Summary:

- Rivian Automotive has launched another green convertible senior note offering, posing dilution risks to investors.

- The company has raised $1.5 billion in cash through this offering, adding to the $1.3 billion raised earlier in the year.

- Despite progress in scaling production, the increasing reliance on dilutive convertible senior notes makes an investment in RIVN less attractive.

Mario Tama

Rivian Automotive Inc. (NASDAQ:RIVN) has come under renewed pressure after the electric vehicle company launched yet another Green Convertible Senior Note offering that is set to dilute investors. The unexpected issue of yet another Convertible Senior note poses very real dilution risks to investors.

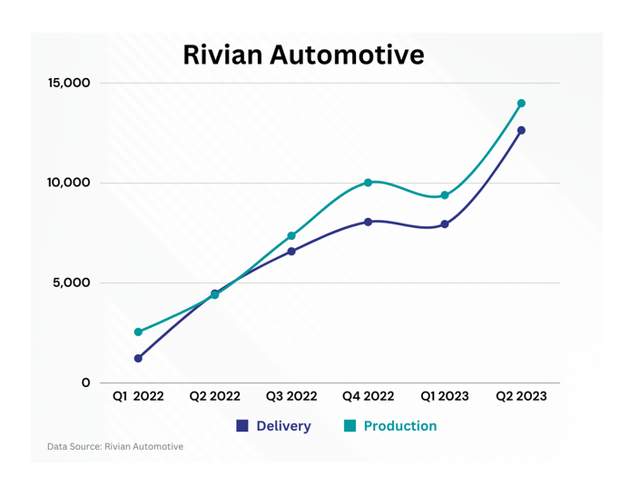

I think that Rivian Automotive is making progress in terms of scaling production (the company delivered 49% QoQ production growth in the second quarter), but an increasing reliance on dilutive Convertible Senior Notes makes an investment in Rivian Automotive less attractive.

With that being said, I think that Rivian Automotive remains a long-term Hold for investors who want to participate in the company’s R1 (S and T) ramp, but I am refraining now from buying the drop.

My Rating History

In March 2023, I added to my investment position in Rivian Automotive after the electric vehicle company said that it launched a $1.3 billion debt offering for 4.625% Green Convertible Senior Notes with a maturity date of March 15, 2029.

Rivian Automotive’s stock drifted towards new 52-week lows at the time and I bought the price drop, believing that the company had enough cash on the books to not precipitate yet another (dilutive) Convertible Notes offering.

However, Rivian Automotive announced yet another offering last week, this time in the amount of $1.5 billion, which yet again caused the EV company’s stock price to crash. With growing dilution risk and a seemingly insatiable appetite for new debt, my new stock classification for Rivian Automotive is Hold.

New Convertible Senior Notes Offering

This is the second time in 2023 that Rivian Automotive is raising cash through a Green Convertible Senior Notes offering. In last week’s debt raise, the company issued 3.625% Green Convertible Senior Notes due 2030 and it included an aggregate principal amount of $1.5 billion.

Rivian Automotive, as I said, already raised $1.3 billion in cash from investors, also through a Green Convertible Senior Notes Offering, in the first quarter. The company is raising debt primarily to invest in the scaling of R1T, R1S, and EDV production.

Rivian Automotive estimates that it will receive $1,486.3 million from the offer. Based on the conversion rate, the initial conversion price is $23.29 and represents a 27.5% premium over the company’s stock price.

Convertibles are dilutive to shareholders, meaning the amount of shares outstanding increases which in turn lowers the amount of earnings that is attributable per share. As such, companies that offer Convertible Notes often experience substantial selling pressure, which is what happened to Rivian Automotive after the debt offer was reported.

Personally, I found it disappointing and frankly disturbing that the company raised so much debt just half a year after it issued its previous Convertibles.

Balance Sheet, Liquidity And Cash Flows

Rivian Automotive is well-financed and has had the cash support of two deep-pocketed financiers Amazon and Ford during its startup phase, but nonetheless, I was blindsided by the Convertible, particularly because the EV company is not necessarily strapped for cash.

Rivian Automotive’s liquidity, as measured by on-the-balance-sheet cash, was $10.2 billion at the end of 2Q-23, and scaling production results in, roughly speaking, a $1.0 billion per quarter cash drain. Despite the comfortable cash cushion, Rivian Automotive raised even more cash to grow production of its R1 electric vehicles, and more Convertibles moving forward are probable, so investors should expect more dilution.

