Summary:

- Today, I will review my Alphabet thesis with you, which consists of four distinct pillars.

- Specifically, within this thesis, I will focus on Alphabet’s cloud business, which I believe to be the “third supermajor.” I will explore precisely what I mean by this with you.

- I will also apply my four foundational investment frameworks to the business, thereby highlighting its attractiveness, and I will perform a valuation exercise using my proprietary valuation model.

- In short, while Alphabet does not offer exactly spectacular returns, I do believe it’s very attractive to the right investor.

hapabapa

My History With Alphabet

In the 2010s, Alphabet (NASDAQ:GOOG) (GOOGL) was one of my largest investments, and, during this period, I was even choosing the username, “Alphabet2030,” because I was so convinced of the thesis and committed to holding until the year 2030.

In the process of building my investing group on Seeking Alpha, and hiring/investing in/training two analysts and an intern, I sold my shares in Alphabet so as to fund these hires, as well as the necessary infrastructure for a small analyst shop.

- (In this vein and as a brief aside, I highly encourage you to read the book entitled, “100 Baggers.” In this book, there’s a short vignette about a lawyer who did approximately the same thing: Sold investments to start a business. At some point into the development of this lawyer’s new venture, the lawyer discovered that, had he simply held onto those investments, he would have been much better off in a variety of respects (namely, his wealth), and, after the last 4 years or so, I can certainly identify with the lawyer!)

Thinking back to the 2010s, when I began my partnership with Alphabet, my core thesis rested on four pillars principally:

- Alphabet had a series of defensible moats, which it has demonstrated in spades in recent years. These moats have included network effects, brand, economies of scale, and embedding/switching costs.

- YouTube was an international monopoly, with room to grow via further monetization and international expansion. I personally have used YouTube almost everyday since 2008 or thereabouts. I actually recently remembered, seemingly out of the blue, the day on which YouTube announced it would show ads on its platform. I remembered wondering whether it would meaningfully degrade the user experience. 15 or so years later, my question has been answered (it has not; at least not meaningfully). YouTube is the second most visited website in the world, behind Google; of course, both of which Alphabet owns.

- Google Search had incremental room to grow internationally as both global population grew and as more humans digitally industrialized. The growing digital industrialization of earth is, in some sense, core to the entire thesis at this point, including the GCP thesis.

- Alphabet had demonstrated the ability to successfully field new products, and GCP could be a great success, which it has been, as evidenced by its rapid growth and positive operating income today.

Today, each pillar remains intact; arguably more intact than ever. As we will explore today, GCP is firing on all cylinders and could be a truly giant software business in the decades ahead. It could become The Third Supermajor.

In 2020, I added another pillar: the company’s likely share repurchase program.

Today, we will start with an exploration of this facet of the thesis, which I detailed for my readers in 2020; after which, we will explore GCP, how Alphabet fits within our four foundational investment frameworks, and the company’s valuation.

Alphabet’s Cash Hoard Was Destroying Shareholder Value

At the lows in March of 2020, I penned the following note:

- Alphabet’s Cash Hoard Is Destroying Shareholder Value

- In the interest of brevity, I won’t explore the value of share repurchase programs with you today. I encourage you to read one of my recent reviews of Chipotle (CMG) to learn more about why I like companies that repurchase their shares. I like growing companies that repurchase shares in a disciplined fashion so much that I’ve gone so far as to make the value creation mechanism one of my four foundational investment frameworks, which I will share with you in a moment.

In that note, I explored why Alphabet was not being aggressive enough in repurchasing shares and what course of action it should take going forward. As an aside, one of NYU’s business school professors reached out to me and asked me to give a talk to their (neutral pronoun out of respect for privacy) class regarding the ideas I shared therein. I share this to highlight that there’s valuable, textbook information (not just me pontificating as to my views on Alphabet’s stock!).

In my case for a more aggressive share repurchase program, I wrote specifically,

In my proposed ASR, Alphabet would reduce its share count by 8.5% this year alone, which would not only be extremely accretive to shareholder value but also extremely positive for confidence in the market as a whole, as Alphabet makes up a significant portion of the S&P500, relatively speaking.

Interestingly, over the last 3.5 years, since roughly when that note was published, Alphabet has repurchased ~10% of its total shares outstanding, which represents a 10 year shares outstanding reduction rate of approximately 29%.

