Summary:

- The company’s large debt still keeps away many investors.

- The outlook for the company seems to be brighter in my opinion, however, I am still skeptical of the management’s decisions going forward.

- I think the main issues have been priced in and not much left to the downside, so I will be initiating a position through cash-secured puts at a lower price.

Brandon Bell

Investment Thesis

AT&T (NYSE:T) popped 7% after reporting Q3 earnings, so I wanted to take a look at the company as a whole and see if it is time to jump back in. I believe that the major issues of the company have been priced in and there is not much left on the downside, however, I assign a hold rating for now because I can see the stock price coming back down in the next couple of months to my PT. I will be nibbling at the shares via cash-secured puts for the next couple of months until the company’s share price comes to me.

Financials

As of Q3 ’23, the company had around $7.5B in cash and a whopping $138B in total debt. That is a big reason why the company is unattractive to many investors. Over the years, the debt figure ballooned to where it is now. From the acquisition of Tele-Communications Inc. for $48B, Bellsouth for $67B, MediaOne for $62B to Time Warner for $85B, and DirecTV for around $50B, the company splurged on these companies like there’s no tomorrow and now it has to pay a ridiculous amount of annual interest on that leverage. So, how worrisome is this debt? 9 months ended September ’23, the company had to pay around $5B in interest expense while the company earned around $18B in EBIT, so the interest coverage ratio is around 3.6, which is not that bad according to many analysts because they view anything over 2.0 as a healthy ratio. I like to be more conservative and think that an interest coverage ratio of 5 is much safer, so T is getting an X here.

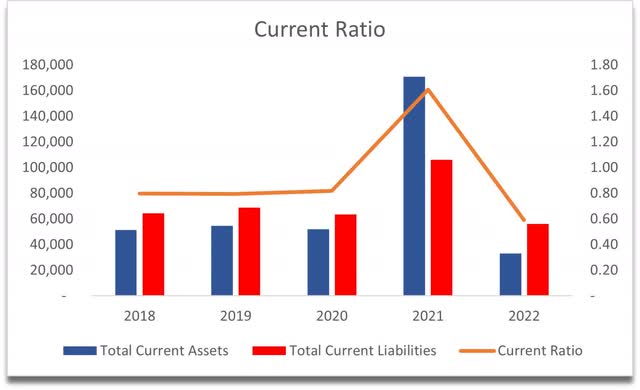

The company’s current ratio has also deteriorated quite a bit since FY21, however, looking at the past ratio in the last decade, the company never managed to go over 1 except for in FY21, so it’s not a good thing but it’s probably not too bad either since the company has been operating like this for many years.

Current Ratio (Author)

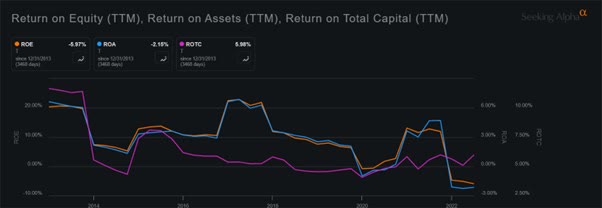

In terms of efficiency and profitability, the company’s ROE, ROA, and ROTC metrics have been trending down for the last decade, which is not comforting. These seem to have bounced slightly, but how sustainable this is, only time will tell. It will depend on the company’s ability to generate positive bottom-line returns going forward.

ROE, ROA, and ROTC of T (Seeking Alpha)

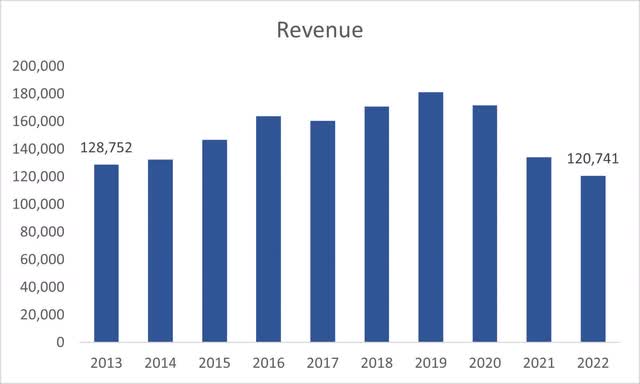

In terms of revenues, the company has been experiencing a massive decline since FY19 which can be attributed to the company’s divestitures of Time Warner and AT&T Wireless. In the recent past, the company considered an option to sell its ad business Xandr or DirecTV back in 2020, and just recently John Stankey said he wouldn’t rule out selling DirecTV if a good opportunity arose.

