Summary:

- Bank of America Corporation reported fairly strong Q3 numbers, surpassing both EPS and revenue expectations.

- Net interest income was high as expected but is beginning to flatline.

- Consumer spending power is falling and alarmingly at that.

- But the stock is trading at 20% discount to its book value, backed by a solid 3.50% yield.

Brandon Bell

Bank of America Corporation (NYSE:BAC) has just reported its Q3 earnings, as Seeking Alpha has reported here. EPS beat estimates by 8 cents while revenue beat by $130 million. The stock is up about 1% pre-market as of this writing. Judging by the market’s somewhat muted reaction, it sounds like an “okay” report. But let’s dig deeper.

My most recent coverage on Bank of America was in July reviewing the company’s dividend increase. Since then, the stock has lost about 5% (including dividend) compared to the market’s 0.50% loss. With that background out of the way, let’s review The Good, The Bad, and The Ugly from Bank of America’s Q3 report.

The Good

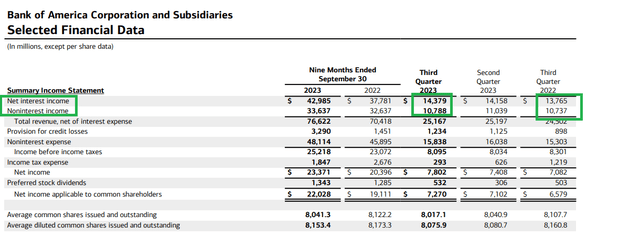

- Bank of America’s Q3 revenue of $25.2 billion was its 2nd highest (slightly behind Q1 2023’s $25.3 billion) at least since December 2020. Net interest income went up nearly 5% YoY thanks to the Federal Reserve and it should comfort BAC investors that rates are expected to stay high at least, if not go higher.

- EPS of 90 cents/share went up 11% YoY and was almost 10% above the consensus. This pushes the stock’s FY 2023’s forward EPS to at least $3.46, giving the stock a forward multiple of 7.80. Add the 3.50% yield, backed up the dividend increase covered above, and it is easy to see why the stock appears enticing here. Especially after losing 20% YTD in what many considered to be favorable environment for banks.

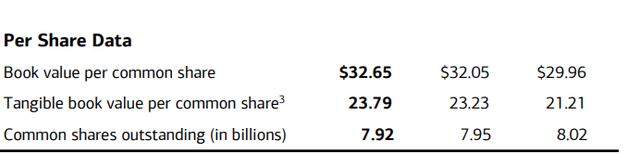

- Book value per share went up 9% YoY to reach an impressive $32.65. While that sounds attractive compared to the market price of $27, let’s not forget that banks have been priced notoriously low compared to their book values in the past.

BAC Book Value (investor.bankofamerica.com)

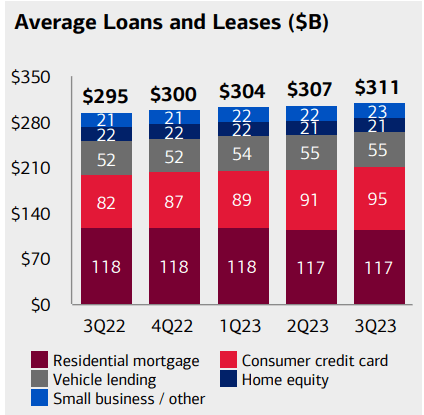

- Bank of America, largely seen as “the system” and “one among the big boys,” is actually doing quite well when it comes to getting business from the smaller guys (no pun intended). The company reported that Q3 2023 was the 35th consecutive quarter (almost 9 full years) where its net new Small Business checking accounts grew in number. Bank of America is also the #1 Small business lender according to FDIC (page 11) and it shows in the recent numbers as Small business loans overtook Home equity loans in value in the last two quarters.

BAC Avg Loans (investor.bankofamerica.com)

The Bad and The Ugly

- While the revenue reported was the 2nd highest in recent times as mentioned above, it meant just a 3% YoY growth. Non-interest expenses kept pace with that and increased 3% YoY as well.

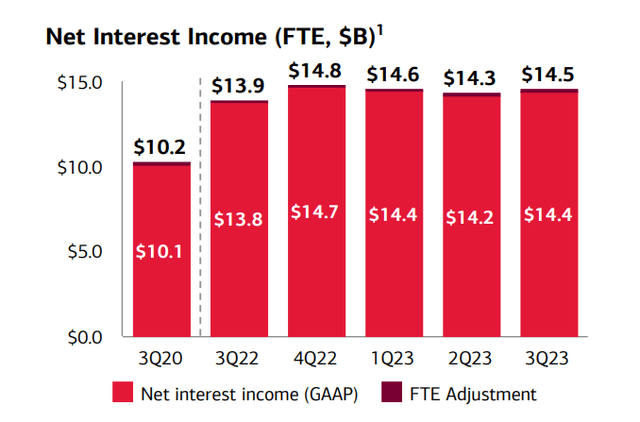

- Non-interest income went up just 0.50%. This should concern investors about the bank’s growth (or lack of it) when the high-interest environment subsides or even retreats. Status quo doesn’t last forever. Just ask the companies that borrowed too much before the Federal Reserve tightened. It should also be noted that Bank of America’s Net interest income has already started flatlining over the last 4 quarters, as shown below.

