Summary:

- Investors buy AT&T mostly for its dividend.

- AT&T’s long-held status as a Dividend Aristocrat was lost last year, and there are reasons to believe that the dividend will remain under pressure in coming years.

- AT&T struggles to grow, has vast amounts of debt and has been diluting shareholders in the past decade.

- In this analysis, I discuss the reliability of AT&T’s dividend.

Ronald Martinez

Even Benjamin Graham liked AT&T for its dividend

I’ve had trust issues with dividend stocks since AT&T (NYSE:NYSE:T) slashed their dividend in the wake of the Warner Bros. (NASDAQ:WBD) spin-off. I sold my shares shortly thereafter. I’m glad I did, because the stock price has gone nowhere but down since then, in line with the 5 YR and 10 YR trend.

Now the good thing is you can now buy the shares and get pretty much the same dividend as you could before the spin-off.

Buying AT&T for its dividend would be no new phenomenon. According to Alice Shroeder’s biography on Warren Buffett (“The Snowball“), at one point in his long investing career, Benjamin Graham started buying shares of AT&T. This move puzzled Warren Buffett, then Graham’s apprentice. Graham had always bought the “cigar butt” type companies no one else wanted – not blue chips like AT&T. It turned out Graham was about to retire and had bought AT&T to preserve his capital and receive the dividends. This was in the 1950s.

More than 70 years later, many investors are still considering AT&T a safe haven blue chip with a strong dividend. However, this reputation is under pressure, and in 2022 AT&T lost its “Dividend Aristocrat” status. This of course leaves the question whether AT&T can turn things around and once again establish itself as a leading dividend stock. As I will be discussing in detail below, I have my doubts: The company struggles to grow top and bottom lines with debt weighing on its balance sheet, and even after examining future prospects, I am left on the bearish side.

This is why I think you’re paying for the dividend yourself

AT&T has vastly more long-term debt sitting on its balance sheet now than it did 10 years ago. AT&T only started decreasing its debt load in 2020-2021, and has been able to continue paying down the debt since then – in part through the spin-off of WBD (numbers from Seeking Alpha):

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTM |

| Debt (USD, ~billions) | 77 | 122 | 118 | 128 | 167 | 149 | 152 | 150 | 133 | 128 |

The recent focus on repaying debt doesn’t hide the fact that the face value of AT&T’s debt is higher than the total equity tranche of AT&T’s capitalization currently priced at approximately $100 billion. It also doesn’t hide the fact that AT&T has struggled to bring down the total interest expense regardless of the lower debt (numbers from Seeking Alpha):

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTM |

|

Interest (USD millions) |

3,613 | 4,120 | 4,910 | 6,300 | 7,957 | 8,422 | 7,727 | 6,716 | 6,108 | 6,296 |

Much of AT&T’s debt was taken on to fund acquisitions, the largest of which were the purchase of DirecTV in 2015 and Time Warner in 2018. DirecTV has later been exited partly at great expense to shareholders, not least because the revenue and earnings from that division is now gone while the debt from the transaction is still there. The same holds true for Time Warner which became a separate company in 2022.

Adding to this is the fact that AT&T has gradually increased its shares outstanding. When the number of shares outstanding is increased, remaining shareholders own a relatively smaller part of the assets of the company. With the combination of shares outstanding increasing and debt having increased over time, you’re sharing the pie with more and more other investors (numbers from Seeking Alpha):

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

|

Shares (~billions) |

5.2 | 5.6 | 6.2 | 6.2 | 6.8 | 7.3 | 7.2 | 7.2 | 7.2 | 7.2 |

It should be noted, however, that if not rounded the shares outstanding is now slightly lower than it was in 2020.

So while you’re getting a dividend cheque every quarter, you’re also seeing a gradually increasing equity and debt claim against the assets that you own a residual share of. Imagine you did this with your personal finances. You take out a loan from a bank merely to pay yourself a quarterly amount with money from that loan, or you dilute your interest in an asset by allowing in more co-owners all the time. Would this make you better off financially?

I guess issuing shares and taking on more debt would be reasonable if the company was growing. At least then they’d have more cash to service the stakeholders. But revenues are basically flat measured against that of 10 years ago. Some of that is attributable to sell-offs and write-downs. But the debt is still there, and so are the new equities issued. This is the development of AT&T’s revenue (numbers from Seeking Alpha):

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | TTM |

| Revenue (USD ~billions) | 133 | 147 | 164 | 161 | 171 | 181 | 143 | 134 | 121 | 121 |

As noted, AT&T’s net income has also decreased in recent years and are currently in the negative. Much of this is attributable to write-downs and other accounting methods. The table below illustrates the development (numbers from Seeking Alpha):

| Year | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | 2020 | 2021 | 2022 | 2023 |

| Net income (USD ~billions) | 6.4 | 13.4 | 13.0 | 29.5 | 19.4 | 13.9 | (5.2) | 20.1 | (8.5) | (8.8) |

In my opinion, with a general trend of diluting shareholders through issuing shares, and a trend to borrow and thereby tying assets to loans and committing to interest payments – without growth following from that – as a shareholder you’ve basically let your assets lose value in exchange for receiving a cash dividend.

Even with the unfavourable developments that I have highlighted here, it’s obvious that AT&T’s position as a top wireless carrier and other assets make AT&T still a very valuable company.

