Summary:

- Nike is a company with an economic moat and an outstanding brand portfolio.

- The company has excellent financial metrics, including high profitability and a strong balance sheet.

- Despite NKE is far from its all-time high, the Chowder score and discounted cash flow analysis imply that the company is still fairly overvalued.

- Due to the possibility of further economic distress and geopolitical friction, it is likely that better opportunities will occur to buy shares of NKE.

hapabapa

Investment thesis

NIKE, Inc. (NYSE:NKE) is a company that I really want to add to my own dividend growth stock portfolio, but it is also a stock that always seems expensive. Personally, I like the know what you own approach in investing. I own a lot of NKE products myself and this had triggered me to know more about the company. NKE also has a compelling dividend growth history, since it has now 10 years of consecutive dividend growth.

At the moment the stock is far from its all-time high of $173.68 and currently shares are trading at $103.71 per share.

Share price development (Seeking Alpha)

Is this a good moment in time to add NKE or is it still too expensive? Let’s find out!

Company overview

NKE is a large business in selling athletic footwear, apparel, equipment and accessories with a market cap of $155.30 billion.

Their products are not only functional, but also have a high fashion factor. Over longer periods of time NKE manages to stay on top when it comes to following trends and technology. The company is actually the largest of athletic footwear and apparel in the world.

Does the company have a moat?

I think it does when it comes to its brand recognition. Almost everyone around the world recognizes the iconic “swoosh” logo and NKE is still the most popular footwear brand among American teenagers. NKE has a high brand awareness, which measures how much consumers are aware of a brand and whether they correctly associate it with a particular product or service. There are studies where NKE achieves a brand awareness of 95%, which can be labeled as very high.

The brand NKE is also often associated with high quality products, maximum sports performance, innovation. The most important association has to be the connection of the brand with athletic celebrities. NKE really knows how to capitalize on this and also invests a lot of money in advertisement and promotion to remain popular. Investing in this is an important part of maintaining their economic moat in the future. This gives the company their competitive advantage and the ability to charge premium pricing.

Brand portfolio

NKE offers products through different brands, the most important ones are:

Nike: The products of NKE are designed for athletic and casual purposes. They are available in different price categories, from affordable to some more exclusive extend. At the moment Air Force 1 and Dunk are part of the most popular footwear franchises in the world.

Jordan Brand: Talking about brand association, the Jordan Brand is one of the most promising brands under NKE’s wings and is famous for its jumpman logo. For almost 40 years The Jordan Brand is still widely popular. Some models are particularly difficult to acquire. This adds to their appeal and makes them even more exclusive.

Due to the high demand and small supply, the company manages to keep things interesting. This is the main reason that Jordan shoes are more expensive. This increases the willingness to pay a higher price for these products witch underlines the pricing power of this brand.

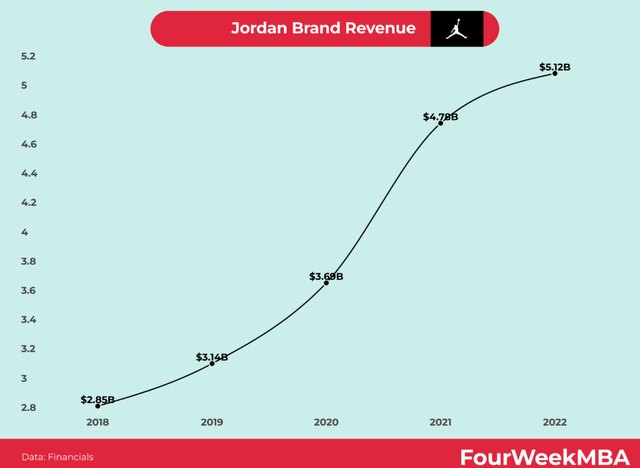

Jordan Brand revenue development (fourweekmba.com)

As you can see the Jordan Brand is growing at a rapid pace and from 2022 to 2023 the brand grew another 29% to $6.6 billion, which is very impressive.