NII Flattening (investor.bankofamerica.com) BAC Income Statement (investor.bankofamerica.com)

- Global Wealth and Investment Management’s net income decreased significantly YoY for the third consecutive quarter this FY. It went down 19% in Q1 2023, 15% in Q2 2023, and 13% this time in Q3. This also brings into question the state of the global economy if a large wealth management firm like Bank of America is facing pressure in this area.

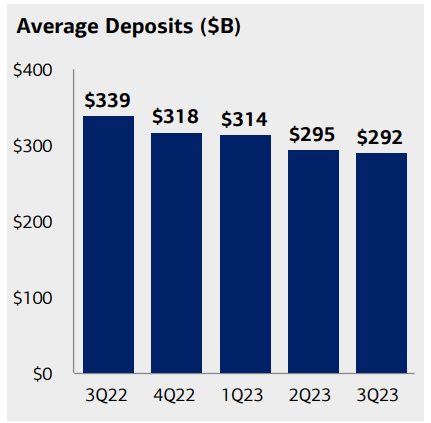

BAC Wealth Mgmt Deposits (investor.bankofamerica.com)

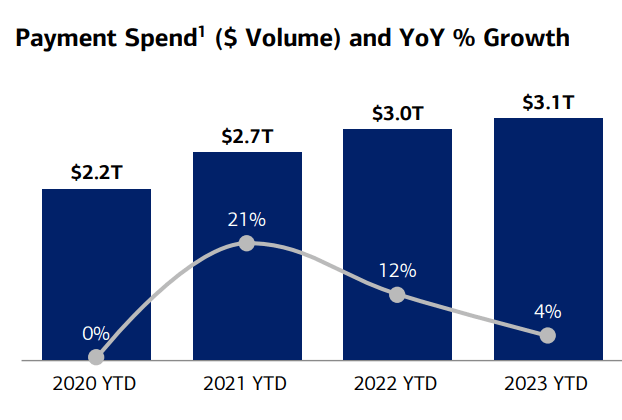

- It has been known for a while that Consumer spending has been tightening. But Bank of America’s Q3 report made me realize the extent to which the spending power has fallen. While 2023’s YTD personal spending has still increased by 4%, the trend is clearly down and down alarmingly from 21% to 12% to 4% over the last 3 years.

Consumer Spending (investor.bankofamerica.com)

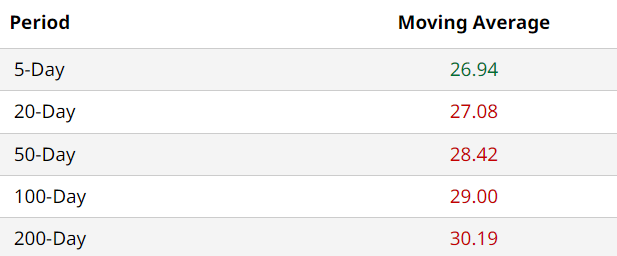

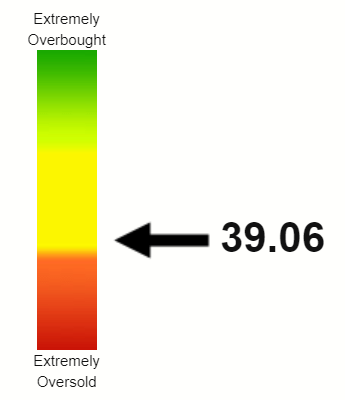

- This is not just about the Q3 report but also the stock’s recent trend. BAC stock’s moving averages are progressively lower as shown below, and that suggests the stock is in downtrend with on clear bottom yet. Income-oriented stocks and bank stocks have been under pressure the last few months, and should that continue, I can see the stock going way below the oversold sold. Its Relative Strength Index [RSI] of 39 also confirms the stock is not having much buying momentum. I don’t believe Q3 came out strong enough to shake the stock off of its recent slumber.

BAC Stock Moving Avgs (barchart.com)

BAC RSI (stockrsi.com)

Conclusion

The current high interest rate environment is a double-edged sword for banks. While they get higher interest payments from their borrowers, they need to pay a higher rate to their depositors as well (although this spread is in their favor). More importantly, higher rates have a detrimental effect on the borrowing capacity of most individuals and small to medium-sized businesses. While Bank of America seems to be executing well within its realms, the macroeconomic conditions will likely determine how the market values the stock.

However, at nearly 20% discount to book value, while paying a solid 3.50% dividend, Bank of America Corporation stock appears like a good risk reward to me. I retain my “Buy” rating on the stock. Q3 wasn’t a blockbuster for BAC, but it wasn’t a dud, either. It proved that Bank of America can operate successfully in the current environment, which is expected to last a while.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.