Summary:

- Apple’s upcoming earnings report may reveal disappointing holiday quarter sales, particularly in China, due to competition from Huawei.

- The lack of a fall iPad launch so far could result in a decline in revenue for the tablet segment during the holiday period.

- Analysts have lowered revenue estimates for Apple’s December 2023 period, helping to push the valuation too high for my liking.

Auris/iStock via Getty Images

As we get ready for earnings season to start ramping up, investors are very curious to see how the consumer is doing into this year’s holiday season. One of the best indicators will come when we get results from technology giant Apple (NASDAQ:AAPL) on November 2nd. Unfortunately, the latest news suggests that things may not be as rosy as previously hoped, which is why I’ve become bearish on the stock for the remainder of this year.

In my early September Hold article, I wondered if the new phone launch from Huawei would be a headwind for Apple’s sales in China. It was just four years ago that the Chinese company had a tremendous 38% smartphone share in its home country, but the pandemic and US embargo cut that number down quite a bit. Earlier this week, we got multiple data points from analysts that the newest iPhone line is not selling well so far, with Huawei strength seemingly being the main culprit. At the same time, this wasn’t the greatest new iPhone update we’ve seen. This year’s entry level iPhones only have last year’s chipset, although they did get a decent main camera upgrade. Wednesday morning, UBS came out and said iPhone demand is down across all regions relative to last year.

Another item that worries me for the short term is Apple’s tablet strategy. In 2022, we saw a new iPad Air in March, followed by new entry level and Pro models in October. So far, there has been no fall tablet launch, which makes year ago comparisons much harder to top. Recent rumors of multiple new models launching early this week have proven to be untrue so far. Unless Apple does launch some new iPads rather soon, the tablet segment could see a revenue decline of up to $2 billion year over year for the holiday period. Until we get some new iPads, the current lineup remains quite outdated, which is not good when trying to deliver meaningful year over year revenue growth.

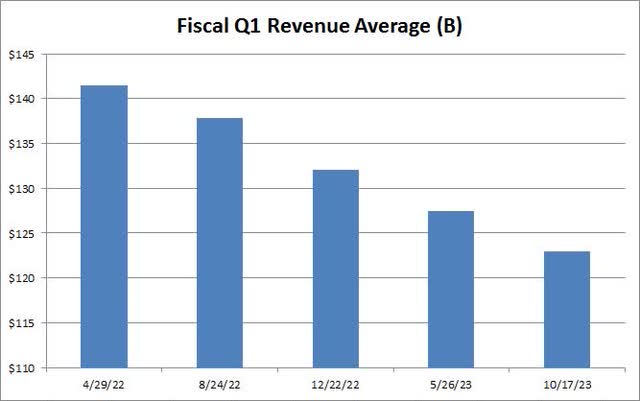

I’m not quite sure investors realize just how much we’ve seen Apple’s revenue estimates come down for the December 2023 period. About a year and a half ago, the street average peaked at more than $141 billion, which would have been a nice revenue growth trajectory from the roughly $124 billion that the company reported in the December 2021 period. However, as the chart below shows, the street has cut its top line estimate average by more than $18 billion since that point.

Fiscal Q1 Revenue Average (Seeking Alpha)

The current street average of $122.91 billion represents less than 5% growth from the year ago period. That quarter was negatively impacted by Covid shutdowns in China that really hurt iPhone production. However, the 2022 holiday period also had 14 weeks due to the way the calendar fell, while this year’s quarter will be the standard 13 week period. The important part here is that over a two year view, analysts are looking for Apple’s biggest sales period to see a revenue decline that’s nearly a billion dollars.

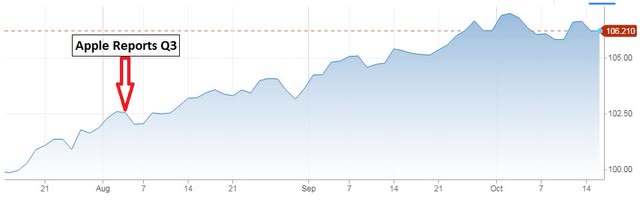

In the short-term, one of the things most impacting expectations will likely be currencies. As the chart below shows, the Dollar Currency Index is up about 4% since Apple reported fiscal Q3 results on August 3rd. The company does have some hedges in place, and it can adjust device pricing if the dollar gets too strong. However, the strength in the greenback could provide a multi-billion dollar headwind to Apple’s holiday period at these levels, with the potential for even more pain if this rally continues.

Dollar Currency Index (CNBC)

Despite the decline in expectations, Apple shares are actually a bit more expensive than they were a year ago. At that time, the stock traded at 22.08 times expected fiscal 2023 earnings per share (the fiscal year that finished a few weeks ago). As of Tuesday’s close, the stock currently trades for 27.05 times currently expected earnings for the September 2024 fiscal year. When you factor in the buyback’s impact on the share count, analysts are roughly looking for flat net income in fiscal 2024 after a small decline in fiscal 2023.

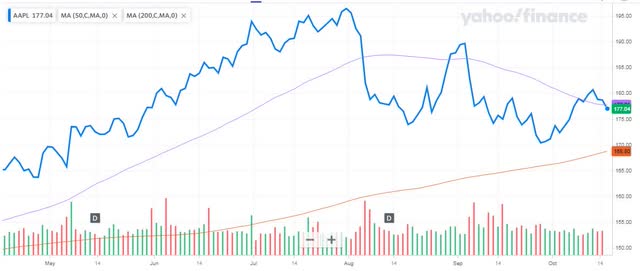

It’s a bit hard for me to justify paying that much more for this stock when you have meaningfully reduced expectations. Thus, I am downgrading Apple to a sell rating right now. We’re not sure the Fed is done raising rates just yet, and we just saw the Fed’s balance sheet dip below $8 billion for the first time in years which has helped to push up interest rates further. I also don’t like the fact that Apple shares have not been able to solidly get back above their 50-day moving average (purple line) seen in the chart below, making me wonder if we will see the 200-day moving average (orange line) rather soon.

AAPL Last 6 Months (Yahoo! Finance)

So what would get me to upgrade Apple back to a hold rating? Well, I would like to see some evidence of these major risks (China, US consumer spending, the dollar, rising rates) coming down a bit. If the company does guide light at the early November report, analysts are going to take down their full year numbers even more and that’s not good for the stock. The street currently sees an acceleration in revenue growth in the back half of fiscal 2024, partially driven by the new headset, but I don’t think that product will be a major seller right away. I also would like to see the valuation come down a little more, perhaps into the low to mid 20s on a forward looking basis. Finally, I need to see what happens should the stock test the 200-day, because failure to hold that key level could add even more selling pressure.

In the end, things don’t look that bright for Apple this holiday season, which is why I’ve become bearish on the stock for now. It does appear that Huawei’s phone launch in China is impacting iPhone sales, and there still hasn’t been any meaningful refresh of the iPad line in a year. Analyst estimates have come down a bit already, but there is still room to go lower, and these cuts have helped to push the stock’s valuation up quite a bit over the past 12 months. Apple may be a better investment as we work our way into calendar 2024, especially if we get a meaningful reset of expectations, but for now, the setup just doesn’t work for me.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Investors are always reminded that before making any investment, you should do your own proper due diligence on any name directly or indirectly mentioned in this article. Investors should also consider seeking advice from a broker or financial adviser before making any investment decisions. Any material in this article should be considered general information, and not relied on as a formal investment recommendation.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.