Summary:

- Exxon Mobil Corporation is set to acquire shale driller Pioneer Natural Resources Company in an all-stock deal, valuing Pioneer stock at $253 per share.

- I explain why I’m a big fan of the transaction, even though I bought Pioneer not too long ago with the intention of holding it long term.

- Those who bought Pioneer in 2020 or not too long ago become shareholders of Exxon at a pretty significant discount given the favorable Pioneer/Exxon spread at the respective time.

- Structuring the transaction as an all-stock deal is a good idea not only from a tax perspective, but also from the standpoint of efficient use of capital.

baona

Introduction

My history with shale driller Pioneer Natural Resources Company (NYSE:PXD) was a very short one. As I reported in this article from early July 2023, I sold my sizable position in 3M Company (MMM) and, as a result, had to reallocate funds with some important objectives in mind. I excluded investments in poor- or mediocre-quality companies and sought a yield on cost equal to the starting yield of my 3M stock position (4.8%). As a result, I invested the bulk of the funds in shares of PXD, CME Group Inc. (CME, my last article here) and Philip Morris International Inc. (PM, my last article here).

Obviously, these are all very solid companies, with PXD having extremely high-quality assets in the Midland Basin in West Texas, many of which the company acquired before the shale boom. I love it when a company focuses on its core competency: Pioneer is working to put more than 100 wells with a lateral section of more than 15,000′ on production in 2023 (and that’s only 20% of the 2023 program). The company is extremely shareholder-friendly, has forward-looking management, and since it is not hedging its pricing structure, the prospects are very good in what I believe will be a long period of high oil prices. With a solid balance sheet and a breakeven price of about $40 per barrel, the company can well afford this rather unusual business practice.

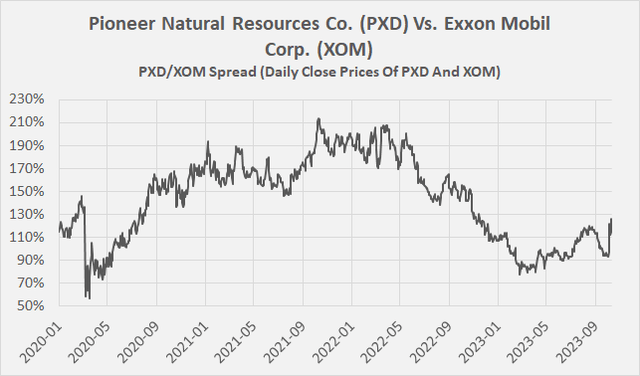

I wasn’t entirely surprised when news of PXD’s acquisition by Exxon Mobil Corporation (NYSE:XOM) made the rounds, as the supermajor had been in preliminary talks about a possible takeover as early as April 2023. The takeover scenario was arguably a (small) part of my investment thesis, even given the fact that PXD CEO Sheffield would retire at the end of 2023 and in light of the favorable PXD/XOM spread at that time (Figure 1) – the latter, of course, assuming an all-stock deal.

Figure 1: Pioneer Natural Resources Co. (PXD) vs. Exxon Mobil Corp. (XOM): PXD/XOM spread (own work, based on daily close prices of PXD and XOM)

Considering that I chose PXD because of its prime acreage, excellent cash flow profitability, management discipline, but also because it is comparatively smaller and, therefore, receives comparatively little media attention (which is not a bad thing in today’s environment), one might conclude that I am disappointed with the XOM transaction. After all, it is an all-stock transaction, so if I don’t sell my PXD shares, I become a shareholder of Exxon Mobil.

However, after looking into the situation, I am actually very pleased with the proposed deal. There are two main reasons for my positive attitude towards the transaction, which I will explain in this update.

