Summary:

- Merck’s Q3 2023 earnings results will be announced on October 26th. In this preview, I highlight some issues to consider and news to look out for.

- Keytruda, Merck’s immuno-oncology drug, continues to drive significant revenue growth and is a key focus for the company with patent expiration due in 2028.

- The company hopes to develop a subcutaneous version of its >$20bn per annum selling drug, potentially extending patent protections.

- Merck’s pipeline includes promising assets in oncology, vaccines, and cardiovascular divisions, which will be important to watch for future growth.

- The company has been forecasting for ~$59bn of FY23 revenues and EPS of ~$3, and I expect this to be confirmed next week. MRK’s share price may be static while the Keytruda saga unfolds, however.

hapabapa

Investment Overview

The New Jersey based Pharma giant Merck & Co., Inc. (NYSE:MRK) announces its earnings results from the third quarter of 2023 next Thursday, 26th October.

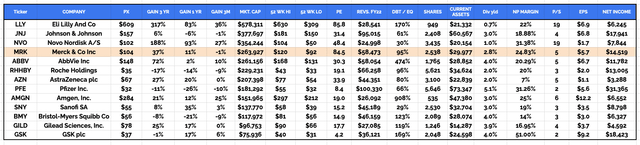

Merck is the world’s fourth largest pharmaceutical company by market cap, with a current valuation of ~$255bn, after Eli Lilly (LLY), Johnson & Johnson (JNJ) and Danish Pharma Novo Nordisk (NVO). The company generated the fourth highest revenue figure in 202 of $58.5bn, behind only Pfizer (PFE), Johnson & Johnson and Swiss Pharma giant Roche (OTCQX:RHHBY).

Global Pharma Cos Compared (data collated from TradingView, Google Finance)

As we can see from the table above, Merck’s 3-year share price performance has been impressive, with shares rising ~37%, the third best performing within the sector, after only Novo Nordisk and Eli Lilly’s, whose valuation growth has been rampant, almost entirely due to their incretin mimetic / GLP-1 receptor agonist drugs, semaglutide and tirzepatide, which are expected to become all-time best-selling drug products.

Merck has its own pharmaceutical best-seller in the form of its immuno-oncology drug, the immune checkpoint (Programmed Death Ligand 1, or “PD-1) inhibitor Keytruda, approved for a wide range of solid tumor cancers including lung, bladder, gastric, liver, kidney, breast, throat and cervical. The drug continues to win new approvals on a regular basis, and its revenue contribution between 2019 and 2022 rose from $11.1bn, to $20.9bn.

The growth of Keytruda, plus a near $6bn per annum contribution from COVID antiviral Lagevrio in 2022, has allowed Merck to grow revenues from $39.1bn in 2019, to $41.6bn in 2020, $48.7bn in 2021, and to $59.3bn in 2022.

In the second quarter of this year, Merck posted revenues of $15bn – up 3% year-on-year, or 7% adjusted for currency fluctuations, and achieved a non-GAAP gross margin of 76.6%. Earnings per share were $(2.06), versus $1.87 in the prior year period, owing to a $10.2 billion one-time charge related to the acquisition of Prometheus, and its portfolio of autoimmune disease drugs.

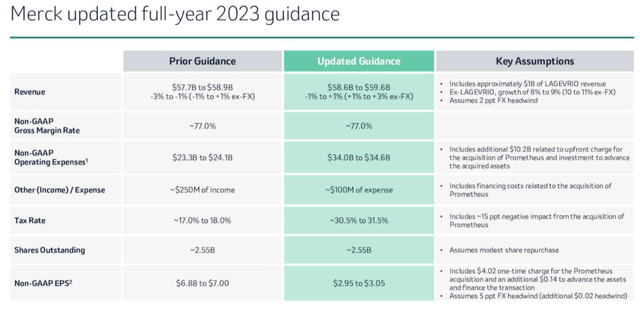

Merck has provided some detailed FY23 guidance, as shown below:

Merck FY23 guidance (Q223 earnings presentation)

Because revenues from Lagevrio are expected to fall from $5.7bn, to ~$1bn in 2023, Merck is unlikely to show any top line revenue growth this year, and with non-GAAP earnings per share (“EPS”) expected to come in at just $2.95 – $3.05, the company’s forward price to sales (“P/S”) and price to earnings (“P/E”) ratios are expected to come in at ~4.3x, and ~33x. That is a touch higher than the market might expect from a Big Pharma, although the outlay on Prometheus is chiefly responsible for the reduced profits – last year, Merck’s profit margin of ~25% was the fourth highest in the sector, level with Amgen (AMGN).

