Summary:

- JPMorgan Chase beats analyst expectations with strong revenue and profitability growth in Q3 2023.

- The bank maintains solid credit quality and raises expectations for FY interest income to $89 billion.

- Concerns about Basel III uncertainties and CET1 headwinds are pressuring JPMorgan’s stock price.

- I feel encouraged to reiterate my price target with more than 50% upside. I am upgrading JPMorgan to a “Strong Buy”.

Michael M. Santiago

JPMorgan Chase (NYSE:JPM) did it again: The bank posted a set of super strong Q3 results, beating analyst consensus on both revenue and profitability estimates. In the September quarter, the U.S. largest bank managed to score a 19% and 40% YoY growth in revenues and EBT, respectively. And while JPMorgan’s September quarter was already very strong, the bank raised expectations for FY 2023, with interest income now estimated at $89 billion. On the credit, liquidity, and capital side, everything looks solid — in fact, likely much better than some analysts have expected. The only major concern currently pressuring JPMorgan’s stock price relates to Basel III uncertainties and connected CET1 headwinds. However, at a consensus forward P/E of 8.7x, I argue investors have priced any headwinds excessively; and it is time to price JPM stock again based on business quality and earnings power.

On the backdrop of a leading global business franchise, strong earnings, solid capital returns to shareholders, and a cheap relative valuation, I am upgrading JPMorgan to a “Strong Buy”.

JPMorgan Beats Expectations, Again

In the third quarter of 2023, JPMorgan continued to demonstrate the impact of a favorable rate environment, combined with a solid operating model to leverage the interest tailwind into earnings. From June through September, the largest U.S. bank generated around $38.4 billion in total revenues, marking a strong 19% year-on-year growth compared to the same period the previous year. On a quarter-over-quarter basis, revenues increased by 8%, implying a 36% growth on a compounded annualized basis. That said, JPMorgan’s revenue surpassed analyst expectations by nearly $450 million, as per estimates collected by Refinitiv.

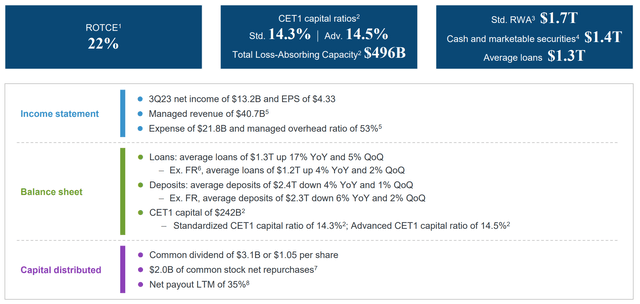

Regarding profitability, JPMorgan reported a quarterly profit before taxes of $16.7 billion, surpassing analyst consensus by approximately $1.4 billion and representing a year-on-year growth of almost 40% compared to Q3 2022. In Q1 2023, JPMorgan achieved a post-tax return on tangible shareholders’ equity (ROTE) of about 22% (vs. 11-12% industry median) and maintained a cost-to-income ratio of 52%, in line with the previous year, but on higher revenue.

On the balance sheet side, JPMorgan continues to show strength: Deposits were down only 4% YoY, and 1% QoQ, despite the ongoing pressure from high-yielding deposit-like alternatives such as short-dated fixed income securities, and despite a slow repricing of deposits. Notably, JPMorgan is currently paying an average remuneration on interest-bearing deposits of approximately 2.5%, up only 0.7% from the same period one year earlier. For reference, Citi (C) is paying a comparable remuneration of 3.4%, almost 100 basis points higher.

In that context, JPMorgan’s CFO Jeremy Barnum said in the earnings call that the deposit repricing is slower than previously assumed; although CEO Jamie Dimon added that

[on deposit repricing] we have a big debate inside this company. I personally think it will happen a little bit sooner than Jenn and Marianne and Jeremy

… We’re not predicting when it’s going to happen … [but once it is happening] we’re going to compete to keep customers. If that means repricing deposits we’re going to do it but we’re going to do it as a function of the competitive environment.