There’s probably a lesson somewhere in this somewhat coincidental math, e.g., exercise patience in business.

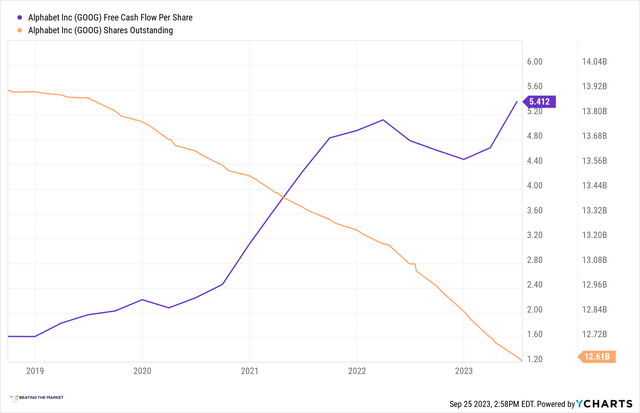

At any rate, I have been content with Alphabet’s concerted effort to return capital to shareholders via more aggressive share repurchases. These more aggressive share repurchases have served to 1) reduce Alphabet’s share count rapidly, and 2) accelerate the rate at which free cash flow per share has grown, and, by extension, the rate at which the company’s share price has appreciated.

We can see these two points in the images/data below:

Alphabet’s Share Repurchase Program Has Accelerated Returns Over The Last 3.5 Years

Alphabet’s Shares Outstanding Have Declined ~10% Over The Last 3.5 Years

Despite a more aggressive share repurchase program in recent years, via which Alphabet’s cash hoard has declined from ~$140B to ~$110B, the company has not taken on more debt, leaving room for the execution of a leveraged recapitalization at some point in the future, which would serve to accelerate the reduction in the company’s shares outstanding even further.

In short, I am quite content with Alphabet’s newfound commitment to returning capital to shareholders over these last few years, and this newfound commitment makes the business even more investable than it was in the 2010s, at least in my eyes.

Let’s now turn to a review of Alphabet’s latest line of business, GCP.

The Third Supermajor

As an owner of Amazon (AMZN) for specifically its AWS asset, I am sympathetic to the concerns some have voiced about the rise of Azure and GCP.