In short, by many measures Merck represents a strong company with good growth potential, both in terms of revenues, profits, and valuation. A solid blue chip Pharma, Merck pays a dividend currently yielding ~2.9%, slightly below average for the sector. With that said, since my last bullish note on the company for Seeking Alpha, published at the end of May, the company’s share price has trended down slightly, being down ~8%, hinting at some potential underlying issues at the company.

In this post, I’ll take a deeper dive look at Merck’s current – and future – drug product portfolio, and the Pharma’s overriding business model and its planned evolution, highlighting some areas to keep a close eye on when Q3 2023 earnings are announced next week.

Although the company may be in rude health today, there are some notable uncertainties to be aware of, such as the looming patent expiration of Keytruda, and the company’s attempts to bolster its oncology, vaccines, cardiovascular and immunology divisions in order to offset any lost revenues.

Biggest Threat To Merck’s Future Is Keytruda LOE – Look Out For Subcutaneous Study Data

As mentioned, Keytruda is as important to Merck as any drug is to any Pharma, given that the drug drove $12.1bn of revenue across the first half of 2023, accounting for 41% of Merck’s total revenues of $29.6bn.

Keytruda has established itself as standard of care therapy across multiple solid tumor – and some hematological – cancer indications, but the incredible thing about the drug is that its potential as an earlier line form of therapy is still being explored. As Merck’s Head of Research Dean Li told the audience during a fireside chat at the recent Morgan Stanley Global Healthcare conference:

KEYTRUDA really has had and continues to have significant impact in the metastatic setting and indeed is still driving growth in the metastatic setting, and we expect that to continue. But increasingly, our focus has been to try and help patients earlier in their cancer journey. And we have a number of indications in the earlier-stage setting.

But we do expect early-stage to be a significant part of the story for KEYTRUDA. Indeed, we expect early-stage to represent about 20% of our sales this year. It’s the majority of our growth, and we expect it to be about 25% of our total sales for KEYTRUDA in the year ’25 and grow thereafter.

And this is really important because the earlier we can treat patients, the better the prognosis. And we’re not stopping there. It’s an important part of why our subcutaneous KEYTRUDA program is underway to ensure we can provide improved access to patients and for that broader patient segment as we see a younger, earlier-stage cancer patients moving forward.

The subcutaneous program mentioned in the last paragraph is doubly important as it may provide Merck with the opportunity to extend the patent protection lifetime of its key asset. Roche has made the first breakthrough with a UK approval of subcutaneous tecentriq – an immuno-oncology drug with a similar mechanism of action (“MoA”) to Keytruda – although its application for FDA approval has been delayed into 2024 as the Pharma updates manufacturing processes.

Merck itself has been running a Phase 3 study – MK-3475-A86 – comparing subcutaneous Keytruda to the intravenously administered version – the current dosing regimen involves infusion either every 3 weeks, or every 6 weeks. The full results from this study have not been released yet, so it will be interesting to see if management provides any updates or insights on the upcoming earnings call with investors and Wall Street analysts.

If the results are positive, Merck believes that it could one day treat half of all Keytruda patients subcutaneously, therefore it is hard to overstate the importance of this pivot to subcutaneous. Succeed, and Merck protects its key asset from generic drug competition, which typically leads to the original drug’s revenues declining by >25% per annum, and is able to pursue its strategy of targeting earlier stage cancer treatment. Fail, and generic competition could begin to bite as early as 2028, when a key Keytruda patent expires.

