Summary:

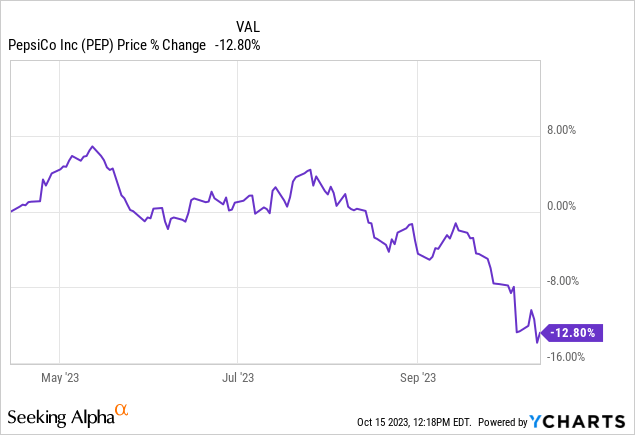

- PepsiCo stock has fallen in the past 6 months, making it a buy opportunity due to the recent pullback in price.

- PEP’s price drop can be attributed to rising interest rates and uncertainty in the economy, creating a discount for investors.

- The Company has shown resilience during past recessions and has a strong track record of financial growth, making it a recession-proof investment.

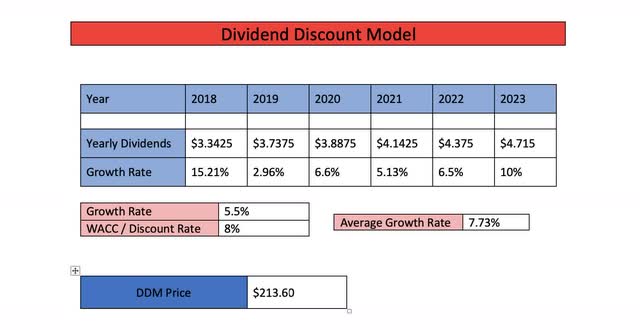

- Using the Dividend Discount Model, I have a price target of $213, offering investors a double-digit upside.

JHVEPhoto

Introduction

PepsiCo (NASDAQ:PEP) (“Pepsi”) is one of the most well-known brands globally. I’ve actually been around the company my whole life. My mother was and still is a huge Pepsi drinker. I asked her why she preferred Pepsi over Coca-Cola (KO) and she said she liked the taste better. Realizing it now, we always had cases of the beverage company in our house when I was a kid. Of course, I look back now and ask why didn’t I invest or think about investing in them. As kids, most of us don’t think about that at the time, but we hold it against our older selves. Seeing the company’s history, I say that to myself all the time. But now I think an opportunity presents itself with the recent pullback in price. In the past 6 months, the stock has fallen double-digits from almost $200 and is now trading closer to its 52-week low of $155, making it a buy in my opinion.

Why the Price Drop?

I understand it’s hard seeing your stocks fall or your portfolio in the red for days or even months at a time. As most of us know there’s a lot of uncertainty going on right now. Recession talks, high interest rates, surging oil prices, etc. When everything seems to be going great in the economy, that’s when stocks normally trade at very high premiums. And right now, there doesn’t seem to be much positive sentiment surrounding the stock market. But that uncertainty allows the best opportunities to present themselves to buy high-quality stocks like PEP at discounts.

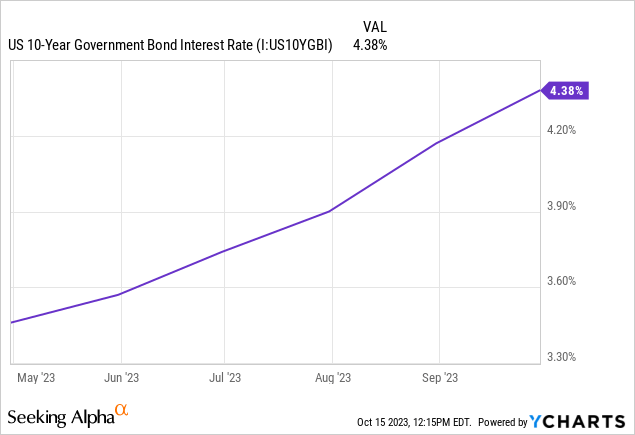

One reason I believe the price has fallen recently is treasury rates. Before the recent price pullback, the stock was grossly overvalued in my opinion as investors were looking for safe places to park their money. As you can see below, bonds have surged in the last 6 months. This has impacted investor sentiment and outlook on the market as a whole. Why invest money into a stock that yields less than 3% when I can get almost 6% risk-free? That’s a fair and valid question. There are several elements that go into investing in the stock market. Time horizons, age, how much capital one has, type of investing, investment goals, etc. all play an important role.

So, investors have had to deal with not only rising interest rates, but more and more talks of a recession which is speculated to occur in 2024. Hearing all this negative sentiment is hard as an investor because no one wants to lose money. I actually mentioned a recession in one of my earlier articles, and a reader commented that recession talks were debunked. I’m not so sure he’s saying that now.

