Summary:

- AT&T is delivering on its goals of growing users and revenue in its Mobility and Consumer Wireline businesses.

- The company has increased its full-year guidance for free cash flow and EBITDA, providing reassurance for the safety of its dividend.

- With continued growth and lower capex, AT&T should reach its leverage targets by early 2025, allowing dividend growth to resume.

franckreporter

Long Awaited Guidance Raise

For several quarters, I have covered AT&T’s (NYSE:T) slow, incremental delivery of its the focused strategy it has pursued since the partial sale of DirecTV and Warner Media (WBD) spinoff. The first point of the strategy was to grow users and revenue in its Mobility and Consumer Wireline businesses. This would be delivered by massive capital investments in 5G and fiber technology, combined with the right pricing and bundling offers to attract and retain customers. The second point was to improve cost efficiency, saving $2 billion over the next three years. A large part of this effort includes phasing out of legacy copper-based networks with their higher support costs. The final point is improving the balance sheet and dividend coverage.

While I have been saying for several quarters that AT&T is delivering its strategy, as evidenced by subscriber count and EBITDA margin growth, last quarter I also noted that the dividend yield had gotten to a sufficiently high spread above the company’s bonds and preferred shares that my rating shifted to a Buy. Between that time and the most recent earnings report, T share price held steady, while the S&P 500 (SP500) declined.

What’s new this quarter is that AT&T’s very conservative management has increased full year guidance. The company is now forecasting $16.5 billion in free cash flow, up from $16 billion previously. They are also forecasting 4% EBITDA growth for the year, up from 3%.

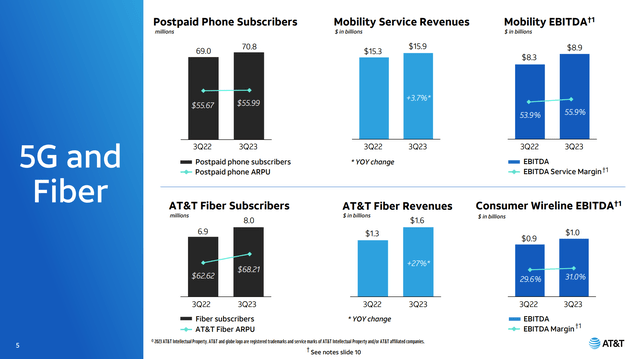

Third quarter results provide further evidence that AT&T is delivering on their strategy. In the Mobility business, the company had net additions of 550,000 postpaid customers. While this is down from the 1 million plus net adds seen during the pandemic-influenced 2021 and 2022, it is still a strong number considering the general macro worries that exist around consumer spending. More importantly, revenue per user and EBITDA margins continue to improve. The company is cutting cost and pushing price increases without driving away customers, as indicated by the low 0.79% postpaid churn rate.

On the Consumer Wireline side, it has now been a year since the number of fiber customers exceeded the number of legacy technology customers. About 1 million customers per year continue to switch out of older technologies into fiber. This is happening even with a 9% increase in revenue per user. It is also happening despite the ongoing macro worries about consumer spending and a slower housing market where a move is often the prompt to sign up for new service.

Additionally, the company has introduced a fixed wireless service known as Internet Air. While fiber is still the primary growth focus, Internet Air provides a way to attract a different segment of customers who have lower data usage rates or where fiber may not yet be available. These customers may eventually adopt a fiber service as well as bundle with phone service, creating more higher-paying core customers for AT&T. Internet Air may also provide a faster way to phase out legacy copper networks and cut costs by offering equivalent service levels with newer technology.

The growing customer count, revenue per user, margins, and EBITDA are all evident in the quarterly results, as they have been for the past several quarters.

The guidance raise may finally provide the inflection point needed for AT&T stock, after an ugly 6 months driven by low first quarter free cash flow in April and the lead cable scare in July. The negative market reactions from these events took AT&T share price below the $15 zone that had been a historic bottom set in the mid-1990’s and retested after the dotcom crash.