Merck has a strong pipeline and has engaged in what looks like some positive, near-term revenue accretive M&A, but replacing the rapidly falling sales of a drug that could be posting revenues of >$30bn per annum by the time its patents is an extremely tough challenge for any Pharma, that will almost certainly lead to a downward correction to top line revenues and a declining share price.

Merck – Spotlight On Vaccines and Oncology Divisions

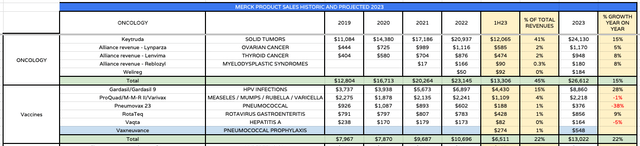

In 1H23, Merck’s Oncology division drove $13.3bn of revenues, or 45% of total revenues, its vaccines division drove $6.5bn revenues, or 22% of total revenues, hospital acute care $1.8bn, or 6% of total revenues, Virology $854m or 3% of total revenues, diabetes $1.75bn, or 6% of revenues, and animal health $2.95bn, or 10% of total revenues.

After Keytruda, the vaccine Gardasil, indicated for human papillomavirus, and cancers caused by HPV, is Merck’s best-selling asset, driving $4.4bn of revenues in 1H23, and $2.5bn in Q223 – up 53% year-on-year primarily driven by growing global demand, particularly in China. The strong performance allowed Merck to raise its FY23 guidance last quarter, therefore Gardasil revenue in Q3 will be an important number to pay attention to when results are announced next week.

Another interesting number to note will be the revenue performance of Vaxneuvance, Merck’s pneumococcal vaccine, approved last year. The vaccine drove revenues of $274M in 1H23, and is a rival to Pfizer’s Prevnar, which generated >$5bn of revenues last year. As such, this could become another key growth asset for Merck.

Merck product performance – historic and projected (historic data Merck’s, projections mine)

In the above table I have collected historic revenue data from Merck’s current commercialized product portfolio, up to 1H23, and used the 1H23 data to forecast FY23 revenues product by product. As we can see, within vaccine and oncology, Keytruda, Gardasil and Vaxneuvance are the key drivers behind most of these 2 division’s year-on-year gains.

It is worth noting that both lynparza and lenvima face patent expirations before the end of the decade, as does Gardasil, in 2028. Luckily, as I will discuss shortly, Merck expects multiple new approvals in oncology, that could generate revenues of $3-$5bn by the end of the decade.

Remaining Divisions Flat To Underwhelming Performance Unlikely To Change In Q3

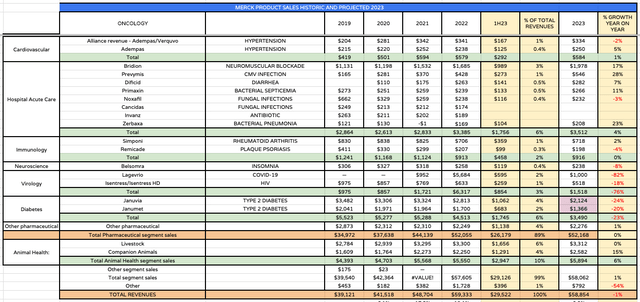

Merck markets and sells nearly 30 major drug products across multiple divisions besides oncology and vaccines as shown below.

Merck drug product revenues historic and projected (Merck historical data, my assumptions)

Merck’s cardiovascular and hospital acute care divisions provide solid revenue streams, although there is little evidence of strong individual product growth, and the same can be said for immunology, and neuroscience. Unfortunately for Merck, within its diabetes division, both Januvia and Janumet have lost their patent protections this year, which explains their poor performance, and gives Merck a headache, as this division generated >$4.5bn of revenues last year.

The animal health division exhibits good growth, although when we note that Bridion, within the Acute Hospital Care division, also loses patent protection potentially as early as 2026, reviewing Merck divisions outside of vaccines and oncology presents a slightly underwhelming picture, that may be preventing the company from showing the strong growth that underpins a rising share price. Fortunately, however, Merck’s pipeline can help to bolster several of these divisions going forward.

