Summary:

- Tesla, Inc. stock dropped after a disappointing Q3 earnings announcement, but margin compression is expected to be transitory.

- Margin compression occurred due to price cuts, inflation, and high borrowing costs negatively impacting Tesla’s bottom line.

- Tesla’s fundamental backdrop is expected to strengthen as the economy improves, leading to higher stock prices in the future.

- The $220-200 range is an attractive long-term entry level for Tesla.

Spencer Platt/Getty Images News

Tesla, Inc. (NASDAQ:TSLA) stock has dropped after its “disappointing” Q3 earnings announcement. Tesla is trading around $225, down roughly 7% in pre-market when writing this. While Tesla’s margins contract during this challenging phase, margin compression could be transitory. The slow growth and high-interest rate economic environment negatively impact Tesla’s bottom line.

Price cuts, inflation, high borrowing costs, and other temporary elements are eating into Tesla’s bottom line, negatively impacting its stock price. However, Tesla’s fundamental backdrop should strengthen as the economic downturn passes and the economy returns to normalized financial conditions. Due to Tesla’s dominant, market-leading position, its economies of scale, and other competitive advantages, its revenue and EPS growth could accelerate in the coming quarters, leading to a much higher stock price in future years.

Tesla’s Buy-In Zone Approaches: $220-200

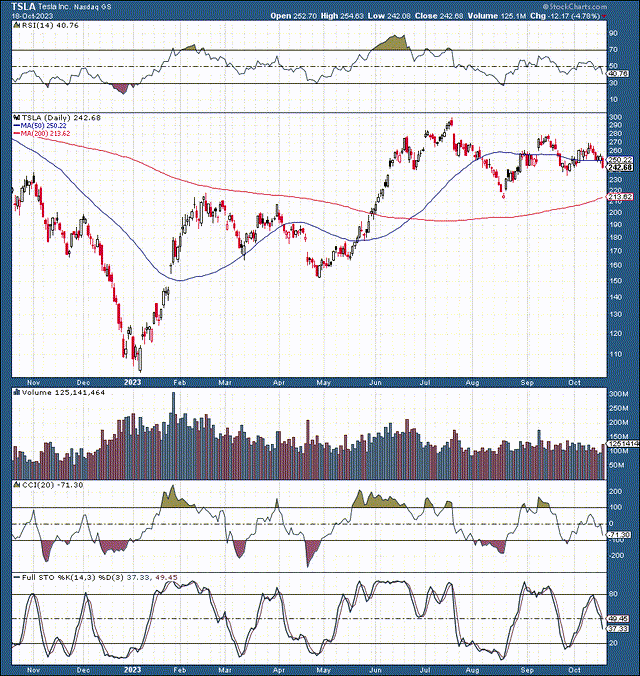

Tesla’s stock is still in the $200-300 range. Tesla has consolidated in this range for around five months and could continue moving sideways in the near term. The technical image is stable, neither oversold nor overbought. However, constructive fundamental factors should push Tesla’s stock higher, likely above the $300 resistance level in Q1 2024. We can continue making money from Tesla’s stock via the wheel and the covered call dividend (“CCD”) options strategies.

The Tesla CCD Plan

I sold covered calls against my Tesla position earlier this month, earning about 5% on my Tesla position after repurchasing the $270 covered calls before earnings. I then sold the $250 covered calls closer to its earnings announcement. Now, I am repurchasing those covered calls for a substantially lower premium. I own Tesla for the long term, and the stock makes money for me in times of volatility via the covered call dividend strategy.

Tesla’s Wheel Strategy

We can implement the highly effective wheel options strategy with Tesla. We can sell/create cash-secured put options, selling the 11/17/23 $220 puts for $20, earning a 10% premium, earning the possibility to purchase Tesla shares in our $220-200 buy-zone. Also, I am not worried about Tesla in the intermediate and long term, as its stock price should go much higher.