AT&T Price Chart (Seeking Alpha)

The stock was up around 7% shortly after the 3Q results were released, taking it back above the lows set 20 years ago. Of course, the very fact that AT&T share price is the same as 20 years ago is often cited as a reason to avoid the stock. I don’t want to minimize that fact or claim that T is about to turn into a growth stock. However, for income investors, current levels provide a well-covered 7.25% yield which is better than bonds and offers modest capital appreciation potential if the company simply continues to deliver on its strategy.

Well-Covered 7.25% Yield? Really?

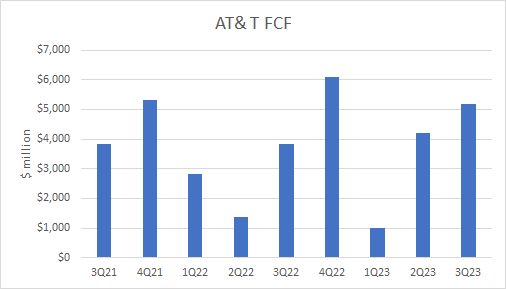

Yes, really. As I alluded to above, T stock’s biggest one-day drop this year came during the free cash flow freak-out that followed 1Q results when the company delivered just $1 billion of FCF against the then full-year plan of $16 billion. Never mind that the company always stresses that FCF is seasonal and much more heavily weighted to the second half. After the near halving of the dividend following the WBD spinoff, investors are understandably skittish about the safety of the existing $0.2775 quarterly dividend. Third quarter results should put an end to this worry. The company delivered $5.2 billion of FCF in the quarter, up from $3.9 billion last year. Year-to-date, FCF has been $10.4 billion, compared to $8.0 billion in the first 9 months of 2022. The company needs $6.1 billion of FCF in 4Q to hit its new full year target. That’s $0.9 billion more than what they actually delivered in 3Q, but history shows this is easily achievable given historical seasonality.

Author Spreadsheet (Data Source: AT&T Financial and Operational Trends supplement)

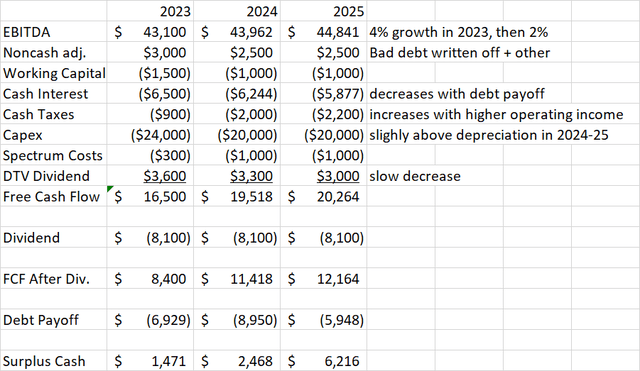

Once the 4Q dividend is paid out, AT&T will have paid $8.1 billion in dividends for the year, representing a FCF payout ratio of just 49%. That leaves $8.4 billion FCF after dividends. So far this year, AT&T has reduced net debt by $1.8 billion. (Gross debt +$2.0B, cash +$3.8B) That leaves $6.6 billion available for debt reduction by the end of this year. That amount, plus post-dividend FCF in 2024, can easily cover the $11.3 billion of debt due in the next 12 months.

Looking forward, AT&T will not turn into a growth stock. In fact, the 4% EBITDA growth planned for this year could even be on the high end of what is expected in the future. This does not mean the company is not still a cash machine with the ability to raise the dividend in the future.

After this year, I am assuming EBITDA growth of 2% in 2024 and 2025. This does not even require any market share growth in Mobility. It can be accomplished by delivering the remainder of the planned $2 billion of cost cuts plus price increases on services to keep up with inflation. With more runway for growth in Consumer Wireline (fiber), this segment can help offset continued decline in Business Wireline. Mexico is also a growing segment, although small compared to the overall size of the company. With the large 5G and fiber capital program wrapping up capex will decline to around $20 million per year, about 10% greater than annual depreciation. Interest expense will decrease with debt payoff. You can see how much debt is due each year and the average interest rate on page 72 of the 10-K. The DirecTV dividend, around $3.6 billion this year, will probably decline gradually.