The deposit beta is certainly a debate that remains highly relevant for bank investors, especially as Jamie Dimon commented that he believes banks are currently overearning on the NIM spread, and rates may likely have started to peak. However, I would like to point out that neither of these considerations necessarily imply peak NIM for banks. According to my expectations, even with peak rates and a gradual increase in deposit beta, banks’ margins stand to benefit from repricing in the asset portfolio, most notably loan holdings that were priced in the low interest rate era. As these assets mature, banks may roll over their low-priced asset book at considerably higher rates, pushing profitability upwards.

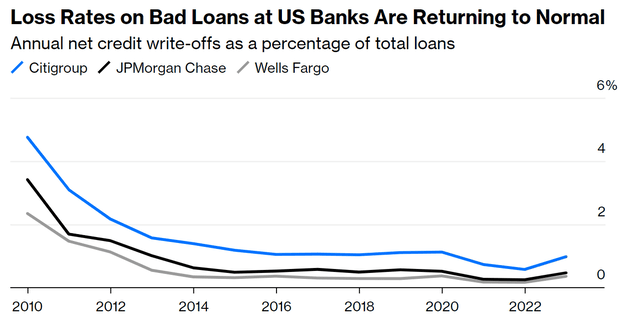

Another important consideration in the earnings discussion relating to interest income is JMP’s strong credit quality on the bank’s loan holdings. As of Q3 2023, JPMorgan, and other banks as well, have not yet faced substantial pressure arising from loan losses, as the much-feared expected repercussions of higher interest rates on consumers and the wider economy have yet to materialize. To provide further context, in the third quarter of 2023, JPMorgan earmarked a relatively modest $1.5 billion for provisions related to anticipated credit losses. While these provisions saw a QoQ increase of 6%, it’s important for investors to recognize that JPM’s write-offs, as a proportion of total loans, remain consistent, if not below, with the patterns observed prior to the onset of the pandemic. Currently, JPMorgan is only writing off 47 cents for every $100 loaned out.

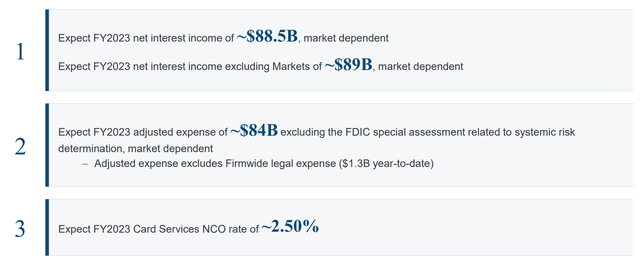

Anchored on such favorable rates, deposit, and credit backdrop, JPMorgan once again increased FY 2023 net interest income expectations, up to $89 billion. At the same time, management broadly reiterated the forecasts for full-year expenses.

Basel III Is The Major What If

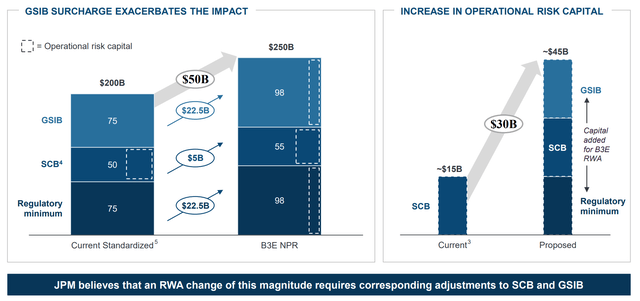

JPMorgan’s Jamie Dimon has for a long time been a strong critic of the capital rules relating to the “Basel III Endgame”. According to Mr. Dimon and his management team, the suggested U.S. B3E NPR1 would catalyze a 30% rise in the Firm’s Risk-Weighted Assets, equivalent to $500 billion in dollar value. What this means for JPMorgan is that the bank may be required to add a 25% top-up to the regulatory required capital, amounting to $50 billion.

In the context of the higher capital requirements, JPMorgan contests specially the rationale in the $22.5 billion increase that is attributed directly to the bank’s 4.5% GSIB2 surcharge, which according to Jamie Dimon, increases capital requirements without any notable benefits to the bank’s systemic risk.