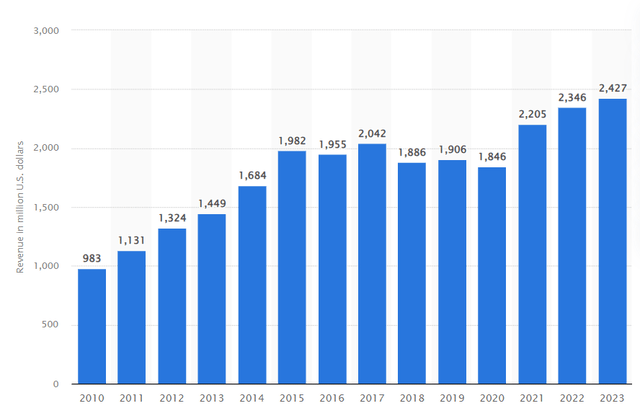

Converse: This brand has a long history, since they’re producing shoes from the start of the 20th century. If you think of Converse think about brands like All Star, Converse, Star Chevron, Chuck Taylor and Jack Purcell. In 2003 they were acquired by NKE for $315 million, two years after they went bankrupt. Converse has 4.7% of the total revenue of NKE and had a 10 year growth CAGR of 3.7% and is more of a slow grower compared to the 7.3% CAGR of the company’s total revenue.

Converse revenue growth (statista)

Revenue distribution

The company is operating in various segments around the world:

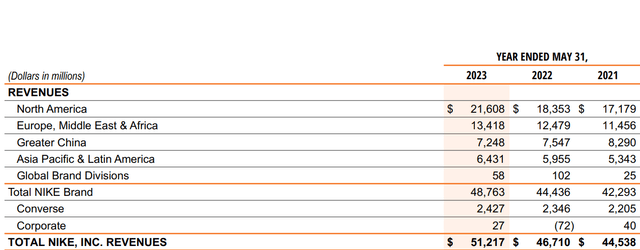

Global revenue distribution (NKE annual report)

The revenue is well diversified and had a solid base in North America, which accounts for 43% of total revenue. I like the fact that the revenue is distributed well, because this reduces the risk of becoming too dependent on a specific continent.

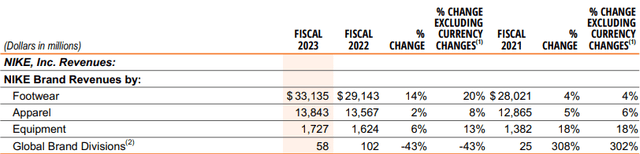

Looking at the revenue distribution in products it is clear the company earns the most of its money through footwear (64.6%), which is by far their most important business segment.

Revenue distribution (NKE annual report 2023)

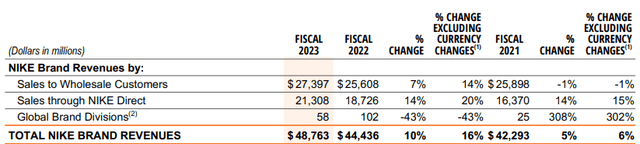

At the end of FY 2023 the percentage of sales to wholesale costumers (56.1%) is still higher compared to Nike Direct (43.7%). Wholesale still plays an important role for NKE to get the breadth and depth of access to consumers. Despite the importance of wholesale, it seems only a matter of time before the tables are turned.

Wholesale vs Direct (NKE annual report 2023)

During the years NKE has made significant changes, shifting more towards a direct-to-consumer approach. This excludes the help of wholesalers or retailers.

Through the Consumer Direct Acceleration strategy, NKE is focused on creating a marketplace of the future with more premium and consistent consumer experiences. The company continues to invest in a so called “Enterprise Resource Planning Platform”. This should help NKE into their digital transformation.