Putting all these together, I see a path to $20 billion of FCF per year starting in 2024. As you can see on the table below, while the amount of debt due each year varies, there is still cash left over after debt payoff. Since 2024 has a particularly high amount of debt due, AT&T’s management may hold off on a dividend increase until 2025. At that time, we should see more discussions about how the surplus cash is split between dividends and buybacks rather than the safety of the current dividend.

To be fair to the skeptics, at the time of the WBD spinoff, AT&T did plan for $20 billion of FCF and a net debt/EBITDA ratio of 2.5 by the end of 2023. High capex costs and spending on spectrum licenses have deferred this to the first half of 2025 but with the heavy investment phase for 5G now out of the way, the target appears achievable, even if delayed. I expect AT&T’s conservative management to wait to hit these targets before raising the dividend. This means possibly one more year without a dividend increase, but at existing share prices, a yield above 7% is still attractive.

Valuation And Peer Comparison

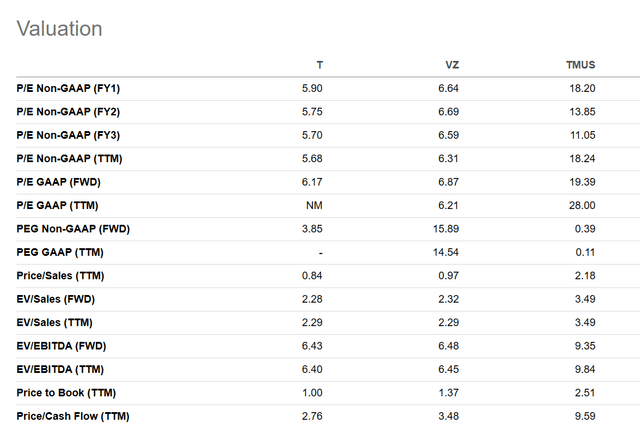

AT&T is valued around 12% below Verizon (VZ) on a price/earnings basis. The P/E’s of both are around 2/3 cheaper than T-Mobile (TMUS) on current year earnings, but this gap narrows in the out years because of T-Mobile’s perceived faster growth. On an EV/sales and EV/EBITDA basis, T and VZ are valued almost identically, and both are about 1/3 cheaper than T-Mobile.

Given the similarities between AT&T and Verizon and the guidance raises by AT&T, I think the P/E’s can equalize in the near term, which would imply a current price target of $17. While this is just a 12% upside to T share price at the time of writing, I consider the stock a Buy because of the safe dividend with the potential for raises within a couple years. Longer term, further capital gains will depend on the market seeing and believing in the sustainability of the projected free cash flow increases. Once investors have developed trust in the company’s cash delivery, a further 20% increase (in line with estimated FCF growth) to $20 is possible.

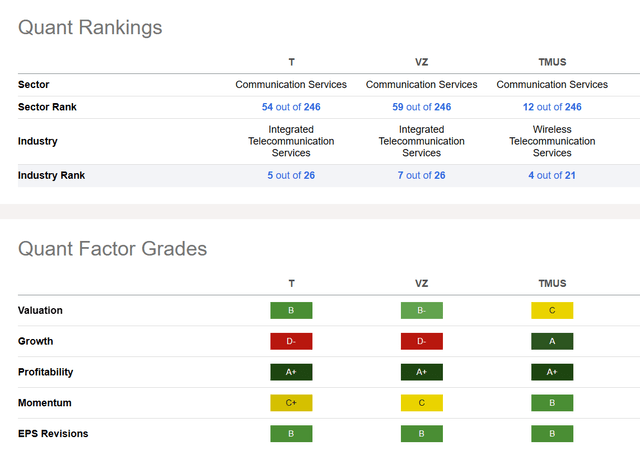

Looking at Seeking Alpha’s Quant Ratings, T has a slight edge over VZ on valuation and momentum but both are severely disadvantaged to T-Mobile on Growth.

