Summary:

- Activist investor Nelson Peltz has resurfaced in the The Walt Disney Company fray, asserting that the company is undervalued and asking for a board seat.

- Peltz’s history suggests that he has a knack for timing value and making successful moves against entrenched management.

- The Peltz move will likely be the most critical factor in moving Disney shares up or down from their current trading range.

Ben Gingell

If you want to become a believer in the prospect of activist investor Nelson Peltz’s initial move on The Walt Disney Company (NYSE:DIS), you’d have to go way back into the history of the man first. Back in the day, a close friend was part of Pelz’s inner circle. Also, my cousin, then managing his dad’s wholesale produce business, knew Peltz as he was essentially doing the same thing for his dad’s produce business. I’d met Peltz at a family affair, and we chatted a bit among a few friends while imbibing a very good Petruse.

Back at my table, my wife asked what was it that our little group had been chatting so energetically about? I told her, and also remember noting, “This guy Nelson is a waste hustling grapefruits and frozen foods. He belongs on Wall Street, loves battling with corporate nobodies…”

I take no kudos as a prophet. It was obvious, as it would have been to anyone. Nelson Peltz was determined to make his mark in finance, one way or another, one time or another.

Now we have him surfacing once more into the Disney fray after an earlier effort months ago from which he receded. He has again asserted his conviction that the company is undervalued and has asked for a board seat. His $2.5b position in the stock gives him a proper forum for certain. But there is much more here than meets the eye and ear. This move is a lot more about rescuing Disney value from the tepid responses to date from the CEO Bob Iger board and management teams. Among the moves originally suggested by Peltz was urging Disney to sell off ESPN. There was more, but the heart and soul of it is this: with a debt load as big as that of Disney, a speeded-up policy to reduce debt exponentially is what is called for now.

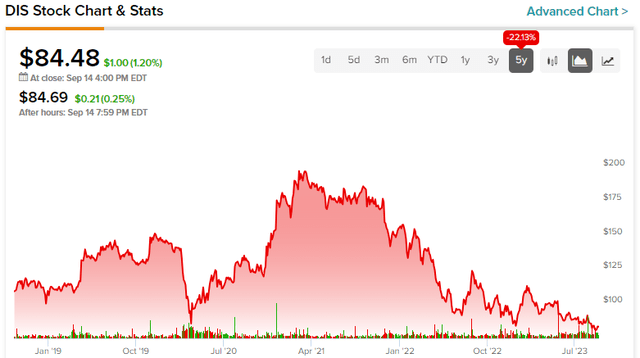

Above: Slight spike on jobs report and, I believe, from the Peltz announcement.

Pelz is a master of timing value. It may be remembered that he sold the quirky Snapple beverage company in 2000 to Cadbury Schweppes for $1.5b after holding it for only 2 ½ years in his hedge fund. He and his partner, Peter May, bought the business for $300m, of which only $75m in cash. It was part of Peltz’ ground rooting savvy in the consumer products sector, having been active with Wendy’s, P&G, Heinz and Sysco in his past career. He’s also had reverses in his moves on DuPont (DD).

This is not the forum to display his resume since 2005 when he began his fund, Trian. Safe to say, should he succeed, his instinctive grasp and track record would clearly result in policy pivots that would move Disney stock in our view. This was the case with Snapple. When he sold Snapple it had $772m in sales and threw off $110m in cash flow, the value had grown due to management getting its arms around its challenges.

So his entire history has been a succession of coups against entrenched management. But his core breeding has come from the rough and tumble world of the New York wholesale produce business.

In brief, we are strongly inclined to believe that over the next few months, the Peltz move, whether a triumph or a bust, will be the single most critical factor in moving the shares up or down from its apparent dead pool trading range.

Most recently, after the shares have dipped just below $80, they found support by the last strong jobs report. One must suggest investors saw this as a positive for the consumer economy and discretionary income spend. Then came the Peltz announcement-a cowbell sound to investors.

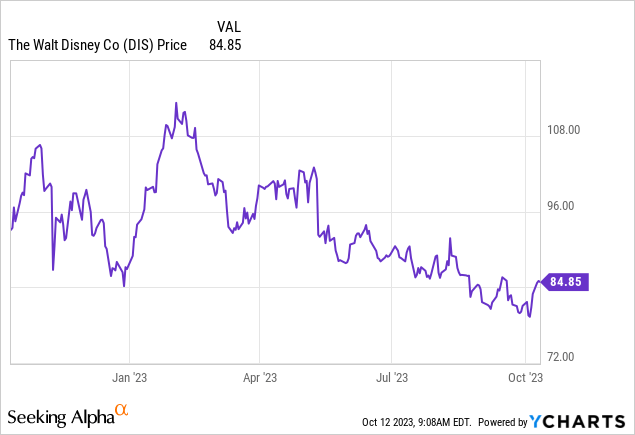

Above: Some analysts read this as a signal to buy on value, but we think it will take more than this to move shares smartly higher.