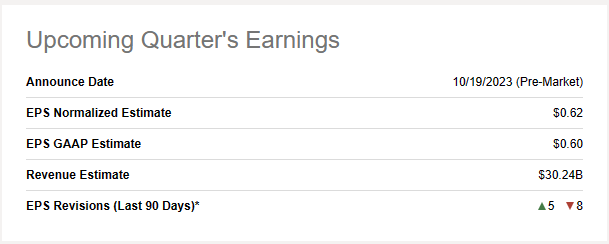

Going forward, AT&T will have to try and reverse the situation. For the upcoming quarter – to be reported in a couple of days – the revenue estimate is $30.24 billion. This, however, is very much in line with what AT&T turned over per quarter before the DirecTV acquisition, which was also around $30 billion a quarter:

Seeking Alpha

Much of AT&T’s revenue growth in the years 2016-2019 was due to the DirecTV acquisition. Before that and after the spin-off, AT&T’s “old-school” core business areas such as cell phone service and broadband have had to drive the revenue growth. But going forward, I don’t see those areas suddenly delivering more growth than they have been for years. Therefore, I would expect AT&T’s revenue to develop positively in the low single-digits over the coming years. Once AT&T gets all the accounting friction from DirecTV and Time Warner (write-downs etc.) out of the way, I would expect net income to follow suit and also grow in the low single-digits – at least when assessed over a multi-year period. One thing that I will be following with particular interest in the years ahead is whether AT&T will once again attempt to buy their way into growing. They’ve struggled to do so in the past as demonstrated by the acquisitions mentioned here. But it’s one classic way to attempt to push growth for companies that generate lots of cash but can’t seem to grow the core business.

In the following, I will attempt to assess what the developments outlined here mean for the value of the stock.

The value of AT&T shares

AT&T currently trades at a forward P/E of ~6.

This appears a low earnings multiple, but if you accept the premise that AT&T is mostly bought for its dividend, then justifying even that price is going to require some growth in the dividend.

To arrive at a fair price estimate for AT&T, I’ll use the “H-Model” variant of the dividend discount model (DDM). The H-Model is used to estimate the present value of future dividends. Unlike the classic DDM, it assumes an initial stage of high dividend growth, and a subsequent stage of low growth.

For the high growth stage, I assume dividend growth of 1 % a year. That’s not a lot, but AT&T hasn’t grown its dividend at all recently in order to focus its vast free cash flow generation (more than $12 billion for 2022) on debt repayment. For the purposes of this analysis, I assume that this high stage is 5 years. For the low growth stage, I’m assuming a perpetual 0.5 % dividend increase. The required rate of return is set at 9 %, somewhat in line with the general market.

Under these assumptions, each share of AT&T should trade at $13.29, or a forward P/E of ~5.5. This is much in line with the current share price, albeit slightly lower, suggesting modest overvaluation.

How I could be wrong

The investment thesis laid out here calls for caution with the AT&T stock because of its growth trouble and the increase in debt and equity. Buying a stock for its dividend when growth lacks and debt and equity are increased seems a poor strategy to me.

Having said that, there’s “risk” in that thesis in the sense that it could be wrong for a number of reasons.

First of all, there’s the price. The forward P/E of AT&T is less than 6. Even for a no-growth company, that’s very low. With a price tag like that, it’s possible that even under pressure, the company could be undervalued. If AT&T starts actually growing its top and bottom line sustainably, the stock is clearly undervalued as almost no growth appears priced in. I just doubt it will grow much on a per share basis.

Secondly, AT&T clearly has a moat in the telecommunications sector. It’s hard to imagine anyone really succeeding in taking on the few companies dominating telephone communications – AT&T, Verizon (NYSE:VZ) (which, by the way, is a former AT&T group company) and T-Mobile (NASDAQ:TMUS). Also, within broadband and fiber services, AT&T has an equally strong position. AT&T even managed to outcompete Google when Google entered the fiber market only to pause expansion shortly thereafter. AT&T simply lowered prices and upped their offerings.

The combination of a low P/E (low to no growth expectations) and strong positions in its market could make AT&T a traditional value stock – or a value trap, depending very much on the development in the years ahead.

Key takeaways

AT&T is a well-known dividend stock that has been famous for its dividend for decades. It recently lost its “Dividend Aristocrat” status as it failed to keep increasing dividends in the wake of the WBD spin-off and its increased focus on repaying debt.

It appears the dividend could still be under pressure in coming years. AT&T has gradually increased its shares outstanding, and debt loads – although decreasing – are considerable. AT&T has had a hard time pushing down the level of interest expenses. The combination of dilution from issuing shares and the fact that AT&T has taken on significant debt without growing top and bottom lines as a result make me conclude that as a shareholder, you’re basically paying the dividends yourself through the relative increase in claims against the assets you residually own as a shareholder.

Assessing the stock value using the H-Model (modified DDM) confirms this assumption. With little to no growth, the stock appears slightly overvalued by the market as I’ve estimated a fair price at just above $13 per share.

Of course, on an absolute basis, a P/E of ~6 is relatively low. With just about no growth priced in, I could be proven wrong if AT&T starts consistently growing top and bottom lines.

But even with AT&T’s strong position in its core markets, I think AT&T has too much debt and too little proven growth to be a worthwhile investment at this point.

For the reasons stated above, I rate AT&T a Sell.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.