Of course, T-Mobile’s Growth rating benefits from not having the declining legacy wireline business. Still, the Valuation ratings suggests that paying 3x the P/E for T-Mobile amounts to overpaying for that relative growth. Looking at customer metrics that are not direct inputs to the quant rankings, T-Mobile has roughly half the total number of customers as AT&T, but postpaid phone net adds are in the same ballpark. On high-speed internet net adds, T-Mobile has about 2/3 more than AT&T fiber each quarter, explaining AT&T’s recent expansion into fixed wireless internet.

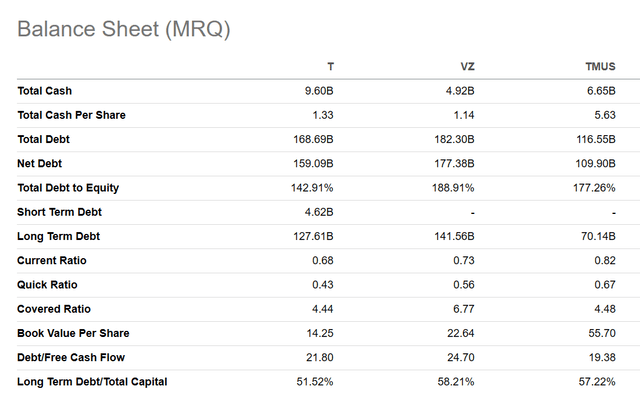

When it comes to the balance sheet, it is time to stop singling out AT&T for its debt issues. AT&T has the lowest debt/equity and debt/total capital ratio of the three majors. AT&T’s interest coverage (operating income / interest expense) is nearly identical to T-Mobile but not as good as Verizon. AT&T’s rankings are likely to improve in the next couple years as capex spending declines, improving cash balances and net debt.

On the dividend side, T-Mobile just recently instituted a $0.65 dividend, amounting to a yield of around 1.8% if maintained quarterly. This is far below the other two majors. Verizon’s yield of 8.6% now exceeds AT&T, although Verizon’s payout ratio is higher as it did not cut the dividend last year as AT&T did.

Risks

AT&T’s second biggest one-day share price drop this year came on July 14, when a Wall Street Journal story raised concerns about lead-coated cables, even leading to quick calls for congressional investigations. AT&T quickly countered that the cables do not pose a threat. By September, the EPA tested several areas of concern and agreed that there is no immediate health risk from these cables. By late September, the share price had recovered to where it was before the WSJ story, and after today’s earnings-related rebound it is once again above those levels. Still, a possibility of legal action or the need for remediation remains, however it was not even asked about by analysts on the 3Q earnings call.

The macro environment remains a risk. Net adds have come down in the last few quarters suggesting slowing growth, however current levels represent more of a return to normal from supercharged demand during the covid pandemic. Higher interest rates and consumer credit quality are typical concerns in a recession which could increase delinquencies and account write-offs when customers fail to pay their bills. While there was some worry a couple of quarters ago about customers extending the time they take to pay bills, there is no indication this behavior has worsened since then. Interest rates would also be a concern if AT&T has to roll over maturing debt, however the current free cash flow projections show the company being able to retire debt as it matures. The company’s growing cash balance also earns a higher rate of interest.

Conclusion

AT&T’s gradual slow delivery of their 5G and fiber growth strategy, in combination with cost cutting and net debt reduction have not been rewarded by the market for most of this year. Third quarter results, however, included a guidance raise for free cash flow and EBITDA. Initial market reaction appears positive. The guidance increase provides additional reassurance that the dividend is in no danger despite the high 7.25% yield.

As AT&T moves out of its high capital spending phase, free cash flow will increase, the company can reach its target 2.5 net debt/EBITDA leverage, and management can begin discussing a dividend increase. This would provide justification for the share price to move further off the 20-year lows set a few weeks ago. While that may still be a year off, the current dividend provides good compensation to wait for that outcome.

Editor’s Note: This article was submitted as part of Seeking Alpha’s Best Value Idea investment competition, which runs through October 25. With cash prizes, this competition — open to all contributors — is one you don’t want to miss. If you are interested in becoming a contributor and taking part in the competition, click here to find out more and submit your article today!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of T either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.