Summary:

- Exxon Mobil has agreed to acquire Pioneer Natural Resources in an all-stock transaction valued at $59.5 billion.

- The deal will allow Exxon Mobil to more than double its oil and gas production in the Permian Basin and capture $2 billion in annual run rate synergies.

- Investors should consider acquiring shares of Exxon Mobil due to the potential upside and upside if the deal falls through, while Pioneer Natural Resources is less compelling here.

JHVEPhoto

October 11th ended up being a really fascinating day for shareholders of two of the largest energy companies in the US. After several days of speculation, news finally broke that energy behemoth Exxon Mobil (NYSE:XOM) had agreed to acquire all of Pioneer Natural Resources (PXD) in an all-stock transaction valuing that company at $59.5 billion on an equity basis and at $64.5 billion on an enterprise value basis. As expected, this caused shares of Exxon Mobil to pull back slightly while shares of Pioneer Natural Resources popped up. But the movements for both companies was fairly small since the market had already priced in a deal occurring.

Unfortunately, we do not yet know if this transaction will end up being truly profitable for shareholders of Exxon Mobil, nor do we have a firm understanding of whether investors in Pioneer Natural Resources have gotten a good deal for their business. But this is only because of the extreme volatility of the energy market. Ignoring the prospects of significant synergies, and assuming that energy prices do remain elevated for the foreseeable future, I would argue that Exxon Mobil has certainly got the better end of this transaction. At the same time, however, they do also capture all of the risk associated with it as well.

As for investors individually, I would posit that the best strategy from this point on would likely be to consider shares of Exxon Mobil. This is because, while Pioneer Natural Resources is not priced at levels that are unreasonable, there is a chance that the transaction will hit regulatory hurdles that could make closing the deal difficult or even impossible. When you factor in the implied upside on shares today compared to the possible downside should the deal fall through, I would say that focusing on the long haul by acquiring Exxon Mobil, which is a company that should fare well with or without this transaction and would likely see its share price rise in response to the deal falling, is the more sensible play.

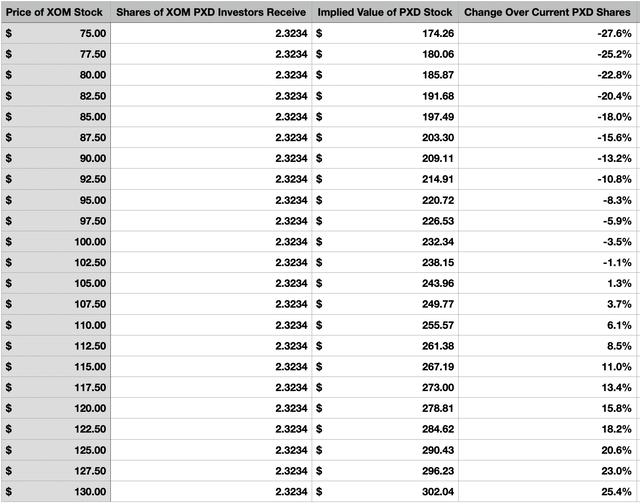

An interesting deal

According to the press release issued by both Exxon Mobil and Pioneer Natural Resources, the former has agreed to essentially absorb the latter in an all-stock deal. In exchange for each share of Pioneer Natural Resources that an investor owns, they will receive 2.3234 shares of Exxon Mobil once the deal finally closes. Based on where prices were before the deal was announced, this should translate to a price per unit for Pioneer Natural Resources investors of $253. But because the ultimate purchase price will vary based on how shares of Exxon Mobil fluctuate, this picture could change. For instance, on the day that the market digested the news, shares of Exxon Mobil dropped around 3.6%, while shares of Pioneer Natural Resources popped up only 1.4%. Assuming shares of Exxon Mobil remain unchanged from this point on, the current price on Pioneer Natural Resources works out to $247.42.