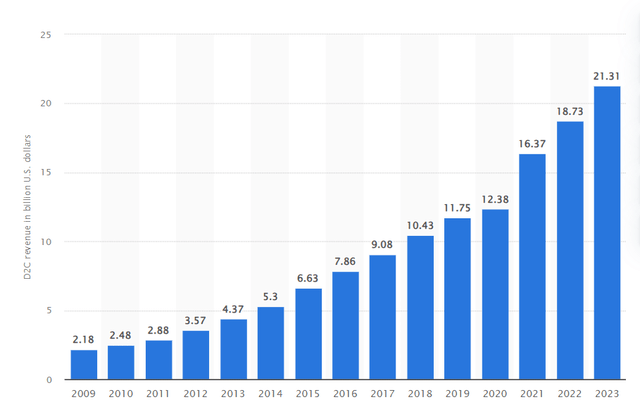

Direct-to-consumer revenue growth (www.statista.com)

One of the most important benefits of this approach is the access of data, since it gives NKE the opportunity to gain insight in customer behavior and enhance consumer value. The extra information makes it more easy for the company to give their customers what they want, which creates brand loyalty. Demand sensing and data analysis should also enhance efficiency in the future.

Financial metrics

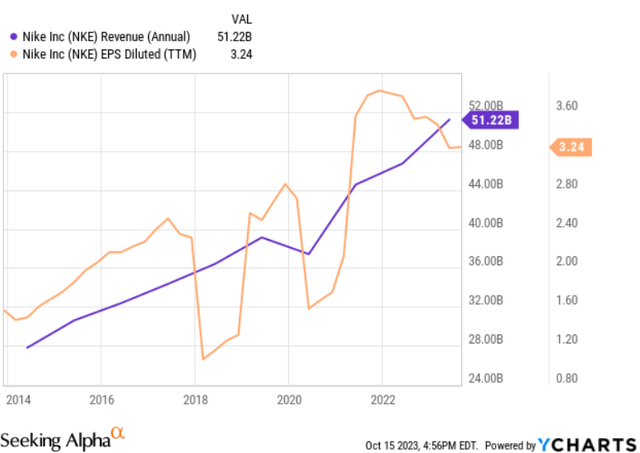

Looking at the growth numbers we can see that NKE has achieved decent growth over the years. The company has managed to grow its revenue at a CAGR of 7% and a Diluted EPS growth of 7.9% annually.

NKE revenue and EPS chart (YCharts)

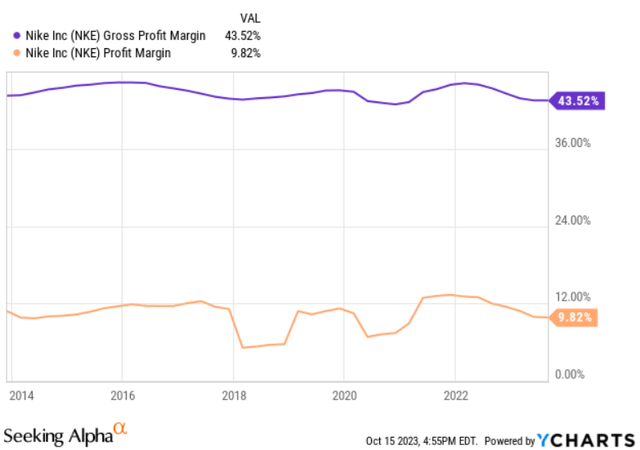

Where NKE really shines is their profitability. Over a 10-year time frame the company has managed to keep their gross profit margin above 42%, which is significantly higher compared to its sector median of 35.50%. Their current net income margin of 9.82% is also significantly higher compared to the sector median of 4.42%. This confirms that NKE is able to charge higher prices for its goods because of its economic moat, which leads to meaningful value creation.