Tesla’s Transitory Margin Compression

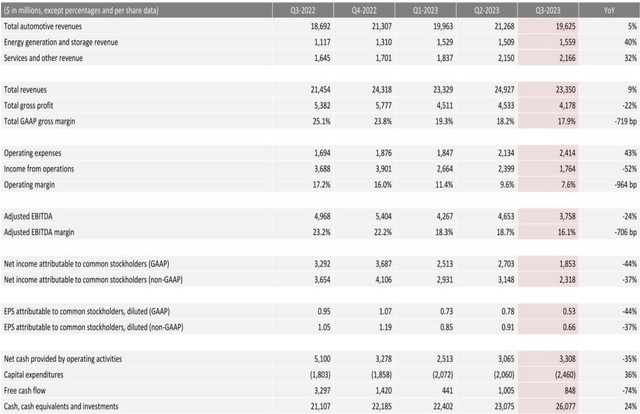

Tesla recently reported Q3 non-GAAP EPS of $0.66, missing the consensus estimate by seven cents. Additionally, Tesla reported $23.35B in revenues (+9% YoY), missing the consensus mark by $790 million. Tesla reported a Capex of $2.46B, a 19% rise over the same time last year.

However, the primary reason why Tesla missed revenue estimates and reported slightly lower-than-expected profits was due to price cuts in the electric vehicle (“EV”) segment. Tesla’s most recent round of price cuts could cost the company around $2 billion in annual sales.

While this may seem detrimental, Tesla’s price cuts should be transitory. Tesla’s ability to drop prices enables it to capture market share from other car companies. Moreover, Tesla can afford to decrease price tags due to its high level of profitability. This phenomenon represents a distinct advantage for Tesla, as it can raise prices in the future. Additionally, this dynamic should push Tesla toward advertising more, enabling increased sales.

Tesla’s Financial Summary

Financial summary (ir.tesla.com)

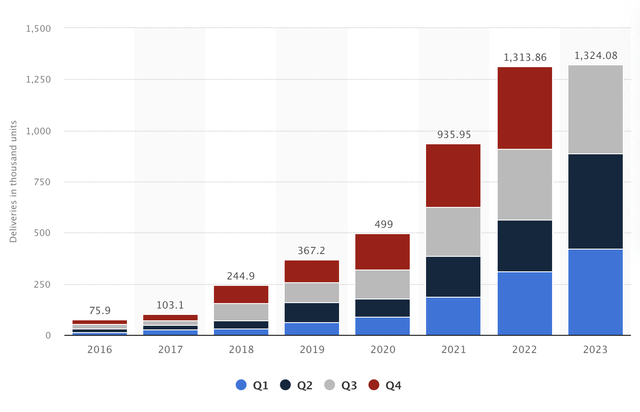

Total automotive revenues were $19.625B last quarter, a 5% YoY gain. Yet, deliveries surged by 26% YoY, illustrating the significant impact of the price cuts. However, EG&S revenues surged by 40% YoY, demonstrating solid demand and robust growth in Tesla’s energy space. Services and other revenues also surged by 32%. Additionally, Tesla’s Cybertruck and Tesla Semi segments should provide increasingly more revenues in 2024 and 2025. Moreover, Tesla’s viral and ultra-profitable Model 3/Y segments should provide improved revenue growth in future years as ASPs go up.

Tesla Deliveries – By Quarter, Yearly

Tesla deliveries (Statista.com)

If we dig deeper, we see that Tesla’s automotive sales revenue was about $18.58 billion in Q3. Once we adjusted for lease accounting, Tesla delivered around 14,706 Model S/X vehicles and approximately 402,311 Model Y/3 cars in the third quarter. If we use an ASP of about $110,000 from the Model S/X segment, we reach nearly $1.6 billion in Model S/X sales. Therefore, the Model 3/Y segment accounted for roughly $17 billion in revenues. This dynamic suggests that Tesla’s Model 3/Y segment ASP was around $42,250.

This ASP is a decrease over last year’s ASP and is less than my (higher-end) $44,000 ASP estimate in Tesla Q3 projections. However, we should see Tesla ASPs increasing as the economic landscape improves, the Fed adopts a more accessible monetary stance, and cheaper financing options become widely available. Despite the challenging macroeconomic atmosphere, Tesla’s gross margin was 18% last quarter. Tesla’s GAAP net income margin was 8%.

