Summary:

- Pfizer issued a massive warning, cutting revenue targets by $9 billion due to lower-than-expected sales of its COVID vaccine and treatments.

- The company will return 7.9 million oral antiviral Paxlovid treatment courses and record a $5.5 billion non-cash charge for inventory write-offs from Comirnaty.

- Pfizer plans a cost reduction program to deliver $3.5 billion in annual savings, but this program will take years to fully reduce costs.

- The stock likely doesn’t have much downside, but Pfizer won’t likely rally much until the other side of the COVID shakeout.

Joe Raedle

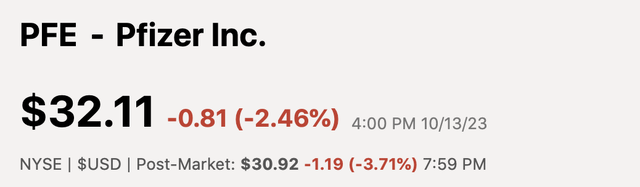

After hours on Friday, Pfizer (NYSE:PFE) dropped a bomb on the market. The biopharma benefitted greatly from COVID vaccine and treatment-related drug sales and the company is getting hit hard by the flip side of those sales disappearing. My investment thesis remains Neutral on the stock as Pfizer has likely hit bottom, but the stock won’t rally with the COVID overhang ongoing.

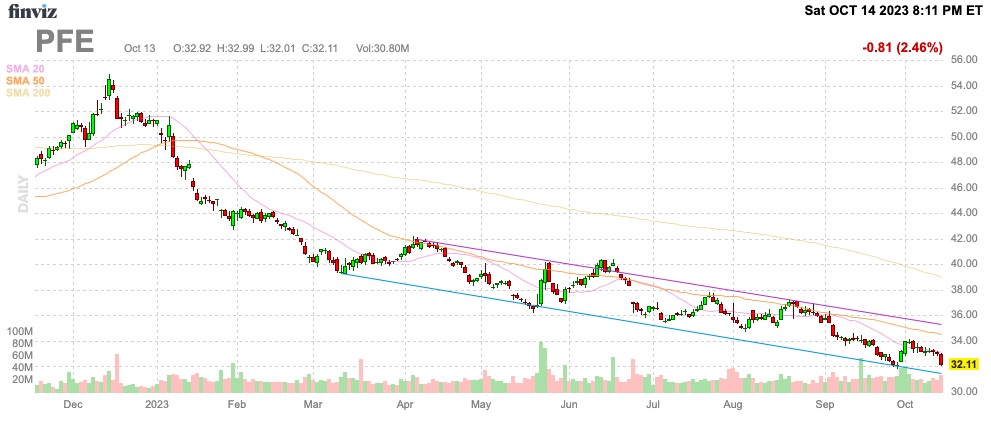

Source: Finviz

COVID Cliff

In somewhat of a shock, Pfizer issued a massive warning to the market after the market close on Friday. The biopharma amended a supply agreement with the U.S. government to return 7.9 million oral antiviral COVID treatment Paxlovid treatment courses at the end of 2023.

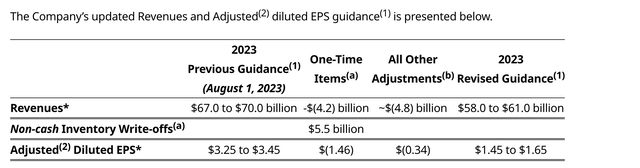

The company cut revenue targets by $9 billion for the year due to the impacts on Paxlovid and Comirnaty sales below forecasts. The troubling part is the return of the Paxlovid treatments only accounts for $4.2 billion of the $7.0 billion revenue hit from Paxlovid.

Source: Pfizer COVID warning release

In addition, Pfizer will record a $5.5 billion non-cash charge due to COVID inventory write-offs from demand below forecasts. The company appears to have incorrectly assumed higher Paxlovid demand from waning vaccine rates when in reality the waning vaccine rates were a sign that potential U.S. patients were no longer worried about catching COVID and needing treatments.

As highlighted by Reuters last week, only 7 million COVID vaccines had been administered to Americans by mid-October. This amounts to only about 2% of the U.S. population have taken the updated vaccine from either Pfizer/BioNTech (BNTX) or Moderna (MRNA) targeted at the XBB.1.5 variant.