As analysts here on Seeking Alpha, we don’t have all the answers, nor can we predict where prices will go. All we can do is give our opinion with the knowledge & research we have done and give that to our readers. I’ll be the first to admit I find myself asking the same questions. “Did I miss something?” “Was my research thorough enough?” I often go back and double-check. Whatever you have to do to remind yourself, I say do it. For me, I often go back and look at Warren Buffett’s videos. I was actually listening to one recently.

One I watched stood out to me and I think is relevant with a recession looming:

If you guaranteed me there would be a recession next year, I would be buying and selling the same securities I’m buying and selling today.

I think this is very important for my readers to think about. I’m sure some may have already heard this. But sometimes we need a reminder, especially when times are tough.

Well, How Did Pepsi Do During The GFC?

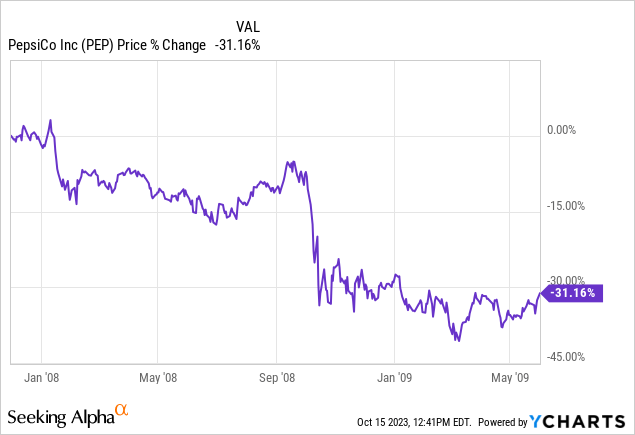

The GFC lasted a total period of 18 months, from December 2007 to June 2009. During that time, the stock fell 31%. Another quote from Buffett that stands out to me and I think it bodes well currently:

Berkshire Hathaway (BRK.B) 3 times since I took over has gone down roughly 50%, did I feel poorer then? No not at all, I knew it was going to be worth more over time.

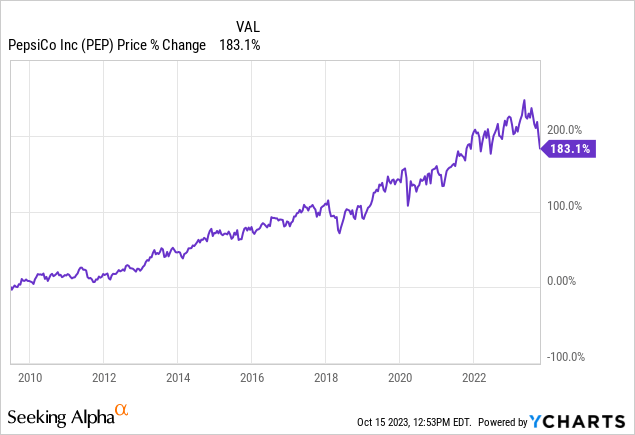

Well, we see below what PEP has done since then. The price has appreciated nearly 200% from a price of $54.96 on June 30th, the month the recession was declared over in 2009. Back in 2008, I was just starting to get my feet wet investing. One of my superiors used to mention it, and I would always ask questions about what companies I should invest in. I was a young sailor back then so I had no clue what I was doing. I was just looking to place my money into the stock market, hoping to get a positive return. I looked at it like the lottery and would log on to my brokerage account to check the balance multiple times every day. Whenever it was green, I was excited. Whenever it was red, I would get anxious and start questioning myself. This caused me to sell a lot of great companies such as KO and miss out on great returns in the process.

Financial Growth Since The GFC

Most of us know PEP has more than a half of century of dividend growth and is a dividend king. The company actually raised its dividend during the last recession by 25% from $0.30 to $0.3750. And have continued raising it uninterrupted to the current dividend of $1.2650. PEP raised the dividend by 10% earlier this year back in May from its prior of $1.15. One way the company has been able to do this is by growing its earnings and operating cash flows over time.

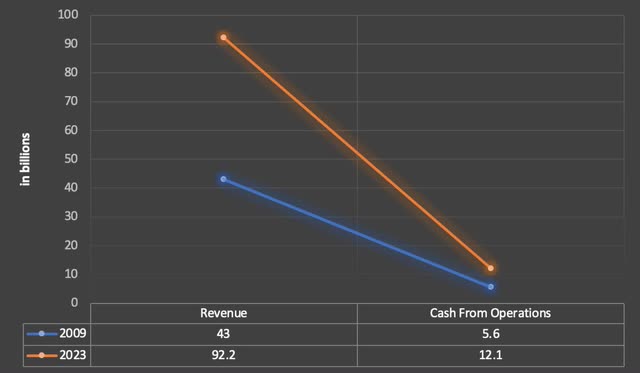

Since 2009, PEP has managed to double its revenue and operating cash flow, growing revenue from $43 billion to an estimated $92.2 billion for 2023, and operating cash flow from $5.6 billion to $12.1 billion TTM. Earnings also grew from $3.71 to an estimated $7.55 consensus for 2023.

