Summary:

- Meta Platforms stock is still massively undervalued despite the price more than tripling compared to the November 2022 bottom.

- Recent quarterly earnings show strong growth in revenue and profitability, with a solid cash flow increase.

- Meta’s expansion into new niches and its large user base present opportunities for unlocking new revenue streams.

AlexSecret/iStock via Getty Images

Investment thesis

Meta Platforms (NASDAQ:META) stock has been one of the biggest winners in my investment portfolio since I was brave enough to buy it in November last year when it faced massive pessimism. The stock price more than tripled from last year’s bottom, but my valuation analysis suggests the stock is still substantially undervalued. My previous investment thesis about META aged very well since the stock rallied more than 25% since May 26, compared to a below 4% growth for the broader U.S. market over the same period. Today, I would like to reiterate my “Strong Buy” rating because recent development suggests the company is still on its path to improving financial performance and building long-term value for shareholders.

Recent developments

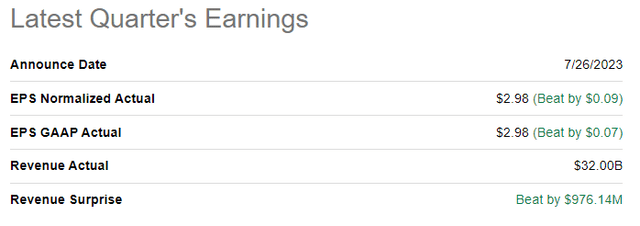

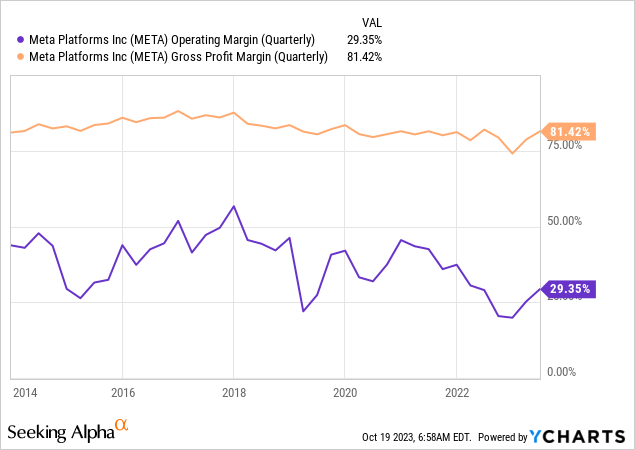

META released its latest quarterly earnings on July 26, when the company topped consensus estimates. Revenue demonstrated a solid 11% YoY growth, which is impressive amid the current harsh macro environment. The adjusted EPS followed the top line and demonstrated a solid YoY expansion from $2.46 to $2.98. I like profitability metrics YoY dynamics with the gross margin remaining above 81% and the operating margin expanding from 29% to almost 32%. As a result of the expanded operating margin together with the improved working capital management, the cash flow from operations increased by almost 50%, which is a solid near-term indicator.

Seeking Alpha

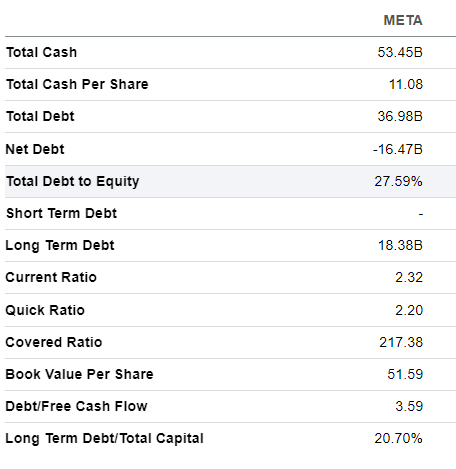

As a result of another solid quarter, the balance sheet improved again. As of the latest reporting date, the company had more than $50 billion in outstanding cash, and the net cash position was above $16 billion. Leverage is low, and liquidity metrics are in excellent shape. Meta’s fortress balance sheet makes it well-positioned to continue investing in innovation and growth, which is likely to boost long-term value for shareholders.

Seeking Alpha

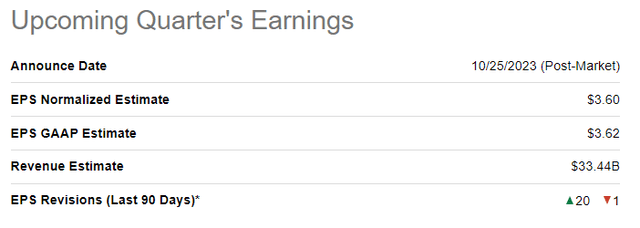

The upcoming quarter’s earnings release is approaching as it is scheduled for the next mid-week, October 25. Consensus estimates forecast quarterly revenue of $33.4 billion, which means a massive growth momentum is still in place with the expected 20% YoY growth. Profitability is also poised to impress investors with the adjusted EPS expansion from $1.64 to $3.60.

Seeking Alpha

I am very optimistic about the company’s near-term prospects. Key profitability metrics are on their path to returning to 2020-2021 levels as cost-cutting initiatives are bringing benefits for the company. Apart from increasing profitability, the company still invests vast resources in innovation with an R&D to revenue ratio still close to 30%.