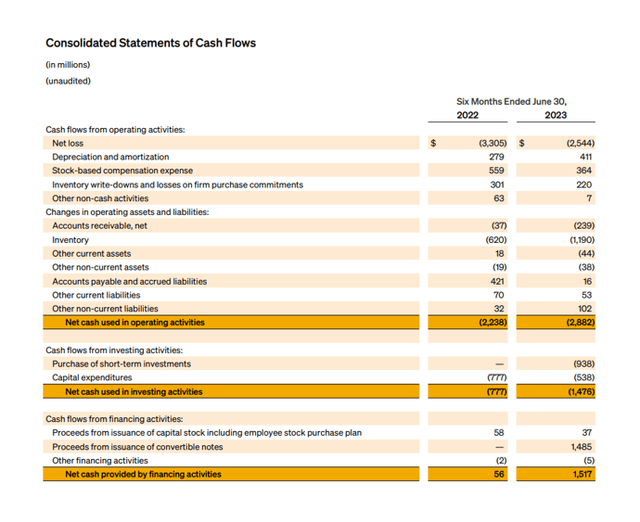

Rivian Automotive’s operating cash flows are negative and should be expected to remain so in the medium term. Though the electric vehicle company produced $1.1 billion in sales in the first half of the present financial year, Rivian Automotive will rely on financing measures, such as Convertibles, to ensure that it will be able to ensure production growth.

Cash Flows (Rivian Automotive)

Rivian Automotive May Be Set To Raise Its Production Target When It Releases Earnings

In 2Q-23, Rivian Automotive increased its production forecast for 2023 by 2K and now expects to produce a total of 52K electric vehicles.

Rivian Automotive had a production output of 16,304 electric vehicles in 3Q-23, reflecting 121% YoY growth. This implies that the EV company produced a total of 39,691 electric vehicle in the first nine months of the year and fulfilled 76% of its 2023 guidance.

Taking into account the triple-digit production growth rates on a YoY basis in the previous two quarters, I think that Rivian Automotive is set to raise its full-year production target when the company releases third quarter earnings in the first week of November.

Taking into account the 2023 production uptick, I think that Rivian Automotive could raise its guidance from 52K to a new range of 55-56K for the full year.

Production And Delivery (FXCM)

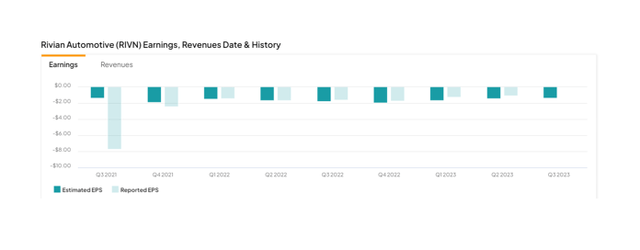

EPS Expectations For 3Q-23, Valuation Multiple

According to Tipranks’ estimates, Rivian Automotive is forecast to report a third quarter loss of $1.34, but losses are expected to narrow compared to the year-ago period.

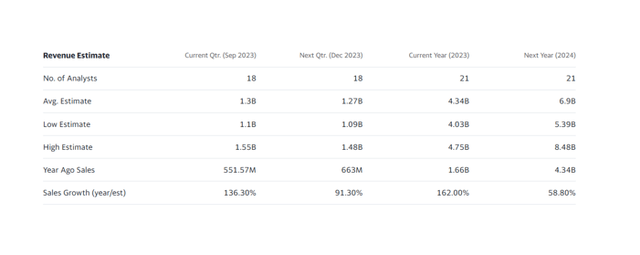

The market presently models $4.34 billion in sales for Rivian Automotive for this year which leads us to a sales multiple of 4.1x. Tesla Inc. (TSLA) sells for twice this multiple: 8.2x.

Though Rivian Automotive has seen robust production growth in the first two quarters and the company has upside as it scales production, I am more cautious than at the beginning of the year since I find that management could have been more straightforward about a follow-up Convertible Notes offerings.

Revenue Estimate (Yahoo Finance)

Why Rivian Automotive Could See A Lower/Higher Valuation Multiple

Though the speed of production growth has improved in 2023 and production risks have decreased as a consequence, the risk of dilution simultaneously increased, particularly after the company did its second Convertible.

The company may continue to offer Convertible Notes to investors in 2024 as it scales its R1 production which would further increase the share count and dilute investors.

My Conclusion

Rivian Automotive reported its second Green Convertible Debt offering in a short period of time. The debt offering adds new cash to Rivian Automotive’s balance sheet at a time when the company is laser-focused on scaling its production of R1Ts and R1Ss.

Though the company has made progress in growing production and Rivian Automotive could easily surprise shareholders with a raised production target for 2023 in 3Q-23, I think that dilution risks and growing share counts are now a serious concern and impact the investment thesis in a negative way.

While I think that Rivian Automotive is a long-term Hold for investors looking for a fast-growing EV play in an increasingly crowded industry, I think that management could have done a better job in guiding investors through its plans to raise dilutive debt.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of RIVN either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.