Additionally, the beverage behemoth managed to grow OCF & earnings during the 18 months of the GFC. Earnings grew roughly 10% from $3.37 in ’07 to $3.71 in ’09. Operating cash flow also grew nearly 25% from $4.5 billion to $5.6 billion during the same period. So I think it’s safe to say PEP’s business model is recession-proof.

Recent Earnings

Pepsi reported its Q3 earnings earlier this month and the giant did not disappoint. EPS was $2.25, beating analysts’ estimates by $0.10 while revenue was in-line at $23.45 billion. Both were up year-over-year. EPS was up double-digits roughly 14% from $1.97 a year ago while revenue was up nearly 7% from $21.97 billion. Although inflation is easing, it still continues to be a headwind for several companies.

And through all of this, PEP managed to show their resilience. Organic sales increased nearly 9% year-over-year which was led by strong growth in Europe & the Africa/Middle East, and South Asia regions. Operating profit was also up 20% during the quarter. This strong growth allowed management to increase full-year core constant currency EPS by 1% to 13%.

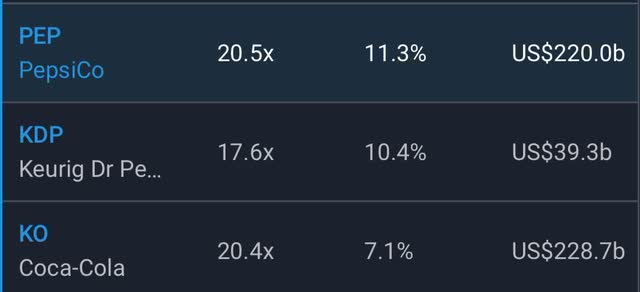

Valuation vs. Peers

Over the past 6 months, Pepsi and its peers Coca-Cola & Keurig Dr Pepper (KDP) are all down double-digits. According to Seeking Alpha, PEP’s trailing P/E is still above its 5-year average of 25x, and significantly above KO’s 21.8x. KDP has a P/E of 24.5x. At the time of writing PEP has a forward P/E of 20.5x, so now may be a great time for investors to buy.

With the recent fall in price, PEP now offers investors a decent margin of safety and an upside of nearly $30 to its average price target of $189.13.

My Valuation

As a dividend investor, my preferred method of finding a stock’s intrinsic value is the Dividend Discount Model (DDM). Below I’ve calculated PEP’s average dividend growth rate. Because we are expected to go into a recession next year, I decided to be a bit more conservative and use a growth rate of 5.5% for next year’s dividend. This is a tad lower than Seeking Alpha’s consensus estimate of $5.36, for a total of $5.34. Also being conservative on the expected rate of return, this gives me an intrinsic value of $213.60. Again, readers have to remember this is an estimate, and this could very well come in higher or lower. But I believe it’s better to be more conservative than overly optimistic.

Risks

Like several food & beverage companies, PEP has been a topic of the recent emergence and popularity of weight loss drugs. During Q3 earnings, management stated the impact has been negligible so far.

The biggest risk to the company in my opinion is a recession. Although they continued to grow during the GFC, times and consumer habits are different than nearly two decades ago. Demographic shifts, lifestyles, etc. are all different and continue to be a factor going forward. PEP has been very conscious of changing consumer habits and has been adjusting accordingly. They have been reducing the portion size of products while maintaining affordability as consumer spending becomes tighter. Management is also very aware of inflation headwinds and expects these to continue to have an effect on volumes going into 2024.

Here’s a quote from their CEO:

With regards to PBNA, we continue to optimize the portfolio. So we should probably be thinking about a few more quarters where we will continue to see volume decisions that, again, we’re trying to maximize units and transactions. And we’re trying to continue to optimize the margin of the business.

Furthermore, if and when we go into a recession and consumer income becomes more stressed, I expect the convenience store channel to see some stress as well. Although revenue was up 8% in foods and 5% in beverages, historically the company has seen this channel experience stressors with higher gas prices and tighter spending.

Conclusion

PEP is a global company that has faced years of adversity and managed to grow its income due to its pricing power. In the last 6 months, the stock’s price has fallen due to controversy surrounding weight-loss drugs and rising interest rates, making it a buy. Even though I consider the business to be highly resistant to economic downturns, I suspect the company will continue to face headwinds going forward because of elevated inflation and tighter consumer spending. Additionally, if rates continue to rise, I expect PEP’s price to decline due to negative market sentiment and their historically low yield. If so, that would give investors an even better opportunity to dollar-cost average into this stellar stock and give them a great margin of safety also. Those with a long-term outlook should buy PEP and add on any signs of share price weakness.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in PEP over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.