Profitability metrics (YCharts)

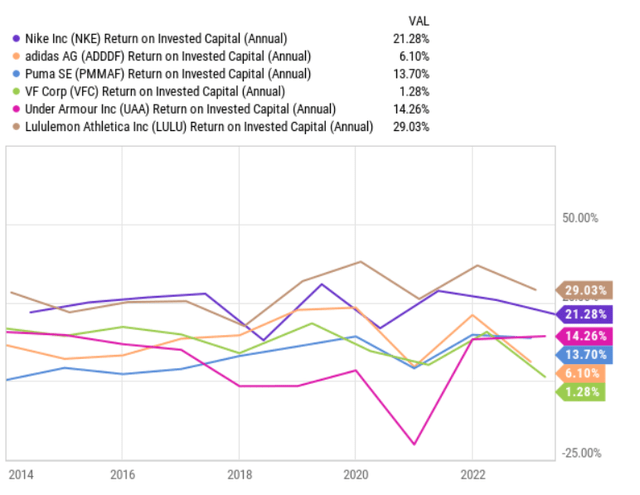

What is also an important metric for long-term investors to evaluate the efficiency in capital allocation is the ROIC. NKE has a ROIC of 21.28%, which is rock-solid. The company is scoring really well in the long run comparing to some of its peers.

ROIC + peers comparison (YCharts)

Balance sheet

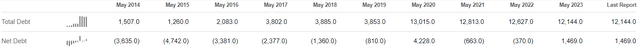

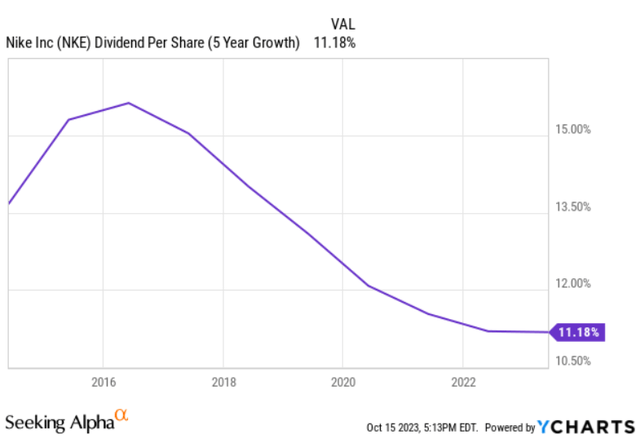

Analyzing the balance sheet of NKE it is clear the company is in a good financial condition. Despite the total debt is way higher compared to 10 years ago, the company also has around $ 10.675 billion in cash and short-term investments, which makes the Net debt only $1.469 billion.

NKE Debt development (Seeking Alpha)

With rising interest rates is it good to know if NKE has any significant debt maturities in the short-term. In 2025, 2026 and 2027 the company needs to refinance $3 billion, which shouldn’t be a problem at all.

Debt maturity schedule (NKE annual report 2023)

NKE also enjoys a healthy AA- credit rating by S&P Global, which means they have a very strong capacity to meet their financial obligations.

Dividends

I’ll assess Nike dividend using the dividend scorecard on Seeking Alpha were used.

Dividend grades (Seeking Alpha)

Dividend yield and growth

NKE pays a quarterly dividend and this FY it has an annual payout of $1.36 per share. At this moment in time the dividend yield of NKE is 1.32%, which is significantly higher compared to its 5-year average of 1.0%.

Yield development (Seeking Alpha)