And just this week, there was the Parks price rise news-which investors apparently find somewhat bullish. It is, in fact, in our view, raising another white flag. Disney has been doing that since its streaming swoon became apparent and the erosion of support around $200 fell fast. We do not suggest that any of the moves Iger has made since his return have no chance of enduring to reset the longer term bullish view of DIS.

The film business post-strike must now come to grips not only with new cost structures, but with the now mandated need to share with the Guild the viewership of its content. This is mainly to sort out the accounting for royalties against a formula to make certain writers get their correct amounts. But the offshoot of this is that now, for the first time, DIS and the streamers in general will have to take these numbers out of hiding. What this means goes beyond accounting. I asked my media/entertainment veteran friend as to how that may impact green light decisions:

“Why do you think they never have shared the data?” he said. “Royalties, part of it. Also part of it is the colossal embarrassment of revealing just how consistently terrible woke material has performed. Not all of course. There have been winners, some great talent, good storytelling. But for the most part the woke DEI material has exposed that it springs not from the goal of producing content appealing to the largest possible audiences. Such projects, tough to say, come from the wokeists rife through DIS management.”

“To them virtual signaling became a religion-probably still is. But expect nothing but lip service to DEI goals to continue but where the new realities sink it, you might discern distinct reduction in absurd casting and stories greenlit.”

“My opinion only here. In a way, DIS and its peers hid viewing numbers from Wall Street as part of an effort to tamp down criticism of its management decision making in the hundreds of millions while it sunk ever deeper in debt. I wonder where the stock would have been had the street known, just how much viewership per show was achieved vs, total production costs.”

The possible Peltz effect

Peltz’ $2.5b stake in DIS may not be the last cash slammed down on the barrelhead on this possible deal. He has lots of long-time friends among hedgies, and also among the mavericks, like fellow activist investor Carl Icahn-a wounded but far from dying animal. Peltz on the board wouldn’t be a silent bobble head member. He will be entering the boardroom with a specific set of ideas that will amount to ignite action aimed at bringing the company into a better earnings posture faster. He will not be alone. Through friends, I have learned that he’s got chapter and verse on how he thinks the pivots that need to be made, will be made.

Whether he sees it through this time or gets seduced on the way with a board seat that comes with something of a gag order, nobody knows. But you can rely on this: as he moves forward-if he does-it will clearly have an impact on the stock. In running through the numbers, it seems to me that DIS fans are keeping its price support because they have bought into the Iger board/manager conviction story that all hands are on deck ready to produce the turnaround that will presage bargain hunting around the low eighties.

For those investors who have not bought into the board and the management potions served to date, there is a case to be made that, given the real world ahead, that is topsy-turvy for media/entertainment. We could be looking at a loss of price support that I have calculated runs into the low $60s. My math, I confess, is reducto – but I hope, not absurdum. It says the speed of debt reduction is too slow, the streaming business continues to be holy mess nobody has yet figured out, production costs are rising, linear networks questionable rescue efforts, ESPN lingering in the Mouse House.

Analyst are looking for next year’s earnings around $4.88 with revenues moving to $93b. Most recently, however, there has been one analyst earnings revision up and four down. DIS will report earnings post-market on Nov 8th. A bounce could slow Peltz, a miss, particularly a big one, will animate his moves.

So, at the end we have concluded, there stands Nelson Peltz. Neither sell him short nor see him as a savior. He has always been one of the smartest guys in the room in consumer businesses. While I believe there might be some short time wiggle up or down on the shares, there are no hidden spikes either way, so figure an entry point somewhere around $77. If DIS dips, or reaches down a bit to $80, that could be a place to be if you also believe Peltz can be the Prince that kisses Snow White back to a wonderful life ahead. Assuming, that is, that Snow White looks enough like Snow White to be recognizable to Prince Nelson and his merry band of dragoons to come.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

The House Edge is widely recognized as the only marketplace service on the casino/gaming/online sports betting sectors, researched, written and available to SA readers by Howard Jay Klein, a 30 year c-suite veteran of the gaming industry. His inside out information and on the ground know how benefits from this unique perspective and his network of friends, former associates and colleagues in the industry contribute to a viewpoint has consistently produced superior returns. The House Edge consistently outperforms many standard analyst guidance with top returns.

According to TipRanks, Klein rates among the top 100 gaming analysts out of a global total of 10,000.