I like the company’s initiative to expand to the micro-blogging niche of social networking with the launch of the Threads application, which gained its first 100 million users faster than ChatGPT. For sure, the honeymoon phase is over, and users’ growth will inevitably decelerate over time, but having more than 2.5 billion monthly active Instagram users [MAUs] makes Meta well-positioned to promote its Threads app. Having a multibillion audience also makes the company well-positioned to unlock new revenue streams at almost no cost. For example, a paid Meta Verified service looks like a brilliant move. The blue badge costs $14.99 in the U.S., which is comparable to many high-quality monthly video-streaming fees. However, the costs to produce buzzworthy video content are incomparably higher. Even if only 5% of MAUs end up subscribing to Meta Verified, it will unlock an extra $21 billion in annual sales for the company, which is massive.

While I consider Facebook and Instagram the company’s major stars, many investors also forget that the company owns WhatsApp, with 2.7 billion MAUs. This app looks slightly under the radar from the earnings perspective because Meta is still far from monetizing it aggressively. However, to me, such a vast user base indicates a massive potential for the company to boost financial results over the long term. I expect that during the nearest earnings release, the company will not only deliver a strong financial performance dynamic but is also very likely to introduce promising plans to add new features across the whole “Family of Apps”.

Valuation update

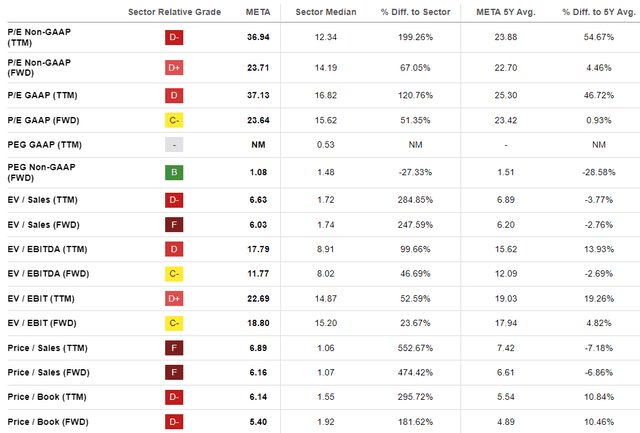

The stock price more than doubled this year with a 154% year-to-date rally. This is the massive outperformance of the broader U.S. stock market. Seeking Alpha Quant assigns the stock a low “D” valuation grade because multiples are substantially higher than the sector median. On the other hand, most of the valuation ratios look attractive compared to the company’s past five years’ averages. I think that given Meta’s ecosystem’s unmatched position in the social networking business and stellar profitability, it is better to look at the comparison with historical averages.

Seeking Alpha

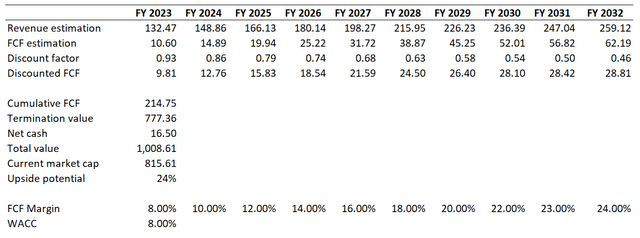

To get more conviction, let me proceed with the discounted cash flow [DCF] simulation. I think that the Fed is now close to the end of its monetary policy tightening cycle, and now I can use a more comfortable 8% WACC instead of the 10% I used last time when the level of uncertainty was much higher. Long-term consensus revenue estimates were upgraded since my previous simulation was conducted, and I also incorporated it into the new DCF model. I implement an 8% FCF margin and expect it to expand by two percentage points yearly, with expansion deceleration starting after FY 2030.

Author’s calculations

According to my DCF simulation, Meta should be a trillion-dollar company, meaning there is still a 24% upside potential. That said, my target price for the stock is close to $400.

Risks to consider

Having about three billion active users across the “Family of Apps” means the company stores vast amounts of personal data and faces substantial risks related to data security. Apart from cybersecurity risks, other data privacy issues are inherent to relationships between the company and the public. Apart from massive reputational risks, Meta also suffers fines for violating a very sensitive and complex web of data privacy rules across the developed world. While these fines and reputational risks never disrupted the company’s operations and were insignificant to earnings, the stock price might negatively react to any news related to data privacy issues. That said, investors should be ready to tolerate volatility related to negative publications regarding potential unintended data privacy misconduct. I consider this risk high because Meta operates across the globe, and its massive scale makes the company subject to rigorous scrutiny.

It is also crucial to remember that this year’s massive META rally was due to a huge stock sell-off last year. The stock bottomed a year ago notably below $100 per share, which was more than four times lower than the stock’s all-time highs of Autumn 2021. This was not only due to the overall weak sentiment in the U.S. stock market in 2022 but mainly due to Mark Zuckerberg’s vast focus on the controversial Metaverse project, which drained the company’s resources. After much criticism regarding the company’s deteriorating profitability, the management announced the plan to improve operating efficiency and cut costs, which helped the profitability to rebound, and the stock price reacted accordingly. That said, there is an elevated risk that the company’s iconic CEO might initiate new risky and controversial projects, which can lead to the investor’s sentiment deterioration toward the stock.

Bottom line

To conclude, META is still a “Strong Buy”. I am optimistic about the stock before its earnings next week because the management’s recent steps to unlock new revenue streams and expand profitability look very promising to me. I also consider the company’s unmatched social networking audience as a huge power to continue introducing new app features, which can be monetized and boost profits further. Last but not least, my valuation analysis suggests the stock is still massively undervalued.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of META either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.