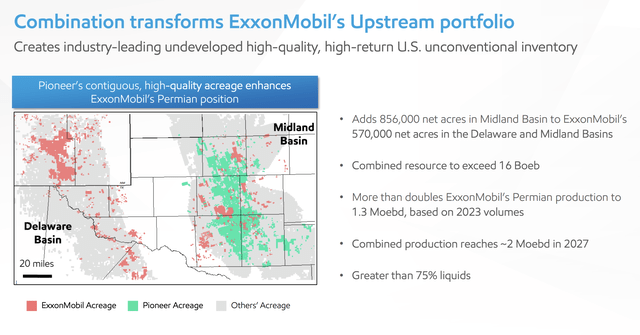

If all goes according to plan, this transaction should be completed sometime in the first half of the 2024 fiscal year. The management team at Exxon Mobil paints this as a major win for the company because it will allow the firm to more than double its oil and gas production in the Permian Basin. As I wrote about in a prior article, Exxon Mobil has a rather large footprint in the Permian. That article, which was published in 2019, pointed out that Exxon Mobil had a significant amount of acreage located in both the Delaware and Midland basins. Even though I didn’t describe it as such at the time, the company’s strategy seems to have been something of a shotgun approach, having a few areas of significant interest, but with the rest of the assets spread them out.

This can be a good strategy if your objective is to try to find optimal acreage. But a failure to cluster your resources does lead to significant inefficiencies in return. At the time, I would have imagined that the goal for Exxon Mobil would have been to intensify its focus on the Delaware Basin since that was where the most clustering of acreage existed. But regardless, management did, at that time, say that their goal regarding future production had been revised. Prior guidance had been to grow output in the Permian to 600,000 boe (barrels of oil equivalent) per day by 2025. But that number had been pushed up to 1 million boe per day by 2024.

The purchase of Pioneer Natural Resources changes things rather drastically. Not only does Pioneer Natural Resources have significantly more acreage, totaling 850,000 compared to the 570,000 that Exxon Mobil boasts, its entire focus has been on the Midland Basin. The size and concentration of these assets is so significant that investors in Exxon Mobil should no longer consider the Delaware Basin to be the primary presence of the energy giant should this deal come to fruition. Although this strategy may seem counterproductive at a time when you would expect a clustering of resource strategy to be better, the management team at Exxon Mobil believes that they will be able to capture around $2 billion in annual run rate synergies over the next decade.

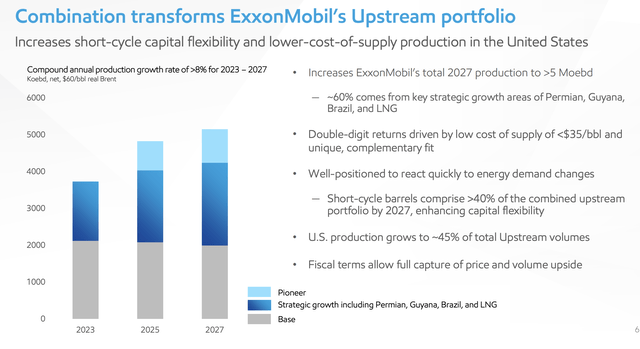

Cost savings will certainly be an important element in determining how attractive this deal has been once management is able to look back on it several years from now. But there is also the production side of things. You see, this transaction will push Exxon Mobil’s production in the Permian up to 1.3 million boe per day using 2023 levels of output by both companies. The goal is to invest further in production growth in order to increase output to roughly 2 million boe per day by 2027. It is unclear whether or not this deal will allow any acceleration of production growth for the assets currently owned by either company. As a note, the 1.3 million boe per day the two will already produce will account for about 22.5% of the output from the Permian Basin already, making the entity the sole power player over what is America’s most significant and lucrative oil-producing region.

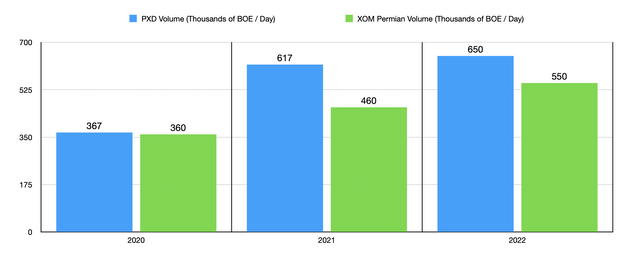

Those looking at headline items might think this is the case because Pioneer Natural Resources has grown more rapidly in recent years than Exxon Mobil has in the Permian. From 2020 through 2022, Exxon Mobil saw its daily production climb from 360 thousand boe to 550 thousand boe, while Pioneer Natural Resources saw its production grow from 367 thousand boe to 650 thousand boe. But it’s also important to keep in mind that acquisitions have been a major part in this. In 2021, Pioneer Natural Resources acquired two different companies for a combined $12.1 billion. And this was offset only by $3.2 billion in asset sales.

