Summary:

- Nvidia Corporation stock is down nearly 5% as the U.S. government tightens semiconductor curbs to weaken China’s AI progress.

- The move was not unexpected, as the U.S. government had previously warned of a possible escalation in its review.

- Nvidia’s growth opportunities remain significant, but near-term downside should be anticipated due to geopolitical headwinds.

- I argue why Nvidia investors must watch the $400 support zone carefully. If sellers were to break that level decisively, more pain could be in store.

- Since August, Nvidia buyers have not lifted its momentum above the $500 level. While I want to buy more, I’m not keen on these levels.

Justin Sullivan

Nvidia Corporation (NASDAQ:NVDA) stock is down nearly 5% today at writing. At one point earlier this morning (October 17), it was down more than 6% as the U.S. government decided to extend its semiconductor curbs to weaken China’s AI progress further.

However, such a move shouldn’t be unanticipated, as the U.S. government had previously highlighted a possible escalation in its review. Furthermore, the surprise progress demonstrated by Huawei recently with its 7nm process P60 Pro smartphone likely expedited the move.

While weakness was experienced broadly across Nvidia’s semi-peers, it led most losers, given its AI exposure and expensive valuation. Nvidia CFO Colette Kress articulated in a September conference that “approximately 20% to 25% of Nvidia data center revenue is associated with its China business.” However, she highlighted that the U.S. government’s restrictions have not “affected short-term demand.” Despite that, Kress cautioned that “long-term impacts are possible depending on future changes.”

Nvidia’s clarification earlier this morning indicates “no meaningful impact” in the near term. Despite that, the market’s adverse reaction suggests that investors are concerned about how Nvidia could navigate these challenges, which could scupper its growth drivers in the H800 and A800 shipments to its Chinese customers. Accordingly, Nvidia “will be required to notify the U.S. government before selling chips that fall below the controlled threshold,” including the 800-series chips highlighted above.

Notwithstanding the caution, investors must remember that this isn’t the first time Nvidia has been caught in geopolitical headwinds. Also, the data center opportunity underpinning the growth in accelerated computing is still in the nascent stages. Recall the $1T total addressable market, or TAM, of x86 servers Nvidia is looking to capitalize, which could spell trouble for Intel (INTC) and Advanced Micro Devices (AMD). Hence, I believe the growth opportunities for Nvidia remain significant, although near-term downside should be anticipated, given NVDA’s growth premium.

The silver lining is these headwinds aren’t company-specific. As such, even AMD is expected to be hit. While Nvidia’s AI chips leadership is formidable, it’s not immune to a robust challenge by AMD. However, AMD has not convinced investors that it is ready to unhinge Nvidia’s hegemony. A recent report by The Information suggests that transitioning from Nvidia’s end-to-end tech stack underpinned by its CUDA software ecosystem is easier said than done. As such, I believe execution risks are much higher for AMD to justify, allowing Nvidia the time and opportunity to extend its leadership further.

However, investors must pay close attention to the moves by hyperscalers looking to diversify their reliance on Nvidia for AI chips. Nvidia’s move with its DGX cloud service has also unnerved Amazon (AMZN) Web Services (AWS), as the cloud computing leader moved further with its Tranium and Inferentia AI chips. Despite that, the AI chip opportunity is expected to broaden to other verticals, industries, and edge computing, suggesting Nvidia is well-primed to capture the potential upside.

Notwithstanding my optimism, investors must also question whether NVDA’s growth premium is still reasonable for them to continue adding exposure at the current levels. Or should they wait for a much steeper pullback before buying more shares?

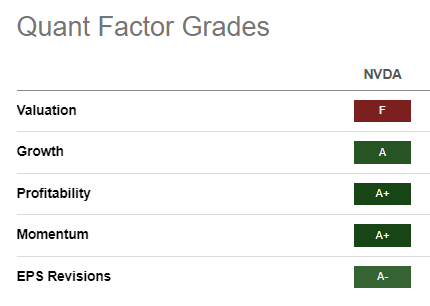

NVDA Quant Grades (Seeking Alpha)

With an “F” valuation grade, NVDA isn’t cheap. However, with best-in-class grades over its sector peers for the other grades, I believe NVDA Bulls would likely argue that its growth premium is justified. Let’s look at whether recent buying sentiments remain constructive or suggest a steeper pullback could be over the horizon.

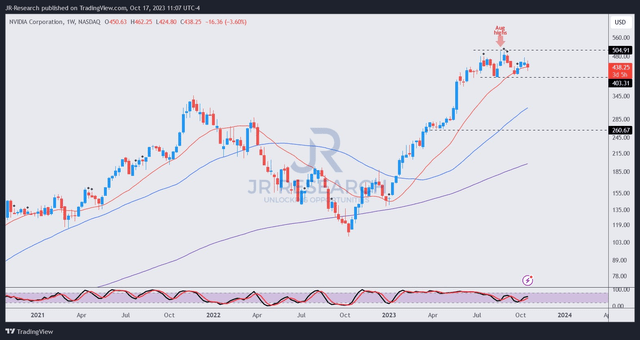

NVDA price chart (weekly) (TradingView)

As seen above, NVDA has struggled to regain control of the $500 resistance level since its August earnings. I assessed that NVDA’s price action suggests its buying sentiments heading into its November earnings release have turned more cautious.

Buyers didn’t seem keen to lift its upward momentum much further, as NVDA has continued consolidating over the past two months. While it may mark an accumulation zone, NVDA’s long-term price action resembles a distribution phase preceding a steeper pullback. If sellers were to breach the $400 zone, it could open up a more pronounced pullback before consolidating.

Could the recent news regarding the U.S. government’s bid to curtail China’s AI ambitions finally intensify the selling pressure on NVDA? While I’m not bearish on Nvidia Corporation as it remains in an uptrend, I believe more attractive opportunities could be in store if buyers remain patient.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of NVDA, INTC, AMD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!