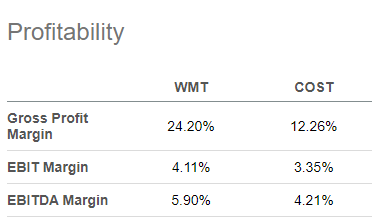

At 24x forward earnings, shares may not appear discounted at first. But when compared to the 35x commanded by COST, as well as their stronger margin profile, the stock doesn’t appear overpriced; even more so, given their outlook, which was increased in their last earnings release.

Seeking Alpha Peer Comparison Tool – Profitability Metrics Of WMT Compared To COST

Is WMT Stock A Buy Despite The Risk From Ozempic?

The increased adoption of medication-based weight loss solutions such as Ozempic does increase the risk of lower grocery sales, especially in the more consumable goods on the lower end of the nutritional spectrum. Though WMT’s risks are buffeted by their diversified operating model, their exposure to consumable goods is greater than other retailers, such as TGT, which derives more of their revenues from the discretionary categories.

While I view the risk as real, I don’t view it as a significant one. WMT’s Furner implicitly confirmed as much by noting that it’s still too early to assess the full impact on customer behavior. But more importantly, he noted that the very same customers that are using the products and buying less groceries are the same ones buying more from WMT elsewhere in other categories.

In my view, their customers are simply applying the savings on their grocery bill to other discretionary categories. And perhaps this could even benefit WMT over the long run since their consumable categories tend to command lower margins.

Those likely to be at greater risk than WMT would be the producers and more pure-play grocery stores. But even in those sectors, investors may find it too early to write off a potential investment solely for the downside risk associated with Ozempic’s effect on consumer behavior. The side-effects, for example, are still being assessed. And there are insurance and cost considerations that are still evolving. Setbacks in any of these could stall the momentum in this trend.

With these considerations in mind, I am maintaining a bullish view on WMT on the premise that its positive outlook and continued market share gains in its core business outweigh any risks associated with lost sales in its grocery business from Ozempic or any other drugs used for weight loss.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.