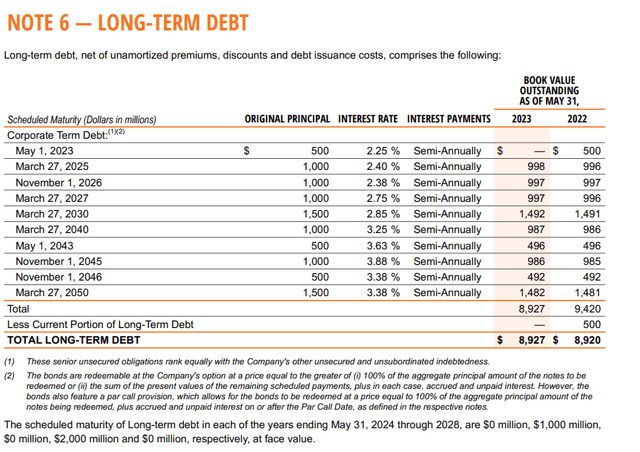

Looking at the 10-year dividend yield chart this could be a relatively good entry point, because the yield is now at a high point in this time frame. However, for the average dividend/income oriented investor a dividend yield of 1.32% is nothing to write home about. From a dividend growth point of view thing are looking better. NKE has a 10-year dividend growth CAGR of 13.98%. Also their 3-year (11.54%) and 5-year (11.20%) dividend growth CAGR are double digits. There is a little bit of a downtrend in their dividend growth and due to economic headwinds there is a possibility that NKE is going to increase the dividend more conservatively. On the other hand I wouldn’t be surprised if NKE is still going to do a +10% dividend hike this year.

Dividend growth (YCharts)

I also like to analyse the combination of the dividend yield and growth. If we apply the Chowder rule we can conclude the company still isn’t in the attractive zone yet. For those who don’t know, Chowder is a Seeking Alpha contributor who created a valuation metric based on the current dividend yield and the compound annual (dividend) growth rate (CAGR). The Chowder rule is easy to apply and it consists on 3 different variations based on the starting yield or sector. Following the Chowder rules, NKE is a stock with a dividend yield less than 3%. Stocks with a dividend yield of <3% need to have a higher dividend growth CAGR to compensate for the lower yield. Adding up the dividend yield of 1.32% and the 5-year dividend growth CAGR of 11.20% we ending up with a Chowder score of 12.52%. This isn’t enough to surpass the 15% threshold to identify it as an attractive investment. A main disadvantage of the Chowder score is that the numbers are based on the past. However, I think NKE can easily maintain the dividend growth rate of 10% for years to come.

Safety and consistency

At the moment the payout ratio is 41.2%, which can be considered safe. The free cash flow payout ratio looks even better with 36.47%. This shows that there is enough room to further increase the dividend into the future, while there is still enough cash left to further invest in the business itself.

NKE has paid 33 years of consecutive dividend and from 2002 until now , the company has grown its dividend every year except in 2012. So the NKE has an official dividend growth streak of 10 years. NKE still needs to raise its dividend this year and in my opinion it is very likely the company will achieve the dividend aristocrat status in the future.

Q1 2024 earnings

The latest earnings of NKE were received very well, as investors sent the stock higher significantly.

In the first fiscal quarter they beat the average analyst EPS estimate by $0.19 ($0.94 vs $0.75 expected). The reported revenue of $12.94 billion was a little bit lower than the expected $12.99 billion. This was due to the lower than expected revenue from Greater China.

In the previous quarters were some concerns about inventory management, but NKE seems to deal with it pretty well. The inventory was down 10% in dollars compared to last year.

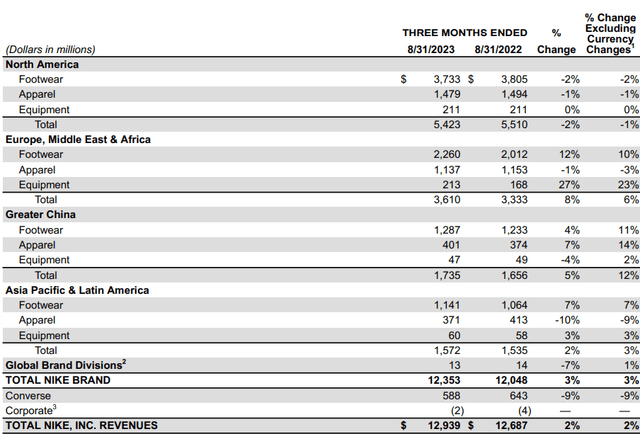

Revenue distribution (Income statement Q1 2024)

Looking at the revenue numbers in different segments it is clear most of the revenue growth comes from Europe, Middle East & Africa and especially Greater China. The North America segment is facing stagnation in revenue growth, but in line with the expectations of management.

