Summary:

- Pfizer is focusing on its core growth engines and strategic acquisitions, particularly in the oncology segment, to compensate for downgraded revenue projections and a concerning debt profile.

- The company’s financial health is fragile, with a significant decrease in FY23 revenue and EPS outlook and a high total debt-to-liquid assets ratio.

- Market sentiment towards Pfizer is cautious, with modest growth expectations and underperformance compared to the broader market, but limited investor pessimism and a commitment to returning capital to shareholders through dividends.

- Investment Recommendation: Given Pfizer’s financial risk and market positioning, a “Hold” stance is prudent; consider hedging strategies for risk mitigation.

Nuthawut Somsuk

At a Glance

In the midst of downgraded FY23 revenue projections and a concerning debt profile, Pfizer (NYSE:PFE) is doubling down on its core growth engines and strategic acquisitions, most notably in the oncology segment. The financial turbulence, largely attributed to altered COVID-19 supply agreements with the U.S. government, casts a shadow on the company’s near-term liquidity and amplifies financial risk—imperative elements for investors to digest. On the clinical frontier, the acquisition of Seagen and FDA approval of Velsipity (etrasimod) signal a directed focus towards oncology and inflammatory conditions. These moves could serve as critical growth levers, compensating for the diminished revenues from the COVID-19 portfolio. Nevertheless, when benchmarked against Johnson & Johnson’s stronger non-COVID growth, Pfizer’s market positioning calls for cautious optimism. The article ahead dissects these intricacies, providing a holistic view that balances clinical promise against financial imperatives.

Financial Highlights

Pfizer’s recent earnings report, compounded by its announcement on Friday, paints a troubling picture. Friday’s sharp downward revision in FY23 revenue and EPS outlook—predominantly due to amended supply deals with the U.S. government impacting COVID-19 product sales—amplifies existing concerns. The previous revenue range of $67B to $70B has been slashed to $58B to $61B, significantly below the Seeking Alpha consensus estimate of $66.36B. This has led to a 6.6% after-hours share price drop to $30.

The balance sheet retains a reasonable short-term liquidity with a current ratio of 2.1. However, the cover of $48.4B liquid assets for its $65.3B total debt still poses a financial risk, covering just 74% of the liability. Despite a net positive cash flow from operations in the past six months, the cash influx seems meager for meaningful deleverage, especially in light of a one-time cash charge of $3B for a new savings program and $5.5B non-cash charge primarily for COVID inventory write-offs.

Pfizer aims to mitigate some damage through a savings program, targeting ~$1B in 2023 and up to $2.5B in 2024. But with reduced annual revenues for Paxlovid and Comirnaty by $7B and $2B respectively, the firm’s financial health appears increasingly fragile.

Market Sentiment

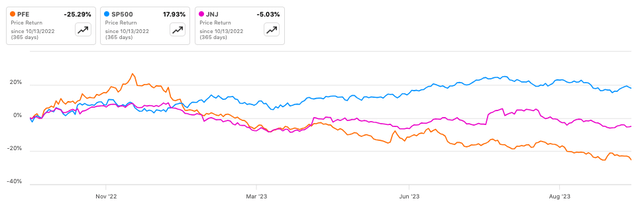

According to Seeking Alpha data, Pfizer’s market cap of $181.29B in the midst of dwindling YoY revenue suggests market apprehension about its growth vectors, while its EV/Sales ratio of 2.60 implies modest growth expectations. Consensus analyst revenue projections for FY2023-2025 indicate a CAGR of only ~0.6%, a sluggish outlook. With regard to stock momentum, PFE has underperformed SPY significantly across all timeframes, exacerbating concerns over Pfizer’s growth prospects in comparison to the broader market. Short interest is at a relatively low 0.91%, signaling limited investor pessimism.

Dividend yield at 5.11% and a payout ratio of 33.61% indicate Pfizer’s commitment to returning capital to shareholders but also leaves room for R&D investments. Institutional ownership stands at a notable 70.76% with Vanguard, BlackRock, and State Street as key holders. New positions account for 17,396,845 shares while sold out positions recently dumped a noteworthy volume, suggesting a mixed sentiment among institutional players. The total insider shares traded in the last 12 months amount to 550,642 with a net activity of -540,436, indicating insiders are cashing in, further complicating the confidence matrix.

Navigating Pfizer’s Shift from Pandemic to Core Growth

Pfizer’s financial trajectory has undeniably been impacted by its COVID-19 related revenues, making it a bellwether of pandemic-era biopharma success. In a hypothetical scenario devoid of COVID-19, the narrative surrounding Pfizer might have panned out differently. The company’s journey back to its pre-pandemic growth trajectory invites a nuanced examination of its performance sans the pandemic tailwinds.

The financial data unfolds a tale of two epochs—pre and post COVID-19. In Q2 2023, Pfizer reported revenues of $12.7 billion, with a 53% operational decrease attributed to the decline in Paxlovid and Comirnaty revenues. Excluding these, the revenues grew by 5% operationally.

Circling back to a time before COVID-19 commandeered the global narrative, in 2019, Pfizer reported a full-year revenue of $51.8 billion, reflecting a 1% operational decline and hinting at challenges even before the pandemic unfolded. However, if one were to sidestep the impact from Consumer Healthcare, a 2% operational growth was observed. This was primarily propelled by an 8% operational growth from Biopharma, spotlighting drugs like Ibrance, Eliquis, and Vyndaqel, and a robust 14% growth in emerging markets.