The stock fell to only $30 in after-hours trading. Pfizer traded as high as $60 in late 2021 due to the market excitement over surging sales from COVID treatments.

Long-Term Impacts

For any investor questioning the long-term impact of these cuts, Pfizer plans a cost reduction program targeted at delivering at least $3.5 billion in annual savings. The biopharma expects ~$1.0 billion in savings to be realized in 2023 and at least $2.5 billion in 2024.

In total, the company now forecasts the adjusted EPS target for 2023 will fall from ~$3.35 to only $1.55 now. A big part of the EPS hit is the $5.5 billion inventory write-off management shouldn’t actually include in the adjusted EPS targets.

Pfizer spends a lot of time discussing the commercial transition of Paxlovid in November 2023, but the details don’t support the move as beneficial to shareholders. The company wouldn’t need to slash costs by levels supportive of annual revenues remaining depressed if the expectation was for revenues to snap back after the transition to a commercial agreement.

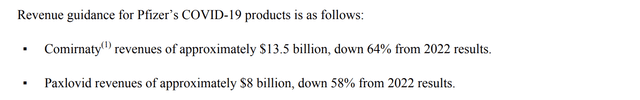

Along with Q2’23, Pfizer had guided to COVID revenues of $21.5 billion for 2023 based on the following numbers:

Source: Pfizer Q2’23 earnings release

The company is now guiding to a revenue hit of $9 billion in the 2H of the year all related to COVID. Pfizer’s total sales for the year are now targeted at just below $60 billion for a company that did slightly below $50 billion in annual sales prior to COVID.

As a reminder, COVID sales were already weak during Q2 due to seasonality. The 1H sales for both Comirnaty and Paxlovid were $8.8 billion suggesting 2H revenues of only $3.7 billion now.

The problem here is that Pfizer would appear to have $12.5 billion worth of COVID drug sales on the books for 2023. The company slashing costs would suggest sales dip further with the massive Q1’23 sales level of $7.2 billion likely set to take a massive hit in 2024.

Pfizer will host an analyst call before the market opens on October 16. The biopharma will hopefully provide better indications of the run rate revenues for 2024 during this call.

The guidance would support sales dipping further in 2024 to account for the 2H sales being closer to the run rate demand for Comirnaty and Paxlovid now that demand for drug treatments for COVID is in decline. The company might not even hand onto annual sales in the $7.4 billion range now.

Pfizer traded in the $30+ range heading into the COVID vaccine and treatment boom. The biopharma earned about $3 per share in 2019, so investors should expect the business to shake out around these earnings per share levels.

The stock could get interesting with the revenue growth potential from the drug pipeline and business development deals. For now, though, Pfizer is likely to remain range-bound as the market shakes off the big disappointment and requisite cost cuts needed to return to the normalized EPS levels.

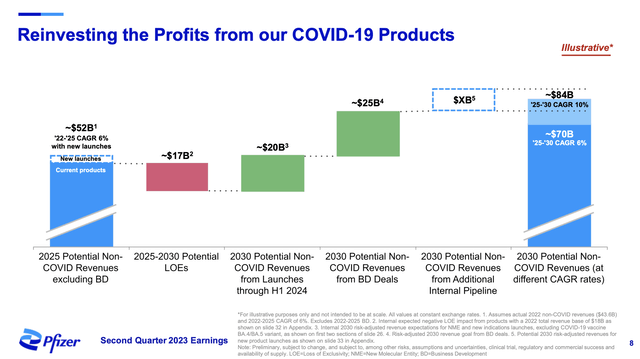

Source: Pfizer Q2’23 presentation

Takeaway

The key investor takeaway is that investors should continue watching Pfizer from the sidelines. The biopharma faces a volatile next few quarters with the shakeout from COVID ongoing. The stock isn’t likely to head much lower, but Pfizer isn’t likely to rally either with so many unknowns on the going-forward business prospects.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The information contained herein is for informational purposes only. Nothing in this article should be taken as a solicitation to purchase or sell securities. Before buying or selling any stock, you should do your own research and reach your own conclusion or consult a financial advisor. Investing includes risks, including loss of principal.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you’d like to learn more about how to best position yourself in under valued stocks mispriced by the market, consider joining Out Fox The Street.

The service offers a model portfolio, daily updates, trade alerts and real-time chat. Sign up now for a risk-free 2-week trial.