Summary:

- Bank of America reported solid headline Q3 2023 earnings, beating analyst expectations on both topline and earnings.

- However, the bank’s paper losses on its investment securities portfolio have ballooned, raising doubts about its ability to create shareholder value.

- Incremental QoQ paper losses equal to about $22 billion more than offset quarterly net-income of $7.8 billion.

- Although this paper loss is not expected to trigger solvency or liquidity concerns, it will certainly impact the bank’s profitability.

Drew Angerer

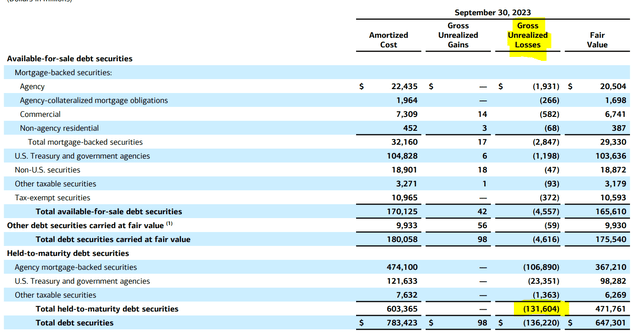

Bank of America (NYSE:BAC) reported earnings for Q3 2023 with strong headline numbers, as the bank topped analyst consensus expectations on both topline and earnings. Personally, however, I see little reason to celebrate, as the bank’s enormous paper losses on the investment securities portfolio remain broadly without discussion in financial media. In the September quarter, Bank of America’s paper losses on the balance sheet ballooned to an eye-watering $131.6 billion, up almost $22 billion from the $109 billion reported a quarter earlier. So, with BAC’s reporting quarterly net income at $7.8 billion, versus $22 billion in fresh paper losses, I remain in doubt about Bank of America’s ability to create shareholder value in this interest rate repricing cycle.

Bank of America stock is down about 5% since I last covered the stock with a Sell rating in July this year, as compared to a loss of 3% for the S&P 500 (SP500). This underperformance is a very small win for my thesis and I expect to gain stronger investor acceptance through the end of 2023 and early 2024. Following Q3 insights, I reiterate a Sell/ Underperform rating for BofA stock.

BofA’s 3Q Highlights, Although Strong…

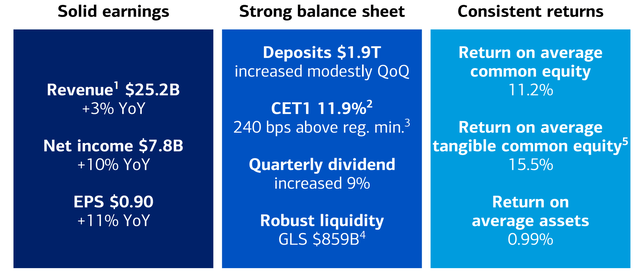

In the third quarter of 2023, Bank of America promoted its ability to capitalize on a favorable interest rate repricing environment, as the bank presented total revenues of around $25.2 billion, up 3% YoY, beating analyst consensus estimates at $25.1 billion by approximately $100 million. In terms of profitability, Bank of America highlighted a $7.8 billion net income, an increase of almost 10% compared to the same period one year prior. EPS was reported at $0.9, YoY growth of 11% respectively.

BofA’s performance in the first quarter of 2023 translated into a post-tax return on tangible shareholders’ equity (ROTE) of approximately 15.5% and a cost-to-income ratio of 63%, down 100 basis points vs. Q3 2023.

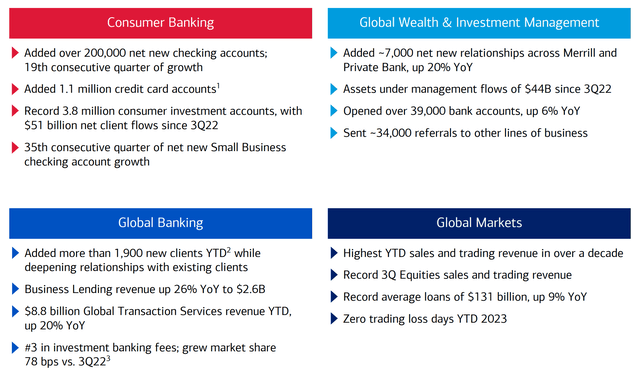

With regard to business segments, there were a few bright spots, most Global Markets and Consumer Banking. Amid a quarter characterized by turbulence in bond markets, the bank’s fixed-income and equities trading segments, emerged as a notable source of strength, with Q1-Q3 2023 posting the highest YTD revenues ever. Revenues in the sales and trading business saw an 8% YoY increase, reaching $4.4 billion. This included a 10% YoY growth in revenue from its equities business, which reached $1.7 billion.

In the Q3 period, BofA also benefited from a strong U.S. consumer: Spending by BofA’s credit card customers rose by 3% compared to the previous year. And broader lending grew 1% YoY despite high interest rates weighing on debt-writing sentiment. Lastly, in a sign that the bank is preparing for potential customer stress, BofA allocated $1.2 billion for potential loan losses. Now, while the loan loss provisions are up 20% compared to the same period a year ago, the metric is still broadly in line with write-downs seen in the pre-COVID era.