Reason 1: Becoming A XOM Shareholder At A Discount

I bought my position in PXD at approximately $200 per share, well aware that the bottom of the last supercycle is behind us and that the serious supply/demand imbalance – which is quite well known – has been factored into oil and gas (O&G) company valuations, at least to some degree. In the above article, I acknowledged my procyclical behavior:

Now, I do realize that by deciding to shift some of my 3M sale proceeds into shares of Pioneer Natural Resources Company, I might come across as a procyclical yield hunter. PXD is definitely not cheap, according to Seeking Alpha’s valuation metrics (Table 1). And while the FAST Graphs chart in Figure 5 suggests plenty of upside potential, I contend that we are definitely far from what can be called the bottom of the cycle and that a recession is probably upon us.

3M Company: I Replaced A Loser With These 3 Leaders – July 11, 2023.

Given the high volatility of the price of oil and the inherent unpredictability of future demand (leaving aside the obvious supply/demand imbalance, see these eye-opening articles), it is, of course, difficult, if not futile, to value an O&G company via the discounted cash flow model or multiples-based approaches. However, using a peer group-based valuation approach, it became clear that the stock is definitely one of the more expensive ones in the sector at $200. I intentionally paid up for quality. Meanwhile, it is known that Exxon intends to acquire Pioneer in a transaction that values the stock at $253 per share, well above what I consider comparative expensive, but acceptable due to the high quality.

However, I am not suggesting here that Exxon massively overpaid. We need to be aware that PXD shareholders would likely vote against the deal at a lower offer (PXD was trading at above $250 shortly after the Russian invasion of Ukraine began). Moreover, we are well past the lows of the last cycle, and fundamentals have changed dramatically in recent years in favor of O&G companies with world-class assets and solid balance sheets.

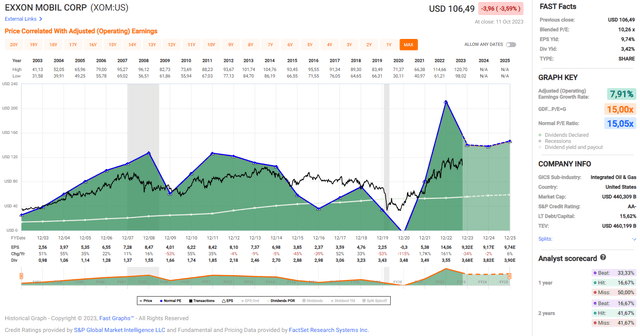

Of course, with its diversified portfolio and “contrarian” stance compared to many other O&G companies, I think Exxon is one of the better supermajors (think of its successes in Guyana) as it remains highly committed to existing and new O&G projects. However, I am ambivalent between Exxon and Chevron Corp. (CVX), which I think is a great company but whose investments in renewables I am somewhat ambivalent about (see, e.g., p. 11 ff. in this article). I already own a position in CVX and have thought about opening a position in XOM, but consider the company’s valuation to be a bit high in terms of price-to-earnings ratio and price-to-earnings growth (Figure 2). Granted, the PEG ratio in particular is not necessarily a meaningful valuation metric in the context of O&G companies. From the perspective of enterprise value (EV) to EBITDA, which takes into account the company’s net debt, I believe XOM stock is fairly valued (TTM EV/EBITDA of 5.6).

Figure 2: Exxon Mobil Corp. (XOM): FAST Graphs chart, based on adjusted operating earnings per share (FAST Graphs)

As an income-oriented investor, I found XOM stock’s current dividend yield of just 3.4% uninspiring, especially considering its five- and 10-year CAGRs of just 2.7% and 4.3%, respectively. When you consider that a risk-free yield of about 5% can currently be locked in for 20 years, it becomes clear what I mean: If Exxon maintains its five-year CAGR, investors would have to wait 14 years before reaching the current yield on the 20-Year Treasuries (US20Y). It is not easy to justify XOM as a strong buy at $107, even if the outlook is solid and a return to higher dividend growth is likely amid the current environment.

