Summary:

- PayPal Holdings, Inc. stock is trading at a 6-year low, presenting a compelling opportunity for investors.

- Despite competition and uncertainty, PayPal’s pricing structure provides a margin of safety and potential for substantial returns.

- With its massive scale, PayPal can defend its position without aggressive price hikes, focusing on improving profitability.

FG Trade

Investment Thesis

The PayPal Holdings, Inc. (NASDAQ:PYPL) stock outlook is unappetizing. Grim. Uncertain. Navigating a highly competitive landscape where peers from all corners are encroaching on its turf. What can PayPal do?

Yes, PayPal stock is wound tightly, like a coil, ready to go higher. But thinking in that manner doesn’t do anybody any good. Why?

Because when you say something is tightly coiled, you are priming investors into the expectation that the stock will pop. Soon. And that’s the wrong way to think about investing. The best sort of investing is boring and slow.

The best sort of investing is when you are buying as others are capitulating. When you have no expectations. And you are willing to put in what others can’t: patience.

Therein lies the PayPal opportunity. Accordingly, here’s why I believe that paying 10x next year’s EPS for PayPal is attractive.

PayPal: Only Bad News Now Priced In

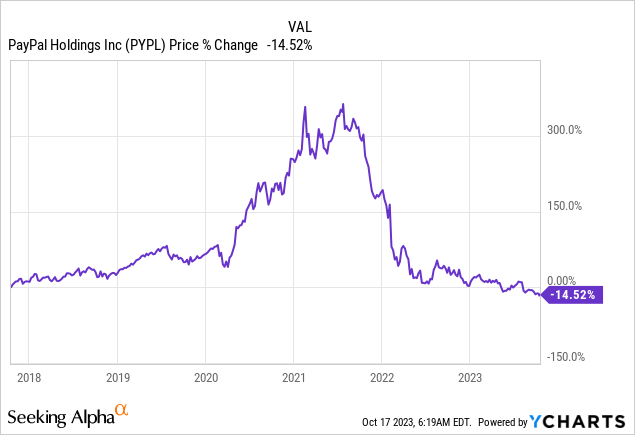

It’s difficult not to marvel at the graphic above. I know I have. I’ve spent my time trying to figure out how exactly PayPal ended trading at a close to a 6-year low?

In hindsight, I can point my finger around at some of the mishaps the company made in the past few years. Probably the most striking blunder would have been PayPal’s eagerness to over-promise on guidance only to fail to live up to it. But that’s one example. There are many more.

But I don’t want to belabor the past. What’s done is done. Now we have to figure out how to move forward.

Where Do PayPal’s Revenue Growth Rates Normalize?

