Summary:

- Salesforce.com’s stock has flatlined over the past month but remains up 50% on the year.

- The company has achieved boosted operating margins and pro forma EPS through efficiency measures and layoffs.

- Salesforce’s diverse array of software products and strong brand reputation will help it gain market share. However, decelerating revenue growth and valuation concerns are risks to consider.

- Buy this stock below $170, but not above that.

JHVEPhoto

The last couple of months have been unduly painful, especially for tech investors. Bargains do abound as valuations pull back in response to higher interest rates, but on the whole, I still recommend that investors cull down their allocations to equities and make exceptions only for reasonably-valued growth stocks.

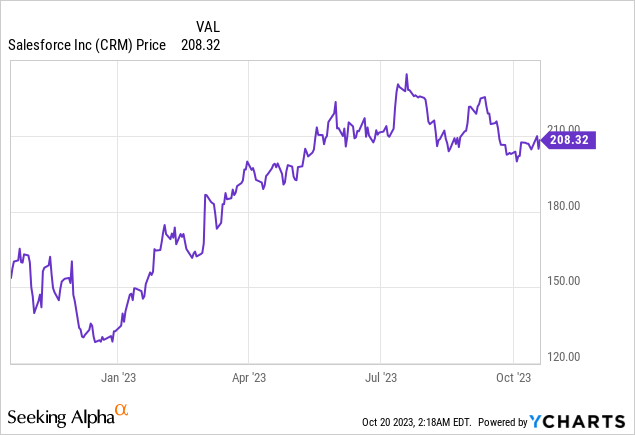

Salesforce.com (NYSE:CRM) is a position I’ve taken a hard look at over the past few weeks. The stock has flatlined over the past month, but remains up ~50% on the year:

Earlier this year in August, I wrote a bullish opinion on Salesforce, citing the company’s massive profit growth amid a reasonable valuation. “Reasonable,” of course, is a relative term – and with skyrocketing interest rates on risk-free cash, what makes the cut in my portfolio is a much slimmer list. In addition, Salesforce released Q2 results that showcased decelerating revenue – and for this reason, I’m downgrading the stock to neutral.

I now see Salesforce as a relatively mixed bag of both positive and negative drivers. On the plus side for the company:

- Salesforce is really hitting its profit stride- By focusing on efficiency and laying off a good chunk of staff over the past year, the company has achieved substantially boosted operating margins and pro forma EPS.

- Best-in-breed reputation will shield Salesforce as smaller competitors dry up- In the software industry, few brands are as recognizable as Salesforce, particularly in the CRM space, where Salesforce has a dominant market share. Amid a tough macro environment where many smaller software companies are folding, Salesforce will continue to gain share.

- Very diverse array of software products- Though we may decry Salesforce’s past penchant for acquisitions, the truth is that Salesforce is now left with a very wide net of software products, all of which carry strong cross-selling potential. Outside of its core CRM and marketing tools, Salesforce has enterprise communication via Slack and Quip, API tools via MuleSoft, BI via Tableau, and a variety of other best-in-class software offerings.

On the flip side, however, there are risks to be aware of:

- Deceleration on top of saturation- Salesforce’s growth is diminishing. Though the company can certainly blame macro conditions here, Salesforce’s CRM is also already among the most widely used products in the industry – raising the question of how much growth is left.

- Valuation is decent, but not a screaming buy in this market- At current share prices near $208, Salesforce trades at a ~22x P/E multiple against FY25 consensus pro forma EPS expectations of $9.39.

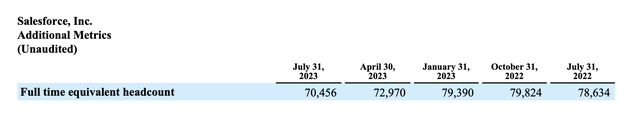

Also – we note the company’s recent trend of declining headcount and rising margins may not last long. Bloomberg recently reported that Salesforce is planning a renewed hiring spree after this year’s layoffs, potentially nullifying the benefits of the efficiency moves the company made this year.

All in all, I don’t see much movement for Salesforce, either up or down in the near term. Continue to keep this stock on your watch list, but the potential for either profit or loss isn’t great. I’d be a keen buyer of Salesforce again if the stock hit a 18x P/E multiple (representing a $170 price target), but stay on the sidelines until then.