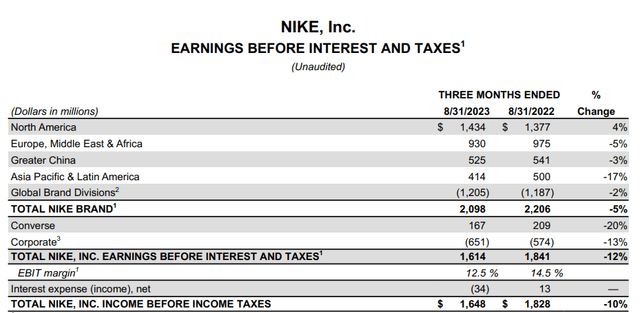

NKE EBIT (Q1 2024 earnings report)

Gross margins were down slightly (10 basis points) to 44.2% due to higher product costs and negative changes in foreign currency exchange rates. However this was almost completely compensated with pricing actions. The total EBIT this quarter was 10% lower compared Q1 2023. I’m confident that in the current economic climate NKE cannot fully maintain its profitability. Management is confident that things will change this fiscal year and will be a turning point for NKE in terms of profitability, which is intertwined in the FY 2024 outlook. They are lowering supply chain costs and as the business becomes more digital they might be able to drive more profits.

In my opinion things are looking decent and NKE is dealing well with the current economic climate. I believe that NKE is able to increase its profitability in the future.

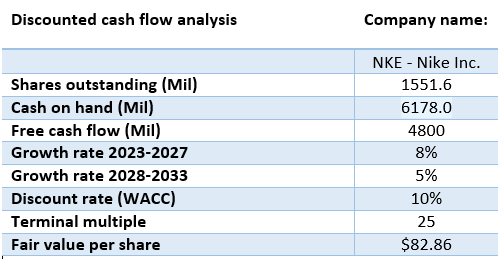

Valuation

For the valuation of NKE the discounted cash flow analysis was used. I my opinion this valuation model fits NKE quite well, because blue chip companies with a moat tend to be more predictable in terms of earnings and this should lead to lower margins of error in the assumptions. I didn’t factor the brand value of NKE into the valuation, since I believe this is already included in their sales and margins.

I used a free cash flow of $4.8 billion (The number of shares outstanding times the free cash flow per share in 2023).

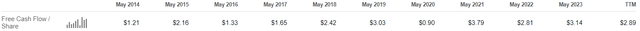

Over the last 10 years the company has managed to grow its free cash flow per share at a CAGR of 10%. However, the free cash flow has fluctuated considerably over the years.

Free cash flow NKE (Seeking Alpha)

I used a little bit more conservative 5 year growth rate of 8% and for the 5 years thereafter 5% because it’s harder to make accurate assumptions over longer periods of time.

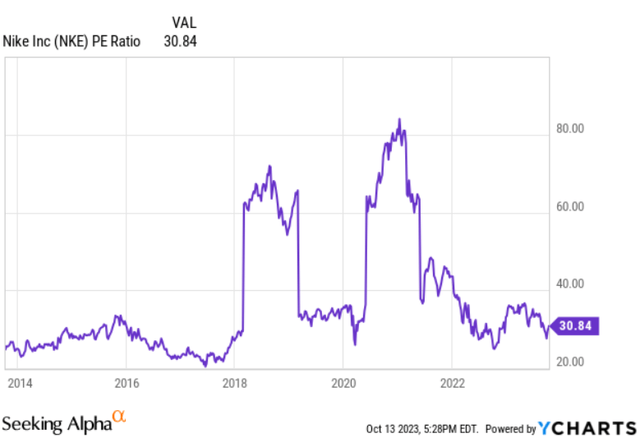

For the analysis I used a terminal multiple of 25x, because NKE is a high-quality business, has a moat and a strong balance sheet. In my opinion a far lower P/E isn’t reasonable. At the moment NKE has a P/E of 31x has an average 5-year P/E-non-GAAP of 33.95x. Some may argue that ” Nike is just a shoe manufacturer”, and that a 5-year average P/E of almost 34x is on the high side – I agree with that. However, Nike has never really been cheap in recent years, so I think an exit multiple of 25x is reasonable.