Revenue numbers (Author)

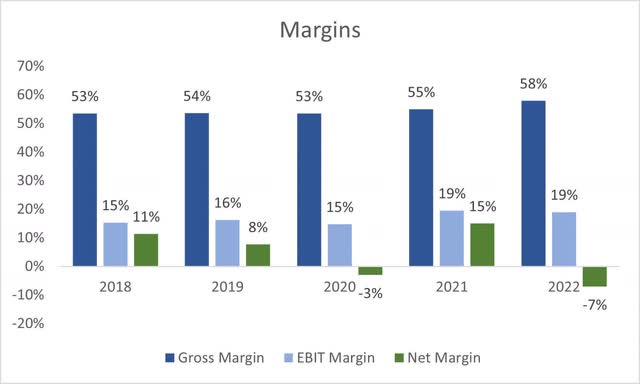

In terms of margins, at the end of FY22, these looked quite awful, which of course led to the company’s share price tumble. The company recorded quite a big non-cash charge at the end of FY22 of around $27B, which affected the bottom line quite drastically and led to negative results in the end. It seems that the company has not had this type of charge this year as of yet, and I don’t expect this to appear in the next quarter. As of Q3 ’23, Operating margins remained relatively the same compared to FY22, while net margins stood at around 10%-11%, which is good to see.

Margins (Author)

Comments on the Outlook

The biggest concern for me before I invest again in AT&T is that the management is very liberal with leverage. Since the last time I invested, the company has reduced it quite considerably, which is a good sign, however, all these acquisitions it made over the years have not been the most successful in my opinion. Let’s take a look at Time Warner. At the time, when I was an investor, I thought this was a good idea and would work out well in the end for them. Fast forward 4 years and the company spun off the resulting WarnerMedia for half of the money it paid to acquire it. In hindsight, it was a bad decision. I didn’t care too much about it because I was getting around an 8% dividend yield that was still increasing by a penny every quarter.

Speaking of the dividend, I sold my position at the end of October 2020. At that point, the company was offering a very nice dividend yield of around 7%-8%. I was very happy accumulating my position, but then I had to make a couple of adjustments to my portfolio, and I ended up selling out of the shares and forgot the company for a long time. Fast forward a couple of years, the company lost half of its value and slashed its dividend pretty much in half and is maintaining the same yield as it did before. Up until January ’22, the company’s yield ballooned to almost 11% according to my calculations, however, bad times fell on the company and the management reduced the quarterly dividend from .52 cents to .278 cents a quarter.

How safe is the dividend at this point? It seems like it is much more certain to remain where it is for the time being than be reduced once again, as the company’s operations have been improving (although slowly), and in the recent earnings call, the management said this:

We remain committed to our dividend payout level and expect its credit quality to consistently improve. In fact, we’ve already generated more than enough cash to meet our annualized dividend even before the fourth quarter, which is generally our highest cash generation quarter.

My opinion is the company is going to remain at these levels of payout for a little while longer, and as operations improve, the company will start to increase the dividend once again. Probably not to the .52 cents a share as it had before off the bat, but gradually. The free cash flow dividend payout ratio stands at around 58% as of Q3 ’23, while it stood at a massive 97.6% a year ago, which was clearly unsustainable.

In terms of management, after the Time Warner debacle, I’m not sure if I can trust their business decisions when it comes to future acquisitions and will have to take them with a grain of salt and be more critical. I would like to see the management taking the debt slightly more seriously than it has and also continue cutting the fat from some less profitable businesses that don’t synergize well with their operations. I wouldn’t be surprised if someone made an offer for DirecTV in the future. Sure, the whole packaging of cable TV, phone, and internet bills sounded good, but once the cord-cutting started to take off, DirecTV started to face many challenges from the streaming competition that was much cheaper.