With that in mind, I view XOM’s offer primarily as a way to gain exposure to this highly diversified and strongly committed O&G supermajor at a discount. When I bought PXD stock at $200, I thought it was fairly valued for its quality (but expensive relative to peers). So with the premium offered, I now have the opportunity to become a shareholder in Exxon Mobil at a price of about $85 per share.

PXD’s current EBITDA is about $42 per share, while Exxon Mobil’s is currently about $23 per share. Put differently, and considering the exchange ratio of about 2.32:1, as a prospective XOM shareholder and based on my cost basis, I am entitled to approximately $1.25 for every $1 of EBITDA before the transaction. From a dividend perspective, my yield on cost is now 4.3%, which is only 10% less than the starting yield of my 3M position at the time. Arguably, XOM is much less of a yield play than PXD was, but I would not necessarily extrapolate PXD’s extremely high dividends paid in 2022 far into the future.

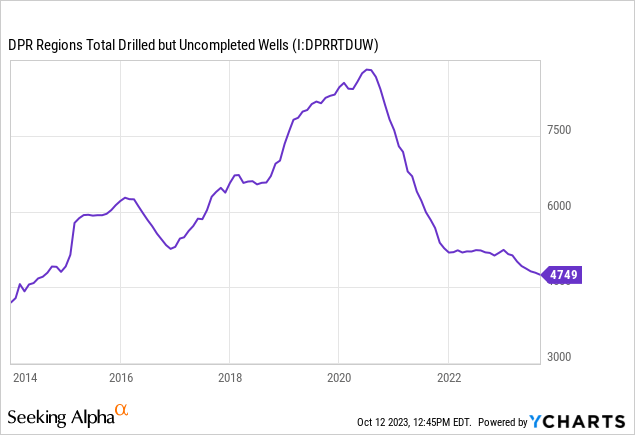

While I believe we are in the early stages of a new supercycle – the prerequisite for sustainable and significant dividends – the relatively short investment cycles of shale drillers make me somewhat cautious and now a happy prospective shareholder in a diversified supermajor at a good price. Shale producers like PXD are currently eating through their inventories, as evidenced by the continued decline in wells drilled but not yet completed (Figure 3). At some point, capital expenditures will have to be increased, which will likely (temporarily) put a lid on the company’s dividend. Of course, that doesn’t mean I want to avoid this subsector in general. In terms of full disclosure, I opened a position in EOG Resources, Inc. (EOG), another top-quality shale driller operating primarily in the U.S., a while ago – same as PXD with the intention of holding it for the long term.

Figure 3: Drilling Productivity Report – Total drilled but uncompleted wells (YCHARTS – I:DPRRTDUW)

Reason 2: Taxes And Efficient Use Of Capital

Considering that the PXD takeover will be structured as an all-stock deal, I should not have to pay any immediate capital gains taxes (we await confirmation of that, but it is the likeliest outcome in my view). Granted, at a premium of about 26% to my cost basis, the capital gains tax would not be a major disaster, but it would still be undesirable. Considering that the capital gains tax where I live is in the high 20% range and I try to keep transaction costs as low as possible, I am indeed very happy that for each share of PXD I currently own, I simply receive about 2.32 shares of XOM and do not have to manually shift funds around and pay taxes in the process. Of course, as can be learned from the recently released 8-K (p. 2), the fractional shares resulting from the exchange will be sold for cash.

As an aside, it is likely that the Board of Directors also had a few words to say on the subject (naturally!). While I’m no expert on U.S. tax law, I suspect that CEO and Board Member Scott Sheffield had no objection to becoming a shareholder of XOM. After all, he owns at least 570,000 PXD shares, entitling him to dividends currently amounting to at least $4.8 million per year.

Aside from the tax aspect, the transaction structure as an all-stock deal also seemed advantageous to me from the standpoint of efficient use of capital. Exxon Mobil could have simply taken on debt to buy out PXD shareholders. However, considering that Exxon Mobil stock has appreciated significantly in recent months and years, and the equity risk premium is currently very low due to high interest rates, it makes a lot of sense to use equity instead of debt. Conversely, it would have been a bad idea to raise cash through a capital increase in 2020 when the entire O&G industry was trading at bargain prices.