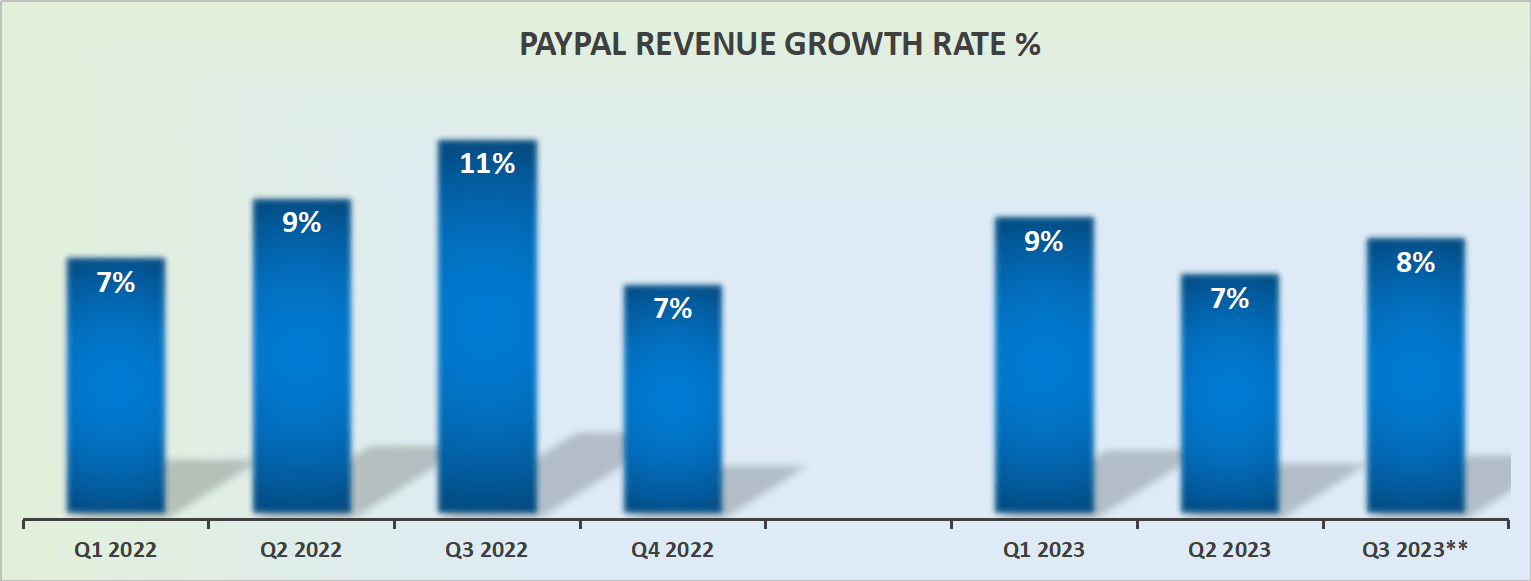

PYPL revenue growth rates

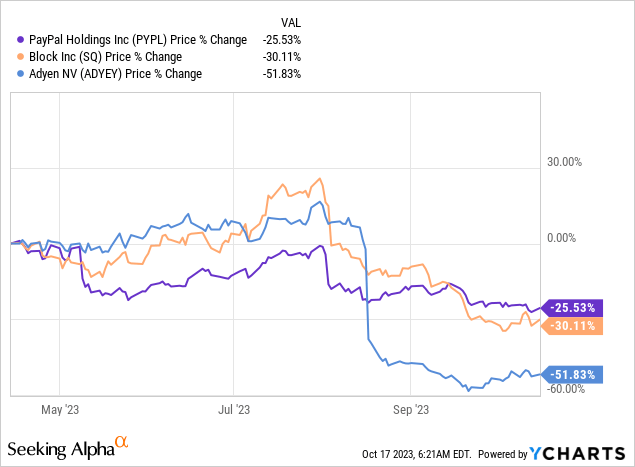

I recognize that PayPal’s revenue growth has matured. I also recognize that PayPal nowadays competes with a myriad of other payment processing solutions. Here are a few peers – and by no means is this an exhaustive list.

- The highly customizable Stripe is highly regarded for its developer-friendly API (application performance interface).

- The cross-border and International-focused Adyen (OTCPK:ADYEY), is tailored for large enterprises and global businesses with complex payment needs.

- Block’s (SQ) Square merchant ecosystem, with much more focus on in-person transactions.

The sentiment facing these different companies is largely the same, there are just too many of them and they are too commoditized. In other words, the market seems to believe, that putting narrative aside, there’s the rationale that they are all having to compete on price and little else.

And whilst I acquiesce to this viewpoint, I have to nevertheless remind readers that PayPal’s pricing structure has plenty of levers providing the business with a large margin of safety. In other words, PayPal doesn’t need to overly aggressively rely on raising its prices to drive its revenues higher.

Instead, PayPal can opt to keep its prices steady and defend its existing position. And by extension, by being priced more attractively, PayPal can cut back on marketing and other operational expenses, with the objective of improving its underlying profitability.

But there’s more to it than this. In plain English, PayPal already has a massive scale, like few of its competitors have. What PayPal believes it can deliver in an effort to distinguish itself from its peers is providing choices to consumers while enhancing its checkout service.

But I digress. The argument I’m in fact making is that readers don’t need to be caught up with all the different moving parts of the fintech world. This stock is cheap enough already that even if its prospects don’t bedazzle investors in 2024, PayPal is still likely to deliver around $6 of EPS in 2024.

This leaves PayPal priced at 9x next year’s EPS. While I recognize that there’s significant competition and uncertainty, I also urge readers to acknowledge that you don’t get a massive global brand priced at 9x next year’s EPS unless the outlook is grim.

The Bottom Line

I firmly believe that PayPal’s current outlook, though painted as unappetizing and uncertain, presents a compelling opportunity for investors.

PayPal’s stock has taken a hit, trading near a 6-year low, largely due to past missteps, but that’s in the past. The key is to look ahead.

Despite PayPal’s matured revenue growth and the competition from various payment processors like Stripe, Adyen, and Square, it’s worth noting that PayPal’s pricing structure provides a margin of safety.

With its massive scale, PayPal can defend its position without aggressive price hikes, focusing on improving profitability. In essence, PayPal Holdings, Inc.’s current valuation, trading at just 9x next year’s EPS, doesn’t reflect its true potential, and even without dazzling prospects, it’s poised to deliver substantial returns, making it an attractive opportunity despite the market’s skepticism.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.