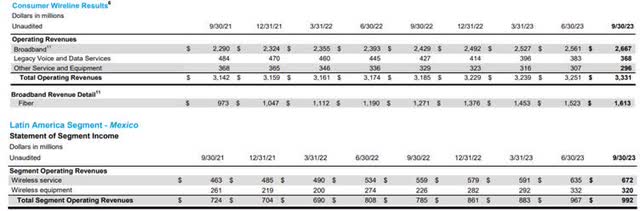

The company’s operations are steadily chugging along, which is not very exciting, apart from the fiber adoption, which saw revenues go up by around 27% y/y this quarter. This segment still is very small compared to total revenue generated (5% of total revenues in Q3 ’23), however, if it continues at this pace, it will become a decent revenue generator for the company especially when every other segment is seeing little to no growth as seen below from the latest quarter.

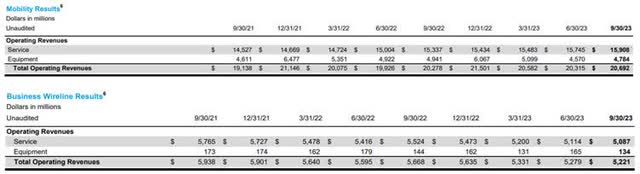

Mobility and business wireline as of Q3 hardly grew y/y (AT&T’s press release)

Fiber is the only one showing decent growth (AT&T’s press release)

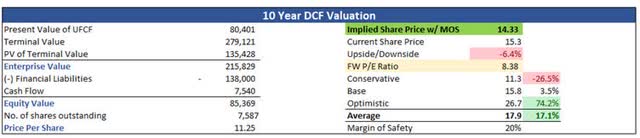

Let’s look at a DCF valuation to see what I would be willing to pay for the company at this time.

Valuation

The company’s business segments are seeing a slight return to growth as of the latest quarter. I decided to take an optimistic yet reasonable approach to my valuation model. I modeled that in the three scenarios, the company will experience some sort of growth in revenues going forward, but it wouldn’t be very impressive as the company hasn’t managed to do that in years. Below are my revenue assumptions for base, optimistic, and conservative cases.

Revenue assumptions (Author)

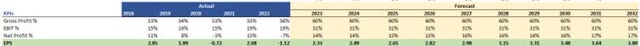

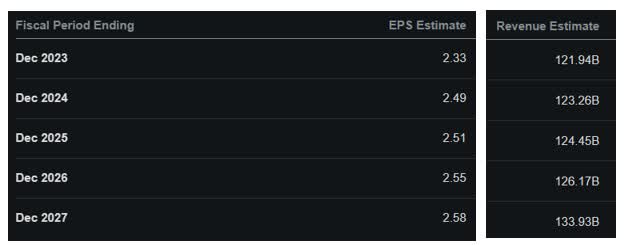

In terms of EPS and Margins, analysts and I do not see much growth in these metrics either, but will still see slight improvements in the long run.

Margin and EPS Assumptions (Author)

Analysts’ Revenue and EPS assumptions (Seeking Alpha)

I went with an 8% discount rate because that would give me a slightly higher margin of safety than if I were to use the company’s WACC, which was around 5%. I also went with a 2.5% terminal growth rate, which may be slightly too high, but I would think the company will keep up with inflation in the end.

On top of these estimates, I went ahead and added another 20% margin of safety because the historical financials and the most recent ones didn’t show me much improvement. This way my PT will reflect the additional risks that may not be present right now, and if I can get a company at a better price in the end, then my returns will be great.

With that said, AT&T’s intrinsic value is $14.33 a share, which means it was fairly valued before the Q3 earnings announcement.

Intrinsic Value (Author)

Closing Comments

So, it seems the company was a buy with my estimates and if I remembered that it was reporting earnings on the 19th of October, I would have recommended a buy. I missed the entry point right now by around 6%, however, I don’t think this is the end. You could buy the company right now at these prices and wait for a couple of years to see how well it’ll perform and hope that it will not cut the dividend. What I will do is start nibbling yet again, however, I would like to enter at a lower price, which I believe will happen in the near future because of the turmoil and volatility in the markets. I will look into selling cash-secured puts at around $14 a share, as that would be a more enticing risk/reward profile than buying in when the company popped 7% in one day. This way I will get paid (very little) to wait for the stock price to come to me. I’m in no rush to be honest.

It does look like a lot of the issues of the company have been priced in and there isn’t much left to the downside, however, be cautious as things can happen, so don’t allocate too much into one stock and be prepared for more mishaps by the company’s management.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in T over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.