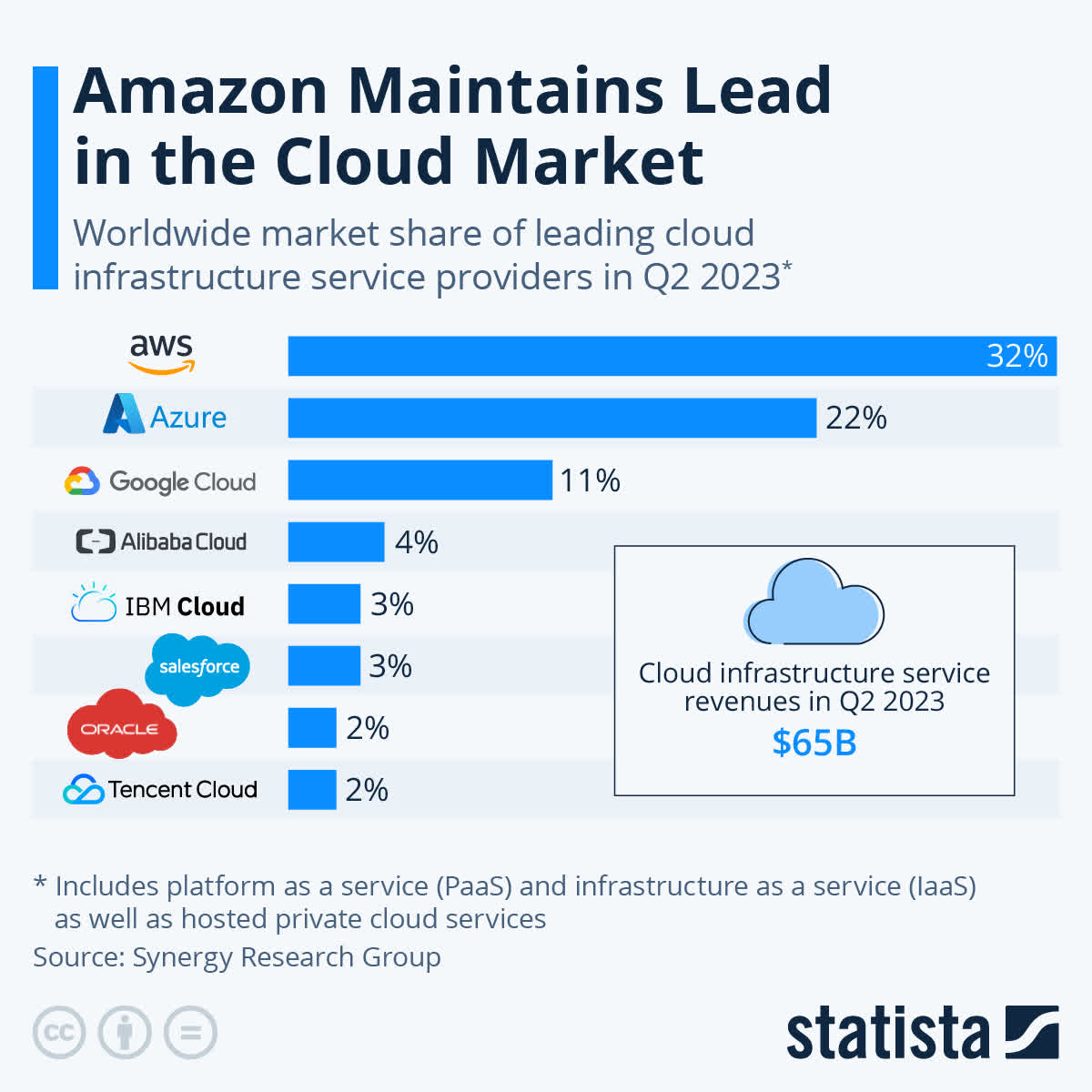

However, in my estimation, history can be a guide in forecasting what the future may look like for the Infrastructure as a Service/Platform as a Service industry, in which AWS, Azure, and GCP have formed an oligopoly, or something very near to it.

Over the last 50-100 years or so, some version of Exxon Mobil (XOM), Chevron (CVX), and Royal Dutch Shell (SHEL), now just Shell, operated in something akin to an oligopoly. These are earth’s three “Supermajors,” vertically integrated oil and gas companies that have dominated, again, in some form, (mergers, acquisitions, antitrust should be noted) over the last 50-10 years.

If data is the new oil, then I believe the new vertically integrated supermajors will be AWS, Azure, and GCP in the 21st century.

With these ideas in mind, Alphabet’s GCP has been performing quite exceptionally as of late.

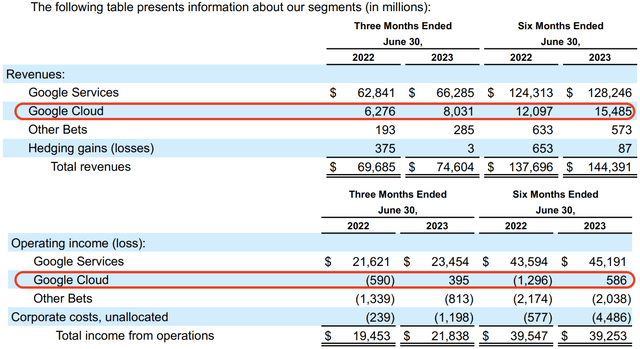

Alphabet’s Google Cloud Platform [GCP] Growth, Six Months Ended June 30th, 2023

As can be seen above, GCP now operates at about a $30B annualized revenue run rate, with about $1B in operating income currently.

This is fairly incredible, and this performance buttresses the idea that GCP will find itself as the third supermajor data platform in the decades ahead, alongside AWS and Azure.

Infrastructure as a Service Market Share, AWS/GCP/Azure

Statista

In the above data, we can see an oligopoly forming, with GCP, Azure, and AWS leaving the other three companies behind. I think it’s notable that Alibaba (BABA) will likely never materially capture market share globally, due to privacy concerns related to the CCP. But I digress.

In short, I think it could be argued that GCP is worth, today, about $200B to $300B in total enterprise value, were the market truly an efficient mechanism pricing in the net present value of all future cash flows for the enterprise. This suggests that GCP has now become a very material contributor to the overall Alphabet thesis, which is incredible insofar as the company has demonstrated the ability to successfully field new products, notwithstanding such immense success from Search and YouTube.