Moving forward, Pfizer’s anticipated operational revenue growth of 6% to 8% for its non-COVID portfolio in 2023 illustrates a reasonable financial outlook, particularly amid dwindling COVID-19 drug sales, and when benchmarked against Johnson & Johnson (JNJ), it positions Pfizer in a moderate standing. Johnson & Johnson showcased a stronger non-COVID growth of 8.9% in Q2 2023. While Pfizer’s forecast is a testament to its financial resilience, the comparative analysis with Johnson & Johnson hints at a potentially more buoyant market performance by the latter, underscored by diversified operational growth across multiple segments. The juxtaposition reflects not only the financial health but also the strategic market positioning and diversified product portfolios that influence the revenue growth trajectories of these pharmaceutical behemoths.

Debt-Leveraged Seagen Deal Augments Pfizer’s Revenue Outlook

Pfizer’s recent acquisition of Seagen for about $43 billion underscores a pivotal maneuver to bolster its oncology portfolio. To facilitate the acquisition, Pfizer leveraged $31 billion in fresh, long-term debt, supplemented by short-term financing and its current cash reserves. Seagen’s anticipated revenue for 2023 is roughly $2.2 billion, with a projected contribution of more than $10 billion in risk-adjusted revenues by 2030, thanks to its robust pipeline including eleven new molecular entities. The fusion of Seagen and Pfizer’s pipelines is seen as a promising venture to advance Antibody-Drug Conjugate [ADC] technology, which Seagen has pioneered. This acquisition not only enriches Pfizer’s oncology portfolio but also doubles its early-stage oncology clinical pipeline, aligning with Pfizer Oncology’s already robust portfolio of 24 approved cancer drugs which generated $12.1 billion in 2022 revenues.

Aside from the oncology sphere, Pfizer is making strides in other therapeutic areas. The drug Velsipity came under Pfizer’s umbrella through a $6.7 billion deal with Arena Pharmaceuticals, and received FDA-approval earlier this month to treat ulcerative colitis. In oncology, notable late-stage candidates include sasanlimab for non-muscle-invasive bladder cancer and elranatamab for multiple myeloma. Pfizer’s vaccine pipeline is also stirring interest with an RSV vaccine for older adults—a multi-billion opportunity—after positive phase 3 results, among other vaccine programs.

Further, a glimpse into Pfizer’s broader vision reveals a commitment to delivering breakthrough treatments to 225 million individuals by 2025, and a strategic emphasis on internal innovation and external deal-making to drive future growth. Moreover, Pfizer continues to explore novel treatments for obesity and Type 2 diabetes mellitus with a late-stage glucagon-like peptide-1 receptor agonist (GLP-1-RA) candidate, reflecting a diversified approach to address various medical needs.

My Analysis & Recommendation

The revaluation of Pfizer into a value stock accentuates market skepticism towards its growth trajectory, exacerbated by the downgraded FY23 revenue outlook. The transition to pre-pandemic growth engines, primarily pivoting towards oncology through strategic acquisitions like Seagen and the approval of Velsipity, delineates a calculated maneuver to reignite growth albeit at the expense of accruing substantial debt. The juxtaposition of Pfizer’s projected 6% to 8% operational growth against Johnson & Johnson’s superior growth exemplifies a comparatively moderate financial recuperation, notwithstanding Pfizer’s earnest efforts.

The evolving market dynamics underscore an imperative for investors to meticulously scrutinize Pfizer’s debt management, the efficacy of its savings program aimed at offsetting financial duress, and the fruition of its oncology-centric growth strategy. Strategically, a diversification into other therapeutic areas alongside oncology could potentiate a more robust financial recovery, mirroring Johnson & Johnson’s diversified growth strategy. The imminent necessity for Pfizer is to navigate the intricate balance between fostering growth via acquisitions and managing a burgeoning debt profile to ensure financial solvency.

Investors might consider a conservative stance, tempering expectations of a swift stock recovery. Don’t count on Pfizer mirroring Meta’s (META) recent rapid and substantial rebound. However, if you are seeking a value-oriented stock with an appealing dividend yield and some resilience during economic downturns, Pfizer could be a viable choice

In light of the aforementioned intricacies, a “Hold” recommendation is posited for Pfizer. The confluence of fiscal, clinical, and market dynamics intertwined with a competitive landscape burgeoning with innovative forays, mandates a cautious optimism towards Pfizer’s financial recuperation and market repositioning.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This article aims to offer informational content and is not meant to be a comprehensive analysis of the company. It should not be interpreted as personalized investment advice with regard to "Buy/Sell/Hold/Short/Long" recommendations. The predictions and opinions expressed herein about clinical, regulatory, and market outcomes are those of the author and are rooted in probabilities rather than certainties. While efforts are made to ensure the accuracy of the information, there might be inadvertent errors. Therefore, readers are encouraged to independently verify the information. Investing in biotech comes with inherent volatility, risk, and speculation. Before making any investment decisions, readers should undertake their own research and evaluate their financial position. The author disclaims any liability for financial losses stemming from the use or reliance on the content of this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.