Earnings Do Not Tell The Complete Earnings Story

So, BofA’s earnings are solid. Everything seems bullish, right? No, I don’t think so. The headline numbers in BofA’s earnings report do not address the elephant in the room: “unlucky” balance sheet management leading to enormous losses in the bank’s securities investment portfolio. As of Q3 2023, BofA’s paper losses ballooned to a staggering $131.6 billion, up 24.4% over the last quarter’s $109 billion. Needless to say, the $22 billion in fresh paper losses, clearly offset the $7.8 billion of net income. And with bond yields having continued to rise post September 30th reporting benchmark for Q3, BofA’s paper losses are now likely trending close to $150 billion by the end of 2023.

Some readers of this article will argue in the comments that paper losses are not real, as BofA likely never needs to realize the losses due to a strong balance sheet holding $357.1 billion of cash and cash equivalents. Now, while I do agree that BofA likely won’t sell securities at a loss, I strongly disagree with the claim that BofA’s paper losses are not real. Investors should not forget that paper losses matter for the earnings story. Specifically, I like to argue that paper losses, while not realized or “cash-in-hand” losses, can have real and tangible implications for a bank’s net interest margins because capital is tied up in an underperforming asset. Capital that could have been used more effectively elsewhere, at higher rates. In other words, in order to record a paper loss, a security’s effective, quoted yield must be below the alternative yield that an investor can get elsewhere. The implication of this shouldn’t need any further explanation.

Notably, BofA’s quarterly performance was supported by a muted backdrop in cost of capital, as the bank did not need to increase remuneration on deposits to the same extent as its competitors to retain deposits. As of Q3 2023, BofA’s average interest bearing deposit account pays 2.1% in annual interest. That is up from 0.35% only from a year ago, despite the surge in interest rate benchmarks independent of duration. Moreover, BofA’s deposit rates are materially lower than what JPMorgan (JPM) and Citigroup (C) are paying, at 2.5%, and 3.4% respectively. Now, it is no secret that major banks are “underpaying” on their deposits. And this argument is especially relevant for BofA. As industry-wide hikes in deposit rates start to materialize, BofA will likely need to aggressively increase rates to stay competitive for consumers. With that frame of reference, it is very important to consider that with about 25% of BofA’s assets being tied up in low-yielding securities, the bank is less able than competitors to effectively absorb headwinds from the gradual increase in deposit beta; thus, cutting into the bank’s margins. Despite the favorable deposit rate as of Q3 2023, early signs of this thesis are already crystallizing. For the September quarter, BofA’s net interest yield compressed to 2.6%, down from 2.9% peak six months ago, highlighting the pressure on the asset side where BofA invested in underperforming securities.

No, There Is Not A Banking Crisis

Despite these considerable paper losses, there are several reasons to consider Bank of America as a solid and solvent institution: First, While Bank of America’s investment portfolio shows a loss, the underlying assets are still solid and valuable. Investors should consider that BofA’s securities investment portfolio primarily comprises government-backed securities with high credit ratings. This suggests that the underlying loans will likely be repaid as they reach maturity, mitigating the risk associated with these holdings. Second, the bank remains liquid as BofA maintains a substantial cash reserve of approximately $357 billion, far in excess of any paper losses. Third, the bank also remains solvent, with more than $287 billion of shareholder equity, also far in excess of any paper losses. Fourth, the Federal Reserve’s annual stress test has demonstrated the resilience and health of the banking system, including BofA. In a severe downturn scenario, all 23 U.S. banks subjected to the stress test successfully weathered the challenges, projecting their ability to meet financial obligations and continue to extend new loans. Fifth, while Bank of America’s paper losses raise concerns, it’s important to note that other major banks are also navigating similar challenges, although to a much lesser degree. Moreover, BofA’s paper losses do not directly, or in a major way, impact the bank’s business model quality and competitive strength in the financial services industry.

Investor Takeaway

The art of banking anchors on capable capital allocation. And Bank of America’s management team has shown little sophistication and prudence when allocating the billions of deposit inflows (∼$670 billion) during COVID to low-yielding Treasury securities. This argument is evident through the bank’s Q3 results, where incremental QoQ paper losses equal to about $22 billion more than offset quarterly net income of $7.8 billion. Although these paper losses are not expected to trigger solvency or liquidity concerns, it will certainly impact the bank’s profitability. Considering Bank of America’s current position, where the bank is gently forced to be locked into low-yield fixed income securities to avoid realizing a substantial nine-figure paper loss, it is likely that the bank’s Net Interest Income and Return on Equity will lag behind its competitors at least until 2025-2027.

Lastly, I would like to say that I really like bank stocks currently, being very bullish on Citigroup and J.P.Morgan, as well as some European value plays such as Deutsche Bank (DB) and Barclays (BCS). In that context, I like that BofA stock is presenting itself as an outlier with an “Underperform” thesis because a Sell on BofA can offset some industry beta of my long positions. Concluding on this note, I recommend an underweight or sell position for BofA stock, while suggesting an overweight or buy position for JPM and C as more favorable investment options.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of JPM, C either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

not financial advice

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.