Summary:

- CRM has consistently delivered strong revenue growth over the past decade, with revenue exceeding $30 billion annually and growing at more than 10%.

- The growing adoption of AI-related modules is expected to be a key growth catalyst for CRM, with product innovations and partnerships driving this growth.

- CRM’s access to customer data and existing client relationships positions it well to upsell AI modules, giving it a competitive advantage in the AI market.

Stephen Lam

Summary

I am recommending a buy rating for Salesforce (NYSE:CRM) with growth to sustain at above 10% as the growing adoption of AI-related modules is a catalyst for growth. The investment that CRM has made over the years seems to be starting to bear fruit as it gets into a better position to address the AI needs of businesses.

Business

CRM is a big name in the software industry. The business’s main product offering is its customer relationship management (CRM) business, which helps businesses sell their products and services to clients in an efficient manner. CRM success can be seen evidently in its financials, where it has grown at a staggering pace of more than 20% over the majority of the past decade, albeit partially driven by inorganic drivers like M&A. CRM is no stranger to M&A, as it has conducted more than 100 acquisitions over the past decade (since 2010).

Financials/Valuation

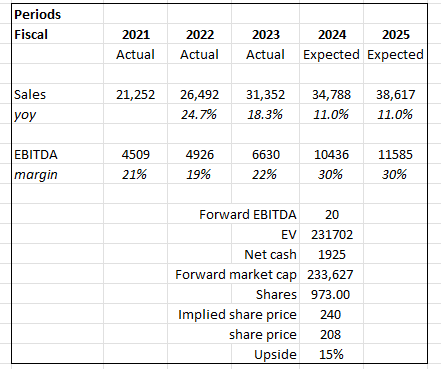

CRM has gone from a ~$2 billion revenue generator in FY12 to an extremely large business that generates over $30 billion in revenue a year and is growing at more than 10% (as of the latest quarter). The strength in revenue growth translates directly into the business profit profile, wherein EBITDA has increased more than 10x from $130 million in FY12 to $9.6 billion as of the last 4 quarters. While the business is a known serial acquirer, the balance sheet remains at a net cash position of $3 billion.

Based on author’s own math

Based on my view of the business, CRM should be able to grow by more than 10% easily based on the upcoming growth catalyst, driven by AI adoption. Accordingly, margins should gradually expand towards the levels of more mature large application software businesses like Oracle and Adobe. However, to also take into account the possibility that CRM needs to reinvest heavily in AI in the near term in order to better position itself for the long-term secular tailwind, I am modeling flat margins for FY24 and FY25 (note that the LTM EBITDA margin is 30%). I valued CRM relative to other large and mature software application businesses like Adobe, Oracle, Intuit, Sage Group, Veeva Systems, SAP, and Workday. Relatively, CRM has a similar growth profile over the near term; however, its margin profile is near the bottom of the group, and as such, I expect it to continue trading at a discount to peer multiples (peers are trading at a medium of ~20x forward EBITDA).

Comments

I believe CRM has entered a new stage of growth, one that is fueled by the growing adoption of AI. There are two aspects that should drive growth ahead: Product innovations and partnerships.

At the heart of all AI functions lies a dataset that can be leveraged with efficiency and efficacy to enable automation. This is where I believe CRM has done a tremendous job in elevating its platform to address the need for businesses to tap into their data. The introduction of the Salesforce Data Cloud in the previous year, a large-scale real-time data platform, and the subsequent release of Einstein 1 this year have demonstrated CRM’s commitment to providing a platform that is driven by real-time automation and intelligence, while also offering a streamlined user interface. The impact should be evident, as it should facilitate the achievement of CRM’s ultimate objective of presenting the most pertinent customer data. With that being stated, I expect CRM will see further advancement of this platform by integrating its various clouds within a unified metadata framework. This integration aligns with the company’s ongoing transition to its proprietary cloud infrastructure, Hyperforce, which has been in progress for multiple years. Upon completion of this task, the Einstien 1 platform would be able to establish connections with customer data sources more efficiently. Consequently, this would lead to a reduction in challenges related to implementation, integration, and adoption, as it would enable the facilitation of productivity features. Therefore, I perceive the improvements of the CRM metadata platform as an essential measure in mitigating technical obstacles for clients and yielding enduring advantages for the business in the long run.

As customer CRM improves the underlying infrastructure to optimize data utilization, it should also strengthen its customer-facing offerings, such as AI modules. In my perspective, the current timing is opportune for CRM. This is due to the fact that AI remains a relatively nascent concept in numerous industries, and organizations are likely in the process of developing their AI strategies, specifically in relation to generative AI. For businesses that are already doing business with CRM, I believe CRM holds a very strong competitive advantage that competitors may not be able to overcome. The reason being that CRM already has access to the underlying business data, and the relationship rapport has already been built. It is a lot easier for CRM to upsell these clients their AI modules than for competitors to convince these clients to switch, which requires a complete overhaul of operating procedures, user interfaces, and data. Arguably, the last aspect might be the one that deters many businesses, as any mistakes made could risk the loss of data. I expect the CRM to see growth acceleration from FY24 onwards as businesses are likely to be finalizing their budget for 2024, and I see that as a positive catalyst for customers to direct resources toward implementing AI-related modules.

Another factor that has the potential to stimulate growth is CRM’s partnership strategy. Openness and LLM neutrality remain central to CRM’s approach. The recent development in the collaboration between Salesforce and Google (GOOG) (GOOGL) serves as a noteworthy illustration of this phenomenon. The agreement establishes Google as the initial extensibility partner for Einstein Copilot, and Salesforce as the primary integration partner for Google Workspace’s newly introduced Duet AI extension framework. In particular, I anticipate that CRM will allow for increased AI uses on the platform by allowing customers to import Google’s LLMs. The forthcoming release of Gemini has generated considerable anticipation due to its anticipated improvements in various aspects, including model size and parameters. In light of these advancements, it is conceivable that this partnership could expand to enable Salesforce to utilize its extensive dataset for training purposes, thereby facilitating the exploration of additional opportunities to enhance productivity.

Risk & Conclusion

The downside for CRM is that it is a rollup company. In the event the M&A machine stops, actual organic growth might disappoint investors, hence impacting terminal value. In addition, CRM’s ability to grow might be impaired by worsening macroeconomic conditions if they get worse as businesses delay any implementation or deployment of CRM or AI efforts.

I recommend a buy rating for CRM based on my expectation of sustained growth exceeding 10%, driven by the growing adoption of AI-related modules. CRM, a major player in the software industry, primarily offers customer relationship management solutions. Over the past decade, it has shown significant growth, with revenue now exceeding $30 billion annually, accompanied by a robust net cash position of $3 billion. While CRM has a history of serial acquisitions, it continues to deliver strong financial performance.

I foresee CRM’s growth being fueled by the adoption of AI, with two key drivers: product innovations and partnerships. The company’s efforts in elevating its platform to harness data efficiently, as well as its introduction of Salesforce Data Cloud and Einstein, are expected to enhance customer data utilization. The integration of various clouds into a unified metadata framework aligns with CRM’s transition to its proprietary cloud infrastructure, Hyperforce.

Furthermore, CRM’s timing appears opportune for AI adoption, as it already has access to critical customer data. It is well-positioned to upsell AI modules to existing clients, offering a competitive advantage over potential competitors. The partnership with Google also holds promise for expanding AI capabilities on the platform.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.