Merck – Many Promising Pipeline Assets To Track Ahead Of Q3 Earnings

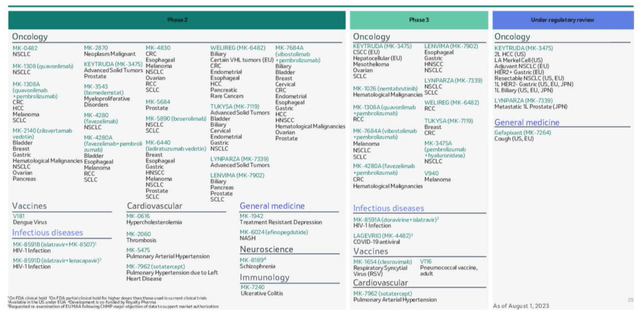

If we take a look at the pipeline overview provided by Merck in its Q223 earnings presentation, we can immediately see some exciting developments.

Merck pipeline as of Q223 (Merck presentation)

Perhaps unsurprisingly, and again underlining its disproportionate importance to Merck, Keytruda is apparently under regulatory review for seven different indications. Last week, the drug secured FDA and European approval in non-small cell lung cancer (“NSCLC”) as an adjuvant therapy, and in September, the drug received 4 new approval in Japan.

Since Q2 earnings were announced, Keytruda has also met key endpoints in multiple late-stage studies, and frankly, the drug has such a strong efficacy profile across so many areas of oncology, it would not necessarily be surprising to see the drug surpass $50bn of annual sales, were it not for patent issues. Once again, the success or otherwise of a subcutaneous version of Keytruda is the key variable in Merck’s future performance and valuation.

Away from Keytruda, the cough medicine Gefapixant is also under regulatory review, having been initially rejected by the FDA in January last year, and although unlikely to achieve blockbuster revenues, could be a ~$500m per annum selling asset.

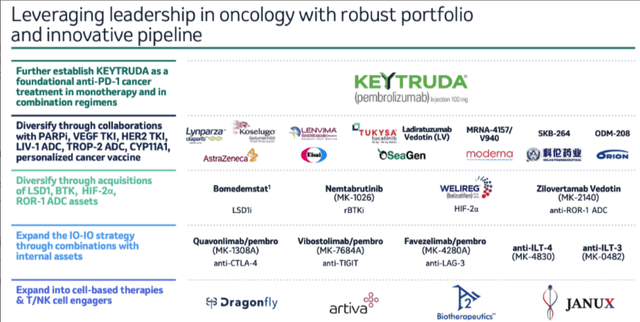

If we take a step further back, Merck’s long term goal is to grow in oncology through partnerships with other major pharmas, and by partnering development stage assets – Vibostolimab, which targets TIGIT, Favezelimab, a LAG-3 inhibitor, and Quavonlimab, an anti-CTLA4 drug, for example – with Keytruda. A slide shared during Merck’s presentation at this year’s JP Morgan healthcare conference shares more detail.

Merck oncology growth strategy (presentation)

An asset of real importance to keep track of during Q3 earnings presentations will be MRNA-4157, which uses an mRNA “vaccine” to enhance the efficacy of Keytruda. This combo could secure an approval in melanoma – a pivotal study is expected to confirm positive Phase 2 data – and that could be the first of many indications – although Merck and Moderna (MRNA) face competition from the likes of BioNTech (BNTX) and Pfizer.

Away from oncology, cardiovascular is a key area of focus for Merck, with Sotatercept – an activin receptor type IIA-Fc (ActRIIA-Fc) fusion protein , acquired via Merck’s $11.5bn buyout of Acceleron Pharma – expected to gain approval in pulmonary arterial hypertension (PAH) early next year. Apparently, Merck expects to drive >$10bn of revenues from its cardiovascular division by the middle of next decade, therefore any updates on sotatercept, and up to 8 additional clinical candidates within the same division – will be worth looking out for.

