Summary:

- Pfizer slashed its FY23 adjusted EPS outlook by nearly 54% due to one-time charges and a sharp reduction in revenue outlook.

- The company no longer expects a midpoint revenue outlook of $68.5B, downgrading it to between $58B and $61B.

- Despite the guidance change, Pfizer remains optimistic about the long-term opportunities for its COVID franchise.

- I assessed that the clarity provided by management is finally in sync with what the market has anticipated, given the hammering in 2023. Pfizer was too optimistic at the start of 2023.

- With PFE already in washed-out status, I argue why the updated guidance should help PFE bottom out finally, as it didn’t collapse below its September lows.

JHVEPhoto

I can hardly blame Pfizer Inc. (NYSE:PFE) investors for feeling frustrated. After seeing PFE topping out in December 2022, the market has correctly anticipated that Pfizer could be mired in a substantial COVID growth normalization phase. Notwithstanding management’s initial confidence in 2023, Pfizer’s recent sharp guidance revision last week justified the market’s pessimism. While I remained bullish over PFE, my mean-reversion thesis has yet to play out accordingly, given the COVID revenue uncertainties.

Accordingly, Pfizer reduced its FY23 adjusted EPS outlook from a midpoint of $3.35. The revised guidance range between $1.45 and $1.65 suggests a midpoint metric of $1.55, down nearly 54% from its initial midpoint outlook. The company highlighted one-time charges (primarily on inventory write-offs) and a sharp reduction in revenue outlook, leading to a significant revision in its guidance.

Accordingly, Pfizer no longer expects a midpoint revenue outlook of $68.5B. The revised revenue outlook is expected to be between $58B and $61B, resulting in a midpoint guidance of $59.5B. Most of these reductions are related to the overstatement of the revenue attribution from its COVID franchise, given the adjustments with the US government.

With that in mind, I believe management has sought to clear the air before its upcoming third-quarter or FQ3 earnings release on October 31. It’s the right move that could help the “washed-out” PFE stock finally form a robust bottoming process for its subsequent recovery. Makes sense?

Management updated investors in a conference call yesterday (October 16) as it elaborated on the critical aspects of its COVID franchise and cost-cutting programs.

While Pfizer is expected to incur one-time restructuring charges of about $3B, it has also identified cost savings of approximately $3.5B through 2024. In addition, Pfizer expects the Seagen acquisition to be unaffected by the recent guidance change as Pfizer looks to shake off the COVID growth headwinds.

Notwithstanding the near-term hit, Pfizer is optimistic about the long-term opportunities for its COVID franchise as it moves into the commercial market. As such, management remains confident about its $30B long-term outlook as Pfizer looks to increase its vaccination rates in line with the annual flu market with COVID-flu combination vaccines.

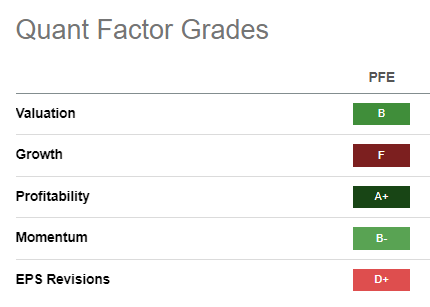

PFE Quant Grades (Seeking Alpha)

As seen above, the market has reflected significant pessimism on PFE’s valuation, with a “B” grade assigned by Seeking Alpha Quant. While it’s expected to take a near-term profitability hit in the second half, it helps Pfizer’s cost base to potentially bottom out this year and inflect in 2024 after reflecting these one-time charges.

While moving toward the commercial market is filled with significant uncertainties, I have confidence in Pfizer’s long-term COVID target, providing upside optimism. As such, while the market could remain cautious as Pfizer makes the necessary transition to the commercial scene, peak pessimism is likely reached or even close, given the recent guidance downgrade.

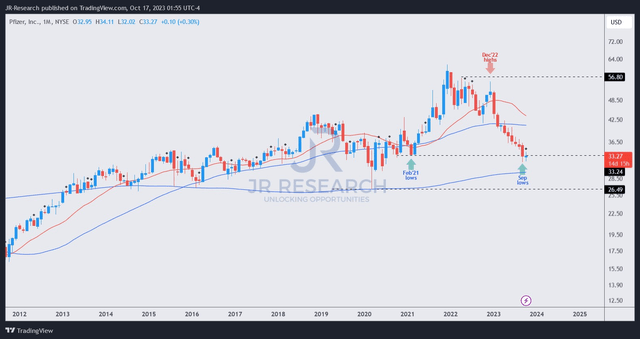

PFE price chart (weekly) (TradingView)

As seen above, PFE didn’t break down below its September lows ($31 level) despite the guidance change last week. As such, it suggests that the market had already anticipated PFE’s guidance revision, focusing on its recovery from 2024. Moreover, PFE’s price action suggests that a bear trap (false downside breakdown) could happen over the next few months if buyers can defend the current levels robustly.

In other words, I gleaned that unless Pfizer still needs to make significant changes to its guidance subsequently, the recent management update should finally be adequate to help its stock bottom out. Investors need clarity to assess the resilience of Pfizer’s COVID revenue, and I believe they likely got what they needed over the past week.

Rating: Maintain Strong Buy.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!