While we see some temporary margin compression, Tesla’s margins remain healthy. Additionally, margin compression occurred due to price cuts, inflation, higher R&D spending, and other transitory factors. As economic conditions normalize, margins and profitability should improve in future years and quarters.

The Bottom Line: Buy The Drop In Tesla

We get few compelling opportunities to buy drops in Tesla. Like all companies, Tesla has moments of imperfection and goes through challenging periods. Tesla is going through a transitory margin compression phase, but there is no reason to panic. Tesla’s stock could go marginally lower from here, yet the downside risk is likely minimal.

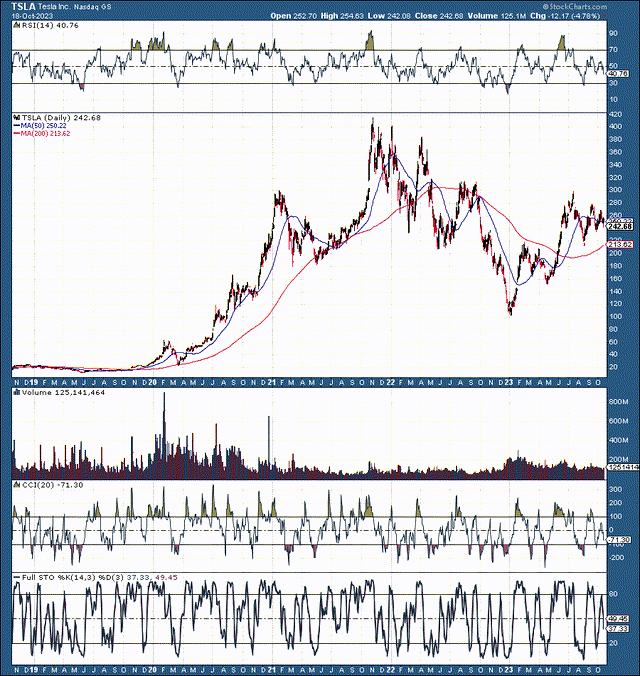

Tesla 5-Year Chart

Tesla’s stock appreciated considerably. It also fell nose-first from its $420 top. However, the $100 bear market bottom may have been a generational buy. Therefore, we should not see Tesla’s stock back near par again. However, we could see a more significant pullback to about the $200 level, roughly a 33% giveback from its recent high.

Additionally, around $200, Tesla’s stock would trade at 28 times $7 in next year’s EPS estimates (higher ed EPS estimates go to $8). Despite Tesla’s transitory slowdown in earnings growth, it could expand EPS more efficiently due to its dominant market-leading position, economies of scale, and other competitive advantages in future years.

Where Tesla’s stock price may be in the future:

| The Year | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $140 | $186 | $242 | $310 | $387 | $472 | $566 |

| Revenue growth | 40% | 33% | 30% | 28% | 25% | 22% | 20% |

| EPS | $6.35 | $9 | $13 | $17.73 | $23 | $29 | $36 |

| EPS growth | 70% | 42% | 44% | 35% | 30% | 28% | 25% |

| Forward P/E | 35 | 34 | 33 | 32 | 31 | 30 | 28 |

| Stock price | $343 | $453 | $585 | $736 | $899 | $1080 | $1200 |

Source: The Financial Prophet.

Risks to Tesla

Tesla faces challenges due to increased competition, inflation, margin compression, and a general economic slowdown. These and other risks could negatively impact Tesla’s revenue and EPS growth, leading to lower-than-expected profitability. This bearish dynamic (if it plays out) could worsen sentiment, potentially leading to multiple compressions and a lower-than-anticipated stock price in the coming years. Investors should examine these and other risks before investing in Tesla.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of TSLA either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am long a diversified portfolio with hedges.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Are You Getting The Returns You Want?

- Invest alongside the Financial Prophet’s All-Weather Portfolio (2022 17% return), and achieve optimal results in any market.

- The Daily Prophet Report provides crucial information before the opening bell rings each morning.

- Implement my Covered Call Dividend Plan and earn 50% on some of your investments.

All-Weather Portfolio vs. The S&P 500

Don’t Wait! Unlock Your Financial Prophet!

Take advantage of the 2-week free trial and receive this limited-time 20% discount with your subscription. Sign up now and start beating the market for less than $1 a day!