Immunology is another area of focus for Merck, thanks to its buyout of Prometheus, whose lead asset, PRA023, has been pegged for peak sales >$20bn per annum by some analysts. If that were to happen, PRA023 would be a ready-made answer to Merck’s Keytruda patent woes, but given the extremely competitive nature of the autoimmune markets, in which, for example, AbbVie’s Skyrizi and Rinvoq drugs are fighting to achieve ~$25bn in annual revenues by 2030, offsetting falling revenues from its patent expired Humira, the only drug to outsell Keytruda last year, I would be significantly more conservative with a peak sales target for PRA023.

Nevertheless, the Prometheus buyout shows that Merck is prepared to spend big on M&A and take risks in order to uncover a new “mega-blockbuster” drug to replace Keytruda, whenever its patents do finally expire. In that spirit, another drug worth paying attention to – and listening for updates on during the Q3 earnings call – would be Merck’s dual GLP-1/glucagon receptor efinopegdutide.

Earlier in this post I mentioned the rampant share price gains made by Pharmas Eli Lilly and Novo Nordisk, thanks to their GLP-1 class drugs tirzepatide and semaglutide, which are already approved (as respectively Mounjaro, Wegovy, and Ozempic) and expected to command the lion’s share of a >$100bn weight loss market going forward.

Although is not pushing for approval of efinopegdutide in the weight loss space yet, its drug has outperformed Ozempic in the indication of non-alcoholic fatty liver disease (“NAFLD”), achieving a >72% reduction in liver fat at week 24. Apparently, Merck used a weakened dose of Ozempic in its study, but nevertheless, given the scale of NAFLD and non-alcoholic steatohepatitis markets, efinopegdutide should be regarded as one of Merck’s most important pipeline drugs.

Concluding Thoughts Ahead of Q3 Earnings – Merck’s Steady Ship Headed For Choppier Waters

There are a couple of reasons why, ahead of Q3 earnings, I am revising my rating for Merck stock from a “Buy,” to a “Hold.”

I do not expect too many surprises from Merck’s Q3 2023 earnings given that, fourth quarter aside, the company’s revenues do not fluctuate much from quarter to quarter. I believe Merck can meet the market’s expectations of ~$15.3bn of revenues, and EPS of ~$1.95, even with the COVID rug lagevrio’s sales falling significantly year-on-year.

It is hard to forecast anything but good growth for Keytruda sales, although management has cautioned that it may be less than in prior quarters, whilst Gardasil revenues ought to continue to outperform. With diabetes division revenues likely to keep falling, and other divisions performing adequately, I expect a stable quarter of earnings, although will that be enough to support some share price growth?

I am not so sure it will be. Shareholders, analysts and the market are all doubtless waiting on updates around subcutaneous Keytruda, and there is potentially an outside chance we will hear some updates next week. Any new information on progress and performance would undoubtedly move Merck’s share price needle. Elsewhere, new information on trial data and steps forward for the many Keytruda partnered studies and approval opportunities will be welcome, as will any updates on PRA023 and efinopegdutide, and sotatercept.

The reality is however that after Q3 earnings are presented investors and the market will still likely have as many questions as answers on Keytruda’s future, and taking all of the permutations into account, I don’t find compelling reasons for Merck’s share price to spike on earnings.

One final issue to consider is the new Inflation Reduction Laws that are coming into effect, restricting the influence Pharmas have over drug pricing. It is rumored that Bristol Myers Squibb’s Opdivo – an immune checkpoint inhibitor and Keytruda’s biggest rival – will soon be targeted by the government and its price controls. If Opdivo is affected, then Keytruda is also a likely target, and that is another headwind for Merck to fight against in relation to Keytruda, on top of patent expiration concerns.

So long as there is so much uncertainly in play, and until new products are approved to supercharge growth amongst Merck’s many flagging divisions, I think the bull case for Merck stock will be somewhat compromised, although if you are a believer that the subcutaneous / patent extension strategy will work, then picking up Merck stock at ~$100 per share – even if that represents a significant premium to the Pharma’s typical trading range prior to this year, may well seem like a worthwhile opportunity. I would be looking more closely at an entry point ~$85 per share.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of BMY, ABBV either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Gain access to all of the market research and financial analytics used in the preparation of this article plus exclusive content and pharma, healthcare and biotech investment recommendations and research / analytics by subscribing to my channel, Haggerston BioHealth.