PE ratio development (YCharts)

I applied a discount rate of 10%, because I want this as a minimal annual return on investment.

Doing the math my calculated fair value is $82.56 per share, compared to the current share price of $103.71 it is 25% overvalued. The findings are in good agreement with the results of the Chowder score.

Discounted cash flow analysis (Google Spreadsheets)

Investment risks

There are certainly some risk factors that you need to put into consideration before investing in NKE.

The main one is their China related business activities. At the moment, the company is growing its earnings really well in China. This could be a great opportunity for further growth, but it’s also a risk. More geopolitical friction between China and the US could arise, which could really impact the growth prospects of the company. The total revenue from China ($7.2 billion) is 14.7% of the total NKE brand, so they could overcome some headwinds from a total business point of view. However, China is still is one of the main potential growth drivers for the company and in my opinion this underlines the importance of not paying too much in terms of a high multiple. Paying too much for lower growth has a huge impact on total return, so my advice is to take this into account with the valuation.

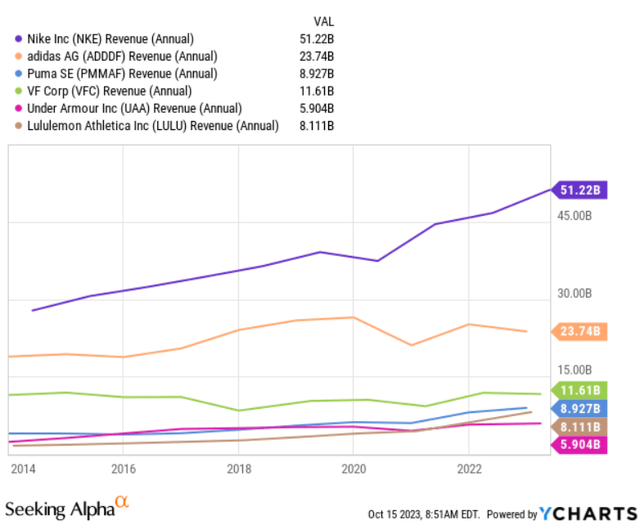

Secondly, the current economic situation could result in reduced demand in products. This could lead to lower earnings and profitability for the company. Also wholesalers can experience headwinds during times of economic uncertainty, which may results in order cancellations. This could hurt the profitability goals of NKE. Finally, there is always a possibility that NKE can lose its brand appeal in the long-term. NKE operates in a market with a lot of competition. Compared to its peers NKE is by far the largest in terms of revenue and it’s not likely its popularity will change in the short-term.

Revenue peers (YCharts)

However, we are living in a world where things can change faster than ever. The influence of social media makes it easier for competitors to take market share of enter the market. Luckily the company’s doing a lot of online advertising to stay on top.

Conclusion

NKE is a great business and there are a lot of things to like. They have an economic moat, solid growth prospects with some popular brands and a healthy balance sheet. Due to its rising profits, the company is been able to pay a reliable growing dividend over time and it is likely that they can continue to do so. Despite the drop in share price, NKE still isn’t in buying territory. The results of my discounted cash flow valuation and chowder score still imply overvaluation. In my opinion the current growth rate don’t justify the current valuation of the company. Also from a combination of dividend yield and growth point of view things are not attractive enough. There is also some noticeable short-term downside risks as well, due to possible economic headwinds. It looks like that I still need to be patient to grab some shares of NKE. I do think there will be opportunities to buy shares below my fair value. If we take the $82 per share and the forward annual payout of $1.36 per share it comes down to a yield of 1.6-1.7%, which is a better starting point to let the dividend compound.

With the Chowder score and my fair value of $82/share in mind and the possibility of further economic distress and geopolitical friction, I don’t mind having to wait for a better entry point. At this moment in time I give NKE a HOLD rating.

Nevertheless, I will follow the developments of the company and there is a good chance that I will initiate a position if the share price approaches my calculated fair value.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.