Summary:

- The company has experienced significant improvements in its economic outlook, with day rates for its ultra-deepwater fleet and harsh environment floaters increasing.

- Transocean’s biggest challenge is its high debt levels, but the company is well-positioned to take advantage of improving day rates and increasing demand in the energy industry.

- Transocean is setting up for future seabed mining operations, which can be a $72.81 billion market by 2030.

izzetugutmen

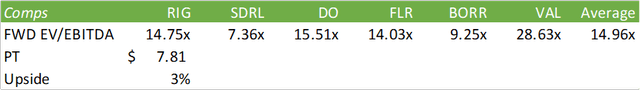

Transocean (NYSE:RIG) has a strong outlook through the duration of the decade but must prove themselves before shares reflect their true potential. Their biggest challenge is the same challenge much of the energy industry faced after the 2014 oil bust, leverage. Despite their challenges with high debt levels, day rates are significantly improving, and the demand outlay for both ultra-deepwater floaters and harsh environment floaters faster than analysts anticipated and Transocean’s fleet is positioned to fully take advantage of this upcycle. RIG currently trades at 22.50x EV/EBITDA with eFY23 guidance providing a forward multiple of 14.75x. Given their historical trading range, I provide RIG a HOLD rating with a price target of $7.81/share for a target EV/EBITDA multiple of 14.96x (industry average).

Financials

Transocean is in a transitory phase in their operations. As oil prices stabilize in the mid-to-high-$80/bbl, operators are becoming more comfortable increasing production rates offshore. Management suggested on their Q2’23 earnings call that the average breakeven price to drill is $50/bbl, providing operators a ~37.5% margin of safety. Management has also voiced that customer inquiries for rigs has significantly improved with new projects in the Gulf of Mexico, West Africa, and Australia.

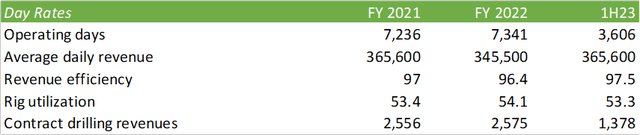

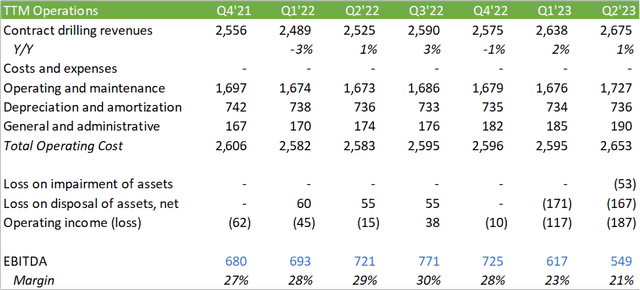

Overall, Transocean has experienced significant improvements in their economic outlay. Day rates for their ultra-deepwater fleet have increased to an average of $363k/day, a 16% improvement from a year ago, with the average duration of contracts increasing to 495 days, up from 310 days in Q2’22. Management anticipates Q2’24 day rates to increase further to $433k/day. Management has also voiced that day rates for their harsh environment semisubmersibles are rapidly approaching $500k/day.

Transocean is taking a page out of Pioneer’s (PXD) playbook of producing to meet demand to improve pricing. Translating to Transocean’s tactics, the firm currently has 11 cold-stacked floaters consisting of 10 ultra-deepwater rigs and one harsh environment semisubmersible and nearly full utilization of their active rigs. One major advantage Transocean has in the industry is that they own eight of the 12 stacked 6th and 7th generation drillships. This provides the firm significant leverage in pricing day rates for future projects while maximizing current utilization.

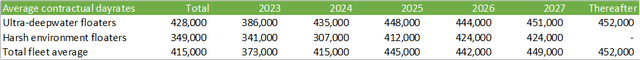

So far, this tactic is working. Transocean recently announced a 3-year award for their new ultra-deepwater drillship Deepwater Aquila for $486mm for a day rate of ~443k/day to work offshore Brazil. The firm also announced a 21-month contract offshore India for $222mm for a day rate of ~352k/day. As of Q2’23, Transocean’s backlog has increased to $9,239mm. This is a $1,200mm improvement from the start of the year. As of FY22, average contractual day rates will improve through 2027 for ultra-deepwater floaters and harsh environment floaters to $451k/day and $424k/day, respectively, up from 2023 contract rates of $386k/day and $341k/day. As the market continues to remain constrained, management expects these rates to continue to increase past the $500k/day mark.

Though trailing figures don’t do the company much justice given their heavy spending on CAPEX and O&M expenses, capital investment should taper off in the coming year as Atlas and Titan have been constructed and have entered into service. O&M expenses will inevitably taper off as well as Transocean relocates floaters away from Norway to Australia and expects them to remain in the region going forward.

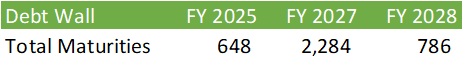

The big elephant in the room is their debt load. Transocean sports a 12x net debt/EBITDA with $6,702mm of debt on the books and $243mm due within one year. Transocean had a new issuance on October 11, 2023, of senior secured 8% callable notes due in 2028 with proceeds summing to $319mm to support current construction costs and pay down debt servicing costs. Though Transocean does not currently have any debt maturities through 2024, their big debt wall is coming due in 2027 for a sum of $2,284mm which will pose a major challenge to come. My presumption is for much of this debt to continue to be pushed out at a potentially more appealing rate as the industry progresses forward. It doesn’t appear likely that Transocean will break the chain of financing debt with more debt until the end of the decade.

SEC Reports

The last point I’ll make before moving into valuation refers to Transocean’s equity investments. Transocean holds noncontrolling ownership interests in Global Sea Mineral Resources, Ocean Minerals, parent to Moana Minerals, and Nauticus. Global Sea Mineral Resources is in the business of developing the technology for deep-sea polymetallic nodule extraction. Nauticus is in the business of developing highly sophisticated, ultra-sustainable marine robots and associated software for deep sea exploration. Ocean Minerals’ business is focused on the extraction of polymetallic nodules and owns priority rights to provide deepwater nodule extraction services to Moana with intent to extract. According to Allied Market Research, the global deep sea mining equipment and technologies market is expected to grow to $72.81b by 2030.

It is way too early to determine whether deep sea metals extraction will experience this growth given the unproven environmental impacts and risks involved in oceanic metals extraction. The New Zealand Supreme Court has recently blocked consent for seabed mining off the coast of South Taranaki. France, Spain, and Germany are also calling for either a ban or moratorium on seabed mining operations. In additional to political opposition, BMW, Volvo, Google, and Samsung have committed to avoiding minerals extracted from the seabed.

Valuation

Overall, the operating environment for Transocean is improving significantly with oil prices remaining in the mid-to-high $80/bbl. The production constraints placed across OPEC+ and domestic producers appear to remain intact with nearly no expectation of this spoken/unspoken agreement deteriorating. Whether this continues is to be seen, but the stars appear to be aligning for the industry. As for investing in Transocean, I provide a HOLD recommendation with a price target of $7.81/share based on their future outlay as well as their debt burden. Though they do not have any maturities through 2024, this huge debt load will be the ball and chain for the company before they can really fly.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.