CET1 requirements matter a great deal to investors when considering buying equity in a bank. While higher capital requirements may pressure banks to be more selective and risk-averse in lending and investment decisions, higher capital requirements also reduce the bank’s overall ability to grow. This is not only because less loans are written, but also because any growth requires higher capital reserves, binding more capital that could be available for distribution, and thus reducing the value of growth to investors.

For reference, in Q3 2023, JPMorgan distributed about $5.1 billion of capital to shareholders. $3.1 billion in the form of dividends, and $2 billion in the form of stock net repurchases. Accordingly, on a quarterly basis, distributions topped 1% of JPM’s market capitalization, implying a 4-5% equity yield on a compounded annualized basis.

Other Risks To Consider

In addition to the discussed Basel III headwinds, which I see as the major valuation-relevant risk for JPM equity holders, I also point out that, as a bank, JPMorgan’s financials are sensitive to economic downturns and interest rate fluctuations. Moreover, challenges in credit and loan risks and operational issues (compliance) may catalyze and reveal vulnerabilities that may only materialize in a recessionary environment. While I do not see any specific, notable risks as of Q3, investors should be mindful of complex dynamics in the macro environment when considering JPM stock as an investment.

Simply Too Cheap To Ignore

Although the Basel III headwind to capital is a valid investor concern, investors should not forget that higher CET1 doesn’t directly, or in a major way, impact the bank’s earnings strength. In fact, the Basel III headwind is a factor that must be weighed against the multiple tailwinds that the bank is enjoying; and in a like-for-like comparison, the tailwinds clearly win the battle. Going into Q4 2023 and FY 2024, JPMorgan is poised to see more upside in the NIM spread. Moreover, I see underappreciated upside in investment banking and capital markets activity, as deals volume on both M&A and ECM gradually recover (as suggested by the encouraging Q3 deal flow, incl. ARM, Birkenstock, and Instacart IPO, as well as the Splunk takeover by Cisco).

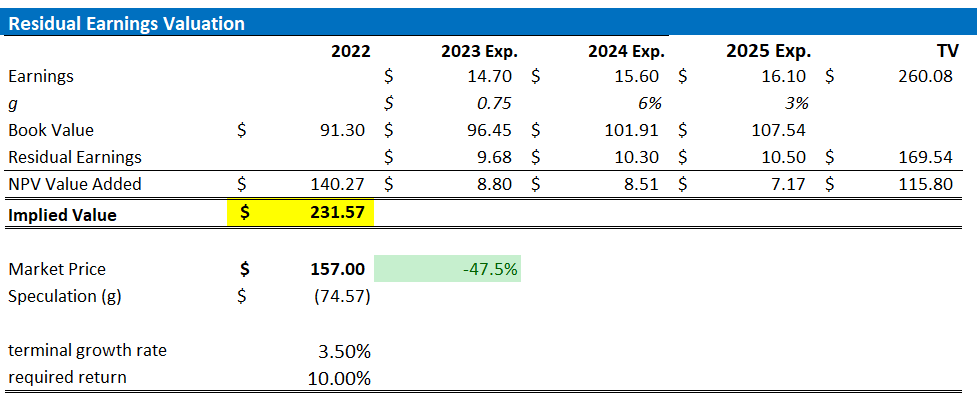

On a valuation to earnings relative analysis, JPMorgan now trades at a consensus 2024 price-to-earnings of only 8.7x, suggesting a 1% discount to the Financials sector. That is too cheap to ignore, in my opinion. As the leader of the industry, I argue that JPM should be trading at a minimum 30% premium to the sector. And the Financial sector remains a very cheap sector overall. That said, I have previously estimated the fair value of JPM stock at about $230/ share. Post Q3 results, I am confident to reiterate my expectation that JPM will manage to expand EPS to approximately $16.10 by 2025 and sustain a 3.5% terminal growth rate thereafter. In line with a residual earning model at a 10% implied rate of required return, JPM stock should be worth about $231.57/ share.

Company Financials; Author’s EPS Estimates; Author’s Calculation

All that said, reflecting on JPM’s strong Q3 earnings and outlook, I feel encouraged to reiterate my price target with more than 50% price appreciation potential. I am upgrading JPMorgan to a “Strong Buy”.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Not financial advise.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.