In this vein, let’s now turn to the foundational investment frameworks into which Alphabet fits. After this exercise, we will consider the business’ valuation using the L.A. Stevens Valuation Model.

My Four Foundational Investment Frameworks

I recently shared that I did not feel bad for re-sharing these four frameworks to an excessive extent over the last two months or so. I believe I’ve reached saturation in terms of sharing such that I’d feel bad re-sharing them with you today and having you re-read them yet again.

To this end, if you’ve not already reviewed them, I encourage you to read the following note, in which I shared our four foundational investment frameworks.

Leveraging these frameworks, we can better understand why we might own Alphabet and why future value creation, and, by extension, share price appreciation, are highly likely.

Before I share the frameworks within which I believe Alphabet fits, I would encourage you to think about the frameworks and attempt to place Alphabet within the frameworks that you believe apply.

In my estimation, Alphabet fits within all four of my foundational investment frameworks. I will explore this contention with you in the bullets below:

- Vertically integrated product, capturing market share in stagnant mature industry: In some sense, Alphabet’s three primary businesses fit within this framework. Google search has siphoned advertising dollars away from traditional, less AI-driven channels and into AI/ML-driven search. YouTube has siphoned advertising dollars away from traditional channels, such as linear TV advertising and radio, and into ads displayed on user-generated content. GCP has siphoned dollars away from traditional, on-prem data storage and compute. In each of these instances, Alphabet has also employed vertical integration to create a more compelling product relative to the incumbent solutions from which it has been siphoning said dollars.

- Businesses that will execute a leveraged recapitalization in the coming years or are extremely disciplined with capital allocation via routine, robust share repurchase programs: As you know, this has been arguably my central bull thesis for the business, and it continues to be at the heart of my thesis for Alphabet. As of today, the business still has a rather de minimis debt burden, which gives it further latitude to aggressively repurchase shares, especially if its valuation remains depressed due to economic uncertainty and rising rates. In fact, for Alphabet, higher rates would actually be a net positive for shareholders, as higher rates would push down on the company’s valuation further, thereby allowing it to repurchase more shares at even more attractive valuations, which would serve to accelerate the growth of fcf/share, as the denominator in fcf/share is reduced at a faster rate when a company can buy back shares at a lower valuation.

- Quality cultures that breed innovation within the larger conglomerate: While this has been called into question for Alphabet, the recent success of GCP has demonstrated that the company remains capable of fielding new products successfully. I think, on some level, the reality is that new successful products are simply very rare. GCP’s success has been extremely heartening and represents one of many attempts at fielding new products working out.

- Growth through quality, moat-building acquisitions: Alphabet has also demonstrated an exceptional ability to make moat-building acquisitions, evidence for which can be seen in Alphabet’s purchase and ownership of Android and YouTube. That said, I am doubtful we will see very meaningfully successful acquisition in the future; not due to lack of competence, but rather due to regulatory scrutiny. While unfortunate for shareholders, this should serve as impetus for the C-Suite and board to further push hard on share repurchases, whereby capital is gainfully employed on behalf of shareholders in a disciplined fashion.

