Summary:

- American Airlines’ stock is trading up 3.7% despite a cut to its guidance, which is a positive reaction compared to other carriers.

- Revenues remained stable year over year, but increased costs, particularly in salaries, put pressure on profitability.

- American Airlines’ guidance shows a challenging environment with stagnant revenues, rising costs, and flat earnings per share.

Bruce Bennett

American Airlines (NASDAQ:AAL) provided its third quarter earnings on the 19th of October before the opening bell. Despite a cut to its guidance, the stock is trading up 3.7% shortly after the opening of the markets which can be seen as refreshing given that the reaction to earnings reports from other carriers primarily brought a negative stock price reaction.

In this report, I will be discussing the results as well as the guidance update and provide a price target for the stock.

American Airlines Revenues Stabilize

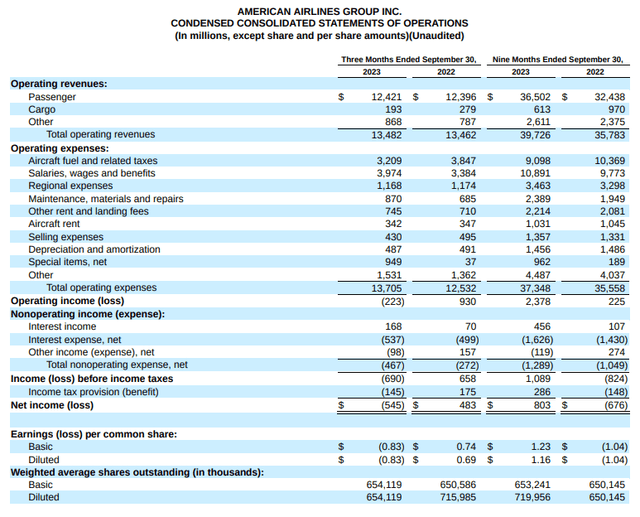

American Airlines

Total revenues came in at $13.482 billion and it shows that revenues were flat year over year the increase being $20 million or 0.1%. Cost on the other hand rose $1.2 billion or 9.4% to $13.7 billion. That, however, also includes $949 million in special items related to the ratification of the pilot agreement which brought some one-off expenses and adjustments. However, what is clear is that the benefit the airline had on a lower fuel was largely offset by higher salaries as fuel costs dropped $638 million while salaries increased $591 million which really makes one wonder how strong profit generation can be on the combination of elevated salary and fuel costs. Adjusted operating margins were 5.4% compared 6.6% and at this stage I would really wonder how the company can remain profitable given its stable year-over-year revenues and the current higher fuel price environment.

Interesting is to look at how unit figures developed. With stable revenues on a 6.9% capacity expansion, yields were down 4.8% while revenue per available seat mile was down 6.3%. So, in some way we see the unit revenues move in the direction opposite to the expansion. Unit costs per seat was up 2.3% including fuel and 3.25% excluding fuel and special items. So, American Airlines is at a point where capacity additions are keeping the revenues stable but still cannot offset growth which realistically puts a lot of pressure on profitability.

American Airlines Guidance Shows The Extremely Tough Environment

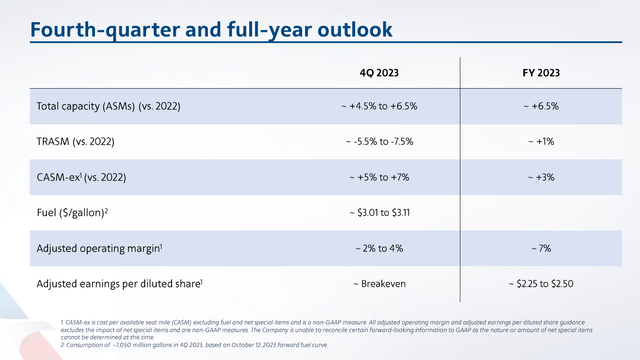

American Airlines

In 2017, then-CEO Doug Parker thought that American Airlines would never lose money again and the pandemic largely was seen as an event where airlines would rebuild in a cost efficient way. All of that rationale went out as airlines were forced to increase labor costs on the back of a pricing strength that is unlikely to last. Fast forward to the Q4 2023 and American Airlines once again finds itself struggling to remain profitable. Capacity is expected to increase 4.5 to 6.5 percent but it will erode unit revenues by 5.5 to 7.5 percent which once against points at very stagnant revenues while unit costs excluding fuel are rising 5 to 7 percent and oil prices to be back above $3 per gallon. It are all the elements, you would not want to see but yet it is happening and it is showing in the margins and earnings expectations with operating margins being 2 to 4 percent and earnings per share being flat.

For the full year capacity is guided to be up 6.5% compared to a previous guidance of 5 to 8 percent. TRASM is now expected to be up 1% compared to a previous guidance of up low single digits. CASM excluding fuel is guided to be up 3% compared to a previous guidance of up 2 to 4 percent. All of it factors into a guidance revision for operating margin from the 8 to 10 percent range to 7 percent and earnings per share now expected to be in the in the range of $2.25 to $2.50 compared to a previous guidance of $3.00 to $3.75 which provides a pressure of $0.75 to $1.25.

Is American Airlines Stock A Buy?

I previously had a hold rating on American Airlines stock and looking at the results and the forward guidance I see little reason to change that. What I find most interesting is that the stock is trading up more than 5% after beating analyst estimates by $0.12. However, from the big carriers that have reported so far, I found the results and guidance presented by American Airlines least encouraging.

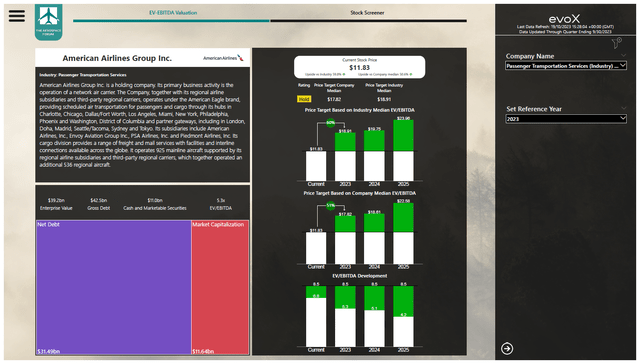

The Aerospace Forum

If you solely crunch the balance sheet numbers as well as the forward projections, there is no doubt that American Airlines stock is a buy as it is undervalued by 50 to 60 percent compared to peers. However, the evoX Financial Analytics monitor that I have developed and includes over 70 names in the aerospace and airline industry also incorporated benchmarking against the markets and American Airlines has not been scoring well on that front taking the rating to a Hold.

Conclusion: American Airlines Has Upside But Risk Is High

I believe that American Airlines has potential, but the stock itself has a bad performance rating making it a hold rather than a buy. Furthermore, after assessing the results I am surprised that the stock is trading higher post-earnings since the results to me looked significantly weaker than what peers presented and its guidance was not encouraging either. In fact, we see a lot of alarming items presented in a report discussing the airline industry heavily impacting American Airlines. So, there is upside but given the underperforming nature of the stock a buy rating is not warranted.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you want full access to all our reports, data and investing ideas, join The Aerospace Forum, the #1 aerospace, defense and airline investment research service on Seeking Alpha, with access to evoX Data Analytics, our in-house developed data analytics platform.