Strategically, this move does help Exxon Mobil achieve some of its major objectives. As I wrote about in a prior article, the energy company is starting to make some big moves in the carbon capture space. But that doesn’t mean that it has stopped focusing on oil and gas production. The fact of the matter is that the Permian Basin is one of three geographical growth regions that the company has expressed interest in, the other two being Guyana and Brazil. Once this deal is completed, approximately 60% of the company’s oil and gas output will come from these regions. Though US production will still account for the largest chunk of this, at about 45%.

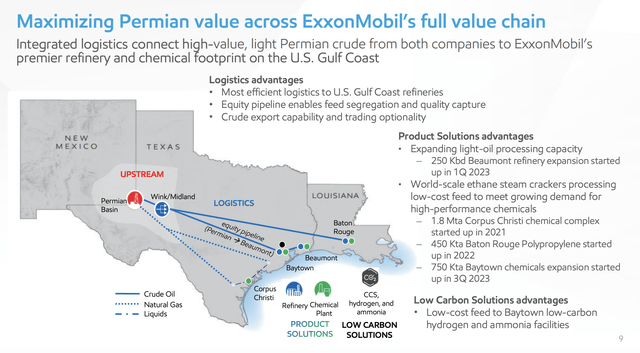

There are a couple of other interesting points that should be made about this transaction. For starters, the management team at Exxon Mobil stated that this purchase will accelerate Pioneer Natural Resources’ plan to reduce carbon emissions to nothing on a net basis. Previously, the company had targeted the year 2050 for this goal. That has now been reduced to 2035. If this sounds unrealistic, I would encourage you to read about the company’s low carbon strategy in the aforementioned article. And the second is that this will also play and with the company’s other assets. In addition to this deal opening up the opportunity for further low-cost feed to the company’s hydrogen and ammonia facilities, it will also allow the company to intensify its focus on other aspects of its value chain as shown in the image below. This certainly does have something to do with the planned synergies from the deal.

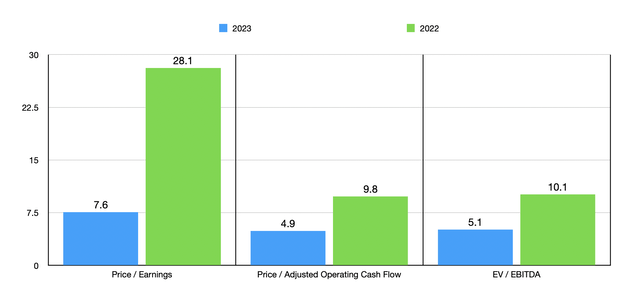

When it comes to whether or not this deal makes sense for shareholders of either company or both, the ultimate answer will boil down to oil and gas pricing more than anything. Using the agreed upon purchase price of Pioneer Natural Resources, I valued the enterprise as shown in the chart below using financial results from both 2021 and 2022. In neither of these cases would I say that shares are expensive. But it is clear that, from one year to the next, pricing has changed considerably. Oil and gas pricing has a tremendous amount to do with whether or not this deal will be considered a great one for Exxon Mobil or just a decent one. What I will say is that, even if financial performance were to revert back to what it was in 2021, and if no synergies were captured, this transaction does not look bad to me. You add in the probability of some synergies being realized and the likelihood of oil and gas prices remaining elevated for now due to both geopolitical reasons and robust demand, and I would say that this transaction currently favors Exxon Mobil.

Takeaway

All things considered, the deal between Exxon Mobil and Pioneer Natural Resources looks interesting. I would argue that the current pricing environment for oil and gas favors the former and its shareholders. But it also saddles them with all of the risk should pricing worsen or operations otherwise falter. For those who are bullish about either company, I would say that investing in Exxon Mobil would probably be more rational. This is because the current spread between the price at which Pioneer Natural Resources is trading at and the current buyout price is only 2.7%. When you add in possible regulatory pushback and the several months that exists between now and when the deal would likely be completed, I would argue that there are better prospects to be had as this time compared to owning Pioneer Natural Resources.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights is an exclusive community of investors who have a taste for oil and natural gas firms. Our main interest is on cash flow and the value and growth prospects that generate the strongest potential for investors. You get access to a 50+ stock model account, in-depth cash flow analyses of E&P firms, and a Live Chat where members can share their knowledge and experiences with one another. Sign up now and your first two weeks are free!