Q2 download

Let’s now discuss some of the key highlights in Salesforce’s most recent quarter, starting with the top-line trends:

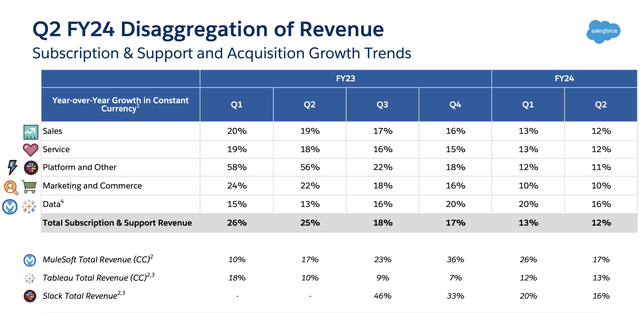

Salesforce Q2 revenue trends (Salesforce Q2 earnings deck)

Revenue grew 12% y/y on a constant-currency basis (11% as reported) to $8.60 billion, beating Wall Street’s expectations of $8.52 billion (+10% y/y) by a slight margin. Growth did, however, decelerate from 13% on a constant-currency basis in Q1 and growth in the high teens in the prior Q3 and Q4.

And as can be seen in the chart above, the deceleration is broad-based across all of Salesforce’s products, most notably the platform cloud (which includes recent acquisitions like Slack) which had been a big driver of growth in FY23.

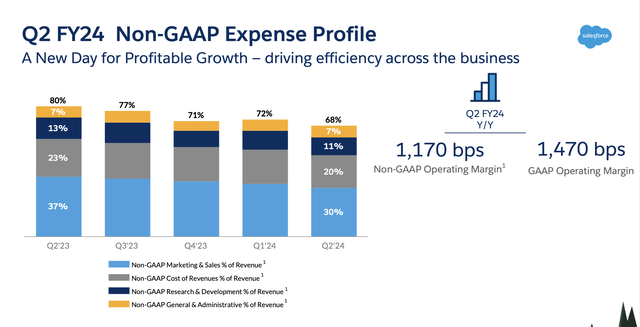

Offsetting growth deceleration, however, is a large increase in margins driven by massive reductions in opex. Since last year, the company has cut 12% of revenue out of its opex, now down to 68% of revenue on a pro forma basis – with cuts largely in the sales and marketing arm.

Salesforce opex trends (Salesforce Q2 earnings deck)

Headcount, as seen in the chart below, is down by 2.5k heads sequentially and is down 10% y/y, driven by layoffs.

Salesforce headcount (Salesforce Q2 earnings deck)

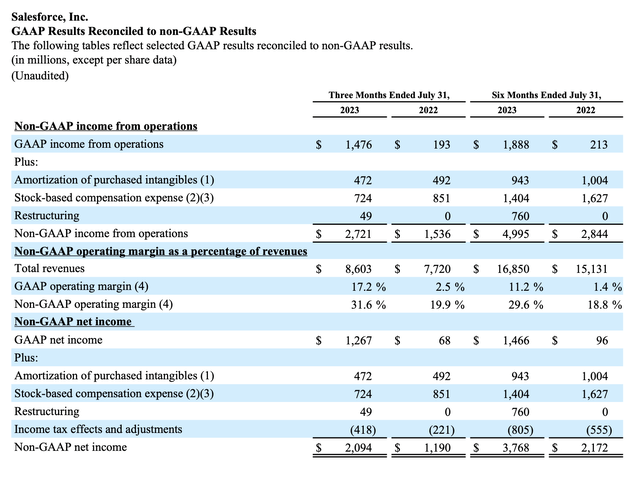

This has driven a massive boost to pro forma operating margins, up 12 points year over year to 31.6%. Pro forma net income, meanwhile, has grown to $2.09 billion, up 76% y/y. Pro forma EPS of $2.12 jumped 78% y/y and beat Wall Street’s expectations of $1.90 with 12% upside.

Salesforce profit metrics (Salesforce Q2 earnings deck)

As previously mentioned, however, the company’s attitude toward hiring may be shifting again to a more aggressive stance. Mark Benioff noted on the recent Q2 earnings call:

And I’m really excited to welcome back to Salesforce so many boomerang employees.

Boomerang employees are employees who are employees, but for one reason or another, left the company, got recruited away or went off to start their own companies or ever. Well, a lot of these results have to do with not only our incredible employees that we’ve had in place. But a lot of folks have really felt the desire to come back and help us. And I just want to say thank you to all of them. It’s been incredible to welcome them back.

And the line is long out the door of people who have left Salesforce and want to come back to Salesforce and we’re welcoming all of them with open arms, especially across our sales, engineering, technology organization, proven winners, incredible leaders who got taken out of Salesforce because they were doing incredible things. To watch them come back because they want to help us and achieve this next level of growth and capability and revenue and margin and in technology and leadership.”

Though hiring to support growth (especially in development areas like AI) is a defensible long-term move, in my view Salesforce’s margin gains are the only incentive keeping investors in the door while revenue growth decelerates to the low teens. A renewed burst of hiring may be the downside catalyst that sends the stock down.

Key takeaways

Though Salesforce’s profit engine has just started to take off, the combination of slowing revenue growth as well as a potential renewed hiring spurt may put a dent in the recent EPS explosion. Keep a close watch on this stock, but don’t buy in yet.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.