Of course, my previous statement that XOM is currently fairly valued sounds a bit like a contradiction when I now praise XOM for using equity instead of debt to finance the transaction. However, I believe that a company does well to use equity rather than debt as long as its shares are not cheap (i.e., as they were in the middle of the cycle trough) and the cost of debt is comparatively close to the cost of equity. Exxon’s cost of new debt is currently about 5.9%, judging from the current yield on its long-term bonds (e.g., 5.9% on the 2016 notes).

Conclusion

I wasn’t all that surprised when news broke that O&G supermajor Exxon Mobil announced its acquisition of premium shale driller Pioneer Natural Resources, given earlier rumors and the fact that Exxon is increasingly facing the law of large numbers that requires growth through major acquisitions at some point. From the other side, PXD, with its world-class assets, rock-solid balance sheet, and strong profitability, represented a typical case of a great company at a fair price – at least when I bought my position in July 2022. In hindsight, I was probably a little late to the party, but opening a position in this potential takeover target was also not a bad idea given the favorable PXD/XOM spread at the time. That being said, the “takeover thesis” played only a minor role in my investment thesis (see the article linked in the Introduction).

But while I bought PXD primarily as a long-term position for my portfolio, I don’t mind the takeover and, in fact, welcome it. Over the years, I’ve come to appreciate Exxon management’s attitude and relentless focus on what it does best at a time when other supermajors were spending tens of billions on renewable energy projects with understandably low expected returns. Moreover, the company’s high asset quality, very solid balance sheet, and commitment to dividends during the pandemic make it a solid long-term investment.

That being said, I wasn’t really interested in buying Exxon Mobil at around $105 when PXD stock was trading at around $200. Since I own a position in Chevron (CVX) that I built in 2020, I was primarily looking for a top-quality shale driller, not necessarily another supermajor. Pioneer was the obvious choice at that point, but at $253 (the implied takeover price), things look different as XOM stock has been flat since early July.

With the closing of the transaction, I essentially become a shareholder of Exxon Mobil at a price of $85 per share. The dividend yield on cost will be about 4.3% – ten percent below the yield on cost of my 3M position, which I sold and partially shifted into PXD, but perfectly acceptable. More importantly, however, is the fact that the deal is structured as an all-stock transaction. Therefore, there should be no immediate tax consequences, which is important to me since I hold PXD in a fully taxable account and pay capital gains taxes in the high 20% range. I also think it is a formidable idea to finance the transaction with equity rather than debt – after all, Exxon’s cost of debt is currently about 5.9%, and the equity risk premium is extremely low by historical standards.

Thank you for taking the time to read my latest article. Whether you agree or disagree with my conclusions, I always welcome your opinion and feedback in the comments below. And if there’s anything I should improve or expand on in future articles, drop me a line as well. As always, please consider this article only as a first step in your own due diligence.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of PXD, EOG, CVX either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The contents of this article, my previous articles, and my comments are for informational purposes only and may not be considered investment and/or tax advice. I am a private investor from Europe and share my investing journey here on Seeking Alpha. I am neither a licensed investment advisor nor a licensed tax advisor. Furthermore, I am not an expert on taxes and related laws – neither in relation to the U.S. nor other geographies/jurisdictions. It is not my intention to give financial and/or tax advice, and I am in no way qualified to do so. Although I do my best to make sure that what I write is accurate and well researched, I cannot be held responsible and accept no liability whatsoever for any errors, omissions, or for consequences resulting from the enclosed information. The writing reflects my personal opinion at the time of writing. If you intend to invest in the stocks or other investment vehicles mentioned in this article – or in any investment vehicle generally – please consult your licensed investment advisor. If uncertain about tax-related implications, please consult your licensed tax advisor.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.