Alphabet’s Valuation

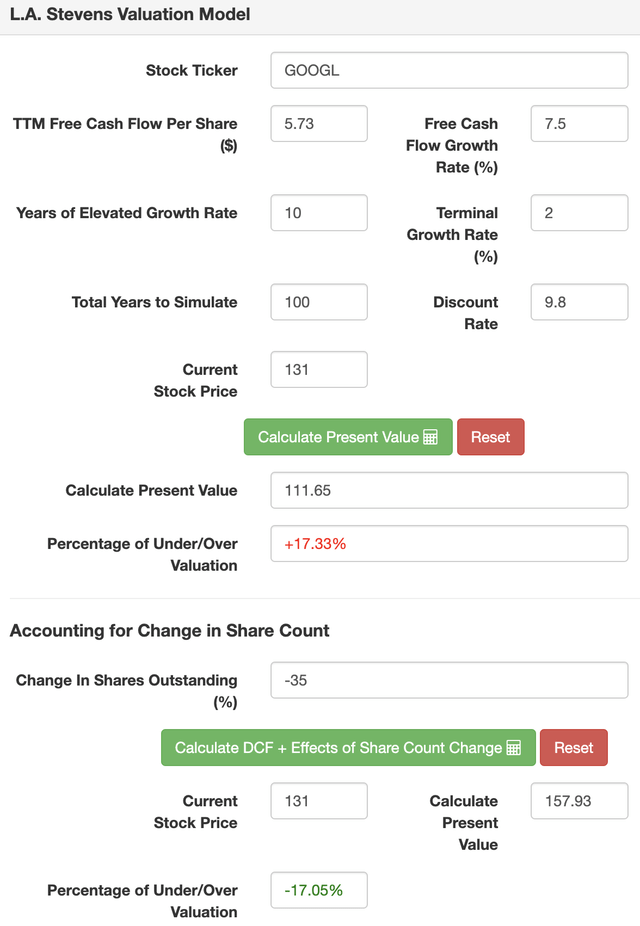

Here are my assumptions for Alphabet’s valuation:

|

TTM revenue [A] |

$289 billion |

|

Potential Free Cash Flow Margin [B] |

25% |

|

Average diluted shares outstanding [C] |

~12.6 billion |

|

Free cash flow per share [ D = (A * B) / C ] |

$5.73 |

|

Free cash flow per share growth rate (reasonable) |

7.5% |

|

Terminal growth rate |

2% |

|

Years of elevated growth |

10 |

|

Total years to stimulate |

100 |

|

Discount Rate (Our “Next Best Alternative”) |

9.8% |

I believe these to be reasonable assumptions. I would say they err on the conservative side. They are certainly not optimistic. Considering the “earth is set to digitally industrialize thesis,” alongside the growth of GCP, which could certainly hit $100B in sales one day, I think they are perfectly reasonable.

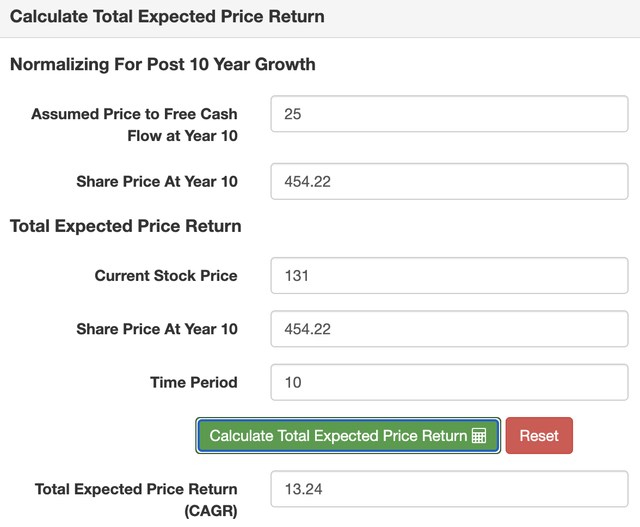

- Note: this was shared with my private community at $131/share, and I think it’s valuable to keep this original price, in that it may serve as a price target for accumulation for some. I still like it at $140/share, and a simple CAGR calculation produces the current projected returns from this price based on the year 10 price target presented below.

L.A. Stevens Valuation Model L.A. Stevens Valuation Model

Notably, I used a terminal rate of 25x EV/fcf, which represents a premium to today’s valuation of about 20x EV/fcf.

The market presently prices many consumer package good companies [CPG] at a premium to Alphabet. I think this will be seen as improper as time goes on. Especially as GCP scales into a $100B+ revenue business, it is likely that Alphabet achieves a more durable, elevated multiple reflecting the strength and durability of its free cash flow, akin to Microsoft (MSFT) or Apple (AAPL), both of which offer free cash flow yields below the current 10 year risk free rate of about 4.5%.

Concluding Thoughts

As I reflect on the valuation of Alphabet, I am reminded that the market has largely priced in the quality of the business. I do think it offers a very attractive return profile for less risk averse investors today, who do not want to tolerate substantial volatility.

That said, I think, looking at the returns from March of 2020, the best time to buy Alphabet is during periods of market pessimism. In fact, it should likely be at the top of any investor’s “buy list for when the market collapses.”

Considering the yield curve remains inverted and interest rates could continue to rise, it’s not totally inconceivable for us to experience another substantial buying opportunity in the six to twelve months ahead.

Armed with today’s review and knowledge, I plan to keep you abreast of my thinking apropos of when to buy Alphabet.

Again, I think it’s very attractive for more conservative investors; however, I’m personally being patient with points of accumulation.

Thank you for reading, and have a great day.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOGL, GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.